Arun Jaitley Tax Scheme

- All

- News

- Videos

-

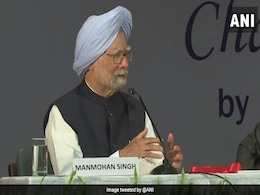

"Will End Poverty Without New Taxes": Manmohan Singh Speaks Up For NYAY

- Saturday April 20, 2019

- India News | Reported by Sunil Prabhu, Edited by Jimmy Jacob

Former Prime Minister Manmohan Singh today endorsed the Congress' NYAY scheme, claiming that its promise of providing annual income support of Rs 72,000 to each of India's poorest families will not only restart the nation's growth engine but also stimulate demand in a manner leading to increased economic activity and job creation.

-

www.ndtv.com

www.ndtv.com

-

For Serving E-Notices, Income Tax Department Notifies New Scheme

- Tuesday February 27, 2018

- Business | Press Trust of India

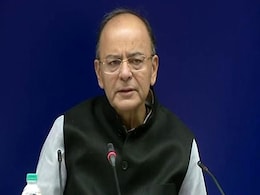

Finance Minister Arun Jaitley had announced in his Budget speech that the electronic assessment of tax returns would be launched in the country.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2018: Healthcare Winner, Losers Could Include Apple

- Thursday February 1, 2018

- Business | Iain Marlow, Bloomberg

With national polls looming next year -- and possibly as early as late 2018 -- Finance Minister Arun Jaitley has rolled out a budget designed to help distressed farmers and rural areas while boosting growth, jobs and private investment.

-

www.ndtv.com/business

www.ndtv.com/business

-

In Budget 2018, Health Care For 10 Crore Families, Farmers Gain Too: 10 Facts

- Thursday February 1, 2018

- Business | Edited by Shylaja Varma

As Finance Minister Arun Jaitley rolled out a Budget focused on farmers and the rural poor today, while boosting jobs and private investment, he has pegged the fiscal deficit target for next year at 3.3 per cent, higher than the earlier 3 per cent goal. Presenting the government's last full-year budget before the 2019 general elections and ahead of...

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax Dispute Scheme Gets Tepid Response, Garners Rs 1,200 Crore

- Sunday April 2, 2017

- Business | Press Trust of India

Finance Minister Arun Jaitley in his budget for 2016-17 announced the Direct Tax Dispute Resolution Scheme that sought not just to settle disputes in retrospective taxes, but end nearly 2.6 lakh pending tax cases.

-

www.ndtv.com/business

www.ndtv.com/business

-

Taxman To Waive Interest If Demand Paid In Retro Cases

- Sunday March 26, 2017

- Business | Press Trust of India

The Central Board of Direct Taxes (CBDT) on March 24 issued a circular for waiver of interest in disputed tax demand in different scenarios.

-

www.ndtv.com/business

www.ndtv.com/business

-

Early Withdrawal From NPS Made Tax-Exempt: 10 Things To Know

- Thursday February 9, 2017

- Business | Written by Surajit Dasgupta

National Pension Scheme has been given a boost in the Budget with Finance Minister Arun Jaitley offering income tax sops on early withdrawal.

-

www.ndtv.com/business

www.ndtv.com/business

-

NPS Withdrawal, Contribution: Income Tax Changes That Will Impact You

- Monday February 6, 2017

- Business | Edited by Surajit Dasgupta

The amendments will be applicable from next financial year, which starts on April 1, 2017 (assessment year 2018-19).

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2017: Finance Minister Proposes Incentives To Boost Investment In NPS

- Wednesday February 1, 2017

- Business | Press Trust of India

A further deduction to an employee in respect of contribution made by his or her employer is allowed up to 10 per cent of the employee's salary.

-

www.ndtv.com/business

www.ndtv.com/business

-

Union Budget 2017: Arun Jaitley's Budget Balm For Poor Skips Election Freebies

- Thursday February 2, 2017

- India News | Edited by Divyanshu Dutta Roy

Finance Minister Arun Jaitley in his Union Budget 2017 pledged to hike government spending on the rural poor and cut taxes on Wednesday, seeking to ease the pain of the notes ban in what he called it a "budget for the poor". He promised to double the income of farmers in the next five years and also to bring 10 million households out of poverty by ...

-

www.ndtv.com

www.ndtv.com

-

Union Budget 2017: Full Text Of Arun Jaitley's Speech In Parliament

- Wednesday February 1, 2017

- India News | Posted by Divyanshu Dutta Roy

Union Finance Minister Arun Jaitley presented the Union Budget for the 2017-18 financial year starting April 1. For the first time the general budget included the railways budget this year. Also in a first, the budget announcement date was advanced to February 1 in a move that would help streamline new schemes and spending. The budget comes just da...

-

www.ndtv.com

www.ndtv.com

-

Income Tax Relief Worth 35,000 Crores Could Be Announced In Budget: SBI

- Tuesday January 24, 2017

- Business | Written by Neeraj Thakur

The demonetisation had sucked out 86 per cent of the currency bills from the economy, hurting the demand in a consumption driven economy

-

www.ndtv.com/business

www.ndtv.com/business

-

Black Money Holders Get Last Chance To Disclose Till March 2017

- Friday December 16, 2016

- Business | Press Trust of India

Not declaring the black money under the scheme now but showing it as income in the tax return form would lead to a total levy of 77.25 per cent in taxes and penalty.

-

www.ndtv.com/business

www.ndtv.com/business

-

Black Money Tax: Government's New Income Declaration Scheme In 10 Points

- Tuesday November 29, 2016

- India News | Reported by Sunil Prabhu, Edited by Divyanshu Dutta Roy

With the ban on 500 and 1,000-rupee notes now more than two weeks old, the government has proposed new rules to tax black money that is being unearthed. The bill was submitted on Monday for parliament's review by Finance Minister Arun Jaitley as the government is being attacked by a united opposition over its sudden withdrawal of 86 per cent of the...

