Gst Changes

- All

- News

- Videos

-

UPI Rule Change, Minimum Bank Balance: Key Money Changes From April 1

- Monday March 31, 2025

- India News | NDTV News Desk

The beginning of a new financial year on April 1 brings a series of changes that will impact taxpayers, salaried individuals, and consumers across India.

-

www.ndtv.com

www.ndtv.com

-

New Tax Rates, UPI And GST: These Things Will Change Starting April 1, 2025

- Saturday March 29, 2025

- India News | Edited by Abhinav Singh

From changes in the tax slabs to the UPI to the launch of the Unified Pension Scheme, here's a complete list of the changes that you can expect.

-

www.ndtv.com

www.ndtv.com

-

6 Major Changes Starting March 1, 2025 That Will Impact You Financially

- Friday February 28, 2025

- Offbeat | Edited by Nikhil Pandey

Starting March 1, 2025, several key changes will impact personal finances, including updates to SEBI nomination rules, LPG cylinder prices, FD interest rates, UPI payment rules, tax adjustments, and GST security enhancements.

-

www.ndtv.com

www.ndtv.com

-

EPFO, UPI, GST And Visa: These Things Will Change Starting January 1, 2025

- Wednesday January 1, 2025

- India News | Edited by Abhinav Singh

From changes in EPFO withdrawal procedures to UPI limit increase, here's what will be changing starting January 1, 2025.

-

www.ndtv.com

www.ndtv.com

-

GST, Visa Fees, Mobile Data Charges & More: Key Changes From January 1 That Will Affect Your Finances And Planning

- Thursday December 26, 2024

- Feature | Edited by Nikhil Pandey

Key updates include stricter GST compliance measures, the launch of Thailand's global e-visa system, streamlined US visa rules, ITC Hotels' demerger, and new telecom regulations for Jio, Airtel, Vodafone, and BSNL.

-

www.ndtv.com

www.ndtv.com

-

Projectors Cannot Replace Smart TVs, Says SPPL's Founder Avneet Singh Marwah

- Monday December 23, 2024

- Written by Ankit Sharma

In an exclusive conversation with Avneet Singh Marwah, founder of SPPL, a company catering to this segment. Ankit Sharma from Gadgets 360 got a chance to sit down with Avneet Singh Marwah, CEO/Director of Super Plastronics Limited (SPPL). Under his leadership, SPPL launched four brands in India: Kodak TV, Thomson, White Westinghouse, and Blaupunkt ...

-

www.gadgets360.com

www.gadgets360.com

-

GST Rates Changed For Some Products And Services: See List

- Saturday June 22, 2024

- Business News | NDTV News Desk

Union Finance Nirmala Sitharaman chaired pre-Budget consultations with finance ministers of states and Union Territories to take their views. It was followed by the 53rd meeting of the GST (Goods and Services Tax) Council today.

-

www.ndtv.com

www.ndtv.com

-

SBI Credit Card To GST, Your Guide To Rules Changing From March 2024

- Wednesday February 28, 2024

- India News | Edited by Amit Chaturvedi

These changes from March will directly impact millions of customers across India, including FASTag users.

-

www.ndtv.com

www.ndtv.com

-

Five Big Changes Coming Into Effect From November 1

- Tuesday October 31, 2023

- India News | Edited by Amit Chaturvedi

From November 1, many sectors and things associated with day-to-day affairs will see changes. These changes will also affect companies who have to file the Goods and Services (GST) receipts. One of them will be particularly important for people who r

-

www.ndtv.com

www.ndtv.com

-

World Way Off Track To Meet Paris Climate Goals, Says UN Report

- Friday September 8, 2023

- World News | Press Trust of India

While progress has been made in combating climate change, the world is far from being on track to meet the long-term goals of the Paris Agreement, says a technical report on the first-ever Global Stocktake (GST) published on Friday.

-

www.ndtv.com

www.ndtv.com

-

Lok Sabha Approves Setting Up Of GST Appellate Tribunal

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha on Friday cleared changes in the Finance Bill to pave the way for setting up of an appellate tribunal for resolution of disputes under GST.

-

www.ndtv.com

www.ndtv.com

-

Big Change In Tax On SUVs In GST Council's Latest Meeting

- Sunday December 18, 2022

- India News | Reuters

The Goods and Services Tax (GST) Council on Saturday decided to have a single definition across all states in the country for sports utility vehicles, attracting a higher tax rate.

-

www.ndtv.com

www.ndtv.com

-

Pay GST On These Items From Monday, As New Tax Rates Kick In

- Sunday July 17, 2022

- Business | Press Trust of India

Customers will have to pay 5 per cent GST on pre-packed, labelled food items like atta, paneer and curd, besides hospital rooms with rent above Rs 5,000 from Monday with the GST Council's decision coming into force.

-

www.ndtv.com/business

www.ndtv.com/business

-

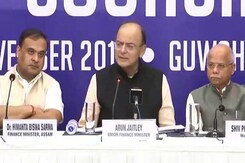

Key Deliberations At GST Council Meet In 10 Points

- Tuesday June 28, 2022

- Business | Edited by Animesh Singh

The GST Council on Tuesday approved changes in tax rates on some goods and services while allowing states to issue an e-way bill for intra-state movement of gold and precious stones, officials said. It was the first day of the two-day meeting of the GST Council which is headed by Finance Minister Nirmala Sitharaman, and is going on in Chandigarh.

