The last day to link Aadhaar with Permanent Account Number (PAN) for income tax purposes is fast approaching. All the taxpayers have to mandatorily link the two by March 31, 2023, failing which they will be liable to consequences under the I-T Act and will have to suffer a number of implications, according to a circular issued by the Central Board of Direct Taxes (CBDT). For those who still haven't done it, they will now have to pay Aadhaar-PAN link fees.

Also Read | Aadhaar-PAN Linking: These Individuals Are Exempt From This Mandate

According to Income Tax Department website, Aadhaar-PAN linking was free before March 31, 2022. A fee of Rs 500 was imposed from April 1, 2022, and was later increased to Rs 1,000 from July 1, 2022.

How to pay Aadhaar-PAN link fees before March 31?

The Income Tax department has provided an e-pay functionality for taxpayers to pay the amount of Rs 1,000 to proceed with the Aadhaa-PAN linking request.

It has also authorised a number of banks for e-pay tax. These are: Axis Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vysya Bank, Kotak Mahindra Bank, Punjab National Bank, UCO Bank Union Bank of India.

If a taxpayers has account in any of these bank, he/she needs to follow these steps.

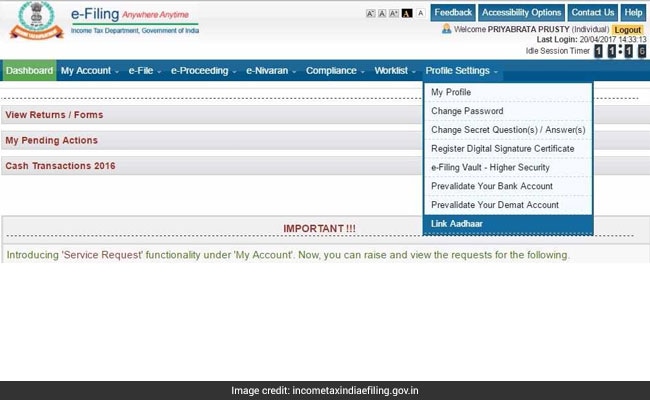

- Visit e-filing home page of the website and click on Link Aadhaar in Quick Links section. Alternatively, login to e-filing portal and Click on Link Aadhar in Profile Section.

- The taxpayer needs to give the PAN number, confirm it and enter mobile number for OTP

- Post OTP verification, the taxpayer will be redirected to e-pay tax page

- Click Proceed on the Income Tax tile.

- Select AY 2023-24 and Type of Payment as other Receipts (500) and continue

- Applicable amount will be pre-filled against Others box and the taxpayer needs to click Continue

- Now, a challan will be generated. On the next screen the taxpayer has to select the mode of payment after selecting the mode of payment. He/she will be directed to the bank website where payment can be made.

The website has listed separate steps for customers of other banks not listed for payment through e-pay tax.

- Visit the e-filing website

- Click on the hyperlink "Click here to go to NSDL (Protean) tax payment page for other banks" given below on e-Pay tax page to redirect to Protean (NSDL) portal

- Click Proceed under Challan No/ITNS 280

- Select (0021) Income Tax (Other than Companies) under Tax Applicable (Major Head)

- Select (500) Other Receipts) under Type of Payment (Minor Head)

- Select AY as 2023-24, provide other mandatory details and Proceed

If a taxpayer hasn't linked the two documents, his/her PAN will become inoperative and that will create problems in filing income tax returns.

Track Latest News Live on NDTV.com and get news updates from India and around the world