Why is the government getting its knickers into a twist every month on the Employee Provident Fund? It just doesn't seem to learn from its mistakes: that irritating the trade unions and middle class is not a great political strategy, however brilliant the economic reasoning behind it may be. Eventually, the government retreats and looks even more silly and weak than it did before it announced its policy.

Today, under pressure of a threatened strike by trade unions, it succumbed and restored the 0.1% interest on EPF that it had it cut earlier this week.

The saga of announce and then retreat started with the Budget, which by all accounts, was one of the better ones presented in recent years. Unfortunately, all that was completely ignored as the government was attacked for introducing tax on 40% on PPF/EPF withdrawals. After a week of vociferous pressure, the government bowed down and the proposal was dropped. Strike One.

So after, in an even more bizarre order, it decided to stop early withdrawals from the EPF; as Bengaluru saw riots, the Government cowered, and cancelled the change. Strike Two.

This week, the Finance Ministry, overrides the EPF Board and Labour Ministry's recommendation of 8.8% interest for EPF holders for last year, and reduces it by a huge 0.1%. The trade unions again threaten action, the Finance Ministry tries to throw the hot potato into the Labour Ministry's court, saying they only gave advice, and not an order. The Labour Ministry, says that's rubbish. By Friday evening the Government does what it did before, it retreats and 8.8% is back. Strike Three.

And that ends another bad week at the office for all concerned.

So why has the government been hell bent on attacking the status quo on EPF? And when you have been beaten back twice, why does the Finance Ministry again rush headlong into another controversy of their own making? What, as they used to say in the eighties, is the fun of it? Any political novice would have told them, leave it alone, may be next year, why create a storm for 0.1%, how much will they save?

The explanation, if there is one, lies in the Chief Economic Advisors (CEA) Economic Survey 2016-17. In a key chapter (5) Bounties to the Well Off, CEA Arvind Subramanian argues that the well-off are highly subsidized and that this should change. Amongst the big subsidies, he says, are small savings. And here he argues that small savings is actually a misnomer, as only postal deposits and schemes for the elderly and women are really small savings. Others like PPF are "not so small", and tax free bonds are "not small at all".

The CEA further argues that within these "small savings" there are different tax treatments of which the one accorded to PPF/EPF is the most beneficial to the well-off and carries the highest subsidy.

PPF is exempt of tax at any stage, an investment of Rs 1.50 lakh per annum is exempt(E) from tax, the annual interest on the deposits are tax free (E), and when you withdraw on retirement or earlier, that is also exempt (E) from any tax, making this EEE. Even postal savings and tax-free bonds he says have some element of tax and argues that" tax incentives distort the interest structure...adversely affecting investment. They are also regressive...as they provide relatively higher tax benefits to (the well off)."

And he therefore calls for India to move to taxing withdrawals as is done in most developed countries and in the New Pension Scheme (NPS).

Taxing PPF/EPF is at the heart of the CEAs effort to lower subsidies to the rich. That is what triggered the tax on withdrawals in the budget, that and bringing it on par with the NPS, which had tax on withdrawals. So by reducing the tax element on the NPS from all withdrawals to 40% of the amount withdrawn, and making the PPF/EPF also the same, the government believed that NPS with its equity market instruments would be more attractive.

Where Mr Subramaniam may have erred is deciding who are the well-off or rich. He states that 62% of all deductions under 80C (which allows Rs 1.50 lakhs tax free saving) happens in incomes above Rs 4 lakhs, and 47% from those who earn more than Rs 5 lakhs. (This isn't surprising as you need to earn something in order to save; Rs 4 lakhs would after saving Rs 1.50 lakhs barely leave one with Rs 20,000, before taxes, a month.)

He follows this up by saying these people are a very small proportion of India's earning population (6% is the total tax paying public) and even in this group, the richest with incomes above 25 lakhs are benefitting the most.

The problem, as Mr Subramaniam knows, is that it is not the tax payers who are at fault but those who don't pay taxes that make these numbers look as gross as they are. While telling us only 6% pay tax, he conveniently forgets that almost 70% of the population is so-called agricultural, and therefore not in the tax game. Also to take full benefit of 80C, you need to earn at least Rs 4 lakhs p.a. (Rs 33,000 pm), so obviously people with such incomes are the bulk of the beneficiaries. But does that make all of them well off? If you only impose a tax of 30% on incomes above Rs 10 lakhs, then obviously those below that aren't rich.

And if the CEA wanted to take away the subsidy from the rich, he could have done that without hitting the lower middle class or workers. He could have withdrawn the Rs 1.5 lakh exemption for people in the 30% tax bracket. It is unlikely that this would have stopped them from investing in PPF/EPF since a) those employed would continue to have EPF schemes and would not want to lose that perk, and b) the fact that interest is exempt still makes it a worthwhile investment. Tax-free bonds show, according to the CEA, an average ticket size of Rs 6 lakhs and these come from funds where tax has been paid, so the rich are happy to put money into schemes with tax/free interest.

