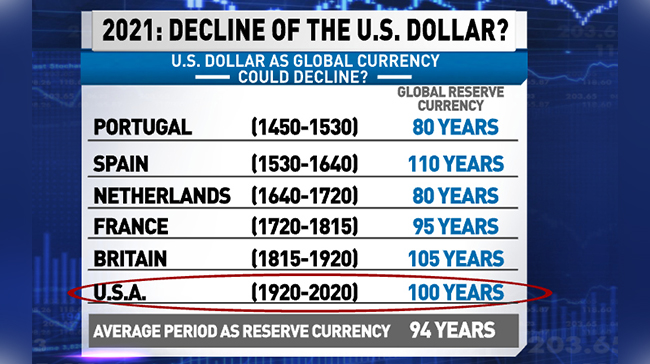

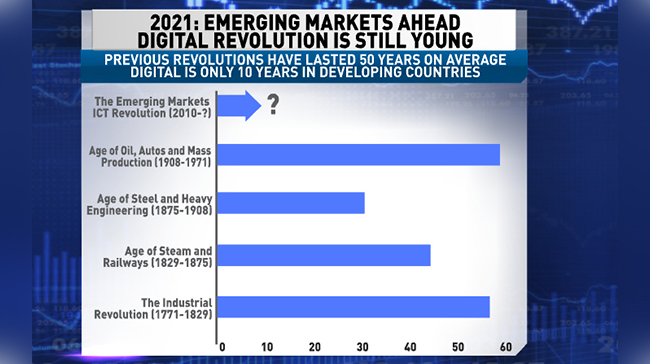

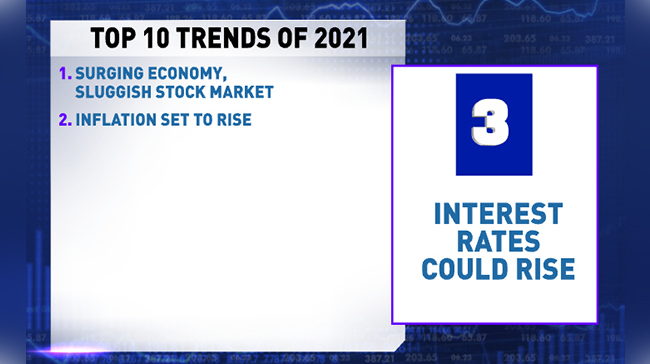

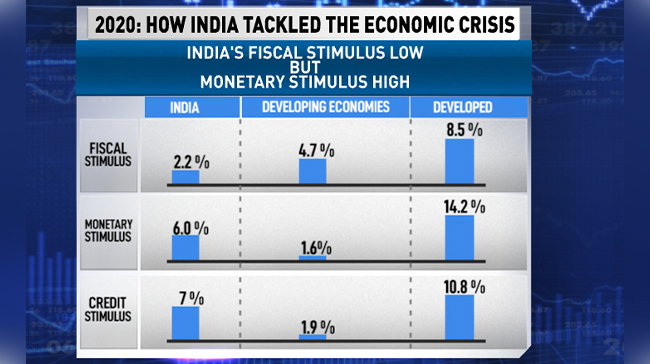

NDTV's Prannoy Roy discusses the top 10 trends of global economy in 2021 with global investor and author Ruchir Sharma. According to Mr Sharma, this year, inflation and interest rates could rise, it might just be the best time to invest in property, and developing countries will make a comeback.

Here are the highlights from Dr Roy's show:

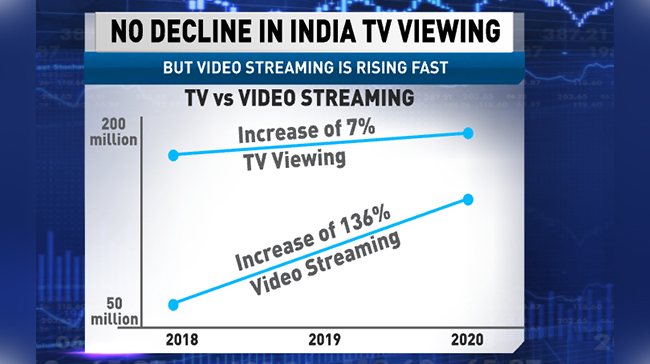

In places like India too I think that TV viewing is just about holding up but my suspicion is that very soon in India to the same is likely to play itself out given the extremely sharp rise we are seeing now in OTT platforms - Ruchir Sharma

