Union Budget 2011: At a glance

Finance Minister Pranab Mukherjee in his Budget Speech signaled the government's commitment to consolidate and expand economic reforms while continuing on the path of fiscal consolidation.

-

Finance Minister Pranab Mukherjee in his Budget Speech signaled the government's commitment to consolidate and expand economic reforms while continuing on the path of fiscal consolidation.

Mukherjee was at his humorous best while presenting the Budget. Few minutes into his speech, he invoked heavenly intervention of Lord Indra for good rain. Through his speech, he took a detour to mention that 'three' is his favourite number and that he is yet to reach the age of 80 and hence, ineligible for the tax relief he announced for citizens above 80 years of age. -

The finance minister estimated the economy to have grown at 8.6 per cent in 2010-11 and has pegged growth at 9 per cent for next fiscal. He made a strong case for tackling high inflation and give a push to economic reforms.

The FM said agriculture sector had grown at 5.6 per cent, industries at 8.1 per cent and the services sector at 9.6 per cent during the current fiscal. -

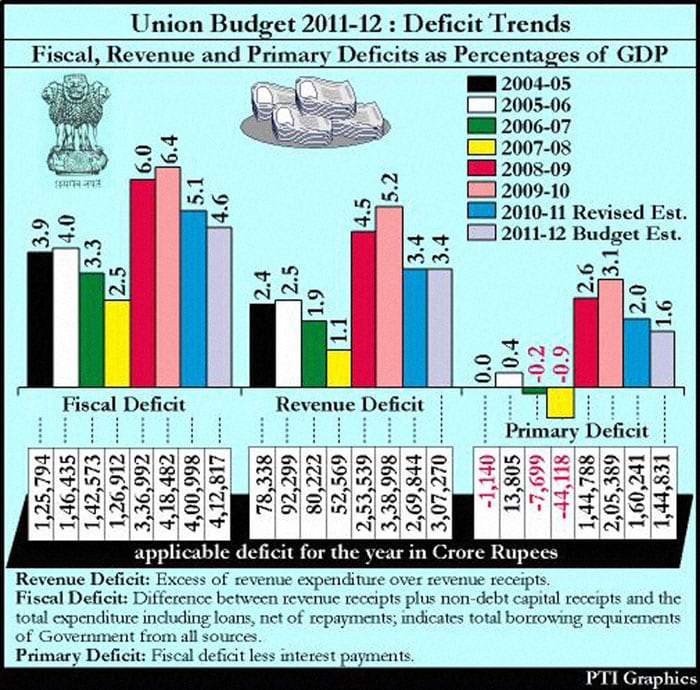

Led by higher than expected non-tax revenue from auction of 3G spectrum, Pranab Mukherjee pegged the fiscal deficit at 5.1 per cent for the current financial year, and reduced the estimates to 4.6 per cent for 2011-12.

In the medium term fiscal policy, Mukherjee pegged the rolling target of fiscal deficit at 4.1 per cent for 2012-13, and 3.5 per cent for 2013-14. -

