RBI Cuts Rates, Allows 3-Month Pause On EMIs To Offset Coronavirus Impact, Other Top Stories

Reserve Bank of India (RBI) Governor Shaktikanta Das slashed the key lending rate by 75 basis points (0.75 percentage point) in an emergency move on Friday, to counter the economic fallout from the fast-spreading coronavirus pandemic. The move came after an unscheduled meeting of the Shaktikanta Das-headed Monetary Policy Committee, which was originally slated for a bi-monthly review early next month. Four out of the six members of the Monetary Policy Committee voted in favour of the move. "

-

The Reserve Bank of India (RBI) on Friday cut interest rates by 75 basis points (bps) - the sharpest in over a decade. It also made available Rs 3.74 lakh crore of additional liquidity to banks and allowed almost all borrowers to defer their loan repayments by three months. The measures are aimed at buying time for the government to deal with the coronavirus crisis by preventing stressed borrowers from being ejected from the banking system and avoiding bond markets going into a freeze due to the sudden cessation caused by the nationwide lockdown.

The Reserve Bank of India (RBI) on Friday cut interest rates by 75 basis points (bps) - the sharpest in over a decade. It also made available Rs 3.74 lakh crore of additional liquidity to banks and allowed almost all borrowers to defer their loan repayments by three months. The measures are aimed at buying time for the government to deal with the coronavirus crisis by preventing stressed borrowers from being ejected from the banking system and avoiding bond markets going into a freeze due to the sudden cessation caused by the nationwide lockdown. -

A day after the government unveiled set of measures to target farmers and unorganised sector workers at the bottom of the pyramid, the Reserve Bank Of India Friday announced a three-month moratorium on loan repayments and slashed its main policy rates by larger than expected 75 basis points and mandatory cash reserve ratio of banks by 100 basis points.

A day after the government unveiled set of measures to target farmers and unorganised sector workers at the bottom of the pyramid, the Reserve Bank Of India Friday announced a three-month moratorium on loan repayments and slashed its main policy rates by larger than expected 75 basis points and mandatory cash reserve ratio of banks by 100 basis points. -

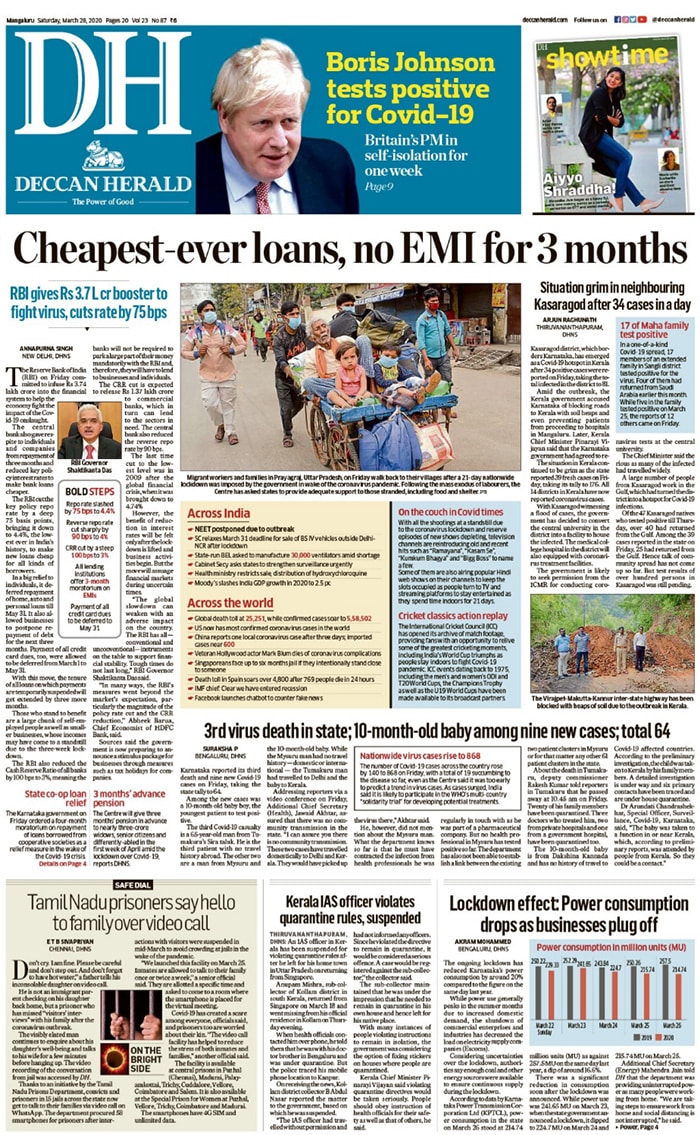

The Reserve Bank of India (RBI) on Friday committed to infuse Rs 3.74 lakh crore into the financial system to help the economy fight the impact of the Covid-19 onslaught. The central bank also gave respite to individuals and companies from repayment of loans for the next three months and reduced key policy interest rates to make bank loans cheaper. The RBI cut the key policy repo rate by a deep 75 basis points, bringing it down to 4.4%, the lowest ever in India's history, to make new loans cheap for all kinds of borrowers.

The Reserve Bank of India (RBI) on Friday committed to infuse Rs 3.74 lakh crore into the financial system to help the economy fight the impact of the Covid-19 onslaught. The central bank also gave respite to individuals and companies from repayment of loans for the next three months and reduced key policy interest rates to make bank loans cheaper. The RBI cut the key policy repo rate by a deep 75 basis points, bringing it down to 4.4%, the lowest ever in India's history, to make new loans cheap for all kinds of borrowers. -

In a huge relief to individuals and companies reeling under financial stress after the nationwide lockdown to combat the spread of Covid-19, the Reserve Bank of India on Friday allowed lenders to provide a three-month deferment on payments of Equated Monthly Instalments (EMIs) for all term loans that were outstanding as on March 1, 2020.

In a huge relief to individuals and companies reeling under financial stress after the nationwide lockdown to combat the spread of Covid-19, the Reserve Bank of India on Friday allowed lenders to provide a three-month deferment on payments of Equated Monthly Instalments (EMIs) for all term loans that were outstanding as on March 1, 2020.

Advertisement

Advertisement