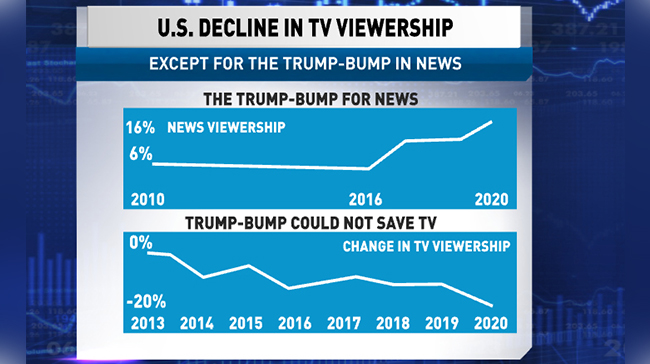

What the pandemic has done in many ways is that it has accelerated many trends that were already underway. That's been for me the one feature of this pandemic. So much more to streaming even theatrical viewing has been declining in America very significantly over the last 20 years - Ruchir Sharma

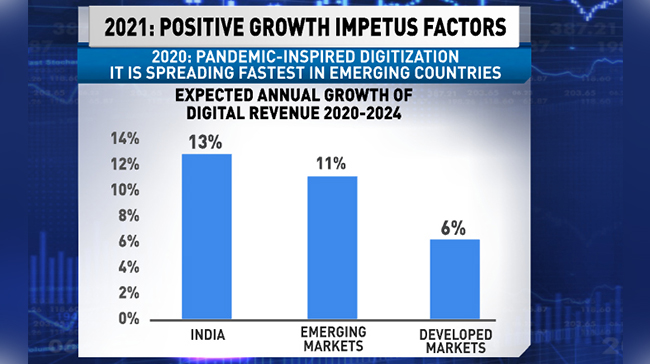

As far as India is concerned as well I felt quite fascinating here that like even in India is such a big disconnect between how foreigners perceive the country another domestic businesses do that in the last year India attracted 23 billion dollars of foreign investor flows and that was the second highest for any emerging market after China - Ruchir Sharma

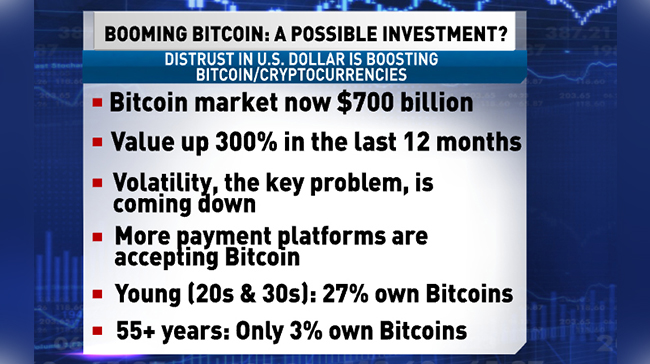

"In many ways, #Bitcoin is emerging as the new gold for many investors": Global Investor and Author Ruchir Sharma to NDTV pic.twitter.com/TJQ62A5eFs

- NDTV (@ndtv) January 9, 2021

"The older people dismissed #Bitcoin as some speculative tech investment, the young are much more passionate about it": Global Investor and Author Ruchir Sharma to NDTV pic.twitter.com/1AYeZT3gES

