9 years ago

A diverse debate on the Goods and Services Tax or GST Bill in Rajya Sabha ends with government garnering the Opposition support even as AIADMK stages a walkout. The Opposition in the Upper House has united behind Congress demanding that the government must introduce the final GST Bill as a finance bill and not a money bill so it is discussed in both houses before becoming a law.

I would like to add that GST will also be the best example of cooperative federalism. Together we will take India to new heights of progress

- Narendra Modi (@narendramodi) August 3, 2016

A victory for the government, cake cutting for its Finance Minister

GST Bill is passed unanimously after AIADMK walkout. Ayes - 203, Noes - Nil

Voting for the GST Constitutional Amendment begins, clause 1 is passed unanimously barring AIADMK walkout

Let us make a first draft of the bill, which will have the contribution of eight of your (opposition) ministers and the parliament will have the provision to discuss the bills. I assure you the government has no intention of bypassing a discussion: Arun Jaitley

What is the harm if honorable finance minister says the GST will be brought as a financial bill? It will give us voting power: Ghulam Nabi Azad

The Finance Minister, come November, will bring the GST as a Money Bill to bypass a debate like he has done in the past with the Aadhar and Private Members Bill: Jairam Ramesh

Can't give assurance of a financial bill since the constituents of the bill are not known to me: Arun Jaitley

In accordance with the precedence, if a bill is a taxing bill, the bill section of the parliament recommends it to be finance bill, otherwise a money bill. We have no intention to bypass the constitution: Arun Jaitely

P Chidambaram reiterates the demand of a united opposition that the bills under the GST constitutional amendment be brought as finance bills and not money bill

An effort has to be made to keep the GST at a reasonable rate: Arun Jaitley

The amendment is just to empower to constitute a GST council. The parliament will have the provision to discuss various laws under the GST.

We will work to keep the rate as low as possible.

The amendment is just to empower to constitute a GST council. The parliament will have the provision to discuss various laws under the GST.

We will work to keep the rate as low as possible.

BJP's Arun Jaitley's reply to ally Shiv Sena on Entry Tax or OCTROI under GST

- A solution within the framework of the GST is workable. The idea is to not stave off the municipal bodies if there's unable to manage funds.

To P Chidambaram's 'clumsy drafting' of GST, Arun Jaitley evokes BN Rau and BR Ambedkar

The text pointed out is verbatim from BN Rau's draft in the constituent assembly.

The 2011 bill had nothing on how to compensate for losses. That is why there were protests. Let us not make this a Congress vs BJP thing.

The text pointed out is verbatim from BN Rau's draft in the constituent assembly.

The 2011 bill had nothing on how to compensate for losses. That is why there were protests. Let us not make this a Congress vs BJP thing.

Arun Jaitley's reply to states' losing revenue to GST

- When we said the Centre will pay compensation for states' loss of revenue, they were not ready to trust the government.

- This is how the word in the bill that Centre 'may' compensate became 'shall' and full compensation was agreed for 5 years.

Arun Jaitley's reply to Chidambaram's demand of tax rate cap

Factor 1 - The state finance ministers did not agree to the 18 per cent cap figure as per the chief economic advisor's report. They wanted higher to keep a cushion.

Factor 2 - The report did not take into consideration the compensation the Centre will have to pay to the states. The chief economic advisor is optimistic that the GST rate can be maintained btw 17 and 19 per cent, but the states are not as optimistic.

Factor 1 - The state finance ministers did not agree to the 18 per cent cap figure as per the chief economic advisor's report. They wanted higher to keep a cushion.

Factor 2 - The report did not take into consideration the compensation the Centre will have to pay to the states. The chief economic advisor is optimistic that the GST rate can be maintained btw 17 and 19 per cent, but the states are not as optimistic.

GST will eliminate the cascading effect of tax on tax: Arun Jaitley

Are states enemies of the people who will levy extra tax on people?

Central government charges excise duty which amounts up to 12 per cent. State levy VAT. Compound tax on almost 60 percent of the goods amounts up to 27 per cent.

After GST is introduced, like Mr Chidambaram said, the system will be more efficient

Central government charges excise duty which amounts up to 12 per cent. State levy VAT. Compound tax on almost 60 percent of the goods amounts up to 27 per cent.

After GST is introduced, like Mr Chidambaram said, the system will be more efficient

It is half truth when you say the Centre has a veto over states. States also have a veto over the Centre.

- The GST council is all of us sitting here.

- Parliament will make a law based on the recommendations of the council. Our law will be based on the council which has 2/3rd majority of states. We will act on the advice of the council.

