Donald Trump had effectively turned the Evans Foundation's gifts into his own gifts. (File Photo)

Donald Trump was in a tuxedo, standing next to his award: a statue of a palm tree, as tall as a toddler. It was 2010, and Trump was being honored by a charity - the Palm Beach Police Foundation - for his "selfless support" of its cause.

His support did not include any of his own money.

Instead, Trump had found a way to give away somebody else's money, and claim the credit for himself.

Trump had earlier gone to a charity in New Jersey - the Charles Evans Foundation, named for a deceased businessman - and asked for a donation. Trump said he was raising money for the Palm Beach Police Foundation.

The Evans Foundation said yes. In 2009 and 2010, it gave a total of $150,000 to the Donald J. Trump Foundation, a small charity that the Republican presidential nominee founded in 1987.

Then, Trump's foundation turned around and made donations to the police group in South Florida. In those years, the Trump Foundation's gifts totaled $150,000.

Trump had effectively turned the Evans Foundation's gifts into his own gifts, without adding any money of his own.

Trump had effectively turned the Evans Foundation's gifts into his own gifts, without adding any money of his own.

On the night that he won the Palm Tree Award for his philanthropy, Trump may have actually made money. The gala was held at his Mar-a-Lago Club in Palm Beach, and the police foundation paid to rent the room. It's unclear how much was paid in 2010, but the police foundation reported in its tax filings that it rented Mar-a-Lago in 2014 for $276,463.

The Donald J. Trump Foundation is not like other charities. An investigation of the foundation - including examinations of 17 years of tax filings and interviews with more than 200 individuals or groups listed as donors or beneficiaries - found that it collects and spends money in a very unusual manner.

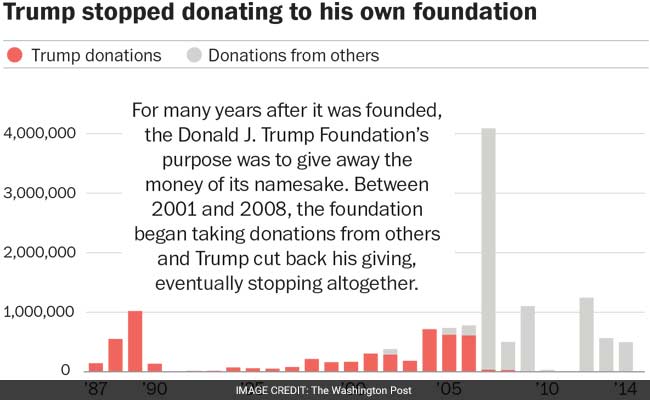

For one thing, nearly all of its money comes from people other than Trump. In tax records, the last gift from Trump was in 2008. Since then, all of the donations have been other people's money - an arrangement that experts say is almost unheard of for a family foundation.

Trump then takes that money and generally does with it as he pleases. In many cases, he passes it on to other charities, which often are under the impression that it is Trump's own money.

In two cases, he has used money from his charity to buy himself a gift. In one of those cases - not previously reported - Trump spent $20,000 of money earmarked for charitable purposes to buy a six-foot-tall painting of himself.

Money from the Trump Foundation has also been used for political purposes, which is against the law. The Washington Post reported this month that Trump paid a penalty this year to the Internal Revenue Service for a 2013 donation in which the foundation gave $25,000 to a campaign group affiliated with Florida Attorney General Pamela Bondi (R).

Trump's foundation appears to have repeatedly broken IRS rules, which require nonprofit groups to file accurate paperwork. In five cases, the Trump Foundation told the IRS that it had given a gift to a charity whose leaders told The Post that they had never received it. In two other cases, companies listed as "donors" to the Trump Foundation told The Post that those listings were incorrect.

Last week, The Post submitted a detailed list of questions about the Trump Foundation to Trump's campaign. Officials with the campaign declined to comment.

Trump and his Democratic opponent, Hillary Clinton, have both been criticized during their campaigns for activities related to their foundations.

Critics have charged that the giant Bill, Hillary and Chelsea Clinton Foundation, which employs more than 2,000 people and spends about a quarter of a billion dollars a year, has served as a way for businesses and powerful figures across the world to curry favor with one of America's most powerful families. The Clinton Foundation has also been credited by supporters and critics alike for its charitable efforts.

