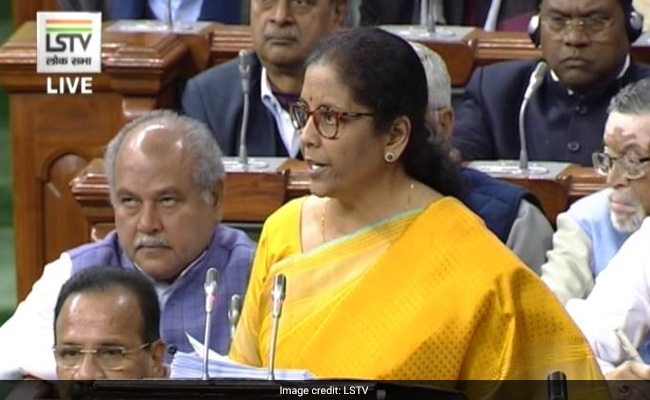

Finance Minister Nirmala Sitharaman started her Budget 2020 speech with tributes to her former counterpart Arun Jaitley. "I pay homage to the visionary leader late Shri Arun Jaitley," she said as she presented her second Union Budget today, amid a slowdown in the economy. "The fundamentals of the economy are strong, and that has ensured macroeconomic stability. Inflation is under control," she said. "In May 2019, Prime Minister Narendra Modi received a massive mandate to form the government again. With renewed vigour we commit ourselves to serve the people of India with all humility and dedication," Ms Sitharaman said. The government has been firefighting runaway price rise and turmoil in the finance and manufacturing sector. The stock markets are open for a special trading session today.

Here are the LIVE updates on Union Budget 2020:

A new system will be created through Kisan Rail and Krishi Udyan for farmers to market and transport their products properly. I believe that this budget will increase Income and Investment, increase Demand and Consumption, bring new vigor in Financial System and Credit Flow. This budget will fulfill the current needs of the country as well as future expectations in this decade.

Provisions of faceless appeals, new direct tax, simple structure, emphasis on disinvestment, provision of universal pension through auto enrollment, move towards unified procurement system, these are some of the steps that will will increase the ease of living. Today, youths have to take many different exams for government jobs. Changing this arrangement, now appointments will be made through online common exam taken by National Recruitment Agency.

Tax benefits have also been provided for start ups and real estates. All these decisions will accelerate the economy and through this will provide new employment opportunities to the youth. Now in the system of income tax, we have gone from dispute to trust. The budget has strengthened the commitment of minimum government, maximum governance.

Modern infrastructure is of great importance for modern India. The infrastructure sector is also a large employment generator. The construction of 65 hundred projects from 100 lakh crores rupees will increase employment opportunities on a large scale. Trade, business and employment will also benefit from National Logistics Policy. Due to the removal of dividend distribution tax, Rs 25 thousand crore will come in the hands of companies, which will help them in further investment. Various tax concessions have been given to attract outside investment in India.

The Ayushman Bharat scheme has given a new dimension to the health sector of the country. In this sector, there has been a lot of scope for human resource - doctors, nurses, attendants as well as medical device manufacturing. To increase this, new decisions have been taken by the government. In this budget, we have made several special efforts to promote employment generation in the field of technology. Several policy initiatives have been taken for areas such as new smart cities, electronic manufacturing, data center parks, biotechnology and quantum technology. With this India will move strongly towards becoming an integral part of the global value chain.

The main areas of employment are agriculture, infrastructure, textiles and technology. In order to generate more employment, these four have been given a lot of emphasis in this budget. 16 action points have been created to double the income of farmers which will work to increase employment in rural areas. Integrated approach to agriculture was adopted in the budget, which along with traditional methods will increase value addition in Horticulture, Fisheries, Animal Husbandry and also increase employment. Under the Blue Economy, youth will also get new opportunities in the field of fish processing and marketing.

I congratulate Finance Minister Nirmala Sitharaman ji and his team for the first budget of this decade, which also has a vision and an action. The new reforms announced in the budget will work to accelerate the economy, financially empower every citizen of the country and strengthen the foundation of the economy in this decade.

