Goods And Services Tax Slab

- All

- News

- Videos

-

GST Had Serious Birth Defects, Worsened Over Last 5 Years: P Chidambaram

- Friday July 1, 2022

- India News | Press Trust of India

The Congress on Friday demanded that the current Goods and Services Tax (GST) law should be scrapped and a new one with a single low slab be brought in its place, claiming the existing law has "serious birth defects".

-

www.ndtv.com

www.ndtv.com

-

GST Rates, Compensation, Top Takeaways From Council Meeting: 10 Points

- Wednesday June 29, 2022

- Business | Edited by Animesh Singh

The Goods and Services Tax (GST) Council meeting ended its two-day deliberations today, where a host of issues like rate rationalisation, levying 28 per cent tax on online gaming and horse racing and the vexed issue of continuing GST compensation to states, were discussed.

-

www.ndtv.com/business

www.ndtv.com/business

-

Key Deliberations At GST Council Meet In 10 Points

- Tuesday June 28, 2022

- Business | Edited by Animesh Singh

The GST Council on Tuesday approved changes in tax rates on some goods and services while allowing states to issue an e-way bill for intra-state movement of gold and precious stones, officials said. It was the first day of the two-day meeting of the GST Council which is headed by Finance Minister Nirmala Sitharaman, and is going on in Chandigarh.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Council May Consider Raising Lowest Slab To 8%, Rationalise Structure

- Sunday March 6, 2022

- Business | Press Trust of India

GST council may look at raising the lowest tax slab to 8 per cent, from 5 per cent and prune the exemption list in the regime

-

www.ndtv.com/business

www.ndtv.com/business

-

Goods And Service Tax Regime Completes 3 Years

- Wednesday July 1, 2020

- Business | Edited by Peter Noronha

GST was unveiled on July 1, 2017 at a glittering ceremony held in the Central Hall of Parliament on the midnight of June 30, 2017.

-

www.ndtv.com/business

www.ndtv.com/business

-

#HandsOffPorotta Trends As Debate On Roti vs Parotta GST Slabs Heats Up

- Friday June 12, 2020

- India News | Written by Sneha Mary Koshy, Edited by Debanish Achom

The government's move to put parotta on a higher bracket than roti under the goods and services tax or GST has angered people on social media, who pointed out that both are similarly prepared flat breads and a staple of most Indian meals.

-

www.ndtv.com

www.ndtv.com

-

Budget Needs To Move Educational Services To 0% GST Slab: Kara Learning

- Saturday February 1, 2020

- Business | Edited by Abhishek

Educational services provider have called upon the Finance Minister to move educational services to 0 per cent goods and services tax (GST) slab from currently under the 'exempt' category of GST,

-

www.ndtv.com/business

www.ndtv.com/business

-

Traders Body Releases White Paper On GST, Asks For Lower Rates

- Thursday July 4, 2019

- Business | Indo-Asian News Service

The body also suggested a review of items placed under different tax slabs under Goods and Services Tax (GST) as many of them are overlapping

-

www.ndtv.com/business

www.ndtv.com/business

-

Election 2019: Rahul Gandhi Says Committed To GST 2.0 - Single Tax, Simple Filing

- Thursday April 25, 2019

- India News | Edited by Swati Sharma

Congress president Rahul Gandhi Thursday said if voted to power, his party was committed to simplifying the Goods and Services Tax (GST) by introducing a single tax slab and reducing the number of tax filings from 12 to four in a financial year.

-

www.ndtv.com

www.ndtv.com

-

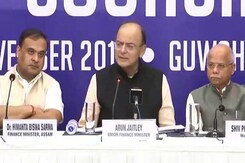

GST Roadmap To Be To Work Towards A Single Rate Between 12%, 18%: Arun Jaitley

- Monday December 24, 2018

- Business | Thomson Reuters

Finance Minister Arun Jaitley said the country should look towards having GST slabs of zero, five per cent and a standard rate for luxury and sin goods. The government will also look at transferring cement into a lower tax slab as the next priority, Mr Jaitley added.