Secondly, the CEA could have said contributions above 12% of salary would not be allowed. This is a practice followed by a number of rich employees. This would restrict the rich from misusing the scheme.

What the CEA misreads is what or who is/are rich. All employees including workers have money going into their EPF accounts. For those under Rs 10 lakhs income a year and employed, this constitutes the bulk of their saving and is a forced saving. These people are not necessarily market savvy, and are unlikely to earn interest of 8+% anywhere else. This is their cushion, if they get unemployed, need money for children's education or marriage and that's why they protested against imposing of a tax and the rule that would have stopped premature withdrawals.

And it is not as if the average employee comes off really well off after years of paying EPF.

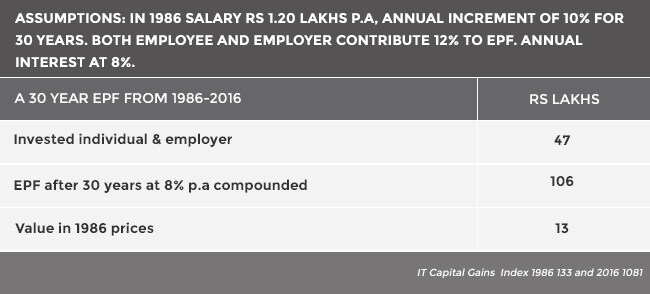

Let's see what would have happened to a person's EPF over 30 years, starting in 1986, at 8% interest per annum, where the individual and employer contribute 12% of the salary each per annum.

So after contributing Rs 47 lakhs over his (her) working life, the money saved is only Rs 13 lakhs in 1986 prices.

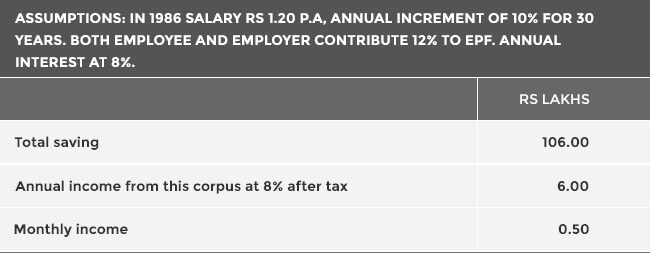

Having a monthly income of Rs 50,000 isn't a princely sum. Most government officers get pensions higher than that, and have annual increases in line with inflation.

If the same individual was lower down the chain and had a salary in 1986 of Rs 2,500, he would have retired today with an EPF of Rs 26.5 lakhs and would earn monthly interest income of Rs 15000. That's not a huge amount of money when you remember that the contract wage today for labour is Rs 10,000.

The government had last month already cut interest rates on all other small savings and in doing so on EPF was really following a similar policy. Unfortunately, while postal savings and deposits are made by the unorganized sector, who don't have a voice, the EPF has trade unions and a large middle class, both vociferous and demanding, both capable of pressuring the government and getting it to back down. And the government once again showed on Friday how well it can do that.

Yes, the Finance Ministry can argue that they had taken a principled stand on reducing the subsidies on "small saving" but principles matter little in politics, economic principles matter even less, so perhaps the CEA should hit the pause button.

In baseball, Three Strikes and you are out.

(Ishwari Bajpai is Senior Advisor at NDTV)

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.

Today, under pressure of a threatened strike by trade unions, it succumbed and restored the 0.1% interest on EPF that it had it cut earlier this week.

The saga of announce and then retreat started with the Budget, which by all accounts, was one of the better ones presented in recent years. Unfortunately, all that was completely ignored as the government was attacked for introducing tax on 40% on PPF/EPF withdrawals. After a week of vociferous pressure, the government bowed down and the proposal was dropped. Strike One.

So after, in an even more bizarre order, it decided to stop early withdrawals from the EPF; as Bengaluru saw riots, the Government cowered, and cancelled the change. Strike Two.

This week, the Finance Ministry, overrides the EPF Board and Labour Ministry's recommendation of 8.8% interest for EPF holders for last year, and reduces it by a huge 0.1%. The trade unions again threaten action, the Finance Ministry tries to throw the hot potato into the Labour Ministry's court, saying they only gave advice, and not an order. The Labour Ministry, says that's rubbish. By Friday evening the Government does what it did before, it retreats and 8.8% is back. Strike Three.

And that ends another bad week at the office for all concerned.

So why has the government been hell bent on attacking the status quo on EPF? And when you have been beaten back twice, why does the Finance Ministry again rush headlong into another controversy of their own making? What, as they used to say in the eighties, is the fun of it? Any political novice would have told them, leave it alone, may be next year, why create a storm for 0.1%, how much will they save?

The explanation, if there is one, lies in the Chief Economic Advisors (CEA) Economic Survey 2016-17. In a key chapter (5) Bounties to the Well Off, CEA Arvind Subramanian argues that the well-off are highly subsidized and that this should change. Amongst the big subsidies, he says, are small savings. And here he argues that small savings is actually a misnomer, as only postal deposits and schemes for the elderly and women are really small savings. Others like PPF are "not so small", and tax free bonds are "not small at all".