P Chidambaram says, "Some crumbs were thrown at the lower tax bracket. Any relief to the lower tax bracket, we welcome it. As far as LIC is concerned, it is highly debatable. To assume that every public sector must go through divestment, is wrong. LIC has increased share of first premium income. We will internally debate it and give our view of the floor, but I think it is highly debatable. External market conditions not favorable for a sovereign wealth fund. Food subsidy has been reduced, fertilizer subsidy has been reduced. Surprisingly, President's speech didn't utter a word on employment. Economic Survey has a chapter on employment. I don't see any firms, all I hear about are stories of firms closing down. I think the budget has done nothing to create budget. Tell me anything that gives a boost to mining, construction or manufacturing, the 3 job creating sector. "

On rating the Budget, he says, "10 has got a 1 and a zero, you can pick either number, am okay with it."

I have not said I wont give any money for recapitalisation. This means as and when there is a need, we will certainly consider it, says Finance Minister.

Nirmala Sitharam says, "We had announced fiscal deficit of 3.3% in July. But because of challenges we faced to improve on consumption demand, to improve on investments which have to be from public, private investment was happening but not at a pace that it would have helped the whole process. Due to some natural disaster-related causes, compliance difficulties, GST collection was coming down. If you look at the way revenue generation is improving, GST collection has crossed one lakh crore. I hope corporate tax cut and befits derived by new companies will come into play."

Revenue Secreatary says, "Made changes to IT. If an Indian citizen stays out of the nation for over 182 days, he becomes an NRI. Now, he has to stay out of the country for 241 days. In many cases, we found that some people were residents of no country."

Nirmala Sitharaman says, "You will see successful divestment in the next few months. Between now and July, a lot of work will be completed and the benefits will go the next financial year."

Tuhin Pandey, Secretary, Disinvestment says, "Air India EOI is already out, very soon BPCL EOI will be out as well. Hopeful that we will be able to achieve the divestment target next year."

Tax charter is a very major step. Other than us going around the nation to tell tax administrators to tell that face-to-face engagement with taxpayers need not be there, to make sure they deal with them more like wealth creators, in spite of that, you'd hear about harassment. Commitment to ensure that taxpayers are respected, it had to be given an expression of sorts. If I am right, only 3 nations have enshrined the rights of a taxpayer, Canada, US & Australia, if am correct. The government's intent is not to harass anybody. There are 1-2 black sheep everywhere, not just among tax administrators.

For the real estate sector, we had announced some things earlier. We had announced that stalled projects would be given last-mile funding. We have extended the date by one year so that exemption for home-buyer is available in cases of affordable housings.

Revenue Secretary Ajay Bhushan Pandey says, "There are close to 120 exemptions, all varied. We reviewed each item. In this new regime, the whole idea was to offer a simplified regime and lower the tax rates. About 70 exemptions have been removed. Retirement befits, leave encashment on retirement, EPFO about certain limit, payment received from National Pension System and others will all be retained.

Those who still want to avail the benefits can follow the old method... You'll definitely benefit in terms of money that will remain in your hand under new regime.

The intention is to reduce the rates as much as to simplify structure. We wanted to make sure money is in the hands of the people. We've reduced income tax particularly for lower and lower middle class. We want to bring the rates down and remove complications in compliance. Too many exemptions make it very difficult for administrators and you need an expert to plan taxation. We want to simplify income tax process and reduce rates. New schemes with very limited exemptions to it, which are indefensible-like.

The government has deferred taxing ESOP or employee stock ownership plan for start-ups. This will bring relief to start-ups since they can now use the money, which otherwise would have gone as tax, to invest in the young company for expansion and other uses.

The government plans to increase investment limit of Foreign Portfolio Investors (FPI) in corporate bonds from 9 per cent to 15 per cent, Finance Minister Nirmala Sitharaman said.

The new tax regime is optional for those willing to forego all exemptions.

