Along with infrastructure, agriculture is also the backbone of India's economy.

The sector employs almost half of India's population, accounting for about 16% of the country's gross domestic product (GDP).

Despite all this, the sector has seen little reforms over decades. India lagged in the agriculture sector in the past due to large scale famines and frequent droughts in several parts. Lack of technology was another reason.

It's only now that efforts are being made to increase the output via modern methods through providing subsidies and fertilisers. These reforms were long overdue.

So what's the most essential part of agriculture, you ask? The answer is agrochemicals.

Farmers use agrochemicals on crops to ensure a good harvest. To meet the food demand, usage of innovative crop protection chemicals would be necessary in the coming decades.

With that in mind, let's take a look at the top agrochemical companies in India.

#1 PI Industries

First on the list is PI Industries.

Having an established presence in both domestic as well as export markets, the company has maintained a leadership position in the agrochemical industry.

The company's presence in agrochemical space spans over five decades throughout which it has built a healthy product mix.

Over the years, PI Industries has registered strong revenue growth and maintained operating margins above 20%.

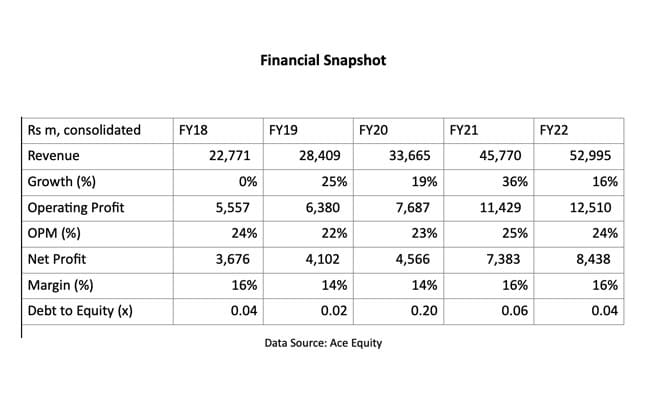

Take a look at its financial performance:

The company maintains a strong research presence through its R&D facility in Udaipur, where it has a dedicated team of over 400+ researchers and scientists.

PI Industries has 3 global locations - Japan for business development activities, China for sourcing, and Germany for knowledge management.

In the September 2022 earnings call, PI Industries highlighted that it launched 5 new products during the quarter while 2 more are planned by the end of December 2022.

It's also in the process of expanding the depth of offerings in new market segments such as Taurus, a revolutionary nematicide and Tomatough, a unique biological product.

In the coming two quarters, PI Industries is expecting 3 to 4 molecules to be commercialised from the agrochemical segment.

As far as stock performance is concerned, long term investors in PI Industries are sitting on sweet gains. In the past five years, the stock has rallied 296%.

#2 India Pesticides

Second on the list is India Pesticides.

The company is the sole Indian manufacturer of several technical such as Folpet, Thiocarbamate, and Herbicide. It manufactures herbicides, fungicide technical, and active pharmaceuticals ingredients (APIs).

It derives close to 95% of total revenues from the pesticides segment while the rest from pharma.

Over the years, the company has developed a niche portfolio of agro-chemical products. It has also diversified its product portfolio over the years. This allowed it to de-risk the business.

Resultantly, revenues have grown steadily while operating margins have also remained over 20%.

Meanwhile, its Hamirpur plant will commence operations next year post March 2023.

India Pesticides was listed in July 2021. The stock has fallen 27% since listing.

With a number of agro chemical products going off patent, the company is set to benefit from the many opportunities that will arise.

#3 Dhanuka Agritech

Third on the list we have Dhanuka Agritech.

The company manufactures a wide range of agrochemicals like herbicides, insecticides, fungicides, plant growth regulators in various forms liquid, dust, powder, and granules.

It has a pan India presence with a strong distribution network.

By having a strong pipeline of products along with strong R&D, the company has registered healthy growth in revenue and operating margin over the years.

The company has long standing tie ups with global innovators including Nissan Chemicals, FMC Corporation among others.

Earlier this month, it set up a new R&D and training center in Haryana.

It is also setting up a manufacturing plant at Dahej (around Rs 3 bn outlay) which should help with revenue visibility. In the past, the company has stood out because of its timely capacity expansions and backward integration.

Here's where it gets more interesting. Despite a working capital intensive business and significant marketing and branding expenses required, Dhanuka Agritech has been maintaining an almost debt free balance sheet.