Trump has claimed that he gives generously to charity from his own pocket: "I don't have to give you records," he told The Post earlier this year, "but I've given millions away." Efforts to verify those gifts have not succeeded, and Trump has refused to release his tax returns, which would show his charitable giving.

That leaves the Trump Foundation as the best window into the GOP nominee's philanthropy.

In the past several days, questions about Trump's foundation have focused on the gift to Bondi's group in 2013. At the time the money arrived, Bondi's office was considering whether to launch an investigation into allegations of fraud by Trump University - accusations that Trump denies.

The investigation never started. Aides to Bondi and Trump say the gift and the case were unrelated. But Democrats have seized on what they see as a clear example of political influence, improperly funded by Trump's charity.

"The foundation was being used basically to promote a moneymaking fraudulent venture of Donald Trump's. That's not what charities are supposed to do," Virginia Sen. Tim Kaine, Clinton's running mate, said on Friday. "I hope there's a significant effort to get to the bottom of it and find out whether this is the end."

- - -

Trump started his foundation in 1987 with a narrow purpose - to give away some of the proceeds from his book "The Art of the Deal."

Nearly three decades later, the Trump Foundation is still a threadbare, skeletal operation.

The most money it has ever reported having was $3.2 million at the end of 2009. At last count, that total had shrunk to $1.3 million. By comparison, Oprah Winfrey - who is worth $1.5 billion less than Trump, according to a Forbes magazine estimate - has a foundation with $242 million in the bank. At the end of 2014, the Clinton Foundation had $440 million in assets.

In a few cases, Trump seemed to solicit donations only to immediately give them away. But his foundation has also received a handful of bigger donations - including $5 million from professional-wrestling executives Vince and Linda McMahon - that Trump handed out a little at a time.

The foundation has no paid staffers. It has an unpaid board consisting of four Trumps - Donald, Ivanka, Eric and Donald Jr. - and one Trump Organization employee.

In 2014, at last report, each said they worked a half-hour a week.

The Trump Foundation still gives out small, scattered gifts - which seem driven by the demands of Trump's businesses and social life, rather than a desire to support charitable causes.

The foundation makes a few dozen donations a year, usually in amounts from $1,000 to $50,000. It gives to charities that rent Trump's ballrooms. It gives to charities whose leaders buttonholed Trump on the golf course (and then try, in vain, to get him to offer a repeat donation the next year).

It even gives in situations in which Trump publicly put himself on the hook for a donation - as when he promised a gift "out of my wallet" on NBC's "The Celebrity Apprentice." The Trump Foundation paid off most of those on-air promises. A TV production company paid others. The Post could find no instance in which a celebrity's charity got a gift from Trump's own wallet.

Another time, Trump went on TV's "Extra" for a contest called "Trump pays your bills!"

A professional spray-tanner won. The Trump Foundation paid her bills.

- - -

About 10 years ago, the Trump Foundation underwent a major change - although it was invisible to those who received its gifts.

The checks still had Trump's name on them.

Behind the scenes, he was transforming the foundation from a standard-issue rich person's philanthropy into a charity that allowed a rich man to be philanthropic for free.

Experts on charity said they had rarely seen anything like it.

"Our common understanding of charity is you give something of yourself to help somebody else. It's not something that you raise money from one side to spend it on the other," said Leslie Lenkowsky, the former head of the Corporation for National and Community Service, and a professor studying philanthropy at Indiana University.

By that definition, was Trump engaging in charity?

No, Lenkowsky said.

"It's a deal," he said, an arrangement worked out for maximum benefit at minimum sacrifice.

In the Trump Foundation's early days, between 1987 and 2006, Trump actually was its primary donor. Over that span, Trump gave his own foundation a total of $5.4 million. But he was giving it away as fast as he put it in, and by the start of 2007, the foundation's assets had dropped to $4,238.

Then, Trump made a change.

First, he stopped giving his own money.

His contribution shrank to $35,000 in 2007.

Then to $30,000 in 2008.

Then to $0.

At the same time, Trump's foundation began to fill with money from other people.

But in many other cases, his biggest donors have not wanted to say why they gave their own money, when Trump was giving none of his.

