8 years ago

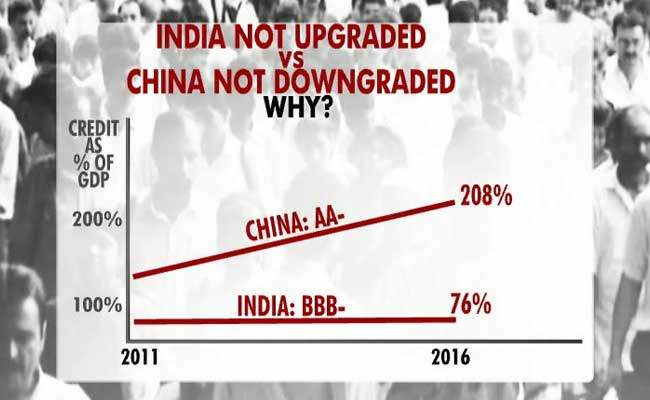

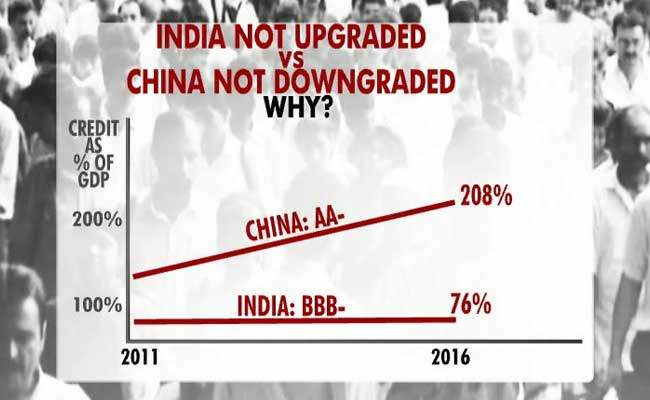

Chief Economic Adviser Arvind Subramanian, in an exclusive conversation with NDTV's Prannoy Roy, discusses the state of the Indian economy, inflation, the Goods and Services Tax or GST reform and the impact of the notes ban. On Thursday, Mr Subramanian had flayed global rating agencies, saying they haven't upgraded India "despite clear improvements in our economic fundamentals" which include inflation, growth, and current account performance. Despite its rapid growth, India still has a BBB rating. China's rating has been upgraded to AA, despite its slowing growth and rising debts. Earlier today, data showed India's consumer inflation eased in April to its lowest in at least five years.

Here are the live updates:

Here are the live updates:

'Not sure how much 'old' demonetised cash came back, it is still being counted' says the Chief Economic Adviser

