India Forecasts Top 10 Economic Trends in 2015

In 2015, will oil prices fall further or are they about to shoot up again? Is the global economy on the brink of a recession or is the revival of the US economy going to boost world growth? Is inflation going to carry on falling or are prices going to go back up next year In the midst of these uncertainties, the focus of the world is on India and the new government. Amongst all this clutter and uncertainty, we take a look at what are the 10 trends that will define 2015.

-

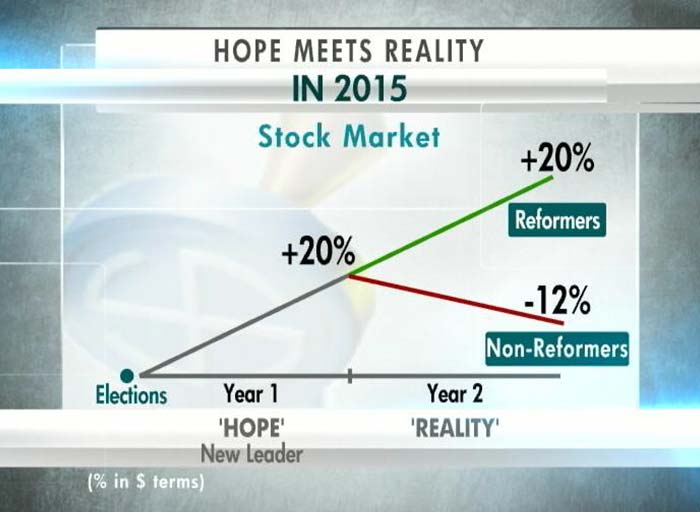

NDTV's Dr Prannoy Roy spoke to Morgan Stanley Investment Management's Ruchir Sharma about the biggest trends of 2014. Mr Sharma says 2015 be a make or break year for the Indian economy. The performance of stock markets will depend on the pace of reforms, he said.

NDTV's Dr Prannoy Roy spoke to Morgan Stanley Investment Management's Ruchir Sharma about the biggest trends of 2014. Mr Sharma says 2015 be a make or break year for the Indian economy. The performance of stock markets will depend on the pace of reforms, he said. -

February will be a big month with the first full Budget of the new government. The Budget can be transformational if it leads to more power for the states, said Ruchir Sharma. February will also decide which way interest rates are headed in the country.

February will be a big month with the first full Budget of the new government. The Budget can be transformational if it leads to more power for the states, said Ruchir Sharma. February will also decide which way interest rates are headed in the country. -

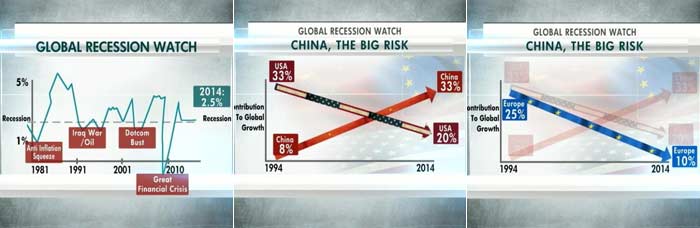

China will be the big risk for the global economy in 2015. Its contribution to global growth has risen to 33 per cent in 2014, while the US, which contributed 33 per cent to global growth in 1994, added only 20 per cent in 2014, says Ruchir Sharma.

China will be the big risk for the global economy in 2015. Its contribution to global growth has risen to 33 per cent in 2014, while the US, which contributed 33 per cent to global growth in 1994, added only 20 per cent in 2014, says Ruchir Sharma. -

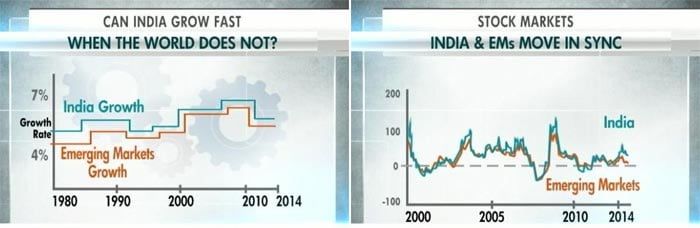

Ruchir Sharma says India is likely to growth faster than emerging markets in 2015, which has been the historical case.

Ruchir Sharma says India is likely to growth faster than emerging markets in 2015, which has been the historical case. -

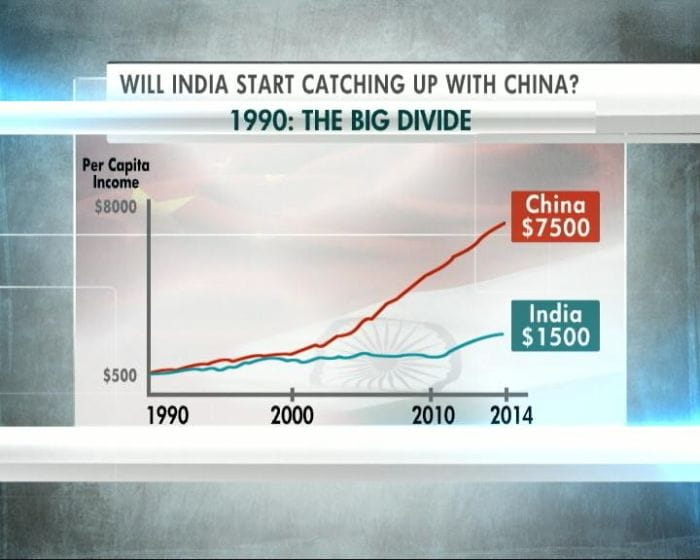

China's per capita income is $7,500, while India's per capital income is just $1,500, says Ruchir Sharma. Before 1990, per capita income in India and China was nearly the same.

