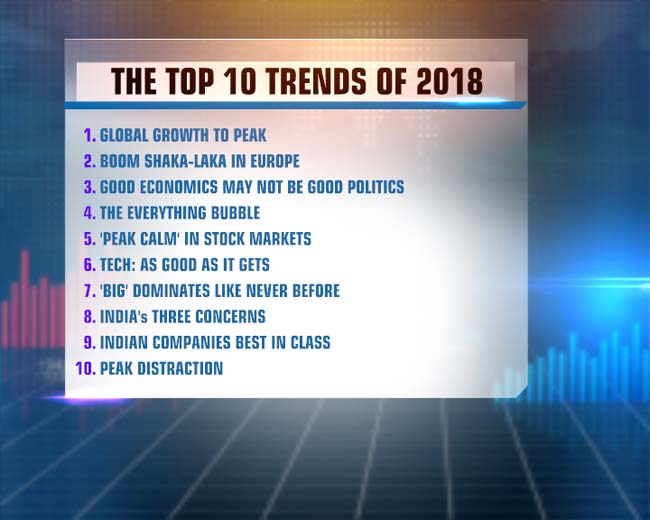

As the new year rolls outs, NDTV's Prannoy Roy and author and global investor Ruchir Sharma forecast the top 10 trends of 2018. From global growth to whether unemployment will fall or rise this year to the stock market, we look at the likely big trends.

Here are the highlights of Prannoy Roy and Ruchir Sharma's discussion on top 10 trends of 2018:

Interest rates may have bottomed out in India #Top10Trendsof2018

- NDTV (@ndtv) January 4, 2018

Watch LIVE: https://t.co/hMlRpgrUU6

Highlights here: https://t.co/KvtPBhnS6h pic.twitter.com/rHw2a9GAGC

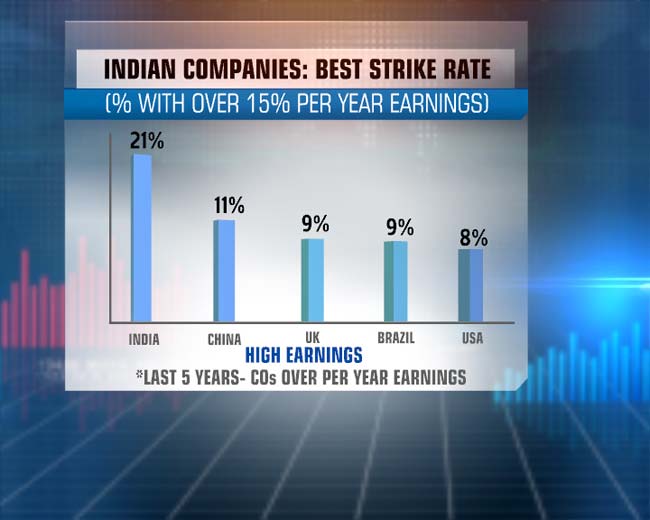

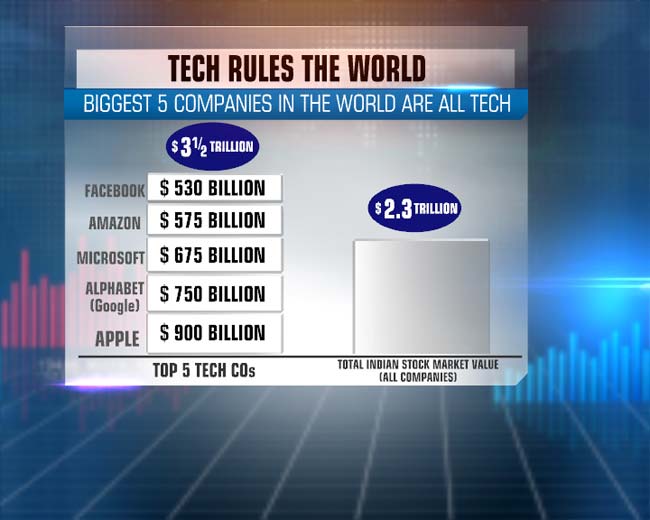

"Tech is ruling the world. The biggest five companies are all tech," says Prannoy Roy. "China has also joined the tech party... Alibaba is worth $470 billion."

"To me, it is unprecedented. The five largest companies by market value are all tech," says Ruchir Sharma. "If you look at Facebook and Google, those two companies account for 75 per cent of advertising in the US."

#TopTrendsof2018 | Do lower interest rates create asset bubbles?

- NDTV (@ndtv) January 4, 2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/QpdJZJZKTW

The valuation of almost every asset in the world is very expensive, says Ruchir Sharma. It may be because interest rates are low... It takes some years for bubble to form... but Bitcoins have jumped tremendously, he says.

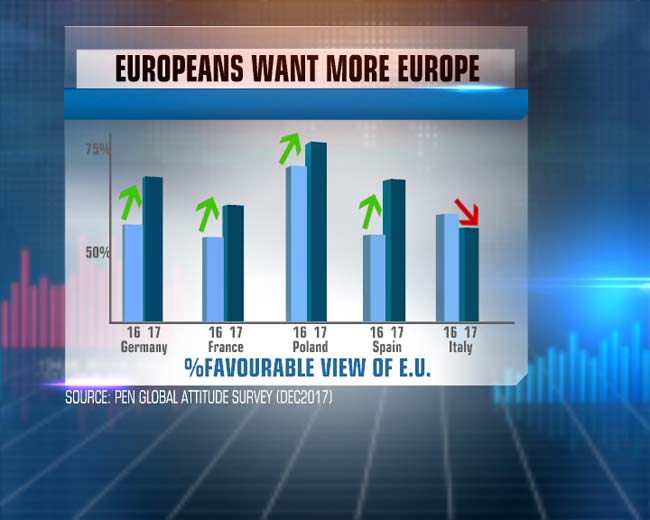

Prannoy Roy says growth in Europe is going to increase this year too and Europeans' business confidence shot up in 2017, he says, adding Europeans want to be a part of the EU.

