Raju named among most outrageous CEOs

The Forbes magazine has come up with a list of “the biggest outrages committed by chief executive officers in 2009.

-

The Forbes magazine has come up with a list of “the biggest outrages committed by chief executive officers in 2009, from pushing through billions in bonuses to people who helped bring down the economy to inventing thousands of fictional employees to help themselves steal money—and even to saying, despite such examples, that what bankers do is ‘God's work’.

The Forbes magazine has come up with a list of “the biggest outrages committed by chief executive officers in 2009, from pushing through billions in bonuses to people who helped bring down the economy to inventing thousands of fictional employees to help themselves steal money—and even to saying, despite such examples, that what bankers do is ‘God's work’. -

Lloyd Blankfein

Lloyd Blankfein

“In November the CEO of Goldman Sachs--who bears scant resemblance to, say, Mother Theresa, the Pope or the Dalai Lama--told the Sunday Times of London that he was, as a banker, just doing "God's work,” Forbes said. (AP photo) -

John Thain

John Thain

Former Merrill Lynch CEO John Thain was criticized over big bonuses paid at the brokerage firm, which was bought by Bank of America. (NYT photo) -

Raj Rajaratnam

Raj Rajaratnam

The Sri Lanka-born Rajaratnam is among 20 people charged in a $52 million insider trading case. The portfolio manager for the Galleon Group hedge fund remains free on $100 million bail. He denies the allegations and says that he did not cheat and the government misled a judge to obtain wiretaps.(NYT photo) -

B. Ramalinga Raju

B. Ramalinga Raju

In January, B. Ramalinga Raju, the founder of Satyam Computer Services, admitted of cooking up the financial books of Satyam to the extent of Rs 7,800 crore. The CBI now estimates that the loss suffered by investors in the Satyam scam may stretch to a staggering Rs 14,000 crore, nearly double of what it was estimated to be earlier. -

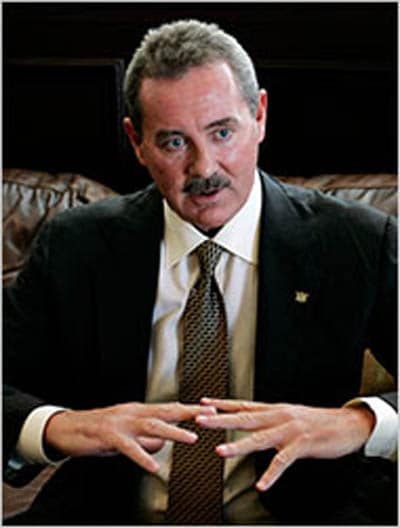

Thomas Petters, a Minnesota businessman, who went on trial in October for allegedly orchestrating a $3.5 billion fraud. He is the former CEO and chairman of Petters Group Worldwide.

Thomas Petters, a Minnesota businessman, who went on trial in October for allegedly orchestrating a $3.5 billion fraud. He is the former CEO and chairman of Petters Group Worldwide. -

Edward M Liddy (centre), former chairman of AIG, which has received more than $170 billion in taxpayer bailout money from the US Treasury and Federal Reserve. AIG planned to pay about $165 million in bonuses to executives. Liddy, then chairman of AIG, said at least some bonuses were needed to keep the most skilled executives. (NYT photo)

Edward M Liddy (centre), former chairman of AIG, which has received more than $170 billion in taxpayer bailout money from the US Treasury and Federal Reserve. AIG planned to pay about $165 million in bonuses to executives. Liddy, then chairman of AIG, said at least some bonuses were needed to keep the most skilled executives. (NYT photo) -

A file photo of Danny Pang, an Orange County financier who was the subject of a fraud investigation by the Securities and Exchange Commission. He died in September at the age of 42.

A file photo of Danny Pang, an Orange County financier who was the subject of a fraud investigation by the Securities and Exchange Commission. He died in September at the age of 42. -

In February, the Securities and Exchange Commission shut down former billionaire R. Allen Stanford’s financial operations, while filing a civil suit accusing him and two other senior executives of committing a fraud it characterized as a “massive Ponzi scheme.”

In February, the Securities and Exchange Commission shut down former billionaire R. Allen Stanford’s financial operations, while filing a civil suit accusing him and two other senior executives of committing a fraud it characterized as a “massive Ponzi scheme.” -

David Rubin

David Rubin

“The Department of Justice indicted David Rubin, founder and chief executive of CDR Financial Products, a municipal bond brokerage, on conspiracy and fraud charges. Rubin denies the allegations and has not yet been tried,” said Forbes. -

Robert Moran (second from left), the chief executive of Moran Yacht and Ship, one of the world’s leading players in the yachting world. He became the first UBS client in the United States to plead guilty after the bank gave US federal prosecutors about 150 names of Americans suspected of tax evasion.

Robert Moran (second from left), the chief executive of Moran Yacht and Ship, one of the world’s leading players in the yachting world. He became the first UBS client in the United States to plead guilty after the bank gave US federal prosecutors about 150 names of Americans suspected of tax evasion.

Advertisement

Advertisement

Advertisement

Advertisement