China's per capita income is $7,500, while India's per capital income is just $1,500, says Ruchir Sharma. Before 1990, per capita income in India and China was nearly the same. -

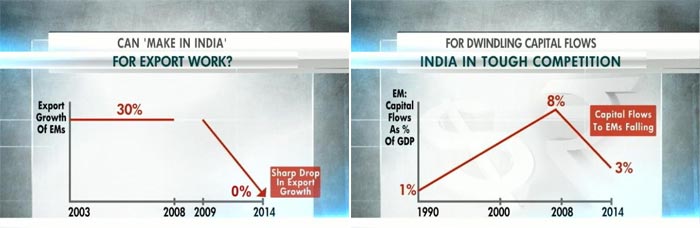

Export growth of emerging markets, including India, has fallen sharply because of global slowdown, says Ruchir Sharma. India is in tough competition for dwindling capital flows, he added.

Export growth of emerging markets, including India, has fallen sharply because of global slowdown, says Ruchir Sharma. India is in tough competition for dwindling capital flows, he added. -

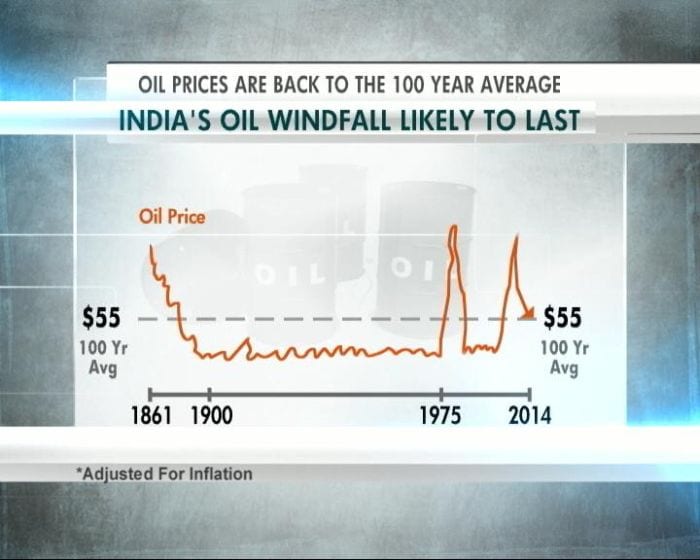

Oil prices are back below $50/barrel, which is the 100-year average, says Ruchir Sharma. Commodity prices are likely to remain low for long period, he added.

Oil prices are back below $50/barrel, which is the 100-year average, says Ruchir Sharma. Commodity prices are likely to remain low for long period, he added. -

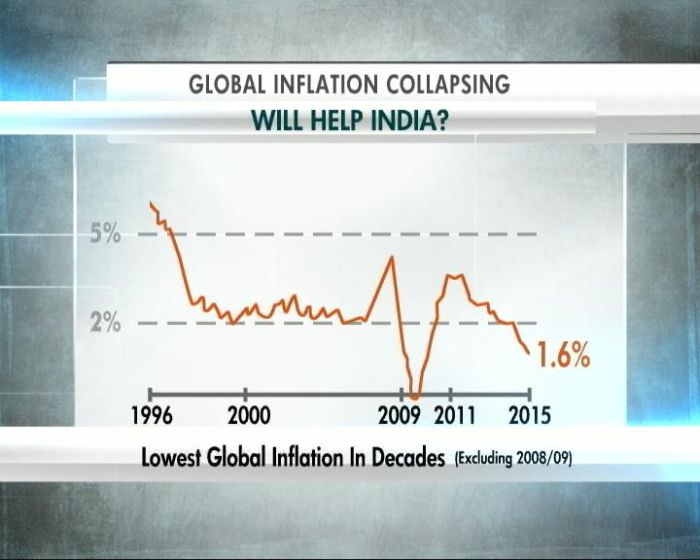

The collapse in global inflation, which has likely eased to 1.6% in 2015, will help India, says Ruchir Sharma.

The collapse in global inflation, which has likely eased to 1.6% in 2015, will help India, says Ruchir Sharma. -

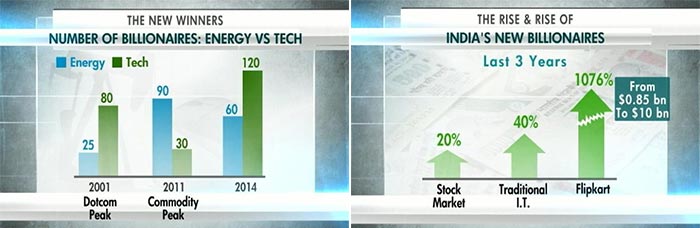

In 2014, tech billionaires overshadowed energy billionaires because of the fall in commodity prices, says Ruchir Sharma. The number of billionaires in India has seen a sharp rise in the last three years, he added.

In 2014, tech billionaires overshadowed energy billionaires because of the fall in commodity prices, says Ruchir Sharma. The number of billionaires in India has seen a sharp rise in the last three years, he added. -

Magazine covers provide huge insight into economy and markets, says Ruchir Sharma. If general interest magazines start playing up a trend, the chances are that the underlying trend is about to end, he says.

Magazine covers provide huge insight into economy and markets, says Ruchir Sharma. If general interest magazines start playing up a trend, the chances are that the underlying trend is about to end, he says.

Advertisement

Advertisement

Advertisement

Advertisement