Earnings central: How corporate India performed in Q4

Corporate earnings are the barometer of markets' performance. Not surprisingly, the markets have failed to go anywhere as more and more companies have reported average numbers.

-

Corporate earnings are the barometer of markets' performance. Not surprisingly, the markets have failed to go anywhere as more and more companies have reported average numbers.

Corporate earnings are the barometer of markets' performance. Not surprisingly, the markets have failed to go anywhere as more and more companies have reported average numbers.

Many analysts had expected FY12 earnings to be in the range of 18-21 per cent. But macroeconomic headwinds and global upheavals have meant that earnings estimates have been downgraded to 15-18 per cent range.

Here is a look at India's biggest corporate results for the fourth quarter. -

Two-wheeler major TVS Motor Company has reported over two-fold jump in its net profit for the quarter ended March 31, 2011.

Two-wheeler major TVS Motor Company has reported over two-fold jump in its net profit for the quarter ended March 31, 2011.

The company has posted Rs 41.68 crore net profit compared to Rs 20.29 crore for the same quarter of the previous fiscal.

Total income for the period under review stood at Rs 1,633.46 crore, as against Rs 1,216.84 crore in the year-ago period, up 34.24 per cent.

For 2010-11, net profit of the company soared over two-fold to Rs 192.58 crore from Rs 88.01 crore in 2009-10. Total income during the last fiscal went up by 41.97 per cent to Rs 6,289.31 crore from Rs 4,430.14 crore. -

The country's largest private sector bank ICICI Bank has reported a 44 per cent rise in net profit to Rs 1,452.11 crore for the fourth quarter of FY11 from Rs 1,005.57 crore recorded in the corresponding period of the previous fiscal. Analysts expected PAT at Rs 1,075 crore for the fourth quarter.

The country's largest private sector bank ICICI Bank has reported a 44 per cent rise in net profit to Rs 1,452.11 crore for the fourth quarter of FY11 from Rs 1,005.57 crore recorded in the corresponding period of the previous fiscal. Analysts expected PAT at Rs 1,075 crore for the fourth quarter.

The bank's net interest income in the fourth quarter rose 23 per cent to Rs 2,509.73 crore from Rs 2,034.94 crore in the year-ago period.

The Board of Directors has recommended a dividend of Rs 14 per share for the year-ended March 31, 2011 against Rs 12 in the previous year.

ICICI Bank's other income stood at Rs 1640.67 crore in Q4 against Rs 1890.84 crore last fiscal. The operating expenses rose to Rs 1845.47 crore against Rs 1526.89 crore (YoY).

The bank's employee cost rose sharply to Rs 856.62 crore against Rs 582.70 crore (YoY). The amount set aside for provisions, however, came down sharply to Rs 383.61 crore against Rs 989.75 crore (YoY). -

IT major Wipro on Wednesday reported 6 per cent growth in consolidated net sales for the fourth quarter to Rs 8,302 crore from Rs 7,829 crore in the third quarter. The company's net profit rose 4.2 per cent to Rs 1,375.4 crore from Rs 1,319 crore in the third quarter.

IT major Wipro on Wednesday reported 6 per cent growth in consolidated net sales for the fourth quarter to Rs 8,302 crore from Rs 7,829 crore in the third quarter. The company's net profit rose 4.2 per cent to Rs 1,375.4 crore from Rs 1,319 crore in the third quarter.

The earnings are slightly higher than Street estimates. NDTV had estimated Wipro's consolidated sales at Rs 8,257.8 crore and net profits at Rs 1,373 crore.

However, the company's guidance for the current fiscal was a muted one. Wipro sees IT services revenue at $1,394-$1,422 million in the first quarter of FY12, implying a growth of -0.4 per cent to +1.57 per cent.

The board has proposed a final dividend of Rs 4 per share (200 per cent on an equity share of Rs 2 par value) for the year ended March 31, 2011, subject to shareholders' approval.

On an annual basis, Wipro's consolidated net profit grew 13.77 per cent to Rs 1,375.4 crore (Q4, FY11) from Rs 1,208.9 crore (Q4, FY10).

In terms of new hiring, Wipro added 2,894 new employees in the IT services business in the fourth quarter as compared to 3,591 in the third quarter. The company added 68 new clients in the fourth quarter as compared to 36 in Q3. -

Cement manufacturer ACC Ltd has reported a 10.87 per cent fall in consolidated net profit for the January-March quarter of the current financial year to Rs 350.17 crore on higher input and transport costs.

Cement manufacturer ACC Ltd has reported a 10.87 per cent fall in consolidated net profit for the January-March quarter of the current financial year to Rs 350.17 crore on higher input and transport costs.

Manufacturing costs saw a sharp rise on increase in energy costs and raw material like fly ash and slag. Coal became dearer both in domestic and international markets.

Sales turnover of the company rose to Rs 2,556.21 crore against Rs 2,240.33 crore in the corresponding quarter last year.

ACC sold 6.16 million tonne cement during the reporting quarter compared to 5.58 million tonne in the January-March quarter of last year. -

Country's largest car maker Maruti Suzuki India Ltd has reported a mere 0.5 per cent rise in its net profit on adverse currency movement from exports, higher commodity prices and new model launches.The numbers are above Street expectations.

