As the board is further revamped, the Bangalore-based software services company will complete the correction of its corrupted code.

With Nandan Nilekani, 62, appointed as non-executive chairman, the founders have wrested back control. That ends the bickering between them and Sikka, who resigned as CEO last Friday. By blaming another cofounder, N. R. Narayana Murthy, for that departure, the board took a silly stance against owners of 13 percent of the company's stock. In effect, it signed its own death warrant.

If there was any remaining doubt, a blog post by Vallabh Bhanshali in the Economic Times removed it. His Enam Securities Pvt. rescued the company's IPO when it flopped in 1993. (The stock has gone on to multiply an original investment of $500 into a million-dollar fortune.) Just the hint that Bhanshali was still supporting the original crew was proof enough that the tussle for control was over. A messy, long-drawn-out battle, which I feared, was avoided.

Stability, however, is only the starting point for what must come next. It's time to repair Infosys, as well as to rebuild it.

Clients are shifting investments to digital technologies such as social, mobile, analytics and cloud -- or smac. Contracts for large enterprise resource planning software are shrinking amid brutal price competition.

Vendors such as Infosys are still clinging to the legacy business while the ground beneath them is shifting fast -- not only in terms of what will sell, but also who'll do the buying. Researcher IDC predicts that in the era of Cloud 2.0, buyers will increasingly be drawn from the ranks of business leaders rather than IT managers.

Those changes also mean that the new Infosys CEO probably doesn't need to be a respected technologist like Sikka. A top consultant with broad experience in everything from global aviation to financial services may be a better fit when it comes to taking a company of almost 200,000 people -- and $5.2 billion in cash -- and making it digital-ready.

Infosys workforce

Almost 200,000

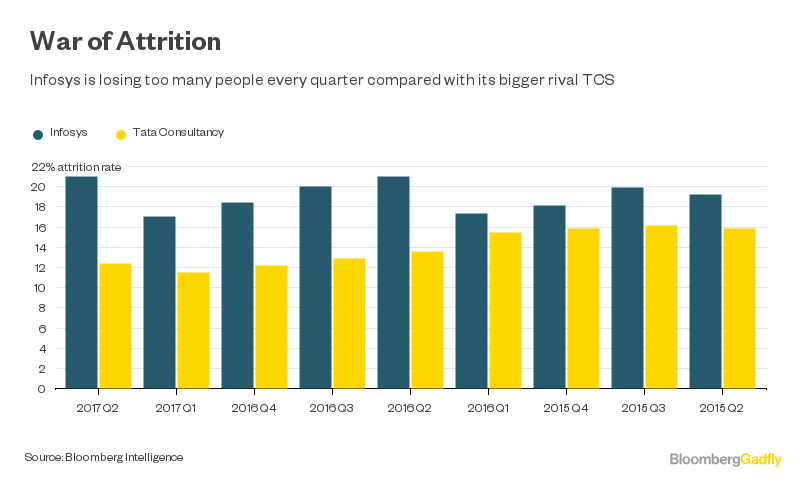

That's the rebuild part. The repair work needs to focus on morale and communication, which Nilekani must drive. Employee attrition was 19.2 percent for Infosys last year, according to Bloomberg Intelligence, versus 13.6 percent for Tata Consultancy Services Ltd., a larger competitor.

Nilekani left Infosys in 1999 to set up a biometric database of 1 billion Indians. The unique-ID project's widespread adoption in everything from tax payments to know-your-client authentication for banking and telecom services prompted India's highest court to declare privacy a fundamental right of citizens on Thursday.

He may have been a reluctant participant in this week's reboot. But now that he's in, Nilekani's bound to relish the twin tasks of repair and rebuild.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

(Andy Mukherjee is a Bloomberg Gadfly columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.)

(To contact the author of this story: Andy Mukherjee in Hong Kong at amukherjee@bloomberg.net To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net)

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.