Rural Bank Accounts

- All

- News

- Videos

-

Union Budget 2022: Post Office Accounts Will Be Accessible Through Netbanking, Mobile Banking

- Tuesday February 1, 2022

- Gadgets 360 Staff

At the Union Budget 2022 session, Minister of Finance Nirmala Sitharaman said that in this year, 1.5 lakh post offices in the country will come under a core banking system, enabling financial inclusion and access to accounts through netbanking

-

www.gadgets360.com

www.gadgets360.com

-

Gujarat MLA Alleges Multi-Crore Scam Under Rural Employment Scheme

- Saturday August 1, 2020

- India News | Press Trust of India

Gujarat MLA Jignesh Mevani has alleged that a multi-crore scam has surfaced in a village in Banaskantha district of the state, in which bank accounts were opened in the name of around 500 villagers without their knowledge for the transfer of money under the MNREGA scheme, in order to siphon off the funds.

-

www.ndtv.com

www.ndtv.com

-

Over Rs 600 Crore Deposited In Bank Accounts Of 27.15 Lakh UP Workers

- Tuesday March 31, 2020

- India News | Press Trust of India

In a big relief to workers under the rural employment scheme (MNREGA) in Uttar Pradesh during the nation-wide lockdown, Chief Minister Yogi Adityanath said on Monday that Rs 611 crore has been deposited directly into the bank accounts of around 27.15 lakh beneficiaries of the scheme in the state.

-

www.ndtv.com

www.ndtv.com

-

In Race To The Finish, A Clash Of PM Modi's Kisan vs Rahul Gandhi's NYAY

- Friday April 5, 2019

- India News | Written by Alok Pandey, Anurag Dwary, Mohammed Ghazali

In rural Uttar Pradesh, and elsewhere in the country, it's Prime Minister Narendra Modi's "Kisan" (farmer) versus Congress chief Rahul Gandhi's "NYAY" (justice), with voters weighing in on the Congress's Rs 72,000 a year income top-up promise for India's poor against the BJP's already implemented scheme of sending Rs 2,000 to the bank accounts of s...

-

www.ndtv.com

www.ndtv.com

-

Minimum Balance Rules Of Key Lenders Explained Here

- Monday February 11, 2019

- Business | NDTV Profit Team

ICICI Bank and HDFC Bank minimum monthly balance rules: Customers having an account in rural areas need to maintain Rs 2,000 for both banks.

-

www.ndtv.com/business

www.ndtv.com/business

-

India Post Launches Internet Banking Facility For Savings Account Users

- Friday December 14, 2018

- Business | Indo-Asian News Service

Communications Minister Manoj Sinha also launched e-commerce portal of the Department of Posts providing an online market place to rural artisans and public sector units to sell their products.

-

www.ndtv.com/business

www.ndtv.com/business

-

Non-Maintenance Of Minimum Balance: Penalty Charges Levied By Top Banks

- Sunday December 9, 2018

- Business | NDTV Profit Team

Most of the leading banks have fixed their AMB according to the location of a customer's account in urban, metro, semi-urban and rural areas.

-

www.ndtv.com/business

www.ndtv.com/business

-

Economic Growth In Second Quarter May Slow To 7.5-7.6%: SBI Report

- Tuesday November 27, 2018

- Business | Indo-Asian News Service

State Bank of India (SBI) estimated the country's economy to expand by 7.5-7.6 per cent, slower than the prior quarter, mainly on account of a slowdown in rural demand.

-

www.ndtv.com/business

www.ndtv.com/business

-

Minimum Balance Rules, Penalty For Insufficient Balance Of Key Banks Explained

- Sunday November 4, 2018

- Business | NDTV Profit Team

Leading banks have fixed their monthly average balance requirements according to the location of a customer's account in urban, metro and rural areas.

-

www.ndtv.com/business

www.ndtv.com/business

-

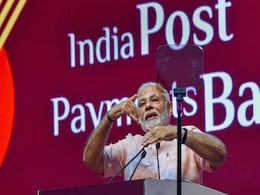

PM Launches India's Largest Payments Bank With Shot At Congress: 10 Facts

- Sunday September 2, 2018

- India News | Edited by Swati Bhasin

Prime Minister Narendra Modi on Saturday launched the India Post Payments Bank or IPPB -- the largest payments bank in the country by network size. A payments bank operates on a small scale; it carries out most banking operations but cannot give loans or issue credit cards directly. The new bank will leverage the postal department's vast network ac...

-

www.ndtv.com

www.ndtv.com

-

SBI Says Nearly 40% Of Savings Accounts Exempted From Minimum Balance Rules

- Monday August 6, 2018

- Business | NDTV Profit Team

SBI has classified its branches into four categories: rural, semi-urban, urban and metro. It has set different average monthly balances to customers holding savings bank accounts with it, depending on the location of branch. Customers failing to meet the average monthly balance requirements in a month have to bear certain penalty charges. These cha...

-

www.ndtv.com/business

www.ndtv.com/business

-

Minimum Balance Requirement: The Monthly Average You Need To Maintain In Your Account

- Saturday August 4, 2018

- Business | NDTV Profit Team

Leading public sector banks State Bank of India (SBI) and Punjab National Bank (PNB), and private sector peers HDFC Bank and ICICI Bank have fixed their monthly average balance requirements according to the location of a customer's account in urban, metro, semi-urban and rural areas, among other factors.