"I don't have time for this. Thank you," said Richard Ebers, a ticket broker in New York City who has given the Trump Foundation $1.9 million since 2011.

"No. No. No. I'm not going to comment on anything. I'm not answering any of your questions," said John Stark, the chief executive of a carpet company that has donated $64,000 over the years.

Vince and Linda McMahon declined to comment.

So did NBCUniversal, which donated $500,000 in 2012. Its gift more than covered the "personal" donations that Trump offered at dramatic moments on "The Celebrity Apprentice" - then paid out of the Trump Foundation.

Trump's donations to the Palm Beach Police Foundation offered a stark example of Trump turning somebody else's gift into his own charity.

Tax experts said they had rarely heard of anything like what Trump had done, converting another donor's gift into his own.

"I question whether it's ethical. It's certainly misleading. But I think it's legal, because you would think that the other foundation that's . . . being taken advantage of would look out for their own interests," said Rosemary Fei, an attorney in San Francisco who has advised hundreds of small foundations. "That's their decision to let him do that."

After three years, the Charles Evans Foundation stopped using Trump as a middleman.

"We realized we don't need to do it through a pass-through," said Bonnie Pfeifer Evans, the widow of Charles Evans and a trustee of the now-defunct foundation.

In 2012, the Charles Evans Foundation stopped giving money to the Trump Foundation.

In 2013, according to tax records, the Trump Foundation stopped giving to the Palm Beach Police Foundation.

The police group, which gave Trump the award, did not know that Trump's money had come from somebody else's pocket. It could not explain why he gave in some years but not others - or why he gave in the amounts he did.

"He's the unpredictable guy, right?" said John Scarpa, the Palm Beach Police Foundation's president, before The Post informed him about how Trump got the money. He said Trump's giving wasn't the only reason he got the award. He also could be counted on to draw a crowd to the group's annual event. The amount paid to Trump's club was first reported by BuzzFeed.

The police group still holds its galas at Mar-a-Lago.

- - -

At the same time that it began to rely on other people's money, the Trump Foundation sometimes appeared to flout IRS rules, by purchasing things that seemed to benefit only Trump.

In 2007, for instance, Trump and his wife, Melania, attended a benefit for a children's charity held at Mar-a-Lago. The night's entertainment was Michael Israel, who bills himself as "the original speed painter." His frenetic act involved painting giant portraits in five to seven minutes - then auctioning off the art he'd just created.

He painted Trump.

Melania Trump bid $10,000.

Nobody tried to outbid her.

"The auctioneer was just pretty bold, so he said, 'You know what just happened: When you started bidding, nobody's going to bid against you, and I think it's only fair that you double the bid,' " Israel said in an interview last week.

Melania Trump increased her bid to $20,000.

"I understand it went to one of his golf courses," Israel said of the painting.

The Trump Foundation paid the $20,000, according to the charity that held the benefit.

Something similar happened in 2012, when Trump himself won an auction for a football helmet autographed by football player Tim Tebow, then a quarterback with the Denver Broncos.

The winning bid was $12,000. As The Post reported in July, the Trump Foundation paid.

IRS rules generally prohibit acts of "self-dealing," in which a charity's leaders use the nonprofit group's money to buy things for themselves.

In both years, IRS forms asked whether the foundation had broken those rules: Had it "furnish[ed] goods, services or facilities" to Trump or another of its officers?

In both years, the Trump Foundation checked "no."

Tax experts said that Trump could have avoided violating the self-dealing rules if he gave the helmet and the painting to other charities instead of keeping them. Trump's staffers have not said where the two items are now.

The IRS penalties for acts of "self-dealing" can include penalty taxes, both on charities and on their leaders as individuals.

In other cases, the Trump Foundation's tax filings appeared to include listings that were incorrect.

The most prominent example is the improper political donation to the group affiliated with Bondi, the Florida attorney general, in 2013. In that case, Trump's staffers have said that a series of errors resulted in the payment being made - and then hidden from the IRS.

First, Trump officials said, when the request came down to cut a check to the Bondi group, a Trump Organization clerk followed internal protocol and consulted a book with the names of known charities.