States admittedly have to be stronger but the union has to be strong too. India is a union of state and not a confederation. It can't exist without the union.

Mr Jaitley switches from Hindi to English after uproar in Parliament over his choice of language

Finance Minister Arun Jaitley begins his conclusive speech after all the parties have put forward their reservations regarding the GST bill

The GST rate must be mentioned in a law. Without it, no tax can be imposed or collected: Anand Sharma

- The 18 per cent cap figure for GST came from the report of your chief economic advisor.

- Currently the break-up of tax results in a 26-28% tax (if you all everything). Comparing that to the developed countries who have GST are at 16.8%, the developing economies with GST are at less than 15%.

- When you (government) bring the GST bills (State, Centre and Interstate), please specify the tax rate under law.

- The bill should be a Finance Bill and discussed in the Rajya Sabha before it becomes a law.

- You must also talk about the commodities excluded from the bill.

A big decision such as the GST cannot be taken by deliberately keeping people in the dark: Congress' Anand Sharma

- It is the right of the people of the country to know what the history to the case is.

- At that time (10 years ago) there were protests. everyone knows that those protests were purely political... Gujarat had protested a lot.

- Narendra Modi himself protested against it. at that time it was said that the GST is not in favour of India, it will weaken the country.

- We always wanted the GST to be implemented. So to say we oppose it is unfair.

We're glad you have finally come around to believe in GST.

To increase your revenue, you (Centre) have eaten into Mumbai's revenue. It may be Mayanagari (enchanted land) for you, it's Maa (mother) for us: Shiv Sena's Sanjay Raut

- If Mumbai is made to beg, then the country will become a beggar too.

- The OCTROI check posts in Mumbai also gives it an extra layer of security. Please consider it while deciding to scrap it after GST.

A cap on tax rate will ensure that the indirect taxes are not too high: D Raja, CPI, Tamil Nadu

- The constitutional amendment will be followed by the Central GST Bill, State GST Bill and the Integrated GST Bill. We don't know the content of those bill.

- So a discussion on all the bills must take place in Rajya Sabha when the GST is introduced as a Finance Bill.

Shiromani Akali Dal's Naresh Gujral urges all parties in Rajya Sabha to support the GST bill which he said would help in creating more jobs, and congratulates Arun Jaitley on a commendable job.

Shiv Sena's Anil Desai highlights the loss of revenue to local bodies such as Mumbai Municipal Corporation which he says earns over 7,000 crore yearly, and asks the Finance Minister to clarify on compensation directly to such bodies.

I have a problem with the government seeking for the support now when they opposed the bill when it was introduced by the Congress over 4 years ago. The government says the GST bill will raise India's GDP by 1-2 per cent. Then why didn't the BJP support the bill as opposition? Narendra Budania, Congress, Rajasthan

Tamil Nadu has a huge borrowing of 2 lakh crores. It should not be further burdened. The compensation for first 5 years of revenue loss of states should be 100 per cent and it should be clearly mentioned: TKS Elangovan, DMK

Ek Vidhan, Ek Karadhan (One Legislation, One Taxation): BJP's Mahesh Poddar

- The GST bill simplify and synchronise indirect tax regime. From 5-7 tax laws to 2 will simplify lives of people

- It will reduce the multiplicity of taxes and reduce the hidden cost in commerce

- This is the first time we will be talking as one nation on taxes

Sikkim will lose revenue on the account of not being able to levy 1 per cent extra surcharge as per the bill. Hope the Finance Minister speaks on the issue: Hishey Lachungpa, SDF, Sikkim

We want a constitutional guarantee and clarity on the mode of payment of Centre's compensation for states' revenue losses for first 5 years: Garikapati Mohan Rao, TDP, Telangana

We have no reservations when it comes to the bill, it's progressive and we're glad it's finally getting passed, but the demands of Odisha are being suppressed: Biju Janata Dal's Dilip Kumar Tirkey

We support the bill but there are doubts. When the Finance Minister clarifies, he must also speak on the timeline of implementing it: Surendra Singh Nagar, Samajwadi Party, UP

GST will bring uniformity. A global investor will benefit if the same law is practiced in all states. This will make India one large market and an investment destination: BJP's Ajay Sancheti

Congress's Vivek Tankha reiterates party's demand to cap the GST rate, says 18 per cent already too high

- If the indirect tax rate is higher than 18 per cent, it will affect inflation and the lives of people.

- Revenue sharing model between the states and Centre must be spelled out.