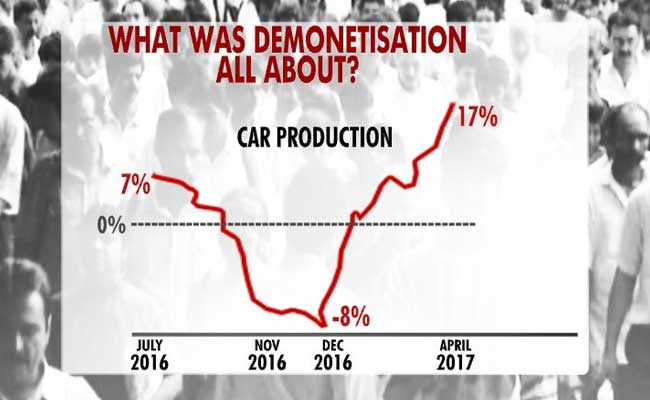

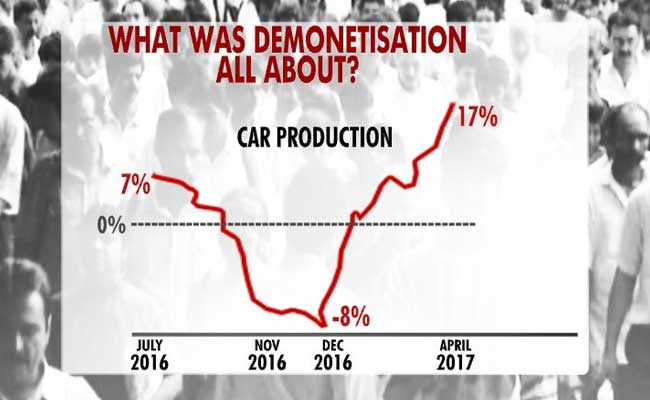

Auto industry back in top gear after demonetisation bump

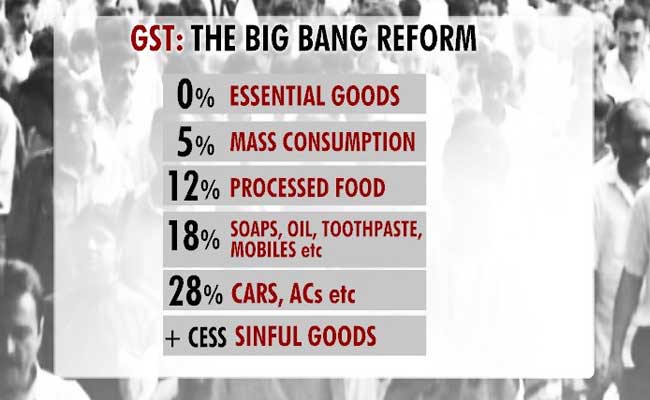

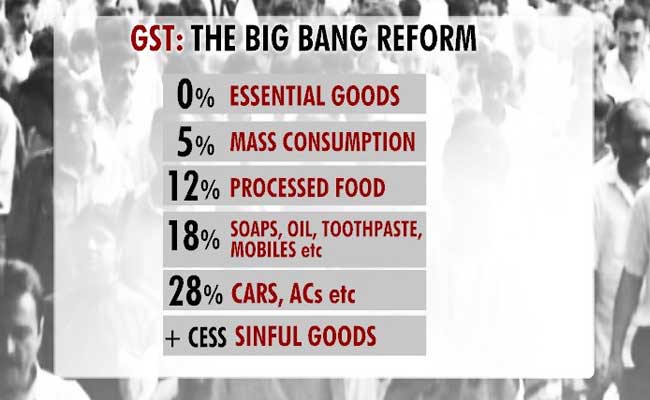

GST is a huge improvement as compared to the current taxation regime: Arvind Subramanian

Prepping for mega reform Goods and Services Tax

China's growth is slowing down but India is going to grow faster: Arvind Subramanian

Industrial growth remains a concern

Rating agencies have acquired a reputation for calling out crises after they happen: Arvind Subramanian

India not upgraded despite improving fundamentals. Global rating agencies unfair to India vs China

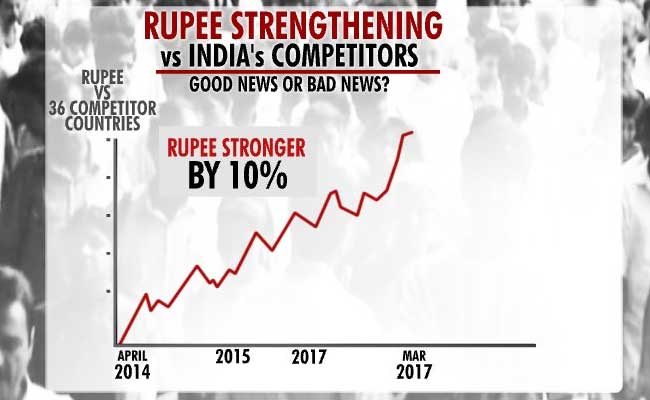

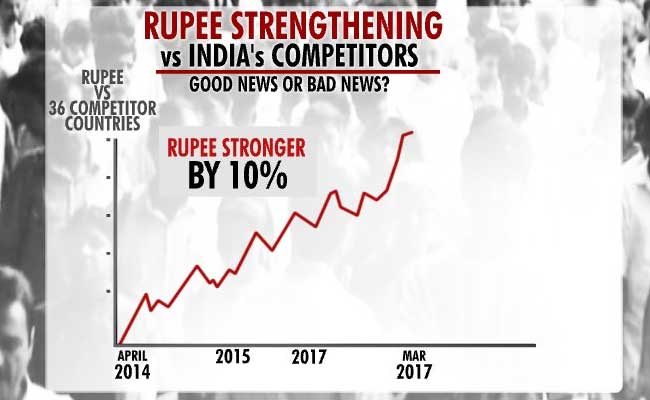

Rupee is strengthening because investors are upbeat about Indian economy: Arvind Subramanian

