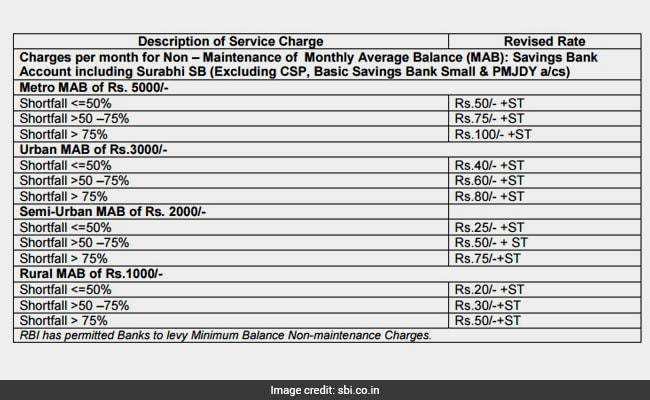

SBI or State Bank of India charges a penalty up to Rs. 100 (excluding GST of 18 per cent) per month for not maintaining the prescribed monthly average balance in savings bank accounts. Banks can levy charges for non-maintenance of minimum balance in normal savings accounts, as per Reserve Bank of India rules. Customers holding savings bank accounts in SBI's metro, urban, semi-urban and rural branches need to pay different penalty amounts for failing to comply with MAB or monthly average balance rules, according to SBI website. SBI, which accounts for more than a fifth of India's banking assets, has specified penalties ranging from Rs. 50 to Rs. 100 plus taxes depending upon the quantum of shortfall for its savings bank customers based on the four categories of branches.

(Also read: For SBI Account Holders, These Charges Go Down From Today)

For example, if your SBI savings bank account is in one of the metro city branches, you need to maintain a monthly average balance of Rs. 5,000. If the average balance maintained during a month comes out to be between zero and Rs.1,500, which is a shortfall of more than 75 per cent, a non-maintenance charge of Rs. 100 plus taxes will be levied, the bank said. In case the average balance remains within Rs. 1,500 and Rs. 2,500, which means a shortfall of less than 75 per cent and more than 50 per cent, a charge of Rs. 75 plus taxes will be levied, SBI has said.

Meanwhile, for savings accounts with average balance of more than Rs. 2,500, SBI will charge a penalty of Rs. 50, plus taxes.

However, for account holders in urban areas other than metros, semi-urban and rural areas, the MAB requirements are Rs. 3,000, Rs. 2,000 and Rs. 1,000 respectively. Here are the details of penalty for not maintaining MAB for these accounts.

How to avoid fine under SBI's minimum balance rules

"A regular review of your account will help you to ensure the average monthly balance is maintained and avoid the minimal charges," SBI has said on microblogging site Twitter.

ATM withdrawal charges

In metros, State Bank of India allows eight free ATM transactions (5 at SBI ATMs and 3 at ATMs of other banks), and 10 in non-metros (5 at SBI ATMs and 5 at ATMs of other banks). If you exceed the permissible limit on ATM withdrawal, a charge of Rs. 20 plus taxes will be levied for each additional withdrawal. However, for customers of Basic Savings Bank Deposit Account, only four withdrawals in a month (including branch and ATM withdrawal) are allowed free of charge.

Beyond 4 withdrawals, if you withdraw money at branch then Rs. 50 plus taxes will be charged. Rs. 20 will be charged if you withdraw at other bank ATMs and Rs. 10 will be levied for withdrawing money at SBI ATMs beyond the 4 free withdrawals.

Track Latest News Live on NDTV.com and get news updates from India and around the world