Gst On Food Items

- All

- News

- Videos

-

BJP Spent Rs 6,300 Crore On Toppling Governments, Claims Arvind Kejriwal

- Saturday August 27, 2022

- India News | Press Trust of India

Delhi Chief Minister Arvind Kejriwal on Saturday claimed that the Centre did not have to impose Goods and Services Tax (GST) on food items if the BJP had not spent a whopping Rs 6,300 crore on toppling governments of other parties in the country.

-

www.ndtv.com

www.ndtv.com

-

No GST On Withdrawal Of Cash From Banks, Says Finance Minister: 5 Points

- Tuesday August 2, 2022

- Business | Edited by Rahul Karunakar

Finance Minister Nirmala Sitharaman in the Rajya Sabha said there is no GST on withdrawal of cash from banks.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST On Packaged Food, Essential Items After States Sought Levy: Official

- Sunday July 24, 2022

- Business | Press Trust of India

GST on pre-packaged goods/ food packets was levied after some states gave feedback of losing revenues they previously earned from levy of VAT on food items, a top government official said.

-

www.ndtv.com/business

www.ndtv.com/business

-

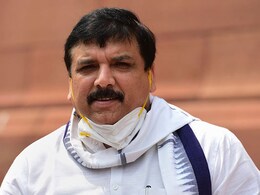

AAP's Sanjay Singh Gives Adjournment Notice In Upper House On GST Hike

- Wednesday July 20, 2022

- India News | Asian News International

Aam Aadmi Party (AAP) Rajya Sabha Member of Parliament (MP) Sanjay Singh on Tuesday gave an adjournment motion notice under Rule 267 to discuss the increased Goods and Services Tax (GST) on food items and rising inflation.

-

www.ndtv.com

www.ndtv.com

-

"Modiji's Masterstroke": Opposition's Barb On GST Rate Hike

- Monday July 18, 2022

- India News | Press Trust of India

The Opposition on Monday attacked the centre over imposing Goods and Services Tax (GST) on packaged food items such as milk and curd, saying it was Prime Minister Narendra Modi's "masterstroke" of making India miserable.

-

www.ndtv.com

www.ndtv.com

-

Hurting People When They Need Relief: BJP's Varun Gandhi On GST Rate Move

- Monday July 18, 2022

- India News | Press Trust of India

BJP MP Varun Gandhi on Monday criticised imposing GST on packaged food items such as milk, curd and rice, saying this will hurt people already struggling with "record-breaking unemployment".

-

www.ndtv.com

www.ndtv.com

-

From Oil To Atta, Prices Have Soared Across Essentials, Now GST Adds To Pain

- Monday July 18, 2022

- Business | Reported by Priyanshi Sharma, Edited by Rahul Karunakar

The prices from oil to atta and across essentials have soared because of supply-driven shortages, and the new GST rates on these commodities will add to the already-stretched household budgets.

-

www.ndtv.com/business

www.ndtv.com/business

-

5% GST On Packaged Cereals, Pulses, Flour Weighing Up To 25 Kg: 10 Points

- Monday July 18, 2022

- Business | Edited by Prashun Talukdar

Starting today, a 5 per cent GST (goods and services tax) rate will be levied on packed and labelled food items such as cereals, pulses and flour weighing up to 25 kg, a detailed frequently asked questions (FAQs) compilation by the Union Finance Ministry stated. Unbranded food items ranging from cereals, pulses to curd, 'lassi' and puffed rice will...

-

www.ndtv.com/business

www.ndtv.com/business

-

"Withdraw GST On Pre-Packed, Labelled Food Items": Arvind Kejriwal To Centre

- Monday July 18, 2022

- India News | Press Trust of India

Delhi Chief Minister Arvind Kejriwal on Monday demanded that the Centre withdraw the Goods and Services Tax (GST) it has freshly imposed on pre-packed and labelled food items.

-

www.ndtv.com

www.ndtv.com

-

GST Rate Hike From Today, These Essential Items Will Get Costlier

- Monday July 18, 2022

- Business | Asian News International

The recommendations on Goods and Services Tax rates that were made during the 47th GST Council meeting held in June come into effect today.

-

www.ndtv.com/business

www.ndtv.com/business

-

No GST On Packaged Cereals, Pulses, Flour Weighing Over 25 Kg

- Monday July 18, 2022

- Business | Press Trust of India

Single packages of unbranded pre-packed and labelled food items like cereals, pulses and flour weighing in excess of 25 kg are exempt from 5 per cent GST levy.

-

www.ndtv.com/business

www.ndtv.com/business

-

Pay GST On These Items From Monday, As New Tax Rates Kick In

- Sunday July 17, 2022

- Business | Press Trust of India

Customers will have to pay 5 per cent GST on pre-packed, labelled food items like atta, paneer and curd, besides hospital rooms with rent above Rs 5,000 from Monday with the GST Council's decision coming into force.

-

www.ndtv.com/business

www.ndtv.com/business

-

PM's "Gabbar Singh Tax" Turning Into "Grahasti Sarvnaash" Tax: Rahul Gandhi

- Wednesday June 29, 2022

- India News | Press Trust of India

Congress leader Rahul Gandhi hit out at the government over rise in taxes on pre-packed food items and hotel stay, alleging that the prime minister's "Gabbar Singh Tax" is now taking the shape of "Grahasti Sarvnaash Tax" (household destruction tax).

-

www.ndtv.com

www.ndtv.com

-

Does Papad Shape Affect GST? Harsh Goenka's Query Answered By Tax Body

- Wednesday September 1, 2021

- Aditi Ahuja

Industrialist Harsh Goenka took to Twitter to ask about taxation on different shapes of Papad. An Indian tax body clarified the issue.

