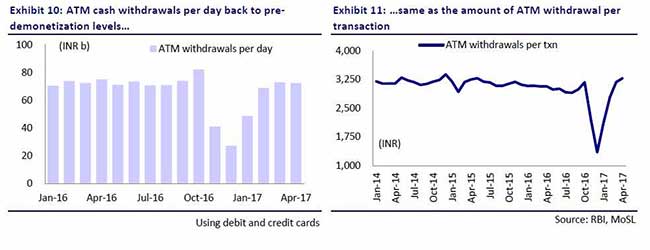

Cash withdrawals from ATMs have moved back to pre-demonetisation levels.

Demonetisation, a step taken by the government in November 2016 in its fight against black money, counterfeit currency and corruption, drove digital transactions. The shock move to withdraw Rs 500 and 1,000 banknotes from the banking system took out 86 per cent of currency in circulation. The government also saw in the notes ban an opportunity to encourage digital payments. But with ATM cash transactions back to pre-demonetisation levels, will the momentum seen in digital payments sustain? Will the average value of digital payment go up further?

Domestic brokerage Motilal Oswal Securities said that the aggregate value of all transactions under electronic payment systems has failed to witness significant increase even six months post-demonetisation. In a research report titled 'digital payments post-demonetisation', it also pointed out that with cash crunch easing post-December 2016, "there has not been any net addition to total volume of transactions" on a countrywide basis.

"One of the key structural benefits expected from the historic demonetisation announced in November 2016 was a shift towards digital payments. However, the aggregate value of all transactions under electronic payment systems (EPS) has failed to witness significant increase even six months post demonetisation," according to Motilal Oswal Securities.

Here are some other things pointed out by Motilal Oswal Securities:

While the value of transactions in retail digital modes (PoS, PPIs, IMPS and UPI) increased sharply in December 2016, it has stabilized at higher levels since then (up to May 2017)

After falling by more than 60 per cent in the last months of 2016, cash withdrawals from ATMs have moved back to pre-demonetisation levels. All these data points raise doubts over the desired structural shift towards digital payments post-demonetisation, the report said.

All these data points raise doubts over the desired structural shift towards digital payments post-demonetisation, the report said.

In a four-month period from November 2016 to March 2017, digital transactions saw a 23-fold surge increase, government think-tank NITI Aayog had said earlier this year. Volume of payments using various digital payment modes (namely UPI, BHIM and USSD) amounted to 63,80,000 in number and Rs 2,425 crore in value, from 2,80,000 in number and Rs 101 crore in value until November last year, it said./

Aadhaar-enabled payments also increased from 2.5 crore in November 2016 to over 5 crore in March 2017 while IMPS or immediate payment service transactions rose from 3.6 crore to 6.7 crore.

"Demonetisation was seen as a boost to digital payments, since approximately 90 per cent of transactions were believed to be taking place in 'cash'. Eventually, digitalisation was expected to help reduce tax evasion and corruption. However, available/estimated data up to May 2017 raises doubts over the increased digitalization in the economy," Motilal Oswal Securities added.

The Reserve Bank of India has said the withdrawal old Rs 500 and Rs 1,000 notes was introduced to tackle increasing fake currency in higher denomination. "India remains a cash based economy hence the circulation of Fake Indian Currency Notes continues to be a menace. In order to contain the rising incidence of fake notes and black money, the scheme to withdraw legal tender character of the old Bank Notes in the denominations of Rs 500 and Rs 1,000 was introduced," according to the central bank.

Domestic brokerage Motilal Oswal Securities said that the aggregate value of all transactions under electronic payment systems has failed to witness significant increase even six months post-demonetisation. In a research report titled 'digital payments post-demonetisation', it also pointed out that with cash crunch easing post-December 2016, "there has not been any net addition to total volume of transactions" on a countrywide basis.

"One of the key structural benefits expected from the historic demonetisation announced in November 2016 was a shift towards digital payments. However, the aggregate value of all transactions under electronic payment systems (EPS) has failed to witness significant increase even six months post demonetisation," according to Motilal Oswal Securities.

Here are some other things pointed out by Motilal Oswal Securities:

While the value of transactions in retail digital modes (PoS, PPIs, IMPS and UPI) increased sharply in December 2016, it has stabilized at higher levels since then (up to May 2017)

After falling by more than 60 per cent in the last months of 2016, cash withdrawals from ATMs have moved back to pre-demonetisation levels.

In a four-month period from November 2016 to March 2017, digital transactions saw a 23-fold surge increase, government think-tank NITI Aayog had said earlier this year. Volume of payments using various digital payment modes (namely UPI, BHIM and USSD) amounted to 63,80,000 in number and Rs 2,425 crore in value, from 2,80,000 in number and Rs 101 crore in value until November last year, it said./

Aadhaar-enabled payments also increased from 2.5 crore in November 2016 to over 5 crore in March 2017 while IMPS or immediate payment service transactions rose from 3.6 crore to 6.7 crore.

"Demonetisation was seen as a boost to digital payments, since approximately 90 per cent of transactions were believed to be taking place in 'cash'. Eventually, digitalisation was expected to help reduce tax evasion and corruption. However, available/estimated data up to May 2017 raises doubts over the increased digitalization in the economy," Motilal Oswal Securities added.

The Reserve Bank of India has said the withdrawal old Rs 500 and Rs 1,000 notes was introduced to tackle increasing fake currency in higher denomination. "India remains a cash based economy hence the circulation of Fake Indian Currency Notes continues to be a menace. In order to contain the rising incidence of fake notes and black money, the scheme to withdraw legal tender character of the old Bank Notes in the denominations of Rs 500 and Rs 1,000 was introduced," according to the central bank.

Track Latest News Live on NDTV.com and get news updates from India and around the world