-

www.ndtv.com/business

www.ndtv.com/business

-

UPI Rule Change, Minimum Bank Balance: Key Money Changes From April 1

- Monday March 31, 2025

- India News | NDTV News Desk

The beginning of a new financial year on April 1 brings a series of changes that will impact taxpayers, salaried individuals, and consumers across India.

-

www.ndtv.com

www.ndtv.com

-

New Tax Rates, UPI And GST: These Things Will Change Starting April 1, 2025

- Saturday March 29, 2025

- India News | Edited by Abhinav Singh

From changes in the tax slabs to the UPI to the launch of the Unified Pension Scheme, here's a complete list of the changes that you can expect.

-

www.ndtv.com

www.ndtv.com

-

6 Major Changes Starting March 1, 2025 That Will Impact You Financially

- Friday February 28, 2025

- Offbeat | Edited by Nikhil Pandey

Starting March 1, 2025, several key changes will impact personal finances, including updates to SEBI nomination rules, LPG cylinder prices, FD interest rates, UPI payment rules, tax adjustments, and GST security enhancements.

-

www.ndtv.com

www.ndtv.com

-

EPFO, UPI, GST And Visa: These Things Will Change Starting January 1, 2025

- Wednesday January 1, 2025

- India News | Edited by Abhinav Singh

From changes in EPFO withdrawal procedures to UPI limit increase, here's what will be changing starting January 1, 2025.

-

www.ndtv.com

www.ndtv.com

-

GST, Visa Fees, Mobile Data Charges & More: Key Changes From January 1 That Will Affect Your Finances And Planning

- Thursday December 26, 2024

- Feature | Edited by Nikhil Pandey

Key updates include stricter GST compliance measures, the launch of Thailand's global e-visa system, streamlined US visa rules, ITC Hotels' demerger, and new telecom regulations for Jio, Airtel, Vodafone, and BSNL.

-

www.ndtv.com

www.ndtv.com

-

Projectors Cannot Replace Smart TVs, Says SPPL's Founder Avneet Singh Marwah

- Monday December 23, 2024

- Written by Ankit Sharma

In an exclusive conversation with Avneet Singh Marwah, founder of SPPL, a company catering to this segment. Ankit Sharma from Gadgets 360 got a chance to sit down with Avneet Singh Marwah, CEO/Director of Super Plastronics Limited (SPPL). Under his leadership, SPPL launched four brands in India: Kodak TV, Thomson, White Westinghouse, and Blaupunkt ...

-

www.gadgets360.com

www.gadgets360.com

-

GST Rates Changed For Some Products And Services: See List

- Saturday June 22, 2024

- Business News | NDTV News Desk

Union Finance Nirmala Sitharaman chaired pre-Budget consultations with finance ministers of states and Union Territories to take their views. It was followed by the 53rd meeting of the GST (Goods and Services Tax) Council today.

-

www.ndtv.com

www.ndtv.com

-

SBI Credit Card To GST, Your Guide To Rules Changing From March 2024

- Wednesday February 28, 2024

- India News | Edited by Amit Chaturvedi

These changes from March will directly impact millions of customers across India, including FASTag users.

-

www.ndtv.com

www.ndtv.com

-

Five Big Changes Coming Into Effect From November 1

- Tuesday October 31, 2023

- India News | Edited by Amit Chaturvedi

From November 1, many sectors and things associated with day-to-day affairs will see changes. These changes will also affect companies who have to file the Goods and Services (GST) receipts. One of them will be particularly important for people who r

-

www.ndtv.com

www.ndtv.com

-

World Way Off Track To Meet Paris Climate Goals, Says UN Report

- Friday September 8, 2023

- World News | Press Trust of India

While progress has been made in combating climate change, the world is far from being on track to meet the long-term goals of the Paris Agreement, says a technical report on the first-ever Global Stocktake (GST) published on Friday.

-

www.ndtv.com

www.ndtv.com

-

Lok Sabha Approves Setting Up Of GST Appellate Tribunal

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha on Friday cleared changes in the Finance Bill to pave the way for setting up of an appellate tribunal for resolution of disputes under GST.

-

www.ndtv.com

www.ndtv.com

-

Big Change In Tax On SUVs In GST Council's Latest Meeting

- Sunday December 18, 2022

- India News | Reuters

The Goods and Services Tax (GST) Council on Saturday decided to have a single definition across all states in the country for sports utility vehicles, attracting a higher tax rate.

-

www.ndtv.com

www.ndtv.com

-

Pay GST On These Items From Monday, As New Tax Rates Kick In

- Sunday July 17, 2022

- Business | Press Trust of India

Customers will have to pay 5 per cent GST on pre-packed, labelled food items like atta, paneer and curd, besides hospital rooms with rent above Rs 5,000 from Monday with the GST Council's decision coming into force.

-

www.ndtv.com/business

www.ndtv.com/business

-

Key Deliberations At GST Council Meet In 10 Points

- Tuesday June 28, 2022

- Business | Edited by Animesh Singh

The GST Council on Tuesday approved changes in tax rates on some goods and services while allowing states to issue an e-way bill for intra-state movement of gold and precious stones, officials said. It was the first day of the two-day meeting of the GST Council which is headed by Finance Minister Nirmala Sitharaman, and is going on in Chandigarh.

-

www.ndtv.com/business

www.ndtv.com/business