That's where Indian billionaire Anil Ambani's Reliance Communications Ltd.'s 2020 U.S. currency notes currently trade, after a bailout by his older sibling. While that's double where they were in mid-November, when the embattled Indian mobile-services firm defaulted on a coupon payment, creditors are still a long way from being made whole.

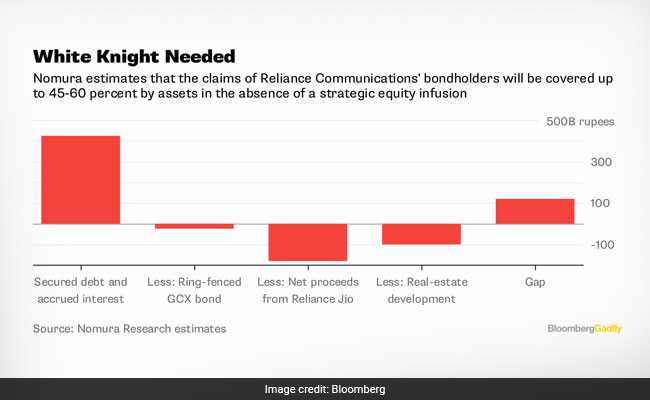

Instead of being greedy, bondholders should for now be grateful that Mukesh Ambani, India's richest man, is getting his Reliance Jio Infocomm Ltd. to buy some of RCom's operating assets for an undisclosed sum. Analysts expect that amount to be in the ballpark of $3 billion. That still leaves $4 billion of debt to be paid by a company that's shuttered its main business. Filling this gap is a daunting task.

The 58-year-old Anil Ambani, who got control of RCom in 2005 as part of a family settlement with his brother, has claimed that sales of wireless spectrum, towers, fiber-optic networks and related assets as well as real estate, will eventually lead to a zero loan write-off situation. To that end, it's encouraging that China Development Bank, which is RCom's largest foreign creditor, has decided not to press ahead with its bid to push the firm into bankruptcy, according to a Jan. 3 REDD Intelligence report. Indian lenders, meanwhile, are sitting tight as part of a standstill deal.

RCom's 6.5% 2020 notes

68 cents on the dollar

But bondholders, whose secured notes would be treated on a par with bank loans, can't relax just yet.

There are other moving pieces.

It would be a fond hope at this stage to think of Mukesh Ambani as that white knight. If he does indeed step into the breach again, bondholders should consider themselves twice blessed.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

(Andy Mukherjee is a Bloomberg Gadfly columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.)

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.