- NDTV (@ndtv) January 9, 2021

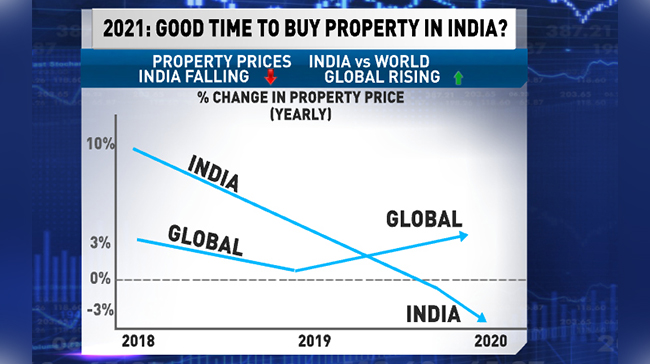

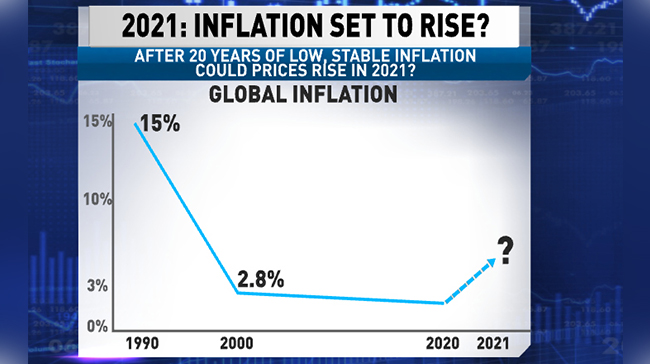

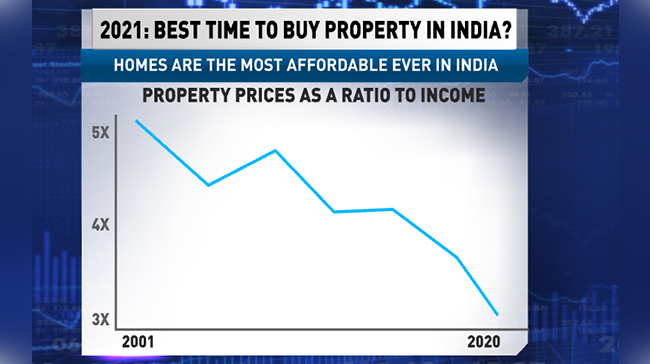

"If inflation begins to inch higher, as I have suggested, that's another reason to buy property": Global Investor and Author Ruchir Sharma to NDTV pic.twitter.com/eo2Nync4nq

