How do you solve a problem like US foreign policy? It's a question two of the world's largest oil consumers will have to wrestle with over the next four months -- and their answers will define the global trade in oil.

China and India, who together imported about 1.4 million barrels a day of Iranian crude over the past 3 months, will soon have to decide whether they want to snub the US government's desire to bring Iranian oil exports to zero, or run the risk of an ever-escalating crude import bill. It's a story that's complicated by the emergence of the US as a major exporter of crude, in particular to China.

Down one path lie surging oil prices and less profitable refineries. Down the other, the wrath of the US government and the risk of exclusion from America's banking system.

"The question is: to what extent India and China can pick up the slack," said Eugene Lindell, analyst at JBC Energy GmbH. "If you're importing 10 million barrels a day and you manage to lower the price of all your imports by a buck or two by taking Iranian crude, it makes a big difference."

The Iranian issue is just one of several US foreign policy decisions that are reaching across the oil market with the potential to upend crude flows. Trade wars are looming with China and Europe. Venezuela's output is crumbling under the weight of sanctions and economic collapse.

At the same time, the President has been pressuring OPEC, and in particular Saudi Arabia, to ramp up output by as much as 2 million barrels a day. If the Trump administration is serious about cutting Iranian exports to zero, prices could top $100 a barrel, consultants such as Energy Aspects Ltd. and JBC have argued.

President has been pressuring OPEC, and in particular Saudi Arabia, to ramp up output by as much as 2 million barrels a day.

Ripple Effect

The impact of curbs in Iranian output will ripple through the world's refiners. Spain's Repsol SA and Cia Espanola de Petroleos SAU have been active buyers in the past, while oil majors like Total SA and Royal Dutch Shell Plc have wound down their consumption, Iran's oil minister said last month.

The US has also put pressure on allies such as South Korea and Japan to end their purchases. India is also a heavy buyer under pressure to cut back. For those customers, Saudi Arabia's barrels are the best replica for those lost from Iran as they are often similarly 'heavy' crudes -- a term used in the industry to denote the grade's density.

"Saudi Arabia is the most obvious replacement for the Iranian barrels," said Olivier Jakob, managing director at Petromatrix GmbH. "To fill the void it's obviously Saudi Arabia, I think it's quite clear that's the plan."

Urals Option?

Another possible outcome is Russia boosting its sales of Urals crude. Flows of Russian crude already shifted significantly this year as OPEC's largest ally in oil cuts diverts more barrels to Asia, but outside of OPEC, Russia is one of the few nations with any spare production capacity.

It's not just Iran where US policy has been extending its reach. In Venezuela production has fallen from around 2 million barrels a day to 1.4 million barrels a day since OPEC begin cutting supply -- a move exacerbated more recently by US sanctions. Venezuelan oil is "a special barrel" because it is one of the heaviest in the world, according to JBC's Lindell. While that makes it harder to replace, Middle Eastern or Canadian grades may help fill the gap, Petromatrix's Jakob said. Canadian supplies themselves are also currently restricted after an outage at an oil sands upgrader.

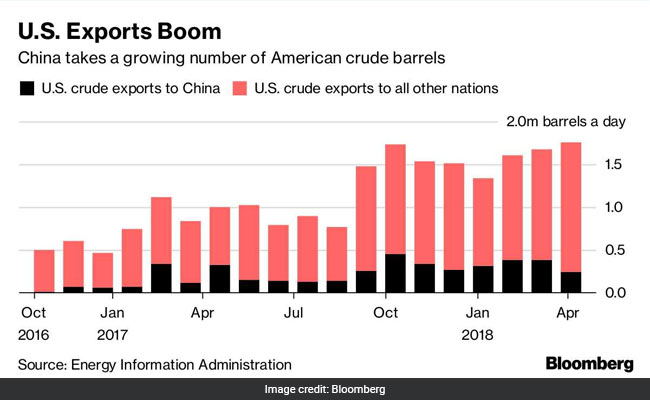

The reach of US foreign policy into energy markets is also jumbled up with its own boom as an oil exporter. Weekly crude shipments topped 3 million barrels a day for the first time ever late last month, according to data from the Energy Information Administration.

It may ultimately be Trump's trade war with China that proves the biggest swing factor for flows. The US has averaged 534,000 barrels a day of crude and products exports to China so far this year. Some US crude grades have a similar density to lighter Iranian barrels, although not with the same sulfur content. As trade disputes between the two superpowers intensify, some analysts argue China may use its consumption of Iran's crude as a political weapon in its dispute with the US

"One option China's got is to switch its imports from the US to Iran, if it wants to escalate that situation a bit further," says Tom Pugh, commodities economist at Capital Economics in London. "The big question mark is will China curtail."

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)Track Latest News Live on NDTV.com and get news updates from India and around the world