- Rupee's rise however hurts the exports sector

- We should not allow our currency (rupee) to become too strong

Rupee bounces back: assessing its rise

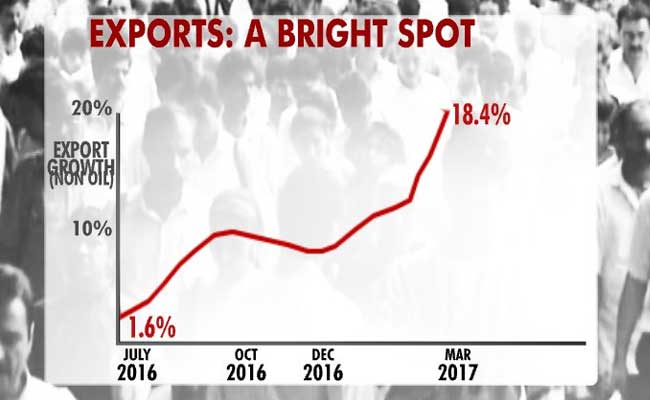

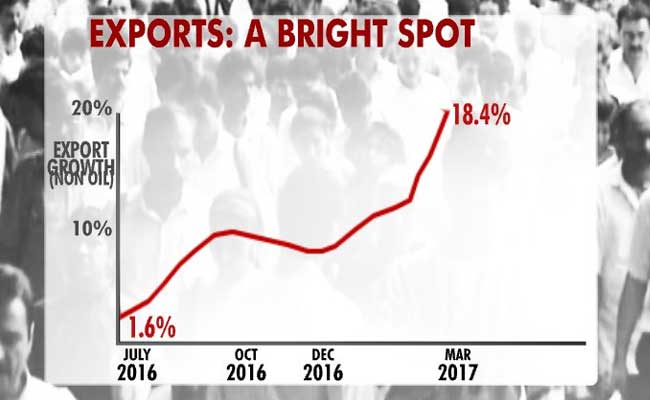

We cannot growth rapidly unless our exports grow: Arvind Subramanian

Export recovery a big positive for Indian economy

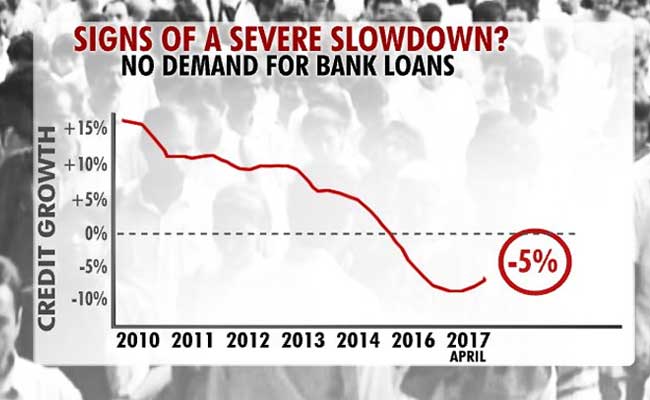

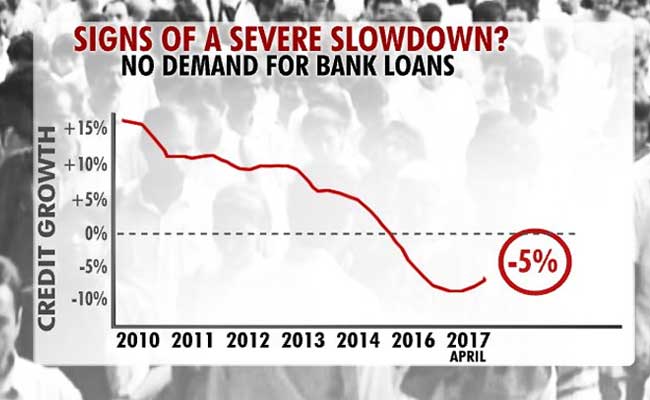

Arvind Subramanian says "Companies are borrowing through bonds, that's Indian jugaad"

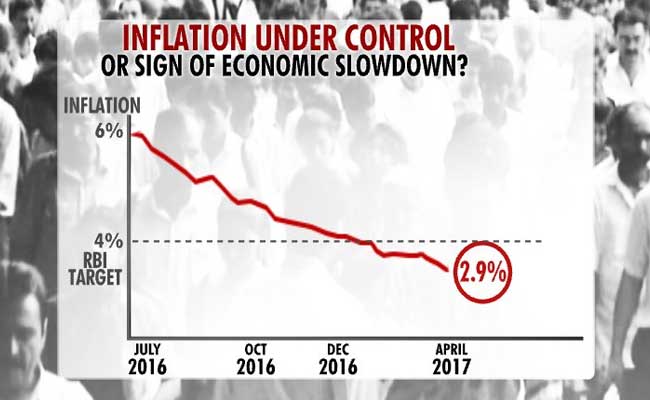

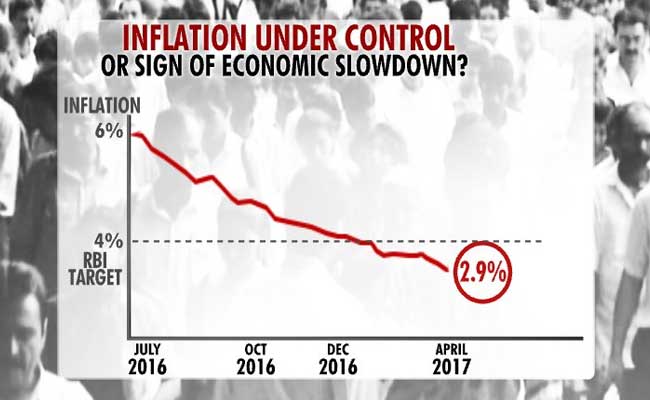

It is the Reserve Bank of India's mandate to keep inflation under check, Mr Subramanian tells Prannoy Roy

