Gst Union States

- All

- News

- Videos

-

Nitin Gadkari Wants States To Consider Cutting GST On Flex-Fuel Vehicles

- Monday September 2, 2024

- Business News | Press Trust of India

Union Minister Nitin Gadkari on Monday said state finance ministers should consider reducing Goods and Services Tax (GST) on flex-fuel vehicles to 12 per cent in the GST Council meeting.

-

www.ndtv.com

www.ndtv.com

-

"Drama": Finance Minister Rubbishes Objections To Tax On Insurance Premium

- Thursday August 8, 2024

- India News | NDTV News Desk

Union finance minister Nirmala Sitharaman, targetted by her critics over the 18 per cent GST on life and medical insurance premiums, retorted today that leaders having objection should first have consulted their state finance ministers.

-

www.ndtv.com

www.ndtv.com

-

Gujarat Cops File Case Over Deepfake Video Of Nirmala Sitharaman

- Tuesday July 9, 2024

- India News | Press Trust of India

Gujarat Police has registered an FIR against a person for sharing a deepfake video of Union Finance Minister Nirmala Sitharaman on GST, state minister Harsh Sanghavi said on Tuesday.

-

www.ndtv.com

www.ndtv.com

-

GST Rates Changed For Some Products And Services: See List

- Saturday June 22, 2024

- Business News | NDTV News Desk

Union Finance Nirmala Sitharaman chaired pre-Budget consultations with finance ministers of states and Union Territories to take their views. It was followed by the 53rd meeting of the GST (Goods and Services Tax) Council today.

-

www.ndtv.com

www.ndtv.com

-

Union Minister's Challenge Amid "Separate Country", Centre-State Funds Row

- Thursday February 8, 2024

- India News | Edited by Chandrashekar Srinivasan

Union Minister V Muraleedharan on Thursday launched a two-for-one attack on the ruling Left Front in Kerala and the Congress, accusing the former of mishandling the state economy and the latter of having lost the peoples' trust.

-

www.ndtv.com

www.ndtv.com

-

Centre Devolves Over Rs 3.09 Lakh Crore Sum To States Till July

- Tuesday July 25, 2023

- India News | Press Trust of India

Of the Rs 3.09 lakh crore net proceeds of shareable union taxes and duties distributed to the states, Central GST collection devolution stood at Rs 94,368 crore till July.

-

www.ndtv.com

www.ndtv.com

-

Petroleum Products Can Be Brought Under GST Once States Agree: Nirmala Sitharaman

- Wednesday February 15, 2023

- India News | Asian News International

Petroleum products can be part of GST and what is needed is the nod from the council members, said Union finance minister Nirmala Sitharaman on Wednesday.

-

www.ndtv.com

www.ndtv.com

-

West Bengal Says Centre Owes It Rs 2,409 Crore As GST Compensation

- Saturday February 11, 2023

- India News | Press Trust of India

The West Bengal government on Friday night said the Centre owes it Rs 2,409.96 crore, responding to Union Finance Minister Nirmala Sitharaman's statement that the state has not sent GST compensation cess claim with accountant general (AG) certificate

-

www.ndtv.com

www.ndtv.com

-

Ex Bengal Minister Says Rs 1.25 Lakh Crore GST Fraud, Cites Centre's Data

- Saturday January 21, 2023

- India News | Written by Saurabh Gupta

The GST Council is the only institution in the country today which is totally federalist, Mr Mitra further argued, saying ministers of 31 states and union territories are part of the council, chaired by the Finance Minister of India.

-

www.ndtv.com

www.ndtv.com

-

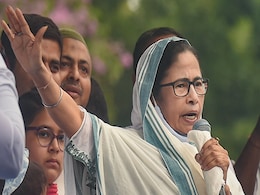

May Have To Stop Paying GST If Centre Doesn't Clear Bengal's Dues: Mamata Banerjee

- Tuesday November 15, 2022

- India News | Press Trust of India

Launching a tirade against the BJP-led Union government, West Bengal Chief Minister Mamata Banerjee today said that if the Centre does not clear the state's dues, it may have to stop paying Goods and Services Tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Tamil Nadu Opposed GST On Food, Says State Finance Minister

- Thursday August 4, 2022

- India News | Written by J Sam Daniel Stalin

Tamil Nadu Finance Minister Dr Palanivel Thiaga Rajan has refuted Union Finance Minister Nirmala Sitharaman's claim that state governments did not oppose the Centre's levy of 5 per cent GST on branded food products including curd and lassi.

-

www.ndtv.com

www.ndtv.com

-

GST Council's Recommendation Not Binding On Union, States: Supreme Court

- Friday May 20, 2022

- India News | Press Trust of India

In a significant verdict, the Supreme Court Thursday ruled that the recommendations of Goods and Services Tax (GST) Council are not binding on the Union and the states and only have a persuasive value.

-

www.ndtv.com

www.ndtv.com

-

GST Council's Recommendations Not Binding On States, Union, Only Persuasive Value: Supreme Court

- Thursday May 19, 2022

- Business | Reported by Arvind Gunasekar, Edited by Rahul Karunakar

The Supreme Court on Thursday, in a significant verdict, ruled that the recommendations of the Goods and Services Tax (GST) council are not binding on the Union and the State Governments.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government Releases Rs 6,000 Crore To States As GST Compensation

- Friday March 25, 2022

- Business | Asian News International

The Union Finance Ministry on Friday said it has released the 13th weekly instalment of Rs 6,000 crore to 23 states and three Union Territories (UTs) to meet the GST compensation shortfall.