The name of the pro-Bondi group is "And Justice for All." Trump's staffer saw that name in the book, and - mistakenly - cut the check from the Trump Foundation. The group in the book was an entirely different charity in Utah, unrelated to Bondi's group in Florida.

Somehow, the money got to Florida anyway.

Then, Trump's staffers said, the foundation's accounting firm made another mistake: It told the IRS that the $25,000 had gone to a third charity, based in Kansas, called Justice for All. In reality, the Kansas group got no money.

"That was just a complete mess-up on names. Anything that could go wrong did go wrong," Jeffrey McConney, the Trump Organization's controller, told The Post last week. After The Post pointed out these errors in the spring, Trump paid a $2,500 penalty tax.

- - -

In four other cases, The Post found charities that said they never received donations that the Trump Foundation said it gave them.

The amounts were small: $10,000 in 2008, $5,000 in 2010, $10,000 in 2012. Most of the charities had no idea that Trump had said he had given them money.

One did.

This January, the phone rang at a tiny charity in White River Junction, Vermont, called Friends of Veterans. This was just after Trump had held a televised fundraiser for veterans in Iowa, raising more than $5 million.

The man on the phone was a Trump staffer who was selecting charities that would receive the newly raised money. He said the Vermont group was already on Trump's list, because the Trump Foundation had given it $1,000 in 2013.

"I don't remember a donation from the Trump Foundation," said Larry Daigle, the group's president, who was a helicopter gunner with the Army during the Vietnam War. "The guy seemed pretty surprised about this."

The man went away from the phone. He came back.

Was Daigle sure? He was.

The man thanked him. He hung up. Daigle waited - hopes raised - for the Trump people to call back.

"Oh, my God, do you know how many homeless veterans I could help?" Daigle told The Post this spring, while he was waiting.

Trump gave away the rest of the veterans money in late May.

Daigle's group got none of it.

In two other cases, the Trump Foundation reported to the IRS that it had received donations from two companies that have denied making such gifts. In 2013, for instance, the Trump Foundation said it had received a $100,000 donation from the Clancy Law Firm, whose offices are in a Trump-owned building on Wall Street.

"That's incorrect," said Donna Clancy, the firm's founder, when The Post called. "I'm not answering any questions."

She hung up and did not respond to requests for comment afterward.

"All of these things show that the [Trump] foundation is run in a less-than-ideal manner. But that's not at all unusual for small, private foundations, especially those run by a family," said Brett Kappel, a Washington attorney who advises tax-exempt organizations. "Usually, you have an accounting firm that has access to the bank statements, and they're the ones who find these errors and correct them."

The Trump Foundation's accountants are at WeiserMazars, a New York-based firm. The Post sent them a detailed list of questions, asking them to explain these possible errors.

The firm declined to comment.

© 2016 The Washington Post

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

His support did not include any of his own money.

Instead, Trump had found a way to give away somebody else's money, and claim the credit for himself.

Trump had earlier gone to a charity in New Jersey - the Charles Evans Foundation, named for a deceased businessman - and asked for a donation. Trump said he was raising money for the Palm Beach Police Foundation.

The Evans Foundation said yes. In 2009 and 2010, it gave a total of $150,000 to the Donald J. Trump Foundation, a small charity that the Republican presidential nominee founded in 1987.

Then, Trump's foundation turned around and made donations to the police group in South Florida. In those years, the Trump Foundation's gifts totaled $150,000.

The Donald J. Trump Foundation is not like other charities.

On the night that he won the Palm Tree Award for his philanthropy, Trump may have actually made money. The gala was held at his Mar-a-Lago Club in Palm Beach, and the police foundation paid to rent the room. It's unclear how much was paid in 2010, but the police foundation reported in its tax filings that it rented Mar-a-Lago in 2014 for $276,463.

The Donald J. Trump Foundation is not like other charities. An investigation of the foundation - including examinations of 17 years of tax filings and interviews with more than 200 individuals or groups listed as donors or beneficiaries - found that it collects and spends money in a very unusual manner.

For one thing, nearly all of its money comes from people other than Trump. In tax records, the last gift from Trump was in 2008. Since then, all of the donations have been other people's money - an arrangement that experts say is almost unheard of for a family foundation.