- Like Mr Chidambaram said, we support the idea and the bill subjective to clarification by the Finance Minister

GST is India's biggest indirect taxes reform, which affects every business big and small: Rajeev Chandrasekhar, Independent MP from Karnataka

I urge to bring it (GST) as finance bill and not as money bill, says Praful Patel

- Earlier the bill only spoke of goods, now services are crucial which will change and improve further.

- I urge all sections of the house to support the bill and urge the government to take us along as partners and discuss in this house before you take the final steps.

For far too long we have had different tax structures in our country. It led to loss of revenue to the exchequer. The GST is a step in major reform that must meet its logical conclusion: Praful Patel

NCP's Praful Patel: We must address the issue of the poorer states. It is in this spirit that progressive states like Maharashtra have come in support of the bill.

Telugu Desam Party's CM Ramesh: We support this (GST) bill.

BSP backs Congress' demand to bring the GST Bill as a Finance Bill before implementation and not a Money Bill so it is discussed in both houses of parliament

- We are supporting the bill to back 90 per cent of the people of this nation which is hoping the bill will help the economy.

Goods and Services Tax has been given massive powers. It takes away from power of the states to amend laws which affects its people: Satish Misra

BSP's Satish Chandra Misra, who was also party's representative in the select committee on GST, begins his argument

Narrow space for states' redressal in case revenue is not paid to them by the Centre: AU Singh Deo

- The Centre should not be given a veto power and the redressal mechanism for states should be stronger.

BJD's AU Singh Deo begins by saying that his party supports the bill, but needs to highlight issues faced by the state of Odisha

The sovereignty of the constitution is the people. We begin by saying 'for the people'. So if any bill which is passed by the Lok Sabha is seen by Rajya Sabha as not in favour of the people, we will block it: Sitaram Yechury

Are we going to reduce the states to come to Centre with begging bowls to ask for money? CPI(M)'s Sitaram Yechury

- We are a council of states here. We need to protect the right of state government.

- If there's no clarify on how Centre and states share the revenue, then the bill has a serious lacuna.

The Finance Minister after the debate must clarify that the bill will not be passed as a Money Bill and speak on the health of local bodies after GST: Sharad Yadav

- We want to work with you and support you, don't do anything that sidelines us.

JDU, the third party after Congress and Samajwadi Party opposes bringing the GST as a Money Bill after it's passed in state assemblies

We agree that if India becomes a single market through a unified tax regime, it will help the economy: Sharad Yadav

- The bill will strengthen the economy and reduce corruption.

JDU's Sharad Yadav takes over the arguments after TMC assures its support to the GST Bill

We need to debate, legislate and implement the GST for the young India of tomorrow: TMC's Derek O'Brien

On P Chidambaram's Good Sense Triumphs for GST Bill, Derek O'Brien calls it Congress' 'Go Slow Tactics'

- Let us know whether the politics on the GST will continue till November or will it become a cricket match with multiple innings.

- We need to pass implement the GST Bill on April 1, 2017 and this is why I am being very specific.

TMC's Derek O'Brien starts with a debate on the 'politics of the GST bill' calls it 'Girgit (chameleon) Samjhauta Tax'

- Before we get to the details of the bill, let me talk of the ping pong the two parties (BJP and Congress) have played for over a decade.

- People ask me if my party supports the bill, perhaps the question should be posed to the government.

This constitutional amendment bill is not constitutional. It violates the fiscal autonomy of the states: AIADMK's A Navneethakrishnan

- It violates the federal structure of the constitution and hence democracy.

- How can a bill be passed without knowing the tax rate? Without defining it, this bill is a waste paper.

- Tamil Nadu will incur losses of over 9,200 crores due to the GST which has to be then compensated by the central government.

The reason why the government does not accept a tax rate cap is because its intention is to increase the tax: Naresh Agrawal

- We agree with P Chidambaram that when the bill, accepted by states, comes back to the parliament, must not be brought in as a money bill. It has to be discussed in both the houses before it is implemented.

We are unwillingly supporting the GST so the people does not think Samajwadi Party is a roadblock in India's economic development: Naresh Agrawal

The new financial transformation through GST Bill will strengthen India's economy and give justice to all economic sections of the country: Bhupendra Yadav

Central government will compensate for the 1 per cent additional tax levied by states quashed in the amendment: Bhupendra Yadav

Tax evasion is due to the complexities of India's tax regime: Bhupendra Yadav

- Our bill has tried to simplify the tax that a common man has to pay. Through GST, we will bring together all the various taxes to be paid and the subsequent returns to be filed.