"Not a single country in Europe is below 50 per cent. Even in Italy, they wanted more European integration. Outside, there is impression that the continent will break up, but more countries will have favourable impression of EU," says Ruchir Sharma. "There is risk in Italy of a far-right movement."

More Germans, French in favour of European Union

- NDTV (@ndtv) January 4, 2018

Prannoy Roy in conversation with Ruchir Sharma on top 10 trends of 2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/Bjrnlr3PWp

Rising business confidence index in Europe

- NDTV (@ndtv) January 4, 2018

Prannoy Roy and Ruchir Sharma on top 10 trends of 2018

Highlights here: https://t.co/srfwiG4KoC pic.twitter.com/2wh35MFO2u

Global unemployment falling

- NDTV (@ndtv) January 4, 2018

Prannoy Roy in conversation with author and global investor Ruchir Sharma on #TopTrendsof2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/lfUWZGPxKn

Global growth expected to remain strong in 2018

- NDTV (@ndtv) January 4, 2018

Prannoy Roy in conversation with author and global investor Ruchir Sharma on #TopTrendsof2018

Watch LIVE: https://t.co/hMlRpgrUU6

Track LIVE updates: https://t.co/yYBcQHiTmI pic.twitter.com/m4R1ukAQTo

China's debt is 216%, highest for any developing nation in history, says Ruchir Sharma. Any other country that would incur debt would have expected to blow up, but China's growth is still increasing, which is very unusual for a country this size, he says.

"There is new China, with tech innovations and no debt, and there's old China where record levels of debt are controlled by the government. This is the dichotomy of China as old china is dragging down the new China," he says.

Global growth remains below the post-war 'miracle'

- NDTV (@ndtv) January 4, 2018

Prannoy Roy and Ruchir Sharma on #TopTrendsof2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/L6Q1rLiFiV

NDTV's Prannoy Roy and author and global investor Ruchir Sharma discuss #Top10TrendsOf2018

- NDTV (@ndtv) January 4, 2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/mopcjL3ECa

A greying world: Working-age population dwindling fast

- NDTV (@ndtv) January 4, 2018

Prannoy Roy and Ruchir Sharma discuss #TopTrendsof2018

Highlights here: https://t.co/qI7XgbKCMy pic.twitter.com/lpcVZBjhNX

Global growth expected to remain strong in 2018

- NDTV (@ndtv) January 4, 2018

Prannoy Roy in conversation with author and global investor Ruchir Sharma on #TopTrendsof2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/9h3ysbQI0p

NDTV's Prannoy Roy and author and global investor Ruchir Sharma discuss #Top10TrendsOf2018

- NDTV (@ndtv) January 4, 2018

Watch LIVE: https://t.co/hMlRpgrUU6 pic.twitter.com/nXnXLMcPqn

There was some basic trade revival last year because global growth picked up, says Mr Sharma. "We had seen global flows in terms of trade, migration, but that didn't just happen. We're in a long phase of de-globalisation in terms of capital flows, multi-year holding period at best."

Ruchir Sharma says there was more excitement on tax cuts forecast. "I think the big story was how much (Donald) Trump didn't matter. How little got done in terms of actual legislation compared to the noise, sound and fury. He shook the world a lot less."

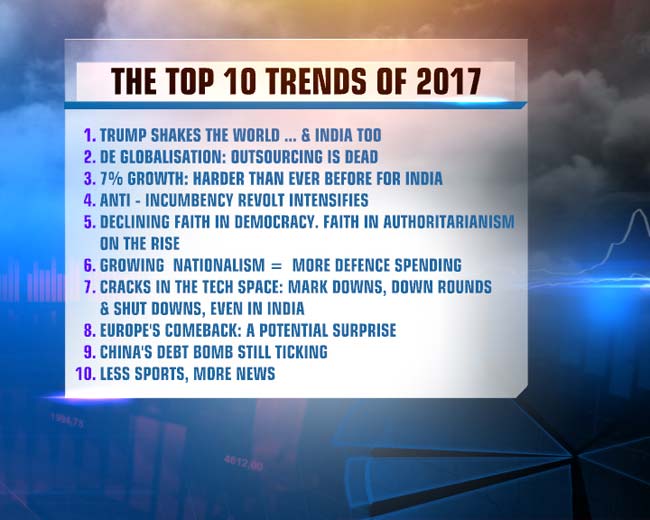

"It's that time of year again - as they say if it's the first week of January - it has to be the moment to forecast what's going to happen this year," says Prannoy Roy. "More than that it's the time of year to listen and understand Ruchir Sharma, author, columnist and global investor. We are going to start by looking back and see how good we're with Ruchir's forecasts last year... Ruchir we shall spend three minutes on a quick recap of your trends vs reality," Dr Roy says.