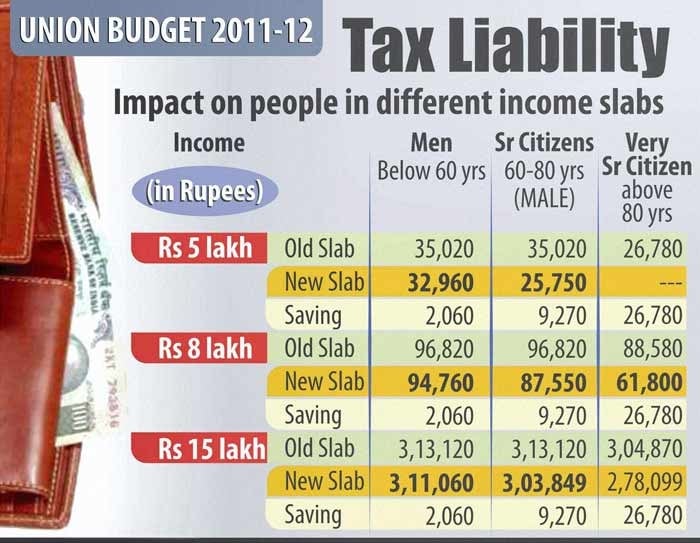

The exemption limit for general category of tax payers has been enhanced to Rs 1.8 lakh from Rs 1.6 lakh. According to the new tax slab, Rs 1.8-5 lakh would levy a tax of 10 per cent, Rs 5-8 lakh would be taxed at 20 per cent and income over Rs 8 lakh would attract 30 per cent tax. Other highlights of direct tax announcements are:

* For senior citizens, the qualifying age reduced to 60 years.

* Senior citizens will get tax exemption for income up to Rs 2.5 lakh, higher from Rs 2.4 lakh now.

* Citizens over 80 years to have exemption limit of Rs 5 lakh.

* A new revised income tax return form 'Sugam' to be introduced for small tax payers.

* No special benefit was announced for women below 60 years whose basic exemption limit remains at Rs 1.90 lakh.

* Direct tax changes are expected to result in a revenue loss of Rs 11,500 crore. -

The Budget had some good news for those whose only source of income is a salary. From June 2011, there'll be no need to file those complicated tax returns.

The government will be issuing a notification exempting 'classes of persons' from the requirement of furnishing income tax returns, said the Finance Minister.

Salaried taxpayers who do not have other sources of income and whose incomes are subject to Tax Deduction at Source (TDS) will be excluded from filing returns. -

The Budget had something to cheer for the industry, prompting the Sensex to rise 785 points through the week. Here are the key announcement on indirect taxation front:

*Surcharge for companies cut to 5 per cent from 7.5 per cent.

*Service tax retained at 10 per cent; duty exemptions to be withdrawn on various items.

*Corporate tax retained at 30 per cent, to be paid by domestic firms earning total income of over Rs 1 crore a year.

*Increase the Minimum Alternate Tax (MAT) to 18.5 per cent from 18 per cent on book profits.

*Standard rate of central exercise duty maintained at 10 per cent; no change in CENVAT rates.

*Nominal 1 per cent central excise duty on 130 items entering the tax net. Basic food and fuel and precious stones, gold and silver jewellery will be exempted.

*Peak rate of customs duty maintained at 10 per cent in view of the global economic situation.

*Basic customs duty on agricultural machinery reduced to 4.5 per cent from 5 per cent.

*Service tax widened to cover hotel accommodation above Rs 1,000 per day, A/C restaurants serving liquor, some category of hospitals, diagnostic tests.

*Service tax on air travel increased by Rs 50 for domestic travel and Rs 250 for international travel in economy class. On higher classes, it will be 10 per cent flat.

Net revenue gain on account of indirect taxes is likely to be Rs 11,300 crore, including an additional Rs 4,000 crore on account of service tax changes. -

Budget announcements will have a direct impact on the cost of essential commodities. Here's the list of what will become cheaper and what will turn dearer:

To be Cheaper: Mobile phones, refrigerators, home loans, cement, printers, paper, diapers & sanitary napkins, homeopathic medicines, soap, steel, yarn/raw silk, LED lights, battery-driven vehicles, agriculture machinery.

To cost more: Healthcare in top-end private hospitals, branded clothes, gold, air travel, A/C restaurants serving liquor, hotel services, drugs, medicinal equipment, prepared food stuff like sugar confectionery, pastry and cakes. -

With an estimated 60 per cent of subsidised fuel not reaching its targeted population, Finance Minister Pranab Mukherjee has said BPL families will get direct cash subsidy to buy fertilizers and cooking fuel at prevailing market prices from 2012.

