On July 1, Prime Minister Narendra Modi and President Pranab Mukherjee ushered in the new indirect tax regime, making India the seventh country in the world to have a nationwide Goods and Services Tax (GST). Introduced with the slogan “One Nation One Tax” during the run-up to the launch, GST is aimed at integrating the economy. While it is too early for companies and industry watchers to comment on how GST will change the existing system of taxation and will impact the lives of citizens, here is a primer on how the new system - touted as the largest reform in the country since Independence - will function.

How We Got Here:

The rollout of the GST was in the making for over a decade.

Since the passage of the GST Constitution Amendment bill in August 2016, there were over 175 officers' meetings and 18 sittings of the GST Council. Reports say that as many as 30 sub-groups and committees worked tirelessly to devise rules and laws as well as fix tax rates for over 1,200 goods and services.

While the final decisions were taken by the GST Council, comprising Finance Minister Arun Jaitley and his state counterparts, most of the state tax officers would camp at the national capital for the entire week during the meetings, before returning to their states over the weekend to look into issues there.

Revenue Secretary Hasmukh Adhia and CBEC chairperson Vanaja Sarna were at the forefront, while Joint Secretary Revenue Udai Kumawat was the man behind drafting of the GST Constitutional Amendment law. Meanwhile, P K Dash, Director General at NACEN, manned the training academy preparing officers to lay down the ground work for a smooth transition, training nearly 55,000 state and central officers.

GST Will Reduce Taxes. But How?

Policymakers have promised that GST will reduce taxes by subsuming 17 different central and state taxes and will not fuel inflation while at the same time increasing the ease of doing business. How it does this is by following a multi-stage collection mechanism wherein it taxes only the vendor’s contribution to the “overall product’s value.”

This also prevents the cascading effect on taxes as GST as the tax paid is not included in the price of the product sold to the vendor next in the chain. This uniformly distributes the burden of taxation to all vendors.

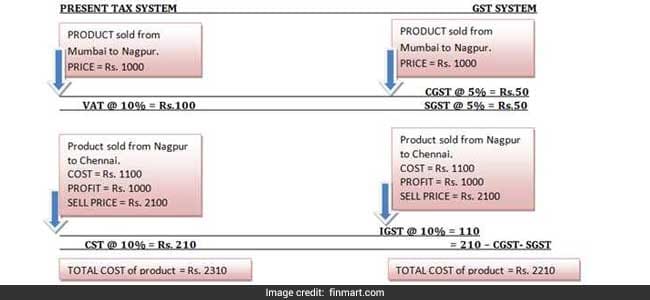

Here is an example to understand GST in action:

Here note that the tax paid on sale within state can be claimed against tax paid on sale outside the state in GST system, which is not in present tax system.

The GST Advantage: Input Tax Credits:

In the GST system, the input tax paid by the vendor in the chain is allowed credit, which means that when a product passes from the manufacturer to the distributor and then to the retailer, all the previous vendors will get back at each stage of production or service delivery can be availed in the succeeding stages of value addition. This means that the end consumer will thus only bear the GST charged by the last point in supply chain, with set-off benefits at all the earlier stages.

For example, a manufacturer's total tax on output comes to Rs. 5,000 while tax paid on input is Rs. 3,000. In this case, the manufacturer needs to deposit only Rs. 2,000 (Rs. 5,000 - Rs. 3,000) as tax, after claiming input tax credit of Rs. 3,000, thus reducing the overall incidence of tax on final product.

In the above example, you can note that the tax paid on sale within state can be claim against tax paid on sale outside state in GST system, which is not in present tax system.

Under GST rules all businesses with an annual turnover of over Rs. 20 lakh will have to file for input tax credits on the GST Network(GSTN) the virtual network. While composition scheme (to pay tax at a flat rate without input credits) is available to some businesses having an annual turnover of up to Rs. 75 lakh, all other businesses will have to file invoices of all transactions to avail tax credits.

Track Latest News Live on NDTV.com and get news updates from India and around the world