The 'South tax' issue has hogged headlines for some days now as the ruling parties in Karnataka, Tamil Nadu and Kerala join hands to protest what is viewed as unfair devolution of taxes by the Centre. These leaders from the South are not wrong. It is clear that Southern states are getting much less than they should out of the Centre's pool of taxes. Karnataka, for instance, gets back 15 paise for every rupee that itS gives to the Centre as taxes. Tamil Nadu gets back 29 paise.

Leaders of South Indian states point out that the reverse is true of Northern states. Uttar Pradesh gets Rs 2.73 out of every rupee of tax paid to the Centre, while Bihar gets Rs 7.06.

The Centre's argument is that the share in the taxes received by each state is based on a formula conceived by the Finance Commission.

The Problematic Clause

The Southern states claim that they are being penalised by the Centre for

- Doing well economically, and

- Keeping population growth rates low

Let us tackle the second point first. It is now well-known that the Census was frozen at the 1971 figures until the 15th Finance Commission used the 2011 census figures in its 2021 report.

This opened up a can of worms - the population of the states in the South had come down by then, and the allocations to these states also reduced correspondingly. The 15th Finance Commission gives 15% weightage to the state's population for calculating its share from the Centre's divisible pool of taxes.

However, this criterion is almost offset by another one termed 'demographic change', which rewards states that achieve lower fertility rate, lower population growth and which do well on other parameters such as infant mortality rate and sex ratio – indicators that Southern states have consistently performed well on. Demographic change is weighted at 12.5%

But the bigger ogre in the room is a clause called 'income distance'. Only large states are taken into account for computing the state with the highest per capita income. This year, it is Haryana. This means that states with high per capita income (like Karnataka, Tamil Nadu and Kerala), would be quite close to Haryana in income terms, and therefore would get lower compensation. North Indian states like Bihar and Uttar Pradesh are further away from Haryana in per capita income, so they would be benefited with higher allocations.

The income distance criterion constitutes a 45% weightage in the computation. Although the 15th Finance Commission brought down the weightage from the earlier 50% prescribed by its predecessor, this is still a very large share.

Critics of the Finance Commission's formula argue that the income distance criterion must be reduced and more diverse criteria be added to capture the complex nature of the problem of allocation. A case in point is Karnataka, which houses the headquarters of most large corporates, because of which the income tax filed is artificially larger than those in other states.

Centre, States Need to Talk

The resolution to the vexatious issue of tax devolution is possible only through dialogue. For one, the Finance Commission and the Centre need to engage with states and look at possible avenues to address these concerns. A crucial move would be to reduce the weightage given to income distance.

As for the protesting states, this is the best opportunity to rationalise social sector spending and choose the key pain points that need addressing. Education, healthcare, sanitation and targeted social sector empowerment schemes are the order of the day. This is perhaps the best chance for states to end the culture of competitive freebies.

They would also need to take a leaf out Uttar Pradesh's book - on how to increase excise collections by 40% through track and trace systems and curbing monopolies.

The 40-Year South Advantage

It is also important to note that the policies of the 1950s gave South Indian states a huge economic lead, to the detriment of mineral-rich states such as Bihar and what is now Jharkhand.

