While such waivers could provide succour for 32.8 million indebted farmers, an IndiaSpend analysis of the impact of previous farm-loan waivers indicates such bailouts are band-aids of uncertain efficacy and do not address a deeper malaise gripping India's agrarian economy.

Over nine years to March 2017, the central and state governments waived Rs 88,988 crore ($13.9 billion) in loans to 48.6 million farmers. The nationwide Rs 52,000 crore ($11.3 billion at Rs 45.99 per dollar) loan-waiver announced by the United Progressive Alliance (UPA) in 2008 occupies the bulk of this figure.

The waivers were primarily meant to discourage suicides by farmers, apparently caused by widespread indebtedness. However, our analysis shows this had little or no impact on suicide rates, probably because 32.5% on average, or 79.38 million, small and marginal farmers across India (with farm holdings of less than 1 to 2 hectares in size) rely on informal sources of credit.

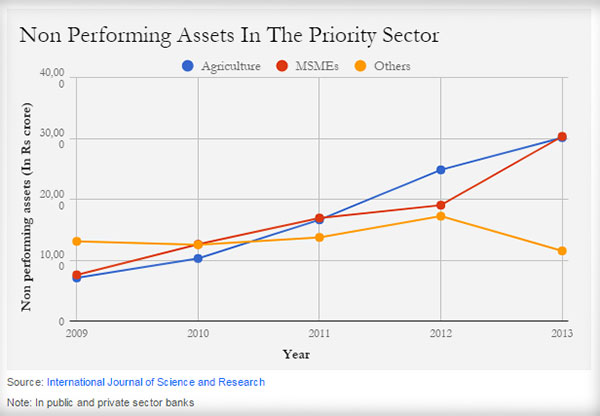

Meanwhile, loan waivers have led to a rise in the non-performing assets of banks, especially public-sector banks, and are likely to have a significant bearing on the state and national fiscal deficits. In 2013, agricultural non-performing assets (NPAs) accounted for about 41.8% of "priority sector"-which also comprises micro and small enterprises, affordable housing, and student loans-NPAs in public and private banks-up from 25% in 2009, according to a 2015 study on NPAs in priority-sector lending in India's public and private banks, published in the International Journal of Science and Research (IJSR).

For example, Maharashtra's Rs 30,000 crore farm-loan waiver for small and marginal farmers will raise the state's fiscal deficit to 2.71%, which is three-fourths (1.18 percentage points) higher than the budgeted deficit of 1.53% of the gross state domestic product (GSDP) for the current financial year, according to this 2017 report by ratings agency India Ratings and Research (Ind-Ra). Uttar Pradesh's Rs 36,359 crore farm-loan is 2.6% of its GSDP, estimated the agency quoted in Mint in April, 2017 The 14th Finance Commission says fiscal deficits should not exceed 3% of state budgets.

22.1 million (67.5%) small or marginal farmers won't benefit from loan waivers

About 85% of all operational farm holdings in India are less than two hectares in size, as IndiaSpend reported on June 8, 2017. Since 1951, the per capita availability of land has declined 70%, from 0.5 hectares to 0.15 hectares in 2011, and is likely to decline further, according to the latest available ministry of agriculture data.

Owners of these shrinking farms find it difficult to use modern machinery and are often too poor to afford farm equipment. Manual labour increases costs, and size and output further limits access to loans and institutional credit.

On average, a third of Indian small and marginal farmers have access to institutional credit. This means no more than 10.6 million of 32.8 million small and marginal farmers in the eight states demanding loan waivers could benefit from debts being written off.

These NPAs affect the credibility of lending institutions. Shares of banks fell 4% after Maharashtra announced its loan waiver, Business Standard reported on June 13, 2017. Further, with public-sector banks (PSBs) accounting for the major share of farm credit-52% in Maharashtra, followed by 32% from co-operative banks and 12% in private banks-these PSBs are "more vulnerable", said this 2017 Kotak Institutional Equities report.

Loan Waivers mean that money which could have gone to strengthening agricultural infrastructure will not have adequate funds.

M S Swaminathan (@msswaminathan) June 13, 2017

Since 2010, cost of growing #turdal has risen 78%, highest in 7 years, shredding farm incomes. pic.twitter.com/8UFi4Awy5D

IndiaSpend (@IndiaSpend) June 8, 2017

Track Latest News Live on NDTV.com and get news updates from India and around the world