More alarmingly, the marquee software services exporter is missing the opportunity to retake its place among India's most transparent companies.

Earlier this year, Ravi Venkatesan, a former Microsoft Corp. India chairman, was asked to mend fences between the board and CEO on one side, and the retired founders (who own 13 percent of the stock) on the other. In media interviews over the past couple of weeks (here, here and here), Venkatesan, one of two non-executive co-chairmen at Infosys, has tried to defend the Bangalore-based company's decision not to disclose the full report of an investigation into a whistle-blower's allegations of financial impropriety in a 2015 acquisition.

The $200 million deal to acquire Israeli automation tech specialist Panaya Ltd., the whistle-blower claimed, was overvalued to produce a kickback, and the irregularities were covered up with hush money paid to the then-CFO and general counsel, who've both since left.

Considering the two-page summary of the probe's findings that Infosys released in June gave the CEO a clean chit, it's hard to see why the board wouldn't want to dump at least some of the evidence -- if not the whole report -- into the public domain. Venkatesan's latest media appearances occurred after co-founder N.R. Narayana Murthy wrote a letter to the board saying he was far from satisfied. Venkatesan responded by reaffirming there was no wrongdoing.

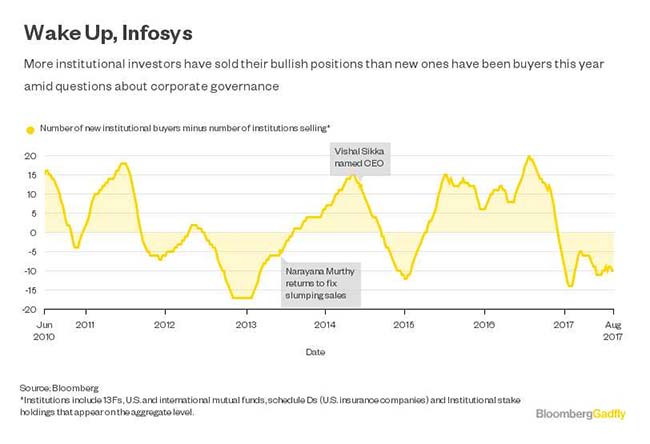

This week, Ambit Capital Pvt., a Mumbai-based broker, suspended its buy rating and put Infosys stock on review, saying it'll wait for more clarity on unanswered questions concerning corporate governance.

The founders, for their part, have behaved foolishly in questioning everything from Sikka's pay to why he lives in Palo Alto rather than Bangalore and charters planes. The diffuse nature of the attack led Gadfly to suspect that their campaign was about ensuring more of the company's $5.2 billion hoard of cash and cash-like securities came to them, rather than being spent on the CEO's transformation strategy. Old-world labor arbitrageurs -- Murthy turns 71 on Sunday -- don't get acquisitions like Panaya, which is helping Infosys consultants clinch deals involving upgrades of enterprise software.

Infosys cash hoard

$5.2 billion

However, questions surrounding that deal -- and the alleged cover-up -- won't go away in the absence of more disclosures. Murthy is right to ask why, if shareholders are paying for expensive investigations, they shouldn't get to see more of their output.

This fight is about culture. Yet deep-seated differences between an Indian company and its Indian-born, but basically American, CEO, aren't the crux of it. Murthy, who once upset his would-be father-in-law by expressing the desire to become a communist politician, needs no lessons in capitalism. Even now, according to an analysis of annual reports by Ambit's Sudheer Guntupalli, the company makes 20 more disclosures than Tata Consultancy Services Ltd., its bigger rival.

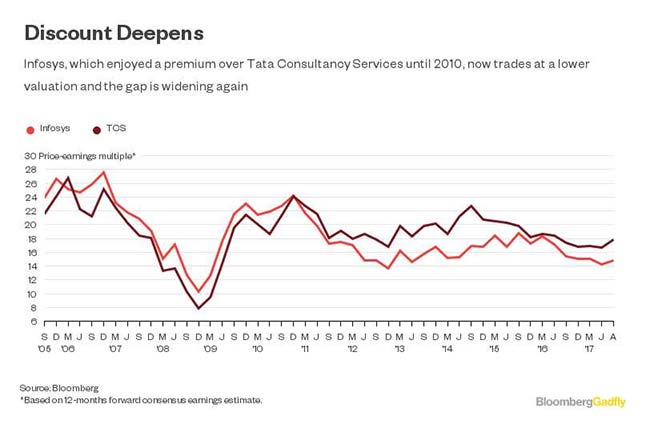

It's the transparency that made Infosys the first Indian tech company to trade on Nasdaq in 1999. (It's now changed the listing to New York). Some of the other co-founders' insistence on having a go at running Infosys before retirement saw the shares' premium over TCS turn into a discount. Early enthusiasm over Sikka, a former tech czar at SAP SE, closed that gap. Amid a recent spate of departures of senior talent, however, the discount is widening again.

Governance is undoubtedly playing a role. The current board has veered far from the original code. Either it does a reboot of the culture, or shareholders should give it the boot.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

(To contact the author of this story: Andy Mukherjee in Hong Kong at amukherjee@bloomberg.net To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net)

(Andy Mukherjee is a Bloomberg Gadfly columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.)

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.