-

food.ndtv.com

food.ndtv.com

-

BJP Spent Rs 6,300 Crore On Toppling Governments, Claims Arvind Kejriwal

- Saturday August 27, 2022

- India News | Press Trust of India

Delhi Chief Minister Arvind Kejriwal on Saturday claimed that the Centre did not have to impose Goods and Services Tax (GST) on food items if the BJP had not spent a whopping Rs 6,300 crore on toppling governments of other parties in the country.

-

www.ndtv.com

www.ndtv.com

-

No GST On Withdrawal Of Cash From Banks, Says Finance Minister: 5 Points

- Tuesday August 2, 2022

- Business | Edited by Rahul Karunakar

Finance Minister Nirmala Sitharaman in the Rajya Sabha said there is no GST on withdrawal of cash from banks.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST On Packaged Food, Essential Items After States Sought Levy: Official

- Sunday July 24, 2022

- Business | Press Trust of India

GST on pre-packaged goods/ food packets was levied after some states gave feedback of losing revenues they previously earned from levy of VAT on food items, a top government official said.

-

www.ndtv.com/business

www.ndtv.com/business

-

AAP's Sanjay Singh Gives Adjournment Notice In Upper House On GST Hike

- Wednesday July 20, 2022

- India News | Asian News International

Aam Aadmi Party (AAP) Rajya Sabha Member of Parliament (MP) Sanjay Singh on Tuesday gave an adjournment motion notice under Rule 267 to discuss the increased Goods and Services Tax (GST) on food items and rising inflation.

-

www.ndtv.com

www.ndtv.com

-

"Modiji's Masterstroke": Opposition's Barb On GST Rate Hike

- Monday July 18, 2022

- India News | Press Trust of India

The Opposition on Monday attacked the centre over imposing Goods and Services Tax (GST) on packaged food items such as milk and curd, saying it was Prime Minister Narendra Modi's "masterstroke" of making India miserable.

-

www.ndtv.com

www.ndtv.com

-

Hurting People When They Need Relief: BJP's Varun Gandhi On GST Rate Move

- Monday July 18, 2022

- India News | Press Trust of India

BJP MP Varun Gandhi on Monday criticised imposing GST on packaged food items such as milk, curd and rice, saying this will hurt people already struggling with "record-breaking unemployment".

-

www.ndtv.com

www.ndtv.com

-

From Oil To Atta, Prices Have Soared Across Essentials, Now GST Adds To Pain

- Monday July 18, 2022

- Business | Reported by Priyanshi Sharma, Edited by Rahul Karunakar

The prices from oil to atta and across essentials have soared because of supply-driven shortages, and the new GST rates on these commodities will add to the already-stretched household budgets.

-

www.ndtv.com/business

www.ndtv.com/business

-

5% GST On Packaged Cereals, Pulses, Flour Weighing Up To 25 Kg: 10 Points

- Monday July 18, 2022

- Business | Edited by Prashun Talukdar

Starting today, a 5 per cent GST (goods and services tax) rate will be levied on packed and labelled food items such as cereals, pulses and flour weighing up to 25 kg, a detailed frequently asked questions (FAQs) compilation by the Union Finance Ministry stated. Unbranded food items ranging from cereals, pulses to curd, 'lassi' and puffed rice will...

-

www.ndtv.com/business

www.ndtv.com/business

-

"Withdraw GST On Pre-Packed, Labelled Food Items": Arvind Kejriwal To Centre

- Monday July 18, 2022

- India News | Press Trust of India

Delhi Chief Minister Arvind Kejriwal on Monday demanded that the Centre withdraw the Goods and Services Tax (GST) it has freshly imposed on pre-packed and labelled food items.

-

www.ndtv.com

www.ndtv.com

-

GST Rate Hike From Today, These Essential Items Will Get Costlier

- Monday July 18, 2022

- Business | Asian News International

The recommendations on Goods and Services Tax rates that were made during the 47th GST Council meeting held in June come into effect today.

-

www.ndtv.com/business

www.ndtv.com/business

-

No GST On Packaged Cereals, Pulses, Flour Weighing Over 25 Kg

- Monday July 18, 2022

- Business | Press Trust of India

Single packages of unbranded pre-packed and labelled food items like cereals, pulses and flour weighing in excess of 25 kg are exempt from 5 per cent GST levy.

-

www.ndtv.com/business

www.ndtv.com/business

-

Pay GST On These Items From Monday, As New Tax Rates Kick In

- Sunday July 17, 2022

- Business | Press Trust of India

Customers will have to pay 5 per cent GST on pre-packed, labelled food items like atta, paneer and curd, besides hospital rooms with rent above Rs 5,000 from Monday with the GST Council's decision coming into force.

-

www.ndtv.com/business

www.ndtv.com/business

-

PM's "Gabbar Singh Tax" Turning Into "Grahasti Sarvnaash" Tax: Rahul Gandhi

- Wednesday June 29, 2022

- India News | Press Trust of India

Congress leader Rahul Gandhi hit out at the government over rise in taxes on pre-packed food items and hotel stay, alleging that the prime minister's "Gabbar Singh Tax" is now taking the shape of "Grahasti Sarvnaash Tax" (household destruction tax).

-

www.ndtv.com

www.ndtv.com

-

Does Papad Shape Affect GST? Harsh Goenka's Query Answered By Tax Body

- Wednesday September 1, 2021

- Aditi Ahuja

Industrialist Harsh Goenka took to Twitter to ask about taxation on different shapes of Papad. An Indian tax body clarified the issue.

-

food.ndtv.com

food.ndtv.com