The rise and fall of India's economy

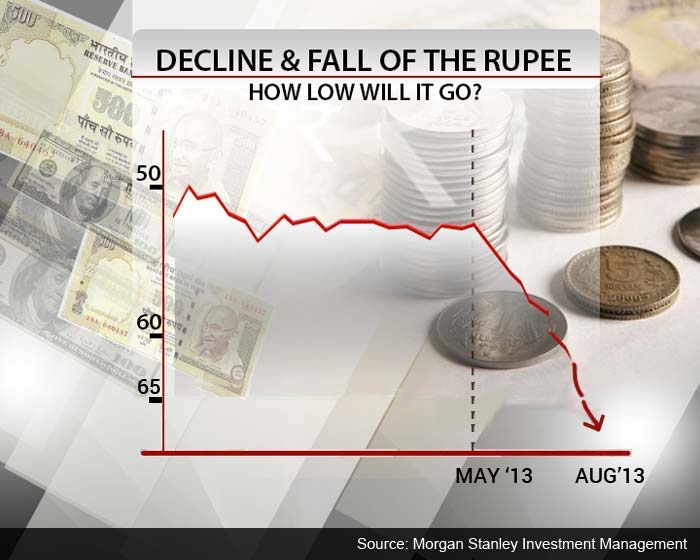

The Indian rupee has crashed over 20 per cent since May 1. The fall began at around the same time the US indicated tapering of its Quantitative Easing.

With the Indian economy at this low point, have we turned from a breakout nation to a breakdown nation?

-

The Indian rupee has crashed over 20 per cent since May 1. The fall began at around the same time the US indicated tapering of its Quantitative Easing.

With the Indian economy at its lowest point in at least the last 20 years, have we turned from a breakout nation to a breakdown nation?

(Watch: The rise and fall of Indian economy) -

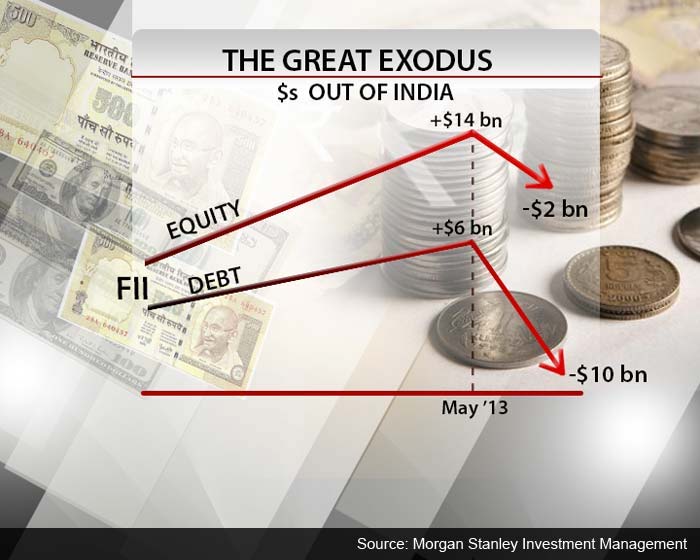

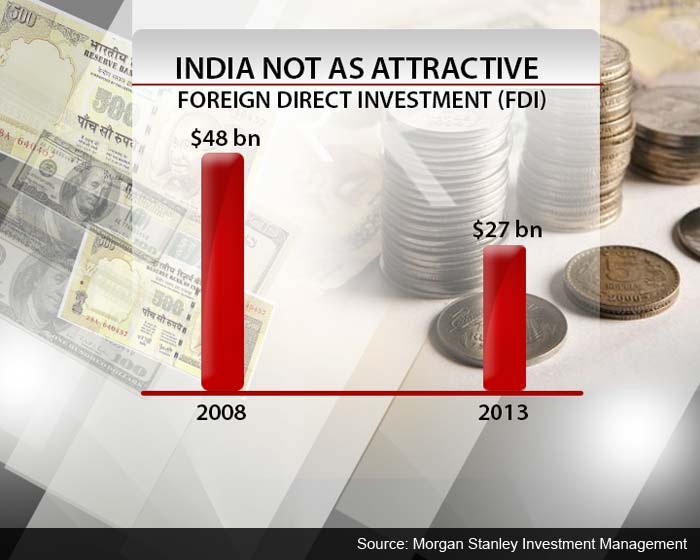

Dollars out of India coinciding with the tapering of Quantitative Easing in the US in May 2013, there has been an outflow of dollars. But this has mainly been an outflow of debt money, not as much FII equity money has left India.