Inflation outlook is relatively benign, says the Chief Economic Adviser

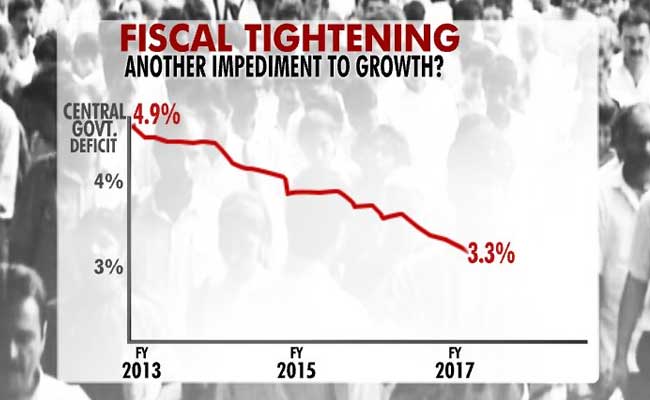

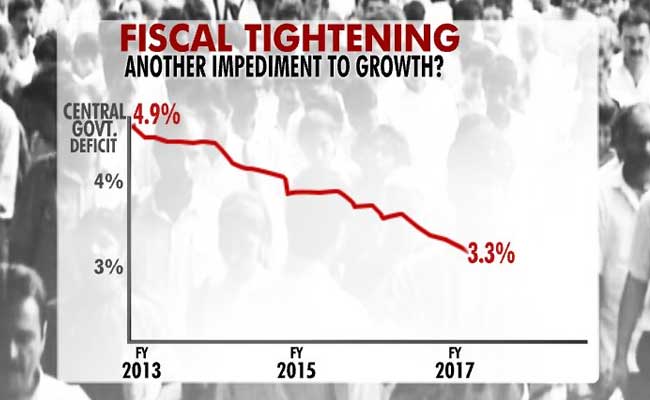

Should government relax fiscal deficit targets to boost growth?

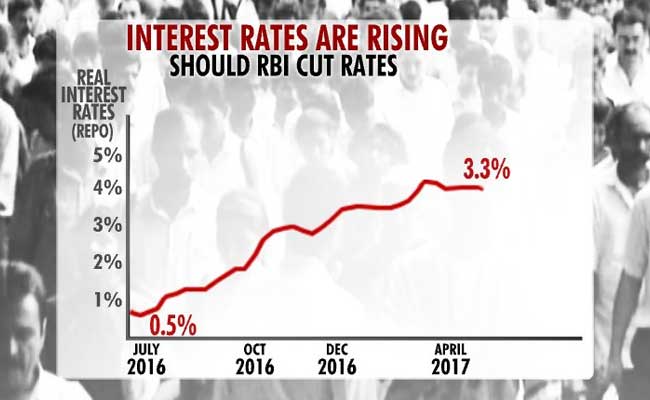

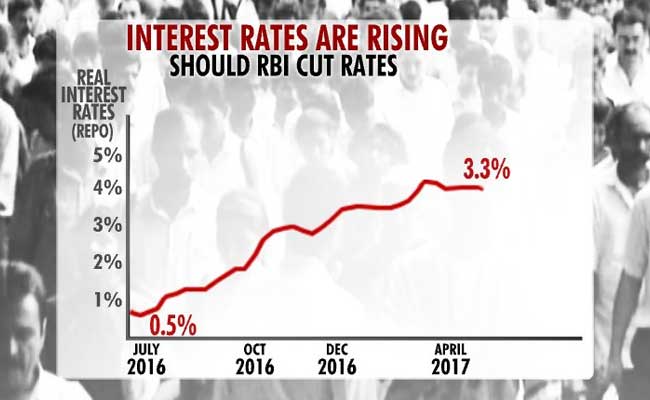

Time for central bank to cut interest rates?

In recent months, we have over-performed on inflation, says Arvind Subramanian, referring to 4 per cent inflation target

Inflation is down to 2.99%: Good news or bad news?

Sluggishness of credit growth is a challenge, Mr Subramanian tells Prannoy Roy

Bank credit growth falls sharply as demand for loans dries up

We don't get enough divergent voices on the macro economy, says Mr Subramanian