-

www.ndtv.com/business

www.ndtv.com/business

-

Nitin Gadkari Wants States To Consider Cutting GST On Flex-Fuel Vehicles

- Monday September 2, 2024

- Business News | Press Trust of India

Union Minister Nitin Gadkari on Monday said state finance ministers should consider reducing Goods and Services Tax (GST) on flex-fuel vehicles to 12 per cent in the GST Council meeting.

-

www.ndtv.com

www.ndtv.com

-

"Drama": Finance Minister Rubbishes Objections To Tax On Insurance Premium

- Thursday August 8, 2024

- India News | NDTV News Desk

Union finance minister Nirmala Sitharaman, targetted by her critics over the 18 per cent GST on life and medical insurance premiums, retorted today that leaders having objection should first have consulted their state finance ministers.

-

www.ndtv.com

www.ndtv.com

-

Gujarat Cops File Case Over Deepfake Video Of Nirmala Sitharaman

- Tuesday July 9, 2024

- India News | Press Trust of India

Gujarat Police has registered an FIR against a person for sharing a deepfake video of Union Finance Minister Nirmala Sitharaman on GST, state minister Harsh Sanghavi said on Tuesday.

-

www.ndtv.com

www.ndtv.com

-

GST Rates Changed For Some Products And Services: See List

- Saturday June 22, 2024

- Business News | NDTV News Desk

Union Finance Nirmala Sitharaman chaired pre-Budget consultations with finance ministers of states and Union Territories to take their views. It was followed by the 53rd meeting of the GST (Goods and Services Tax) Council today.

-

www.ndtv.com

www.ndtv.com

-

Union Minister's Challenge Amid "Separate Country", Centre-State Funds Row

- Thursday February 8, 2024

- India News | Edited by Chandrashekar Srinivasan

Union Minister V Muraleedharan on Thursday launched a two-for-one attack on the ruling Left Front in Kerala and the Congress, accusing the former of mishandling the state economy and the latter of having lost the peoples' trust.

-

www.ndtv.com

www.ndtv.com

-

Centre Devolves Over Rs 3.09 Lakh Crore Sum To States Till July

- Tuesday July 25, 2023

- India News | Press Trust of India

Of the Rs 3.09 lakh crore net proceeds of shareable union taxes and duties distributed to the states, Central GST collection devolution stood at Rs 94,368 crore till July.

-

www.ndtv.com

www.ndtv.com

-

Petroleum Products Can Be Brought Under GST Once States Agree: Nirmala Sitharaman

- Wednesday February 15, 2023

- India News | Asian News International

Petroleum products can be part of GST and what is needed is the nod from the council members, said Union finance minister Nirmala Sitharaman on Wednesday.

-

www.ndtv.com

www.ndtv.com

-

West Bengal Says Centre Owes It Rs 2,409 Crore As GST Compensation

- Saturday February 11, 2023

- India News | Press Trust of India

The West Bengal government on Friday night said the Centre owes it Rs 2,409.96 crore, responding to Union Finance Minister Nirmala Sitharaman's statement that the state has not sent GST compensation cess claim with accountant general (AG) certificate

-

www.ndtv.com

www.ndtv.com

-

Ex Bengal Minister Says Rs 1.25 Lakh Crore GST Fraud, Cites Centre's Data

- Saturday January 21, 2023

- India News | Written by Saurabh Gupta

The GST Council is the only institution in the country today which is totally federalist, Mr Mitra further argued, saying ministers of 31 states and union territories are part of the council, chaired by the Finance Minister of India.

-

www.ndtv.com

www.ndtv.com

-

May Have To Stop Paying GST If Centre Doesn't Clear Bengal's Dues: Mamata Banerjee

- Tuesday November 15, 2022

- India News | Press Trust of India

Launching a tirade against the BJP-led Union government, West Bengal Chief Minister Mamata Banerjee today said that if the Centre does not clear the state's dues, it may have to stop paying Goods and Services Tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Tamil Nadu Opposed GST On Food, Says State Finance Minister

- Thursday August 4, 2022

- India News | Written by J Sam Daniel Stalin

Tamil Nadu Finance Minister Dr Palanivel Thiaga Rajan has refuted Union Finance Minister Nirmala Sitharaman's claim that state governments did not oppose the Centre's levy of 5 per cent GST on branded food products including curd and lassi.

-

www.ndtv.com

www.ndtv.com

-

GST Council's Recommendation Not Binding On Union, States: Supreme Court

- Friday May 20, 2022

- India News | Press Trust of India

In a significant verdict, the Supreme Court Thursday ruled that the recommendations of Goods and Services Tax (GST) Council are not binding on the Union and the states and only have a persuasive value.

-

www.ndtv.com

www.ndtv.com

-

GST Council's Recommendations Not Binding On States, Union, Only Persuasive Value: Supreme Court

- Thursday May 19, 2022

- Business | Reported by Arvind Gunasekar, Edited by Rahul Karunakar

The Supreme Court on Thursday, in a significant verdict, ruled that the recommendations of the Goods and Services Tax (GST) council are not binding on the Union and the State Governments.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government Releases Rs 6,000 Crore To States As GST Compensation

- Friday March 25, 2022

- Business | Asian News International

The Union Finance Ministry on Friday said it has released the 13th weekly instalment of Rs 6,000 crore to 23 states and three Union Territories (UTs) to meet the GST compensation shortfall.

-

www.ndtv.com/business

www.ndtv.com/business