- 5% tax for income between Rs 2.5-5 lakh

- 10% tax for income between Rs 5-7.5 lakh as against 20%

- 15% tax for income between Rs 7.5-10 lakh as against 20%

- 20% tax for income between Rs 10-12.5 lakh as against 30%

- 25% tax for income between Rs 12.5-15 lakh as against 30%

- 30% tax for income above Rs 15 lakh

"We have estimated the nominal growth of GDP for 2020-2021 at 10 per cent," Nirmala Sitharaman said.

The government will sell a part holding in LIC via an initial public offering.

Insurance cover for bank depositors will be raised to Rs 5 lakh from Rs 1 lakh. The Banking Regulation Act will be amended to make bank managements function more efficiently and in a transparent manner.

Opposition leaders protest as Nirmala Sitharaman says the government is "clean, corruption-free and trusting in every citizen".

Clean air is a matter of concern in large cities; Rs 4,400 crore to run programmes for clean air.

Rs 85,000 crore for fiscal 2021 for Scheduled Castes and Other Backward Classes. Rs 53,700 crore for Scheduled Tribes. Rs 9,500 crore for divyangs or the differently abled.

To improve national nutritional status of girls and women, more than six lakh Anganwadi workers are equipped with smartphones to upload nutritional status of 10 crore households.

Beti Bachao, Beti Padhao has yielded tremendous results. Gross enrolment rate of girls under this scheme is 59.7 per cent as against 57.54 of boys. Girls are performing better under this scheme.

Prepaid power meters in 3 years, consumers can choose supplier and best rate.

More Tejas type trains will connect tourist destinations. High-speed rail between Mumbai and Ahmedabad will be pursued. A suburban rail project in Bengaluru is planned.

"Delhi-Mumbai Expressway and other similar projects will be completed by 2023. Work on the Chennai-Bengaluru Expressway will start soon," Ms Sitharaman said.

"Five new Smart Cities will be set up in public-private partnership mode," the Finance Minister said. "We propose to digitally refund duties and levies to exporters."

Nirmala Sitharaman's Daughter, Uncle In Parliament To Cheer For Her

Nirmala Sitharaman's Daughter, Uncle In Parliament To Cheer For HerNirmala Sitharaman's family was spotted in parliament as the Union Finance Minister got ready to deliver her second budget today. The minister's daughter Vangmayi Parakala, maternal uncle and cousin brother were seen on the way to the visitors' gallery of parliament shortly before the budget 2020 was to be presented.

A degree level full-fledged online education programme will be imparted by institutes among the top 100 ranked ones. This will be for students from economically weak families who cannot afford mainstream education.

Hospitals to be set up in PPP (public-private partnership) mode for better treatment under Ayushman Bharat (health insurance) scheme. More hospitals will be empanelled. "TB harega, desh jitega (tuberculosis will lose, the country will win," Ms Sitharaman said.

"The Indian Railways will set up a Kishan Rail through PPP to ferry perishable goods faster; they will have refrigerated coaches... Krishi Udan will also be launched on domestic and international routes," the Finance Minister said. "Horticulture exceeds the production of food grains. We propose to support states for at least one product in every district," she added.

"Our government shall encourage balanced use of all kinds of fertilisers including traditional organic variety to discourage use of chemical fertilisers," Ms Sitharaman said.

"Under Aspirational India programme, the first point is agriculture, irrigation and rural development. We are committed to doubling farmers' income by 2022," Ms Sitharaman said.

"We recognise the need to energise Indian entrepreneurship spirit. The three guiding factors of this Budget are aspirational India, economic development for all and ours should be a caring society," Nirmala Sitharaman said.

"India raised 271 million people out of poverty between 2015 and 2016. The milestones achieved are unprecedented and globally recognised. A household saves an average of 4 per cent annually because of GST... The dreaded Inspector Raj has also vanished," Ms Sitharaman said.

Nirmala Sitharaman's Red Budget Bahi Khata Is Back

Nirmala Sitharaman's Red Budget Bahi Khata Is Back

Prime Minister Narendra Modi has arrived at parliament ahead of the Budget 2020 presentation by Finance Minister Nirmala Sitharaman.