-

- India's strength as one of the biggest markets will converge into one marketplace from 29.

-

- Our PM believes that the states must work together for India's development. Through GST we will be able to portray India as one strong financial market.

BJP's Bhupendra Yadav takes his turn to speak in the Rajya Sabha as former finance minister P Chidambaram concludes his argument.

The GST bill should be introduced as a Financial Bill and not as a Money Bill so both Lok Sabha and Rajya Sabha could debate the bill: P Chidambaram

I on the behalf of my party, loudly and clearly suggest that the GST rate should not exceed 18 per cent: P Chidambaram

Taxation should exclusively be the power of the parliament and not the executive. While the tax rate will not be included in the constitutional amendment, when the finance bill is introduced tomorrow, a standard and most acceptable rate of 18 per cent should be mentioned in the bill.

Taxation should exclusively be the power of the parliament and not the executive. While the tax rate will not be included in the constitutional amendment, when the finance bill is introduced tomorrow, a standard and most acceptable rate of 18 per cent should be mentioned in the bill.

The GST rate must only be changed by the approval of the parliament: P Chidambaram

- When we say cap the tax rate, we say that it should not be changed by the whim of the executive.

- We argue that the government must cap the rate basis its own report, which should only be changed with the approval of the parliament and not executive.

- In the name of the people, the standard rate of GST must not be more than 18 per cent.

- It will be non-inflationary and will be accepted by the people.

Every Finance Minister under pressure to maximise revenues, but we must not forget indirect tax affects rich and poor:P Chidambaram

- In high income countries, the average indirect tax paid is 16.4 per cent, in emerging economies like India, it's 14.1 per cent.

- The collection of direct taxes should be far over the collection through indirect taxes.

If Finance Minister Arun Jaitely looks carefully, he will find pieces of clumsy drafting in the GST Bill: P Chidambaram

- There could not be perfect bill. Congress has never been opposed to the idea of GST. A debate on the matter has been going on for several years.

- There is not much scope of making the bill any better as we are in the final stage of discussion, but if Mr Jaitley will look carefully, he will see the areas of clumsy drafting in the bill.

- The government should revise the GST amendment to strengthen the dispute resolution mechanism.

The 2014 bill was opposed, idea wasn't because we felt it was possible to have a more perfect bill: P Chidambaram

Let me make it clear, Congress was never opposed to the idea of GST: P Chidambaram in RS

Tone and approach has changed over the last 3-4 weeks and that augers well for this bill: Former Finance Minister P Chidambaram in Rajya Sabha on GST

I welcome friendly and conciliatory tone of Finance Minister's speech: Former Finance Minister P Chidambaram in Rajya Sabha

P Chidambaram speaking on GST bill in Rajya Sabha

With a uniform tax rate, we will be able to bring about seamless transfer of goods and services across country: Arun Jaitley

Sate and Centre need to work together: Jaitley

GST bill will empower the states, will increase revenue of states as well as Centre. It will ensure that there is "no tax on tax": FM Jaitley

After GST, India will be one economic marketplace: Arun Jaitley

2/3rd of the voting power in the GST council belongs to states, 1/3rd belongs to the Centre: Arun Jaitley in Rajya Sabha

Extremely thankful to all opposition parties especially Gulam Nabi Azad- Arun Jaitley in Rajya Sabha

A reform like GST cannot be passed on partisan consensus: Arun Jaitley

The select committee made some suggestions, and the government decided to make some radical changes: Arun Jaitley on GST

