LIC last month operationalised a new pension scheme called Pradhan Mantri Vaya Vandana Yojana (PMVVY). This follows Prime Minister Narendra Modi earlier announcing the launch of a scheme for senior citizens (60 years and above) in which they will get a guaranteed interest of over 8 per cent for 10 years. LIC or Life Insurance Corporation of India will operate this scheme. Financial planners say that Pradhan Mantri Vaya Vandana Yojana Scheme will offer more avenues to senior citizens to earn regular income at a time of falling interest rates. According to LIC, Pradhan Mantri Vaya Vandana Yojana Scheme or the pension scheme will be available for one year from date of the launch. The PMVVY pension scheme is subsidised by the government.

Key Things To Know About Pradhan Mantri Vaya Vandana Yojana Scheme

1) According to LIC, the PMVVY pension scheme can be purchased offline as well as online from its website (www.licindia.in).

2) Under the Pradhan Mantri Vaya Vandana Yojana Scheme, the pensioner during the policy term of 10 years will receive pension at the end of each time period chosen (monthly/quarterly/half-yearly and yearly). The pension payment shall be through NEFT transfers (online) or Aadhaar Enabled Payment System, LIC said.

3) If the pensioner survives the policy term of 10 years, purchase price along with final pension installment shall be payable under the PMVVY pension scheme. (The amount invested in the scheme is called the 'purchase price'.)

4) On death of the pensioner during the policy term of 10 years, the purchase price shall be refunded to beneficiary.

5) The minimum age for entry into the PMVVY pension scheme is 60 years (completed) while there is no maximum age limit.

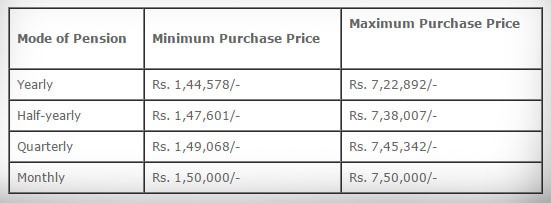

6) There is a minimum and maximum limit for investment in Pradhan Mantri Vaya Vandana Yojana Scheme. The amount varies according to the pension payment mode chosen. For example, under the yearly pension mode, the minimum amount that has to be invested in the scheme is Rs 1,44,578 and the maximum at Rs. 7,22,892. In monthly mode, the minimum amount that has to be invested is Rs 1,50,000 and maximum at Rs. 7,50,000. For other modes, see the table below.

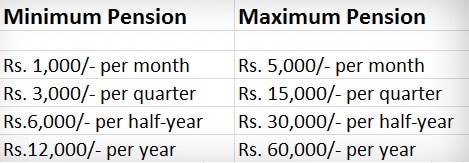

7) Accordingly, Rs 1,000 will be the minimum pension amount payable monthly for which Rs 1,50,000 has to be invested under the Pradhan Mantri Vaya Vandana Yojana Scheme. Similarly, the maximum monthly pension shall be Rs 5,000 per month for which Rs 7,50,000 has to be invested. For other modes, see the table below.

Track Latest News Live on NDTV.com and get news updates from India and around the world