-

www.ndtv.com

www.ndtv.com

-

"Will End Poverty Without New Taxes": Manmohan Singh Speaks Up For NYAY

- Saturday April 20, 2019

- India News | Reported by Sunil Prabhu, Edited by Jimmy Jacob

Former Prime Minister Manmohan Singh today endorsed the Congress' NYAY scheme, claiming that its promise of providing annual income support of Rs 72,000 to each of India's poorest families will not only restart the nation's growth engine but also stimulate demand in a manner leading to increased economic activity and job creation.

-

www.ndtv.com

www.ndtv.com

-

For Serving E-Notices, Income Tax Department Notifies New Scheme

- Tuesday February 27, 2018

- Business | Press Trust of India

Finance Minister Arun Jaitley had announced in his Budget speech that the electronic assessment of tax returns would be launched in the country.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2018: Healthcare Winner, Losers Could Include Apple

- Thursday February 1, 2018

- Business | Iain Marlow, Bloomberg

With national polls looming next year -- and possibly as early as late 2018 -- Finance Minister Arun Jaitley has rolled out a budget designed to help distressed farmers and rural areas while boosting growth, jobs and private investment.

-

www.ndtv.com/business

www.ndtv.com/business

-

In Budget 2018, Health Care For 10 Crore Families, Farmers Gain Too: 10 Facts

- Thursday February 1, 2018

- Business | Edited by Shylaja Varma

As Finance Minister Arun Jaitley rolled out a Budget focused on farmers and the rural poor today, while boosting jobs and private investment, he has pegged the fiscal deficit target for next year at 3.3 per cent, higher than the earlier 3 per cent goal. Presenting the government's last full-year budget before the 2019 general elections and ahead of...

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax Dispute Scheme Gets Tepid Response, Garners Rs 1,200 Crore

- Sunday April 2, 2017

- Business | Press Trust of India

Finance Minister Arun Jaitley in his budget for 2016-17 announced the Direct Tax Dispute Resolution Scheme that sought not just to settle disputes in retrospective taxes, but end nearly 2.6 lakh pending tax cases.

-

www.ndtv.com/business

www.ndtv.com/business

-

Taxman To Waive Interest If Demand Paid In Retro Cases

- Sunday March 26, 2017

- Business | Press Trust of India

The Central Board of Direct Taxes (CBDT) on March 24 issued a circular for waiver of interest in disputed tax demand in different scenarios.

-

www.ndtv.com/business

www.ndtv.com/business

-

Early Withdrawal From NPS Made Tax-Exempt: 10 Things To Know

- Thursday February 9, 2017

- Business | Written by Surajit Dasgupta

National Pension Scheme has been given a boost in the Budget with Finance Minister Arun Jaitley offering income tax sops on early withdrawal.

-

www.ndtv.com/business

www.ndtv.com/business

-

NPS Withdrawal, Contribution: Income Tax Changes That Will Impact You

- Monday February 6, 2017

- Business | Edited by Surajit Dasgupta

The amendments will be applicable from next financial year, which starts on April 1, 2017 (assessment year 2018-19).

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2017: Finance Minister Proposes Incentives To Boost Investment In NPS

- Wednesday February 1, 2017

- Business | Press Trust of India

A further deduction to an employee in respect of contribution made by his or her employer is allowed up to 10 per cent of the employee's salary.

-

www.ndtv.com/business

www.ndtv.com/business

-

Union Budget 2017: Arun Jaitley's Budget Balm For Poor Skips Election Freebies

- Thursday February 2, 2017

- India News | Edited by Divyanshu Dutta Roy

Finance Minister Arun Jaitley in his Union Budget 2017 pledged to hike government spending on the rural poor and cut taxes on Wednesday, seeking to ease the pain of the notes ban in what he called it a "budget for the poor". He promised to double the income of farmers in the next five years and also to bring 10 million households out of poverty by ...

-

www.ndtv.com

www.ndtv.com

-

Union Budget 2017: Full Text Of Arun Jaitley's Speech In Parliament

- Wednesday February 1, 2017

- India News | Posted by Divyanshu Dutta Roy

Union Finance Minister Arun Jaitley presented the Union Budget for the 2017-18 financial year starting April 1. For the first time the general budget included the railways budget this year. Also in a first, the budget announcement date was advanced to February 1 in a move that would help streamline new schemes and spending. The budget comes just da...

-

www.ndtv.com

www.ndtv.com

-

Income Tax Relief Worth 35,000 Crores Could Be Announced In Budget: SBI

- Tuesday January 24, 2017

- Business | Written by Neeraj Thakur

The demonetisation had sucked out 86 per cent of the currency bills from the economy, hurting the demand in a consumption driven economy

-

www.ndtv.com/business

www.ndtv.com/business

-

Black Money Holders Get Last Chance To Disclose Till March 2017

- Friday December 16, 2016

- Business | Press Trust of India

Not declaring the black money under the scheme now but showing it as income in the tax return form would lead to a total levy of 77.25 per cent in taxes and penalty.

-

www.ndtv.com/business

www.ndtv.com/business

-

Black Money Tax: Government's New Income Declaration Scheme In 10 Points

- Tuesday November 29, 2016

- India News | Reported by Sunil Prabhu, Edited by Divyanshu Dutta Roy

With the ban on 500 and 1,000-rupee notes now more than two weeks old, the government has proposed new rules to tax black money that is being unearthed. The bill was submitted on Monday for parliament's review by Finance Minister Arun Jaitley as the government is being attacked by a united opposition over its sudden withdrawal of 86 per cent of the...

-

www.ndtv.com

www.ndtv.com