-

www.ndtv.com/business

www.ndtv.com/business

-

32-Inch TVs, Movie Tickets Get Cheaper; 7 Items Moved From 28% GST Rate

- Saturday December 22, 2018

- Business | NDTV Profit Team

The Goods and Services Tax (GST) Council on Saturday removed seven items from the 28 per cent tax bracket. While six items, such as monitors and TVs up to 32 inches, digital cameras and video game consoles, were shifted from the tax slab of 28 per cent to 18 per cent, one - parts and accessories for carriages for people with disabilities - was move...

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Single Slab Idea "Stupid"? Congress, BJP's Topic Of Twitter Debate

- Friday December 21, 2018

- India News | Edited by Vaibhav Tiwari

An intense debate raged between senior BJP and Congress leaders after Finance Minister Arun Jaitley shot down Congress chief Rahul Gandhi's idea of a single-slab Goods and Services Tax (GST) as "stupid".

-

www.ndtv.com

www.ndtv.com

-

Now PM Using Congress's "Grand Stupid Thought": Rahul Gandhi's Dig On GST

- Thursday December 20, 2018

- India News | Edited by Anindita Sanyal

After two days of insisting that Prime Minister Narendra Modi is asleep, Congress chief Rahul Gandhi today claimed his party has managed to wake him up over the Goods and Services tax. Mr Gandhi, who once dubbed the government's flagship one tax regime "Gabbar Singh Tax" after the famous villain in Bollywood blockbuster Sholay, hit back with the Pr...

-

www.ndtv.com

www.ndtv.com

-

"If Elected, We Will Give You GST, Not Gabbar Singh Tax": Rahul Gandhi

- Monday August 13, 2018

- India News | Press Trust of India

Congress President Rahul Gandhi today slammed the Goods and Services Tax as "Gabbar Singh Tax" and said that one slab GST would be implemented when the "Congress party-Government" comes to power at the Centre.

-

www.ndtv.com

www.ndtv.com

-

GST Had Serious Birth Defects, Worsened Over Last 5 Years: P Chidambaram

- Friday July 1, 2022

- India News | Press Trust of India

The Congress on Friday demanded that the current Goods and Services Tax (GST) law should be scrapped and a new one with a single low slab be brought in its place, claiming the existing law has "serious birth defects".

-

www.ndtv.com

www.ndtv.com

-

GST Rates, Compensation, Top Takeaways From Council Meeting: 10 Points

- Wednesday June 29, 2022

- Business | Edited by Animesh Singh

The Goods and Services Tax (GST) Council meeting ended its two-day deliberations today, where a host of issues like rate rationalisation, levying 28 per cent tax on online gaming and horse racing and the vexed issue of continuing GST compensation to states, were discussed.

-

www.ndtv.com/business

www.ndtv.com/business

-

Key Deliberations At GST Council Meet In 10 Points

- Tuesday June 28, 2022

- Business | Edited by Animesh Singh

The GST Council on Tuesday approved changes in tax rates on some goods and services while allowing states to issue an e-way bill for intra-state movement of gold and precious stones, officials said. It was the first day of the two-day meeting of the GST Council which is headed by Finance Minister Nirmala Sitharaman, and is going on in Chandigarh.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Council May Consider Raising Lowest Slab To 8%, Rationalise Structure

- Sunday March 6, 2022

- Business | Press Trust of India

GST council may look at raising the lowest tax slab to 8 per cent, from 5 per cent and prune the exemption list in the regime

-

www.ndtv.com/business

www.ndtv.com/business

-

Goods And Service Tax Regime Completes 3 Years

- Wednesday July 1, 2020

- Business | Edited by Peter Noronha

GST was unveiled on July 1, 2017 at a glittering ceremony held in the Central Hall of Parliament on the midnight of June 30, 2017.