(Watch: The rise and fall of Indian economy) -

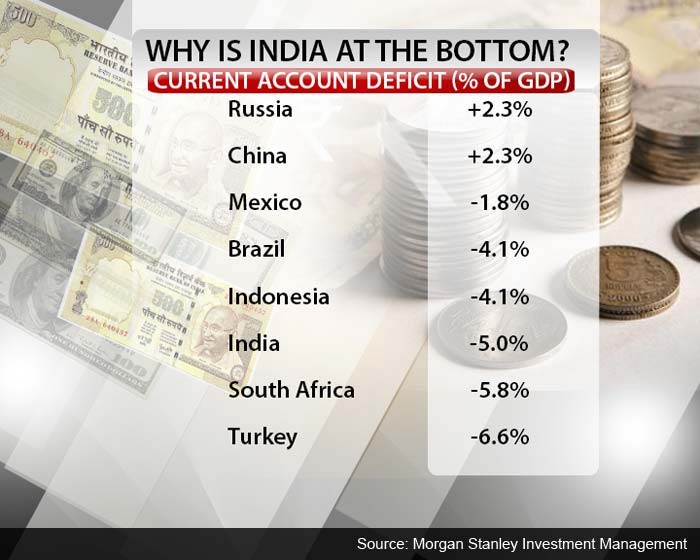

The rupee is among the top losers against the US dollar compared to currencies of other emerging economies. It has lost 16 per cent against the dollar since January 2013, near the bottom of the league of emerging markets.

(Watch: The rise and fall of Indian economy) -

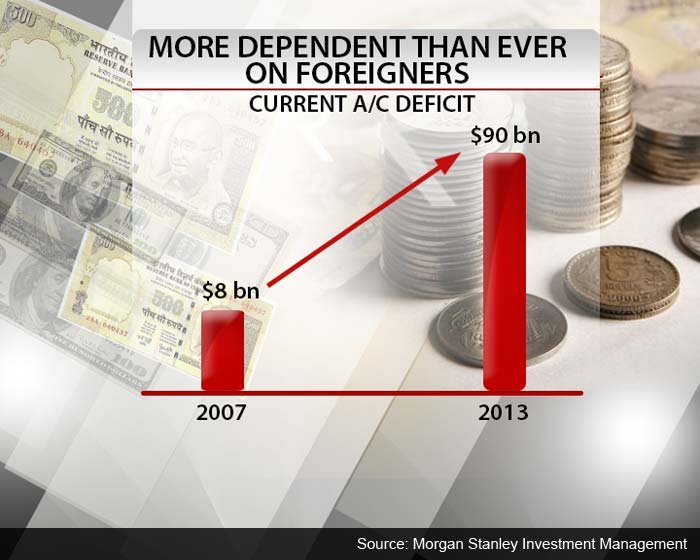

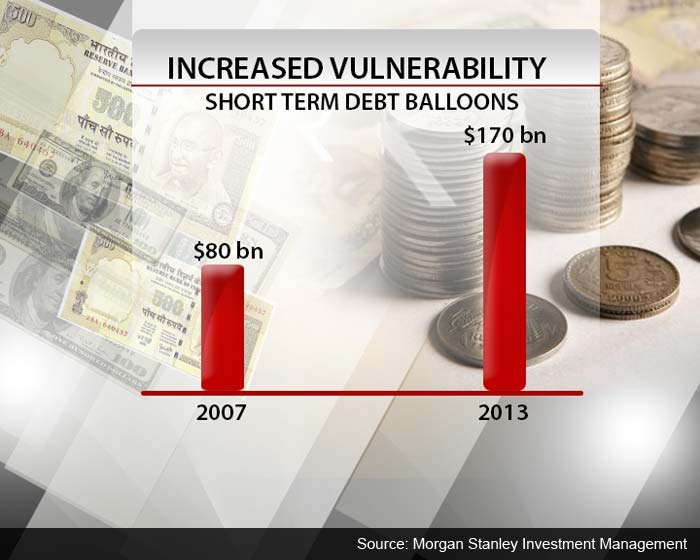

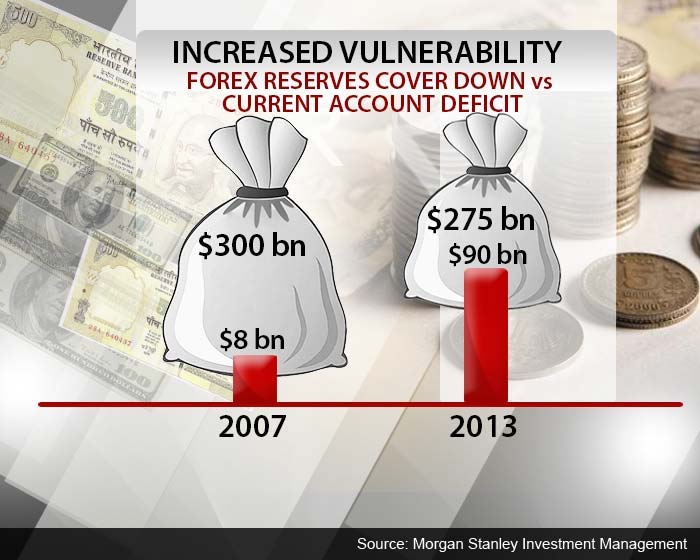

While India's current account deficit has risen sharply, India's foreign exchange reserves have fallen. India's forex reserves were a healthy multiple of the CAD earlier, today the forex cover of imports and CAD is much more precarious.

(Watch: The rise and fall of Indian economy)