- NDTV (@ndtv) January 9, 2021

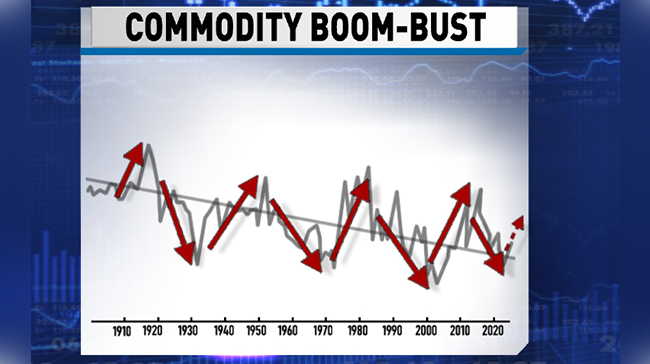

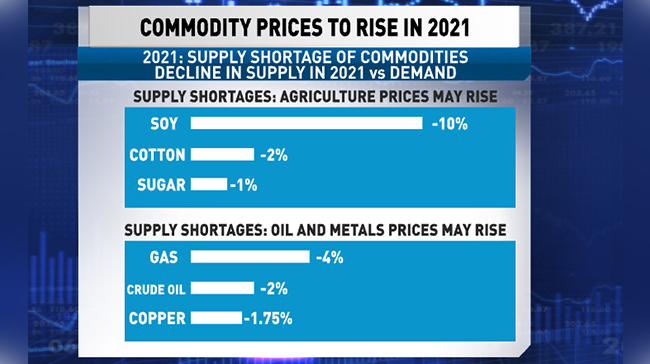

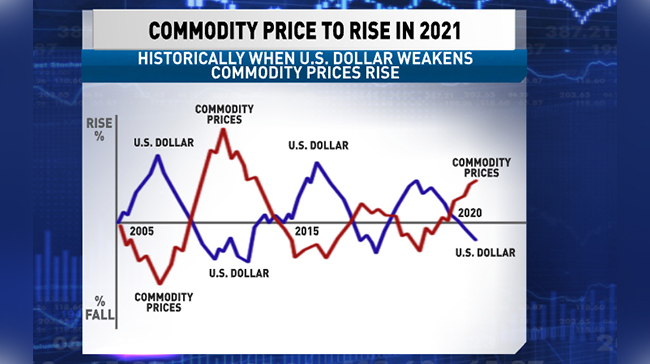

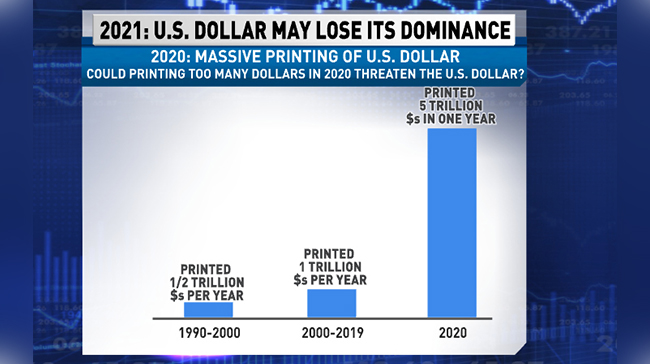

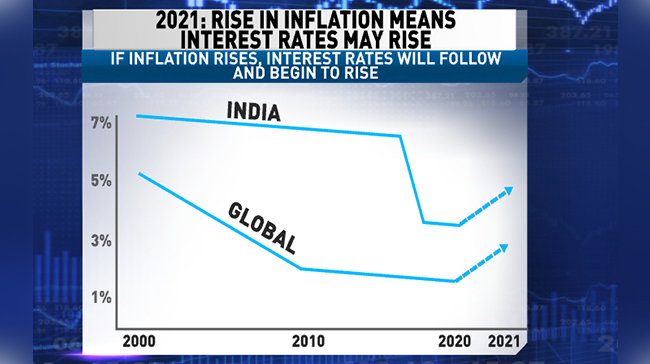

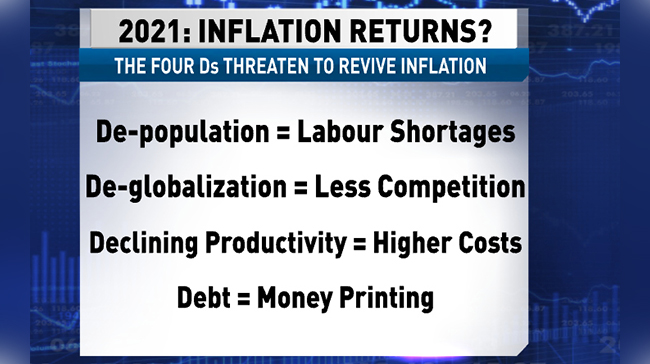

"Seeds are being sown for inflation...": Global Investor and Author Ruchir Sharma to NDTV pic.twitter.com/kEbxbTqRB3

- NDTV (@ndtv) January 9, 2021

"The stimulus effects will begin to fade in 2021": Global Investor and Author Ruchir Sharma to NDTV pic.twitter.com/9R82zBJuw5

- NDTV (@ndtv) January 9, 2021

"In 2020, despite such a horrible economic contraction that we got in the global #economy, inflation did not fall that much": Ruchir Sharma, Global Investor and Author pic.twitter.com/ecwiyfXMFZ

- NDTV (@ndtv) January 9, 2021

The Top 10 Trends Of 2021 | "Economic consequences and effect has been the worst that we have had in post world war 2 history": Ruchir Sharma, Global Investor and Author pic.twitter.com/5TFtXTl1lf