Arun Jaitley on GST bill

GST is one of the most important tax reforms in India's history: Arun Jaitley

GST is one of the most important tax reforms in India's history: Arun Jaitley

Arun Jaitley speaking on GST bill in Rajya Sabha

Finance Minister Arun Jaitley introduces GST Bill in the Rajya Sabha

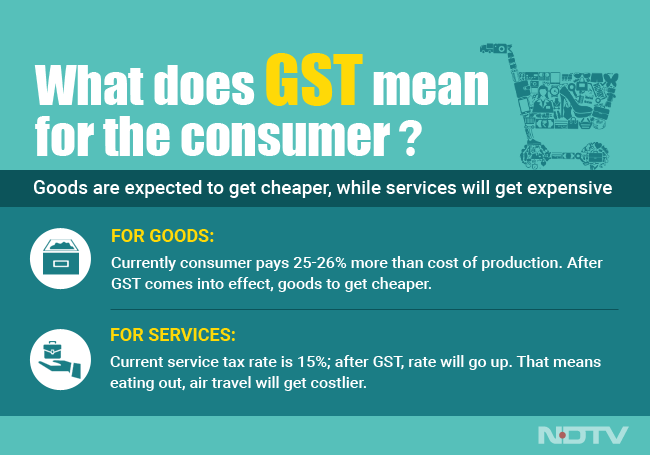

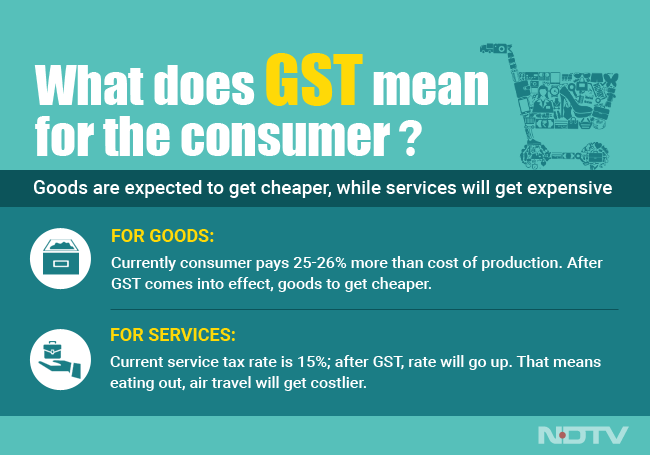

How GST will affect the consumer

Air travel and eating out at restaurants are likely to get expensive as service tax rate will be more following the introduction of the GST.

Air travel and eating out at restaurants are likely to get expensive as service tax rate will be more following the introduction of the GST.

Raman Singh confident that GST Bill will pass Rajya Sabha test

Chhattisgarh Chief Minister Raman Singh said that he was confident that GST bill will be passed by Rajya Sabha. "GST will be passed, Centre has assured that it will help states for first 3 years in case of loss," Mr Singh

Chhattisgarh Chief Minister Raman Singh said that he was confident that GST bill will be passed by Rajya Sabha. "GST will be passed, Centre has assured that it will help states for first 3 years in case of loss," Mr Singh

These are the taxes that you will pay once GST is passed

Sena's Sanjay Raut on GST

Party's stand is clear,how will you compensate loss that will be caused to BMC through GST: Sanjay Raut

Party's stand is clear,how will you compensate loss that will be caused to BMC through GST: Sanjay Raut

Hopeful Of GST Rollout By April 2017: Finance Minister Arun Jaitley To NDTV

The finance minister said all stakeholders have been consulted, states are involved and that the guiding principal for GST is one laid down by state finance ministers - "Lower prices, higher revenue."

The finance minister said all stakeholders have been consulted, states are involved and that the guiding principal for GST is one laid down by state finance ministers - "Lower prices, higher revenue."

Hopeful of GST rollout by April 2017: Jaitley

Finance Minister Arun Jaitley has told NDTV that he was hopeful the GST will be rolled out by April 2017.

Finance Minister Arun Jaitley has told NDTV that he was hopeful the GST will be rolled out by April 2017.

Congress Rajya Sabha strategy meet on GST at 10:15 AM in Parliament today

GST Closer To Reality: What Could Get Cheaper

- Prices of entry-level cars, two-wheelers, SUVs may fall

- Car batteries likely to get cheaper

- Paint, cement prices likely to fall

- Movie ticket prices likely to fall as entertainment tax will come down

- Electronics items like fans, water heaters, air coolers, etc. will get cheaper

How GST Will Help Small Businesses

For many small manufacturers here in Delhi's Kashmere Gate, Asia's largest spare parts market, GST also means dealing, hopefully, with only one tax inspector.

For many small manufacturers here in Delhi's Kashmere Gate, Asia's largest spare parts market, GST also means dealing, hopefully, with only one tax inspector.

Rahul Gandhi Chalk Out Party's Strategy On GST

Congress Vice President Rahul Gandhi met Leader of the party in Lok Sabha Mallikarjun Kharge, former Finance Minister P Chidambaram and Deputy Leader of the party in Rajya Sabha Anand Sharma, among others, in Parliament House and discussed various points regarding the key tax reform legislation.

Click here to know more about what happened on Day 12 of the Monsoon Session.

The Rajya Sabha is likely to witness heated debate as the Goods and Services Tax (GST) reaches the Upper House. The government has circulated copies of the draft Constitution Amendment Bill GST among MPs. The main opposition party, Congress, yesterday got into a huddle to chalk out the party's strategy ahead of its consideration and passage in the Rajya Sabha.