Trump then takes that money and generally does with it as he pleases. In many cases, he passes it on to other charities, which often are under the impression that it is Trump's own money.

In two cases, he has used money from his charity to buy himself a gift. In one of those cases - not previously reported - Trump spent $20,000 of money earmarked for charitable purposes to buy a six-foot-tall painting of himself.

Money from the Trump Foundation has also been used for political purposes, which is against the law. The Washington Post reported this month that Trump paid a penalty this year to the Internal Revenue Service for a 2013 donation in which the foundation gave $25,000 to a campaign group affiliated with Florida Attorney General Pamela Bondi (R).

Trump's foundation appears to have repeatedly broken IRS rules, which require nonprofit groups to file accurate paperwork. In five cases, the Trump Foundation told the IRS that it had given a gift to a charity whose leaders told The Post that they had never received it. In two other cases, companies listed as "donors" to the Trump Foundation told The Post that those listings were incorrect.

Last week, The Post submitted a detailed list of questions about the Trump Foundation to Trump's campaign. Officials with the campaign declined to comment.

Trump and his Democratic opponent, Hillary Clinton, have both been criticized during their campaigns for activities related to their foundations.

Critics have charged that the giant Bill, Hillary and Chelsea Clinton Foundation, which employs more than 2,000 people and spends about a quarter of a billion dollars a year, has served as a way for businesses and powerful figures across the world to curry favor with one of America's most powerful families. The Clinton Foundation has also been credited by supporters and critics alike for its charitable efforts.

Trump has claimed that he gives generously to charity from his own pocket: "I don't have to give you records," he told The Post earlier this year, "but I've given millions away." Efforts to verify those gifts have not succeeded, and Trump has refused to release his tax returns, which would show his charitable giving.

That leaves the Trump Foundation as the best window into the GOP nominee's philanthropy.

In the past several days, questions about Trump's foundation have focused on the gift to Bondi's group in 2013. At the time the money arrived, Bondi's office was considering whether to launch an investigation into allegations of fraud by Trump University - accusations that Trump denies.

The investigation never started. Aides to Bondi and Trump say the gift and the case were unrelated. But Democrats have seized on what they see as a clear example of political influence, improperly funded by Trump's charity.

"The foundation was being used basically to promote a moneymaking fraudulent venture of Donald Trump's. That's not what charities are supposed to do," Virginia Sen. Tim Kaine, Clinton's running mate, said on Friday. "I hope there's a significant effort to get to the bottom of it and find out whether this is the end."

- - -

Trump started his foundation in 1987 with a narrow purpose - to give away some of the proceeds from his book "The Art of the Deal."

Nearly three decades later, the Trump Foundation is still a threadbare, skeletal operation.

The most money it has ever reported having was $3.2 million at the end of 2009. At last count, that total had shrunk to $1.3 million. By comparison, Oprah Winfrey - who is worth $1.5 billion less than Trump, according to a Forbes magazine estimate - has a foundation with $242 million in the bank. At the end of 2014, the Clinton Foundation had $440 million in assets.

In a few cases, Trump seemed to solicit donations only to immediately give them away. But his foundation has also received a handful of bigger donations - including $5 million from professional-wrestling executives Vince and Linda McMahon - that Trump handed out a little at a time.

The foundation has no paid staffers. It has an unpaid board consisting of four Trumps - Donald, Ivanka, Eric and Donald Jr. - and one Trump Organization employee.

In 2014, at last report, each said they worked a half-hour a week.

The Trump Foundation still gives out small, scattered gifts - which seem driven by the demands of Trump's businesses and social life, rather than a desire to support charitable causes.

The foundation makes a few dozen donations a year, usually in amounts from $1,000 to $50,000. It gives to charities that rent Trump's ballrooms. It gives to charities whose leaders buttonholed Trump on the golf course (and then try, in vain, to get him to offer a repeat donation the next year).

It even gives in situations in which Trump publicly put himself on the hook for a donation - as when he promised a gift "out of my wallet" on NBC's "The Celebrity Apprentice." The Trump Foundation paid off most of those on-air promises. A TV production company paid others. The Post could find no instance in which a celebrity's charity got a gift from Trump's own wallet.

Another time, Trump went on TV's "Extra" for a contest called "Trump pays your bills!"