The CEA further argues that within these "small savings" there are different tax treatments of which the one accorded to PPF/EPF is the most beneficial to the well-off and carries the highest subsidy.

PPF is exempt of tax at any stage, an investment of Rs 1.50 lakh per annum is exempt(E) from tax, the annual interest on the deposits are tax free (E), and when you withdraw on retirement or earlier, that is also exempt (E) from any tax, making this EEE. Even postal savings and tax-free bonds he says have some element of tax and argues that" tax incentives distort the interest structure...adversely affecting investment. They are also regressive...as they provide relatively higher tax benefits to (the well off)."

And he therefore calls for India to move to taxing withdrawals as is done in most developed countries and in the New Pension Scheme (NPS).

Taxing PPF/EPF is at the heart of the CEAs effort to lower subsidies to the rich. That is what triggered the tax on withdrawals in the budget, that and bringing it on par with the NPS, which had tax on withdrawals. So by reducing the tax element on the NPS from all withdrawals to 40% of the amount withdrawn, and making the PPF/EPF also the same, the government believed that NPS with its equity market instruments would be more attractive.

Where Mr Subramaniam may have erred is deciding who are the well-off or rich. He states that 62% of all deductions under 80C (which allows Rs 1.50 lakhs tax free saving) happens in incomes above Rs 4 lakhs, and 47% from those who earn more than Rs 5 lakhs. (This isn't surprising as you need to earn something in order to save; Rs 4 lakhs would after saving Rs 1.50 lakhs barely leave one with Rs 20,000, before taxes, a month.)

He follows this up by saying these people are a very small proportion of India's earning population (6% is the total tax paying public) and even in this group, the richest with incomes above 25 lakhs are benefitting the most.

The problem, as Mr Subramaniam knows, is that it is not the tax payers who are at fault but those who don't pay taxes that make these numbers look as gross as they are. While telling us only 6% pay tax, he conveniently forgets that almost 70% of the population is so-called agricultural, and therefore not in the tax game. Also to take full benefit of 80C, you need to earn at least Rs 4 lakhs p.a. (Rs 33,000 pm), so obviously people with such incomes are the bulk of the beneficiaries. But does that make all of them well off? If you only impose a tax of 30% on incomes above Rs 10 lakhs, then obviously those below that aren't rich.

And if the CEA wanted to take away the subsidy from the rich, he could have done that without hitting the lower middle class or workers. He could have withdrawn the Rs 1.5 lakh exemption for people in the 30% tax bracket. It is unlikely that this would have stopped them from investing in PPF/EPF since a) those employed would continue to have EPF schemes and would not want to lose that perk, and b) the fact that interest is exempt still makes it a worthwhile investment. Tax-free bonds show, according to the CEA, an average ticket size of Rs 6 lakhs and these come from funds where tax has been paid, so the rich are happy to put money into schemes with tax/free interest.

Secondly, the CEA could have said contributions above 12% of salary would not be allowed. This is a practice followed by a number of rich employees. This would restrict the rich from misusing the scheme.

What the CEA misreads is what or who is/are rich. All employees including workers have money going into their EPF accounts. For those under Rs 10 lakhs income a year and employed, this constitutes the bulk of their saving and is a forced saving. These people are not necessarily market savvy, and are unlikely to earn interest of 8+% anywhere else. This is their cushion, if they get unemployed, need money for children's education or marriage and that's why they protested against imposing of a tax and the rule that would have stopped premature withdrawals.

And it is not as if the average employee comes off really well off after years of paying EPF.

Let's see what would have happened to a person's EPF over 30 years, starting in 1986, at 8% interest per annum, where the individual and employer contribute 12% of the salary each per annum.

So after contributing Rs 47 lakhs over his (her) working life, the money saved is only Rs 13 lakhs in 1986 prices.

Having a monthly income of Rs 50,000 isn't a princely sum. Most government officers get pensions higher than that, and have annual increases in line with inflation.

If the same individual was lower down the chain and had a salary in 1986 of Rs 2,500, he would have retired today with an EPF of Rs 26.5 lakhs and would earn monthly interest income of Rs 15000. That's not a huge amount of money when you remember that the contract wage today for labour is Rs 10,000.

The government had last month already cut interest rates on all other small savings and in doing so on EPF was really following a similar policy. Unfortunately, while postal savings and deposits are made by the unorganized sector, who don't have a voice, the EPF has trade unions and a large middle class, both vociferous and demanding, both capable of pressuring the government and getting it to back down. And the government once again showed on Friday how well it can do that.

Yes, the Finance Ministry can argue that they had taken a principled stand on reducing the subsidies on "small saving" but principles matter little in politics, economic principles matter even less, so perhaps the CEA should hit the pause button.

In baseball, Three Strikes and you are out.

(Ishwari Bajpai is Senior Advisor at NDTV)

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.

Track Latest News Live on NDTV.com and get news updates from India and around the world