Country's largest car maker Maruti Suzuki India Ltd has reported a mere 0.5 per cent rise in its net profit on adverse currency movement from exports, higher commodity prices and new model launches.The numbers are above Street expectations.

Its revenue rose 19 per cent to Rs 10,212 crore in the fourth quarter as compared to Q4 of 2009-10. The board of directors recommended a dividend of 150 per cent or Rs 7.50 per share (of face value Rs 5).

The dividend in 2009-10 was 120 per cent. For the financial year 2010-11, the company's total income rose 24.6 per cent to Rs 37,522 crore as compared to fiscal 2009-10. The company's net profit during the year declined 8.4 per cent to Rs 2,288.6 crore as compared to 2009-10. -

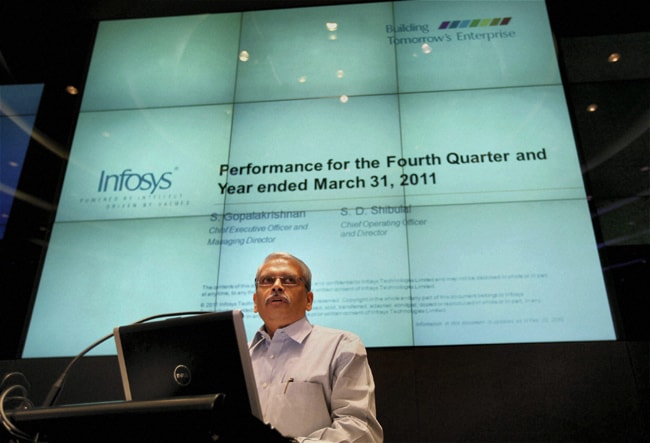

The earnings season kicked off on a disappointing note with IT behemoth Infosys Technologies reporting numbers that failed to meet Street expectations. The unexpected resignation of TV Mohandas Pai from the company was a dampener and Infosys stocks tanked nearly 10 per cent in trade.

The earnings season kicked off on a disappointing note with IT behemoth Infosys Technologies reporting numbers that failed to meet Street expectations. The unexpected resignation of TV Mohandas Pai from the company was a dampener and Infosys stocks tanked nearly 10 per cent in trade.

The company reported a consolidated profit after tax (PAT) of Rs 1,818 crore for the fourth quarter ending March 31, 2011 against Rs 1,600 crore recorded in the year-ago period. Revenues for the fourth quarter increased to Rs 7,250 crore from Rs 5,944 crore recorded during the fourth quarter of the previous fiscal.

According to FY 12 guidance, the company expects 18 to 20 per cent year-on-year growth with an EPS of Rs 126.05 to Rs 128.21. The company expects revenue in the range of Rs 7,311- Rs 7,382 crore for the quarter ending June 30, 2011, and in the range of Rs 31,727- Rs 32,270 crore for the financial year FY12.

For the full financial year ending March 31, 2011, PAT rose to Rs 6,823 crore from Rs 6,219 crore. Revenues for the entire fiscal also rose to Rs 27,501 crore from Rs 22,742 crore in the corresponding period of the previous fiscal.

The board also declared a final dividend of Rs 20 per share for the fiscal on every share of Rs 5 held.

Basic earnings per share (EPS) for the full year rose to Rs 119.45 from Rs 109.02. The guidance given by the company in the previous fiscal pegged EPS at Rs 111.

V Balakrisnanan, CFO of Infosys, said margins could dip next year because the company would hire around 45,000 employees. Also appreciation in the rupee and a decline in utilization capacity are likely to affect the margins. -

Infosys' average numbers were somewhat made up by a strong performance by HCL Tech. So, it was no surprise that investors flocked for HCL Tech stocks that rose to a 11-year high.

Infosys' average numbers were somewhat made up by a strong performance by HCL Tech. So, it was no surprise that investors flocked for HCL Tech stocks that rose to a 11-year high.

The company said its consolidated revenue in the third quarter rose 5.57 per cent to Rs 4,077.9 crore from Rs 3,862.5 crore in the second quarter. The EBITDA margins stood at 17.3 per cent against 16.3 per cent in the previous quarter. The company's PAT (profit after tax) rose 16.2 per cent to Rs 461.3 crore from Rs 397 crore in the previous quarter.

Vineet Nayar, Vice Chairman and CEO of HCL Technologies said, "We continue to expand market share backed by a second sequential quarter of revenue growth of 30%+ YoY along with expansion in margins. HCL's focus on forward investment in key markets and transformation services is paying rich dividends."

Among geographies, the US continued to be the biggest contributor to the company's revenue accounting for 54.3 per cent of the total revenue but that was slightly lower than the previous quarter (57.1 per cent). In terms of verticals, the banking, financial services and insurance (BFSI) vertical contributed 26.2 per cent to the revenue against 24.6 per cent in the last quarter.

The company added 58 new clients in the third quarter against 46 new clients in the last quarter. The company signed 11 transformational deals in the third quarter.