A professional spray-tanner won. The Trump Foundation paid her bills.

- - -

About 10 years ago, the Trump Foundation underwent a major change - although it was invisible to those who received its gifts.

The checks still had Trump's name on them.

Behind the scenes, he was transforming the foundation from a standard-issue rich person's philanthropy into a charity that allowed a rich man to be philanthropic for free.

Experts on charity said they had rarely seen anything like it.

"Our common understanding of charity is you give something of yourself to help somebody else. It's not something that you raise money from one side to spend it on the other," said Leslie Lenkowsky, the former head of the Corporation for National and Community Service, and a professor studying philanthropy at Indiana University.

By that definition, was Trump engaging in charity?

No, Lenkowsky said.

"It's a deal," he said, an arrangement worked out for maximum benefit at minimum sacrifice.

In the Trump Foundation's early days, between 1987 and 2006, Trump actually was its primary donor. Over that span, Trump gave his own foundation a total of $5.4 million. But he was giving it away as fast as he put it in, and by the start of 2007, the foundation's assets had dropped to $4,238.

Then, Trump made a change.

First, he stopped giving his own money.

His contribution shrank to $35,000 in 2007.

Then to $30,000 in 2008.

Then to $0.

At the same time, Trump's foundation began to fill with money from other people.

But in many other cases, his biggest donors have not wanted to say why they gave their own money, when Trump was giving none of his.

"I don't have time for this. Thank you," said Richard Ebers, a ticket broker in New York City who has given the Trump Foundation $1.9 million since 2011.

"No. No. No. I'm not going to comment on anything. I'm not answering any of your questions," said John Stark, the chief executive of a carpet company that has donated $64,000 over the years.

Vince and Linda McMahon declined to comment.

So did NBCUniversal, which donated $500,000 in 2012. Its gift more than covered the "personal" donations that Trump offered at dramatic moments on "The Celebrity Apprentice" - then paid out of the Trump Foundation.

Trump's donations to the Palm Beach Police Foundation offered a stark example of Trump turning somebody else's gift into his own charity.

Tax experts said they had rarely heard of anything like what Trump had done, converting another donor's gift into his own.

"I question whether it's ethical. It's certainly misleading. But I think it's legal, because you would think that the other foundation that's . . . being taken advantage of would look out for their own interests," said Rosemary Fei, an attorney in San Francisco who has advised hundreds of small foundations. "That's their decision to let him do that."

After three years, the Charles Evans Foundation stopped using Trump as a middleman.

"We realized we don't need to do it through a pass-through," said Bonnie Pfeifer Evans, the widow of Charles Evans and a trustee of the now-defunct foundation.

In 2012, the Charles Evans Foundation stopped giving money to the Trump Foundation.

In 2013, according to tax records, the Trump Foundation stopped giving to the Palm Beach Police Foundation.

The police group, which gave Trump the award, did not know that Trump's money had come from somebody else's pocket. It could not explain why he gave in some years but not others - or why he gave in the amounts he did.

"He's the unpredictable guy, right?" said John Scarpa, the Palm Beach Police Foundation's president, before The Post informed him about how Trump got the money. He said Trump's giving wasn't the only reason he got the award. He also could be counted on to draw a crowd to the group's annual event. The amount paid to Trump's club was first reported by BuzzFeed.

The police group still holds its galas at Mar-a-Lago.

- - -

At the same time that it began to rely on other people's money, the Trump Foundation sometimes appeared to flout IRS rules, by purchasing things that seemed to benefit only Trump.

In 2007, for instance, Trump and his wife, Melania, attended a benefit for a children's charity held at Mar-a-Lago. The night's entertainment was Michael Israel, who bills himself as "the original speed painter." His frenetic act involved painting giant portraits in five to seven minutes - then auctioning off the art he'd just created.

He painted Trump.

Melania Trump bid $10,000.

Nobody tried to outbid her.

"The auctioneer was just pretty bold, so he said, 'You know what just happened: When you started bidding, nobody's going to bid against you, and I think it's only fair that you double the bid,' " Israel said in an interview last week.

Melania Trump increased her bid to $20,000.

"I understand it went to one of his golf courses," Israel said of the painting.