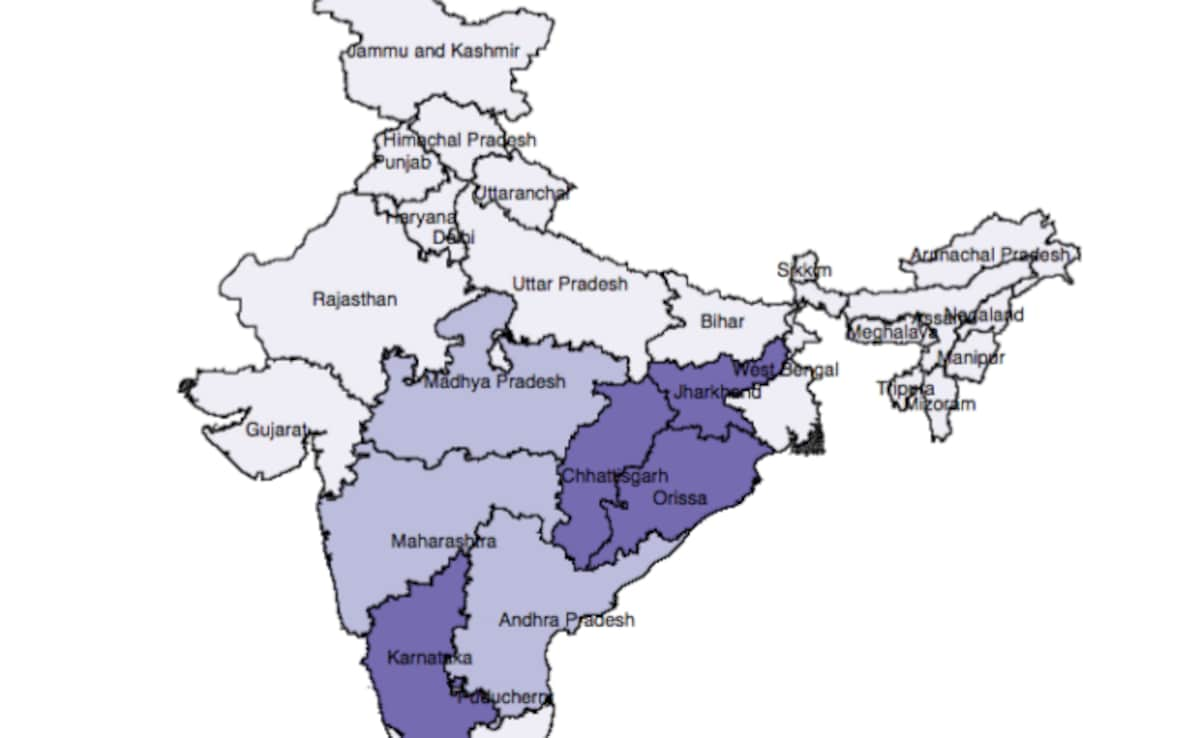

The Freight Equalisation Policy introduced in 1956 and in vogue until 1991 was meant to equalise industrial development by subsidising the transport costs of iron and steel. This meant that mineral-rich states in the North and North-east, such as Bihar, Chhattisgarh, Jharkhand and Odisha, were beaten badly. States like West Bengal, which should have benefited in terms of exports of these minerals, lost out to Maharashtra and Tamil Nadu.

This map shows the distribution of iron ore deposits in India in the 1950s

Photo Credit: Archaeological Survey of India cited in a 2018 paper by John Firth and Ernest Liu

The lion's share of the economic profits from iron and steel manufacturing went to South states, which had geography on their side, thanks to the natural coastal advantage.

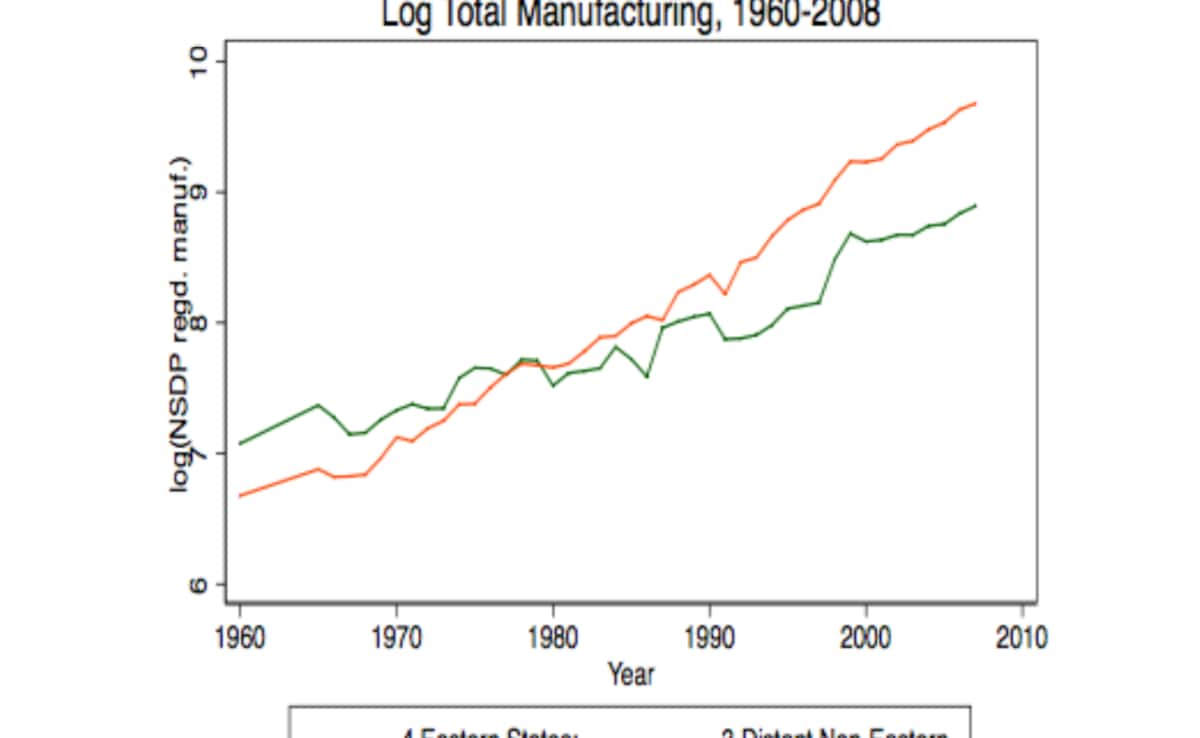

This map shows how the growth of mineral-rich states lagged behind that of distant states under FES

Photo Credit: Archaeological Survey of India & Besley & Burgess data cited in a 2018 paper by John Firth and Ernest Liu

This Freight Equalisation Policy is almost single-handedly responsible for setting Bihar and Jharkhand back by decades, while giving Tamil Nadu and Karnataka a huge impetus that helped them gain even more windfall in the years post liberalisation.

Add to that the huge influx into South India of migrant workers from the North and Northeast, whose labour contributes in large part to building the prosperous economy of the South. It is not in isolation that South India has flourished historically.

It is imperative now, more than ever, that feelings of alienation and mistrust between states and the Centre are resolved and soothed for the greater good of the nation.

(Sandhya Ravishankar is a journalist)

Disclaimer: These are the personal opinions of the author.