To check EPF (employee provident fund) balance, subscribers can also download EPFO's app.

Retirement fund body EPFO or Employees' Provident Fund Organisation has been coming up with new ways for enabling EPF subscribers check their balances or passbook. Currently, EPFO subscribers' entire 12 per cent contribution is deposited into their employee provident fund or EPF accounts. Besides, 3.67 per cent is also contributed to the EPF account by the employer who also contributes 8.33 per cent of basic wages to the EPF account. EPFO has also been sending SMSes to members with activated UANs or Universal Account Numbers on their registered mobile numbers regarding their monthly PF contribution.

How To Check EPF Balance/Passbook Online

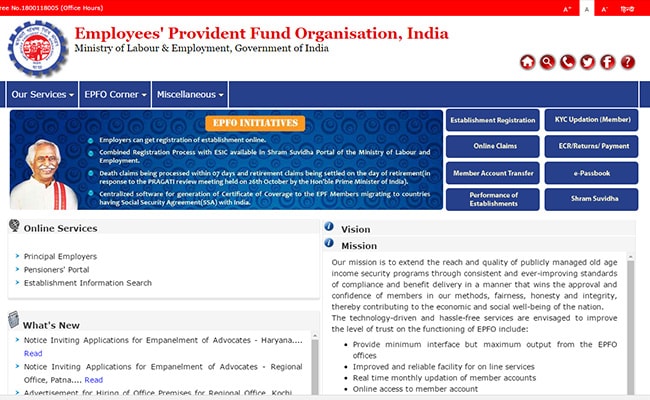

For a quick check of EPF passbook/balance, EPFO has prominently displayed the link for checking it on its website. The e-passbook link can be found at the top-right corner of EPFO's website.

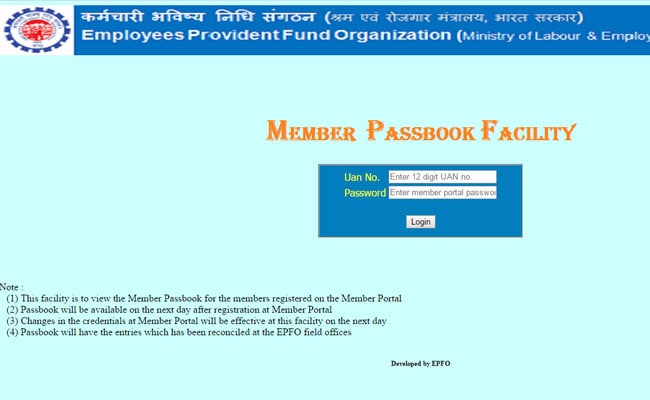

After clicking on the link, the subscribers are taken to a webpage where they need to enter the UAN number and password. (UAN is allotted by the retirement fund body and the number allows portability of provident fund accounts from one employer to another.)

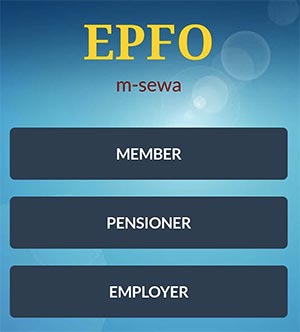

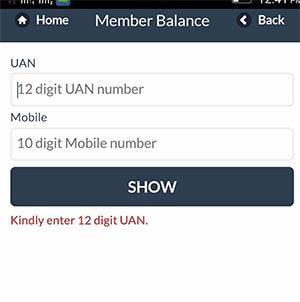

Subscribers can also quickly check their passbook/balances through EPFO's app - m-epf. EFPO subscribers need to click on MEMBER and thereafter Balance/Passbook.

EPFO will make payments to beneficiaries through an electronic or digital fund transfer system only for ensuring "quick transfer of funds, and easier tracking and reconciliation thereof", the retirement body said in a statement. Such move is likely to benefit 4.5 crore EPF subscribers and around than 54 lakh pensioners. This follows the Labour Ministry making amendments in social security schemes administered by EPFO.

As part of government's 'e-gov' initiatives, EPFO subscribers who have activated their UAN and seeded their KYC (Aadhaar) with the retirement fund body will be able to apply online for PF final settlements, PF part withdrawals and pension withdrawal benefits from their UAN interface directly. This will help quicken the claim process.

How To Check EPF Balance/Passbook Online

For a quick check of EPF passbook/balance, EPFO has prominently displayed the link for checking it on its website. The e-passbook link can be found at the top-right corner of EPFO's website.

After clicking on the link, the subscribers are taken to a webpage where they need to enter the UAN number and password. (UAN is allotted by the retirement fund body and the number allows portability of provident fund accounts from one employer to another.)

Subscribers can also quickly check their passbook/balances through EPFO's app - m-epf. EFPO subscribers need to click on MEMBER and thereafter Balance/Passbook.

Some Other Developments

EPFO will make payments to beneficiaries through an electronic or digital fund transfer system only for ensuring "quick transfer of funds, and easier tracking and reconciliation thereof", the retirement body said in a statement. Such move is likely to benefit 4.5 crore EPF subscribers and around than 54 lakh pensioners. This follows the Labour Ministry making amendments in social security schemes administered by EPFO.

As part of government's 'e-gov' initiatives, EPFO subscribers who have activated their UAN and seeded their KYC (Aadhaar) with the retirement fund body will be able to apply online for PF final settlements, PF part withdrawals and pension withdrawal benefits from their UAN interface directly. This will help quicken the claim process.

Track Latest News Live on NDTV.com and get news updates from India and around the world