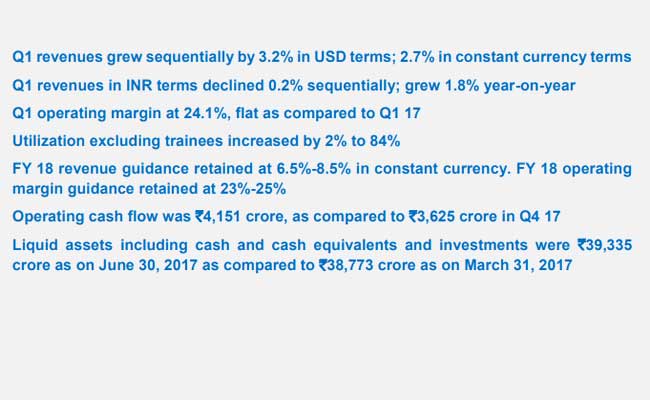

Here are the key highlights of Infosys Q1 earnings:

#InfosysQ1FY18 Utilization excluding trainees at 84%, improvement of 200 bps QoQ https://t.co/lfW51FG8zq

- Infosys (@Infosys) July 14, 2017

Really proud of our team's strong execution and great performance in Q1... @Infosys

- Vishal Sikka (@vsikka) July 14, 2017

An autonomous vehicle for me & Pravin, built right in Mysore @Infosys Engg Services!

- Vishal Sikka (@vsikka) July 14, 2017

Who says we can't build transformative technologies? pic.twitter.com/71qEA2y5vJ

#InfosysQ1FY18 Vertical Metrics: MFG & Hi-Tech grew by 2.0% sequentially; and 1.5% in constant currency https://t.co/lfW51FoxaQ

- Infosys (@Infosys) July 14, 2017

#InfosysQ1FY18 Vertical Metrics: FSI grew by 2.6% sequentially; and 2.0% in constant currency https://t.co/lfW51FoxaQ

- Infosys (@Infosys) July 14, 2017

#InfosysQ1FY18 North America grew by 1.3% sequentially; and 1.3% in constant currency https://t.co/lfW51FoxaQ

- Infosys (@Infosys) July 14, 2017

#InfosysQ1FY18 Europe grew by 4.7% sequentially; and 3.1% in constant currency https://t.co/lfW51FoxaQ

- Infosys (@Infosys) July 14, 2017

#InfosysQ1FY18 Rest of the world grew by 7.3% sequentially; and 6.9% in constant currency https://t.co/lfW51FoxaQ

- Infosys (@Infosys) July 14, 2017

#InfosysQ1FY18 Management commentary is expected to begin at 10:30 AM IST. Watch it live here: https://t.co/WoEjI3186b

- Infosys (@Infosys) July 14, 2017