-

www.ndtv.com/business

www.ndtv.com/business

-

#HandsOffPorotta Trends As Debate On Roti vs Parotta GST Slabs Heats Up

- Friday June 12, 2020

- India News | Written by Sneha Mary Koshy, Edited by Debanish Achom

The government's move to put parotta on a higher bracket than roti under the goods and services tax or GST has angered people on social media, who pointed out that both are similarly prepared flat breads and a staple of most Indian meals.

-

www.ndtv.com

www.ndtv.com

-

Budget Needs To Move Educational Services To 0% GST Slab: Kara Learning

- Saturday February 1, 2020

- Business | Edited by Abhishek

Educational services provider have called upon the Finance Minister to move educational services to 0 per cent goods and services tax (GST) slab from currently under the 'exempt' category of GST,

-

www.ndtv.com/business

www.ndtv.com/business

-

Traders Body Releases White Paper On GST, Asks For Lower Rates

- Thursday July 4, 2019

- Business | Indo-Asian News Service

The body also suggested a review of items placed under different tax slabs under Goods and Services Tax (GST) as many of them are overlapping

-

www.ndtv.com/business

www.ndtv.com/business

-

Election 2019: Rahul Gandhi Says Committed To GST 2.0 - Single Tax, Simple Filing

- Thursday April 25, 2019

- India News | Edited by Swati Sharma

Congress president Rahul Gandhi Thursday said if voted to power, his party was committed to simplifying the Goods and Services Tax (GST) by introducing a single tax slab and reducing the number of tax filings from 12 to four in a financial year.

-

www.ndtv.com

www.ndtv.com

-

GST Roadmap To Be To Work Towards A Single Rate Between 12%, 18%: Arun Jaitley

- Monday December 24, 2018

- Business | Thomson Reuters

Finance Minister Arun Jaitley said the country should look towards having GST slabs of zero, five per cent and a standard rate for luxury and sin goods. The government will also look at transferring cement into a lower tax slab as the next priority, Mr Jaitley added.

-

www.ndtv.com/business

www.ndtv.com/business

-

32-Inch TVs, Movie Tickets Get Cheaper; 7 Items Moved From 28% GST Rate

- Saturday December 22, 2018

- Business | NDTV Profit Team

The Goods and Services Tax (GST) Council on Saturday removed seven items from the 28 per cent tax bracket. While six items, such as monitors and TVs up to 32 inches, digital cameras and video game consoles, were shifted from the tax slab of 28 per cent to 18 per cent, one - parts and accessories for carriages for people with disabilities - was move...

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Single Slab Idea "Stupid"? Congress, BJP's Topic Of Twitter Debate

- Friday December 21, 2018

- India News | Edited by Vaibhav Tiwari

An intense debate raged between senior BJP and Congress leaders after Finance Minister Arun Jaitley shot down Congress chief Rahul Gandhi's idea of a single-slab Goods and Services Tax (GST) as "stupid".

-

www.ndtv.com

www.ndtv.com

-

Now PM Using Congress's "Grand Stupid Thought": Rahul Gandhi's Dig On GST

- Thursday December 20, 2018

- India News | Edited by Anindita Sanyal

After two days of insisting that Prime Minister Narendra Modi is asleep, Congress chief Rahul Gandhi today claimed his party has managed to wake him up over the Goods and Services tax. Mr Gandhi, who once dubbed the government's flagship one tax regime "Gabbar Singh Tax" after the famous villain in Bollywood blockbuster Sholay, hit back with the Pr...

-

www.ndtv.com

www.ndtv.com

-

"If Elected, We Will Give You GST, Not Gabbar Singh Tax": Rahul Gandhi

- Monday August 13, 2018

- India News | Press Trust of India

Congress President Rahul Gandhi today slammed the Goods and Services Tax as "Gabbar Singh Tax" and said that one slab GST would be implemented when the "Congress party-Government" comes to power at the Centre.

-

www.ndtv.com

www.ndtv.com