Hours ahead of the Budget, Chief Economic Adviser Arvind Subramanian talks to NDTV's Prannoy Roy to decode the economic survey. The Economic Survey, which sets the scene for Finance Minister Arun Jaitley's fourth annual budget tomorrow, was prepared by Mr Subramanian and said that the economy should grow between 6.75 per cent and 7.5 per cent in the financial year beginning on April 1. The Economic Survey also said the implementation of wage hikes and muted tax receipts would put pressure on the fiscal deficit in 2017/18. The survey also describes Universal Basic Income, a form of social security in which everyone is allotted a basic allowance, as "a powerful idea" but one that's "not ready for implementation."

Following are the highlights of the discussion between Prannoy Roy and Arvind Subramanian:

(21:05 IST) Prannoy Roy: Congratulations. This (economic report) is exceptional and different from last year.

Arvind Subramanian: We raised ambition this year relative to last year, We have a wonderful team.

Arvind Subramanian: Last year, I said it's the ideas for bettering India that matter. This time we have scores of people who have contributed. There is a contribution by the Finance Minister - the first time actually.

Prannoy Roy: The survey is balanced. It is sober, particularly on demonetisation.

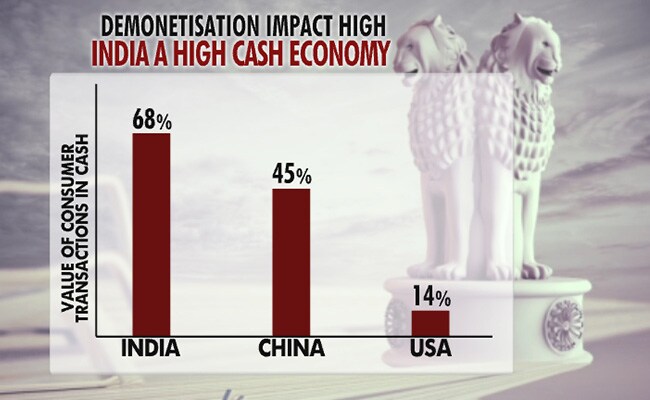

(21:10 IST) Notes ban hit hard as India is a cash dependent economy

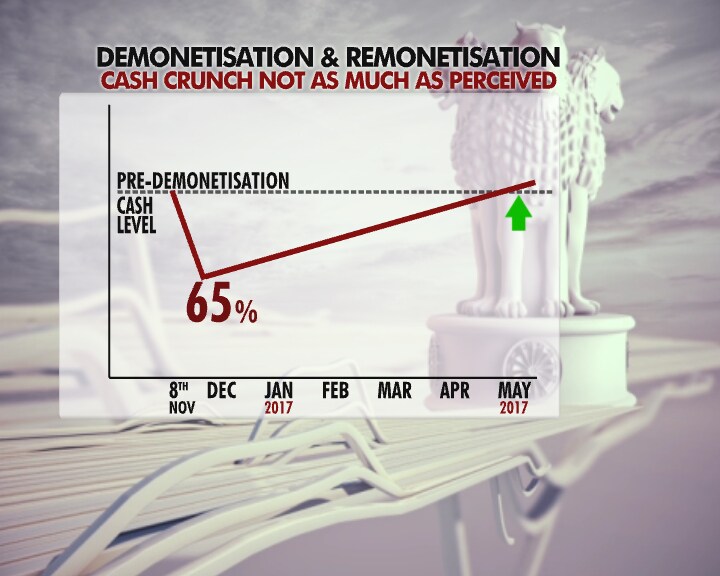

(21:13 IST) Arvind Subramanian: The drop is much less than the reported 86 per cent. Some of the demonetised notes were de facto used as legal tender. If you look at what the headline number is, people think the worst was in November. It was actually in December. We're remonetising and we're well on our way to reaching that.

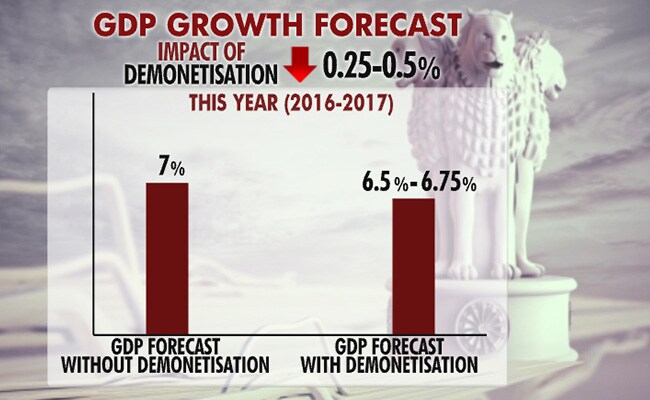

Prannoy Roy: The impact eventually that you studied was that it will drop out GDP rate by 0.25 to 0.5 percent. FinMin had forecast growth rate without demonetisation at 7 pc. GDP with demonetisation has brought down to 6.5-6.75 pc.

(21:15 IST) Cash crunch after notes ban not as bad as believed

- Everyone gets it

- Unconditional

- Agency...you get it as cash (in bank) not kind.

Track Latest News Live on NDTV.com and get news updates from India and around the world