Mukherjee announced about 13 per cent reduction in subsidy of fuel, food and fertilisers for 2011-12 fiscal to Rs 1,34,210 crore from Rs 1,53,962 crore. For the 2011-12 fiscal, the government estimated lower oil subsidy bill at Rs 23,640 crore, compared to Rs 38,386 crore in the current fiscal.

Mukherjee also estimated a decline in fertiliser subsidy bill at Rs 49,997 crore for the next fiscal. -

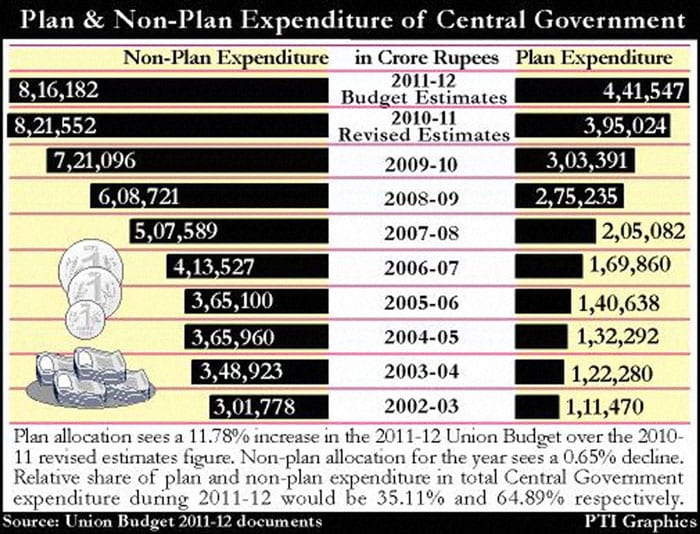

The Budget raised social sector spending by 17 per cent to Rs 1,60,887 crore, infrastructure spending by Rs 2,14,000 crore, up by over 23 per cent, and the credit target for farmers by Rs 1 lakh crore from Rs 3.75 lakh crore to Rs 4.75 lakh crore.

Plan expenditure will be Rs 4,41,547 crore, an increase of 18 per cent and non-plan expenditure will be Rs 8,16,182 crore, an increase of 10.9 per cent over Budget estimates of 2010-11.

Defence expenditure for the next year has been pegged at Rs 1,64,415, an increase of Rs 17,071 crore over the last financial year. This includes a capital expenditure of Rs 69,199 crore.

Allocation for infrastructure has been increased by over 23 per cent to Rs 2,14,000 crore and the credit to farmers hiked by Rs 1 lakh crore to Rs 4,75,000 crore. -

On the economic reform side, announcements on the Direct Taxes Code and Goods & Services Tax were the major takeaways from the Budget.

Direct Taxes Code (DTC)

Pranab Mukherjee has said the DTC, which will replace the Income Tax Act, is proposed to be implemented from April 1,2012. Under the Bill, the government seeks to widen tax slabs to levy 10 per cent tax on income between Rs 2 lakh and Rs 5 lakh, 20 per cent on Rs 5-10 lakh and 30 per cent above Rs 10 lakh.

Goods & Services Tax

The government proposes to introduce the Constitution Amendment Bill in the current session to pave the way for introduction of the GST regime. GST would subsume most of the central and state taxes like excise and sales tax, making rules easier for the industry and other tax payers.

Other Bills in the pipeline:

*New Companies Bill to be introduced in current session.

*Bills on Insurance amendment, LIC and Pension Development Authority, Banking Laws amendment, SBI subsidiaries and BIFR in the current session.

*Public Debt Management Agency Bill in the next fiscal. -

Congratulating Finance Minister Pranab Mukherjee for doing a "commendable" job, Prime Minister Manmohan Singh said, "You cannot please all the people. The Finance Minister has done as good a job as possible."

According to the PM, the Budget meets all the challenges of the economy. “This is a Budget that matches the challenges that our economy faces--sustained growth, inclusive growth, equitable growth and thus, a determined effort to curb inflationary expectations,” Singh said.