- NDTV (@ndtv) January 9, 2021

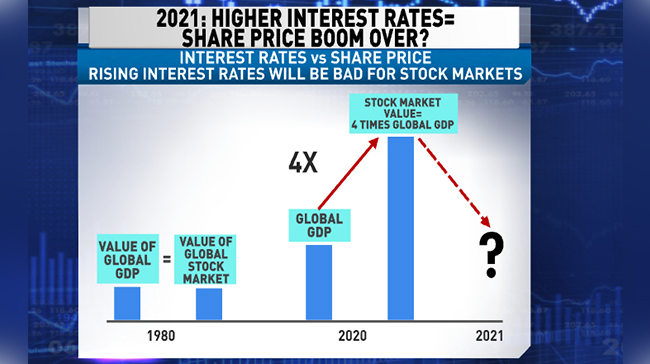

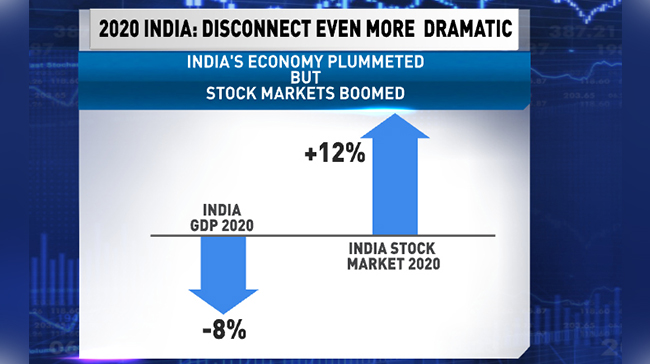

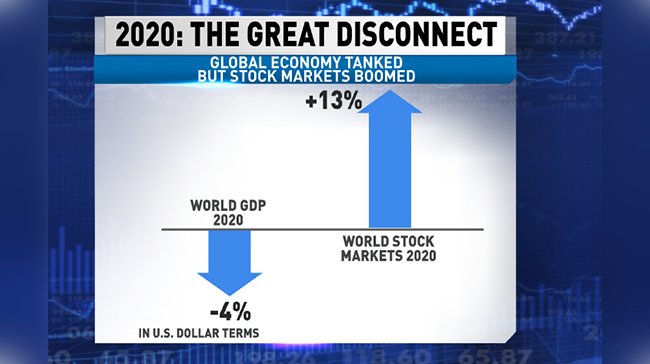

"I'm trying to say that the very factors that propel the stock market to do so well in 2020 in the midst of the devastating pandemic - those very factors now go into reverse. So unless something else happens which we don't anticipate at this juncture, to expect that in 2021 the economy will surge back and the stock market will keep doing well i think is a bit of a disconnect. So i do think that the fact is that interest rates will also go up or the liquidity conditions may not be that abundant - something that we will discuss in our next segments of the show. But I think that it's very important to analyze why did the stock market do what it did in 2020 and how those factors and how those factors will not play out in 2021," Mr Sharma says.

Prannoy Roy: This has been a traumatic year, complete shock out of the blue. How does this crisis compare with 2008, 2001, is this worse than that or about the same or better - not as bad?

Ruchir Sharma: Right, I think that to put this in perspective in terms of the sheer economic effect because we're discussing that on the show primarily - the contraction that the global economy saw this in 2020 of minus four percent was the worst contraction in seventy-five years. So definitely the economic consequences and the economic effect of this has been the worst that we've had in post-World War II history.

Now Time Magazine went to the extent of calling this the worst year ever. I'm not sure I would go to such an extreme because I think that history is better remembered than its lived - the Great Depression, the World Wars, even the 1970s when we had stagflation, Vietnam War, riots and even in places like India..the Emergency - we have had some very difficult periods - but yeah, this ranks right up there in terms of obviously the number of people who have died because of the pandemic and in terms of economic contraction that's the one data which will stand out that this has been the worst economic contraction in seventy-five years.

But again, as your favourite expression is - it all depends who you ask because if you ask people who have been involved with the stock market and in the financial community, they have had a very different view, I think, because 2020 ended up being a pretty good year..if you are a financial investor and almost did nothing and sat through this crisis.