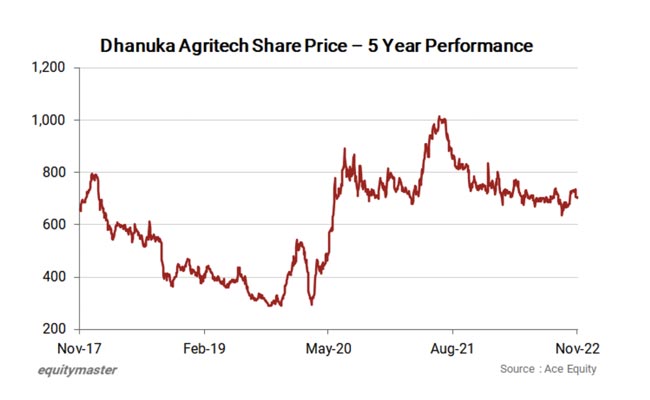

Coming to stock performance, Dhanuka Agritech has shown muted performance even if we consider a long term horizon of 5 years.

But if we take its three year performance, the company has delivered multibagger returns.

The company in October 2022 announced a share buyback through tender offer route. The buyback price would be Rs 850 per share, while the buyback offer amount is Rs 850 m for 1 million shares.

The buyback price is at 20% premium to current stock price.

#4 Heranba Industries

Next on the list is recently listed smallcap company Heranba Industries.

The company is engaged in the manufacturing of a diverse range of agrochemicals and public health products for pest control.

It's a market leader in the synthetic pyrethroids market. Pyrethroids find usage in significant applications across pest protection, environmental health and crop care.

In domestic market, PI Industries, Sharda Cropchem, UPL, Rallis India, Dhanuka Agritech to name a few are some of its big clients.

It has around 50% share in exports market, but the year gone by saw lower exports owing to lockdowns in China.

Owing to strong product portfolio, robust distribution network, and new product launch capabilities, the company has over the years posted robust financials.

The management has planned a capex of around Rs 2-2.5 bn for over three years.

It's undertaking an expansion to manufacture insecticides, pesticides intermediates, fungicides and herbicides (with main focus on expansion in technicals). As per the management, 70% of the capex will be for new products, and 30% is for expansion in existing products.

As far as stock performance is concerned, after seeing a bumper listing (43% premium to issue price), the stock has come under pressure in 2022.

With multiple molecules going off patent in the near future, the company aims to capitalise on significant growth opportunities in the agrochemicals segment.

#5 Paushak

Last on the list is Paushak, a strategic supplier of phosgene and its derivative.

Paushak is India's largest phosgene-based specialty chemical company serving pharma, agrochemical, and performance industries.

It's one of the few players licensed to manufacture phosgene gas, which is highly restricted by the government. This is because phosgene has high toxicity.

The toxicity of phosgene makes it suitable for use in pesticides, insecticides, and herbicides.

Paushak is part of the Alembic group of companies situated in Gujarat, India. Alembic is the oldest pharma company in India founded in 1907.

The company has registered strong operating margins over the years on the back of capacity expansions.

This year, the company completed its first round of capex and tripled its phosgene capacity. It also commissioned a new phosgene plant.

However, the company's management said in an interview that high margins seen last year are not sustainable and would be around 20% for the current fiscal.

Shares of Paushak are currently trading near their 52-week low. This on the back of weak management commentary and muted Q2 results.

The journey of Paushak has been a rags-to-riches kind of story.

In August 2012, Paushak's share price was at Rs 50 per share. Skip forward to present, the stock is trading at Rs 8,000.

Even if we take a 5-year performance, shares have zoomed 800%.

One of the secrets to its success has been the expansion of its customer base beyond the pharmaceutical industry.

Even after years of facing raw material price volatility, the company's margins have not fluctuated significantly because it is aided by strong operating efficiency. This is an example of how a fundamentally strong stock stands tall even in critical times.

Comparative Analysis

Take a look at the below table which shows the comparative analysis of these companies on valuations and return ratios.

India's renewed focus on agriculture and the agrochemical sector could attract investors to these stocks.

And if a major change is announced in the upcoming Budget, these could be the prime beneficiaries...

(Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.)

This article is syndicated from Equitymaster.com

Track Latest News Live on NDTV.com and get news updates from India and around the world