The Goods and Services Tax (GST) collection has crossed the Rs 1 lakh crore-mark for the third month in a row in January on the back of anti-evasion steps taken by tax officers. This is second time since introduction of GST in July 2017 that the monthly revenues have crossed Rs 1.1 lakh crore.

Anurag Thakur, Nirmala Sitharaman's Junior, Prays At Home Before Budget

Anurag Thakur, Nirmala Sitharaman's Junior, Prays At Home Before BudgetAnurag Thakur, the Minister of State for Finance, was seen praying at his home hours before theUnion Budget announcement. In a rust jacket and white kurta, the Minister is seen praying before an idol of Hanuman at his home. "The Modi government believes in sabka sath, sabka vikas. We received suggestions from across the country. The government has made efforts to ensure that this Budget will be good for all, good for the people and the country," Mr Thakur told news agency ANI.

"As per tradition, Finance Minister @nsitharaman calls on President Kovind at Rashtrapati Bhavan before presenting the Union Budget": The office of President Ram Nath Kovind tweeted. The government is likely to announce plans to control inflation, which has started moderating in the past six years.

To achieve the target of doubling farmers' income by 2022, the Economic Survey has said there is an urgent need to address some of the basic challenges like credit, insurance coverage and irrigation facilities in the agriculture and its allied sectors.

#BudgetWithNDTV | Amid slowdown, Nirmala Sitharaman to reveal her second Budget today.

- NDTV (@ndtv) February 1, 2020

Special coverage all day on https://t.co/ckvRk4CUuH and NDTV 24x7#budgetsession2020 #Budget2020 pic.twitter.com/p9Qk2huFkh

The Union Budget comes at a time when the Gross Domestic Product (GDP) growth rate has been spiralling downwards in the last five quarters. It slowed to 4.5 per cent in the July-September quarter - the weakest pace since 2013. The government has revised the GDP growth rate to 6.1 per cent from 6.8 per cent for fiscal 2019.

Minister of State for Finance Anurag Thakur prays at his home ahead of the presentation of the Union Budget 2020 in Parliament by Finance Minister Nirmala Sitharaman today.

A cabinet meeting will be held at 10:15 am in Parliament House ahead of the presentation of Union Budget 2020 by Finance Minister Nirmala Sitharaman. The government has estimated gross domestic product expansion at 5 per cent for the financial year ending on March 31, which would be the slowest pace since the global financial crisis of 2008-09.

With disbursements under the Prime Minister Kisan scheme to farmers being less than the budgeted amount, the Union Budget 2020 may also see measures to get states to on board more eligible farmers under the scheme.

Investments have failed to pick up despite corporate tax cuts and other stimulus measures, higher Foreign Direct Investment (FDI) inflows, plans to consolidate state-owned banks and monetary easing. After corporate tax cuts in September last year, speculation is rife about possible reduction in personal income taxes. A combination of an increase in the basic exemption limit and/or the introduction of a differentiated tax rate structure for higher incomes may be on the cards.

Last month, the statistics office said investment growth was expected to fall to just 1 per cent in the current financial year from 10 per cent the previous year. Private consumption growth might slip to 5.8 per cent from 8.1 per cent. Krishnamurthy Subramanian, Chief Economic Adviser to the Finance Ministry, said the government could push economic reforms to boost growth. The government should rationalise food subsidies to create additional fiscal space, push exports and adopt "counter-cyclical fiscal policy" to boost the sluggish demand and consumer sentiments, he said.

India is facing its worst economic slowdown in a decade. The government estimates economic growth this year, which ends on March 31, will slip to 5 per cent, the weakest pace since the global financial crisis of 2008-09. Finance Minister Nirmala Sitharaman, who will present her second full-year annual budget to parliament, could defer the earlier target of cutting the deficit to 3 per cent of Gross Domestic Product (GDP) in fiscal 2021 by at least two years, government sources told news agency Reuters.