The attrition level in the company came marginally down to 17 per cent from 17.2 per cent. -

India's largest IT services company Tata Consultancy Services (TCS) reported a decent set of fourth quarter earnings on the back of strong pricing and a favourable currency.

India's largest IT services company Tata Consultancy Services (TCS) reported a decent set of fourth quarter earnings on the back of strong pricing and a favourable currency.

Expecting a vibrant demand environment, the company also indicated strong growth with robust hiring plans and a 12-14 per cent wage hike.

TCS's revenue rose 5.1 per cent to Rs 10,157 crore in the fourth quarter (Q4, FY11) from Rs 9,663 crore in the last quarter (Q3, FY11). This is the first time that quarterly revenues have crossed the Rs 10,000 crore mark, the management said. The company's net profit rose 10.7 per cent to Rs 2,623 crore from Rs 2,369.8 crore in the previous quarter. The operating margin of the company, however, declined marginally from 30 per cent to 28.3 per cent in this quarter.

The earnings per share for the company rose to Rs 13.41 from Rs 12.10 in the last quarter. However, there was a decline in volumes growth to 2.9 per cent from 5.7 per cent in the third quarter.

Net sales for financial year 2010-11 stood at Rs 37,324.51 crore against Rs 30,028.92 crore in the last year (2009-10). The profit for FY 11 stood at Rs 9,068.04 crore against Rs 7,000.64 crore in FY 10.

TCS added 19,324 employees in the fourth quarter but for the financial year 2011, a total of 69,685 professionals were hired by the company. The utilisation in the fourth quarter was 82.4 per cent, better than 77.1 per cent in the third quarter. The attrition rate was steady at 14.4 per cent (quarter on quarter).

Analysts and investors expect TCS to continue maintaining the growth momentum and shake off any blues left behind by industry peer Infosys. -

Private sector lender HDFC Bank reported a 33.2 per cent jump in net profit to Rs 1,114.70 crore for the fourth quarter ended March, 2011, driven by an increase in loans.

Private sector lender HDFC Bank reported a 33.2 per cent jump in net profit to Rs 1,114.70 crore for the fourth quarter ended March, 2011, driven by an increase in loans.

The bank's total income rose by 24 per cent to Rs 6,724.3 crore in the January-March quarter of 2010-11 from Rs 5,003.8 crore in the corresponding period a year ago.

Net interest income (interest earned less interest expended) during the quarter was Rs 2,839.5 crore as against Rs 2,351.4 crore in the same period a year ago. This was driven by loan growth of 27.1 per cent and a core net interest margin (NIM) for the quarter of 4.2 per cent, the bank said.

The bank proposed a dividend of 165 per cent (Rs 16.50 per share) for the year ended March 31, 2011 and also recommended a stock split in 1:5 ratio.

For the financial year 2010-11, the bank posted a net profit of Rs 3,926.3 crore, representing an increase of 33.10 per cent from Rs 2,948.6 crore in the previous year. The bank earned an income of Rs 24,263.4 crore in FY11 compared to Rs 20,155.83 crore in the previous fiscal.

The Capital Adequacy Ratio (CAR) of the bank stood at 16.2 per cent at the end of 2010-2011 as against 17.4 per cent as of March 31, 2010. -

India's largest private sector company RIL's results failed to live upto street expectations due to a 50-day shut down at the company's old unit at Jamnagar.

India's largest private sector company RIL's results failed to live upto street expectations due to a 50-day shut down at the company's old unit at Jamnagar.

The company reported a 14.14 per cent jump in its net profit to Rs 5,376 crore for the quarter ending March 31, 2011, from Rs 4,710 crore recorded during the year-ago period.

For the financial year ending March 2011, net profit rose 25 per cent to Rs 20,286 crore from Rs 16,236 crore recorded during the previous fiscal.

Net turnover for the fourth quarter rose to Rs 72,674 crore from Rs 57,570 crore. The company has announced a dividend of Rs 8 per share.

“Reliance had a record year with strong financial and operating performance. Global economic growth, emerging markets demand and tightness in the markets led to recovery in refining margins and record petrochemical earnings," said RIL CMD Mukesh Ambani in a company statement.

RIL's petrochemical revenues stood at Rs 18,194 crore and refining revenues were at Rs 62,704 crore. For the year ended March 2011, production from KG-D6 was 8 million barrels of crude oil, and 720 BCF of natural gas, a growth of 98 per cent and 42 per cent, respectively, as oil and gas production was under ramp-up during the previous year. -

Jindal Steel and Power Ltd (JSPL) has reported 5 per cent rise in consolidated net profit for the year ended March 31, 2011, at Rs 3,804 crore on higher sales.

Jindal Steel and Power Ltd (JSPL) has reported 5 per cent rise in consolidated net profit for the year ended March 31, 2011, at Rs 3,804 crore on higher sales.

The Naveen Jindal-led company's turnover rose to Rs 13,111.6 crore during FY11 compared to Rs 11,091.54 crore in the year ago, it added.

On standalone basis, JSPL's net profit was up by 39 per cent to Rs 2,064.12 crore compared to Rs 1,479.68 crore in FY10.

Advertisement

Advertisement

Advertisement

Advertisement