The Trump Foundation paid the $20,000, according to the charity that held the benefit.

Something similar happened in 2012, when Trump himself won an auction for a football helmet autographed by football player Tim Tebow, then a quarterback with the Denver Broncos.

The winning bid was $12,000. As The Post reported in July, the Trump Foundation paid.

IRS rules generally prohibit acts of "self-dealing," in which a charity's leaders use the nonprofit group's money to buy things for themselves.

In both years, IRS forms asked whether the foundation had broken those rules: Had it "furnish[ed] goods, services or facilities" to Trump or another of its officers?

In both years, the Trump Foundation checked "no."

Tax experts said that Trump could have avoided violating the self-dealing rules if he gave the helmet and the painting to other charities instead of keeping them. Trump's staffers have not said where the two items are now.

The IRS penalties for acts of "self-dealing" can include penalty taxes, both on charities and on their leaders as individuals.

In other cases, the Trump Foundation's tax filings appeared to include listings that were incorrect.

The most prominent example is the improper political donation to the group affiliated with Bondi, the Florida attorney general, in 2013. In that case, Trump's staffers have said that a series of errors resulted in the payment being made - and then hidden from the IRS.

First, Trump officials said, when the request came down to cut a check to the Bondi group, a Trump Organization clerk followed internal protocol and consulted a book with the names of known charities.

The name of the pro-Bondi group is "And Justice for All." Trump's staffer saw that name in the book, and - mistakenly - cut the check from the Trump Foundation. The group in the book was an entirely different charity in Utah, unrelated to Bondi's group in Florida.

Somehow, the money got to Florida anyway.

Then, Trump's staffers said, the foundation's accounting firm made another mistake: It told the IRS that the $25,000 had gone to a third charity, based in Kansas, called Justice for All. In reality, the Kansas group got no money.

"That was just a complete mess-up on names. Anything that could go wrong did go wrong," Jeffrey McConney, the Trump Organization's controller, told The Post last week. After The Post pointed out these errors in the spring, Trump paid a $2,500 penalty tax.

- - -

In four other cases, The Post found charities that said they never received donations that the Trump Foundation said it gave them.

The amounts were small: $10,000 in 2008, $5,000 in 2010, $10,000 in 2012. Most of the charities had no idea that Trump had said he had given them money.

One did.

This January, the phone rang at a tiny charity in White River Junction, Vermont, called Friends of Veterans. This was just after Trump had held a televised fundraiser for veterans in Iowa, raising more than $5 million.

The man on the phone was a Trump staffer who was selecting charities that would receive the newly raised money. He said the Vermont group was already on Trump's list, because the Trump Foundation had given it $1,000 in 2013.

"I don't remember a donation from the Trump Foundation," said Larry Daigle, the group's president, who was a helicopter gunner with the Army during the Vietnam War. "The guy seemed pretty surprised about this."

The man went away from the phone. He came back.

Was Daigle sure? He was.

The man thanked him. He hung up. Daigle waited - hopes raised - for the Trump people to call back.

"Oh, my God, do you know how many homeless veterans I could help?" Daigle told The Post this spring, while he was waiting.

Trump gave away the rest of the veterans money in late May.

Daigle's group got none of it.

In two other cases, the Trump Foundation reported to the IRS that it had received donations from two companies that have denied making such gifts. In 2013, for instance, the Trump Foundation said it had received a $100,000 donation from the Clancy Law Firm, whose offices are in a Trump-owned building on Wall Street.

"That's incorrect," said Donna Clancy, the firm's founder, when The Post called. "I'm not answering any questions."

She hung up and did not respond to requests for comment afterward.

"All of these things show that the [Trump] foundation is run in a less-than-ideal manner. But that's not at all unusual for small, private foundations, especially those run by a family," said Brett Kappel, a Washington attorney who advises tax-exempt organizations. "Usually, you have an accounting firm that has access to the bank statements, and they're the ones who find these errors and correct them."

The Trump Foundation's accountants are at WeiserMazars, a New York-based firm. The Post sent them a detailed list of questions, asking them to explain these possible errors.

The firm declined to comment.

© 2016 The Washington Post

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Track Latest News Live on NDTV.com and get news updates from India and around the world