-

www.ndtv.com/business

www.ndtv.com/business

-

State Bank Of India (SBI) New Interest Rates, Charges, Minimum Balance Requirements Explained

- Monday July 30, 2018

- Business | NDTV Profit Team

SBI (State Bank of India) offers zero balance savings accounts, which do not require any minimum balance. Besides, it also offers savings accounts facility across its metro, urban, semi-urban and rural branches. Minimum balance requirements and penalties across all these savings accounts vary depending on branch location.

-

www.ndtv.com/business

www.ndtv.com/business

-

SBI Lowers Charges On Non-Maintenance Of Minimum Balance To Rs 15 From Rs 50

- Tuesday March 13, 2018

- Business | Press Trust of India

For semi-urban and rural centres, the charges have been reduced from Rs 40 per month plus GST to Rs 12 and Rs 10 per month plus GST, respectively, the bank said in a release.

-

www.ndtv.com/business

www.ndtv.com/business

-

SBI Clarifies On Rs 1,771 Crore Earnings From Minimum Balance Fines: 10 Points

- Tuesday January 2, 2018

- Business | NDTV Profit Team

The country's largest lender, State Bank of India (SBI), collected Rs 1,771 crore between April-November 2017 as charges from customers for failing to maintain monthly average balance in their accounts. This is more than Rs 1,581.55 crore that it earned as net profit in September quarter. The bank on Tuesday clarified on its charges for non-mainten...

-

www.ndtv.com/business

www.ndtv.com/business

-

Union Budget 2022: Post Office Accounts Will Be Accessible Through Netbanking, Mobile Banking

- Tuesday February 1, 2022

- Gadgets 360 Staff

At the Union Budget 2022 session, Minister of Finance Nirmala Sitharaman said that in this year, 1.5 lakh post offices in the country will come under a core banking system, enabling financial inclusion and access to accounts through netbanking

-

www.gadgets360.com

www.gadgets360.com

-

Gujarat MLA Alleges Multi-Crore Scam Under Rural Employment Scheme

- Saturday August 1, 2020

- India News | Press Trust of India

Gujarat MLA Jignesh Mevani has alleged that a multi-crore scam has surfaced in a village in Banaskantha district of the state, in which bank accounts were opened in the name of around 500 villagers without their knowledge for the transfer of money under the MNREGA scheme, in order to siphon off the funds.

-

www.ndtv.com

www.ndtv.com

-

Over Rs 600 Crore Deposited In Bank Accounts Of 27.15 Lakh UP Workers

- Tuesday March 31, 2020

- India News | Press Trust of India

In a big relief to workers under the rural employment scheme (MNREGA) in Uttar Pradesh during the nation-wide lockdown, Chief Minister Yogi Adityanath said on Monday that Rs 611 crore has been deposited directly into the bank accounts of around 27.15 lakh beneficiaries of the scheme in the state.

-

www.ndtv.com

www.ndtv.com

-

In Race To The Finish, A Clash Of PM Modi's Kisan vs Rahul Gandhi's NYAY

- Friday April 5, 2019

- India News | Written by Alok Pandey, Anurag Dwary, Mohammed Ghazali

In rural Uttar Pradesh, and elsewhere in the country, it's Prime Minister Narendra Modi's "Kisan" (farmer) versus Congress chief Rahul Gandhi's "NYAY" (justice), with voters weighing in on the Congress's Rs 72,000 a year income top-up promise for India's poor against the BJP's already implemented scheme of sending Rs 2,000 to the bank accounts of s...

-

www.ndtv.com

www.ndtv.com

-

Minimum Balance Rules Of Key Lenders Explained Here

- Monday February 11, 2019

- Business | NDTV Profit Team

ICICI Bank and HDFC Bank minimum monthly balance rules: Customers having an account in rural areas need to maintain Rs 2,000 for both banks.

-

www.ndtv.com/business

www.ndtv.com/business

-

India Post Launches Internet Banking Facility For Savings Account Users

- Friday December 14, 2018

- Business | Indo-Asian News Service

Communications Minister Manoj Sinha also launched e-commerce portal of the Department of Posts providing an online market place to rural artisans and public sector units to sell their products.

-

www.ndtv.com/business

www.ndtv.com/business

-

Non-Maintenance Of Minimum Balance: Penalty Charges Levied By Top Banks

- Sunday December 9, 2018

- Business | NDTV Profit Team

Most of the leading banks have fixed their AMB according to the location of a customer's account in urban, metro, semi-urban and rural areas.

-

www.ndtv.com/business

www.ndtv.com/business

-

Economic Growth In Second Quarter May Slow To 7.5-7.6%: SBI Report

- Tuesday November 27, 2018

- Business | Indo-Asian News Service

State Bank of India (SBI) estimated the country's economy to expand by 7.5-7.6 per cent, slower than the prior quarter, mainly on account of a slowdown in rural demand.

-

www.ndtv.com/business

www.ndtv.com/business

-

Minimum Balance Rules, Penalty For Insufficient Balance Of Key Banks Explained

- Sunday November 4, 2018

- Business | NDTV Profit Team

Leading banks have fixed their monthly average balance requirements according to the location of a customer's account in urban, metro and rural areas.

-

www.ndtv.com/business

www.ndtv.com/business

-

PM Launches India's Largest Payments Bank With Shot At Congress: 10 Facts

- Sunday September 2, 2018

- India News | Edited by Swati Bhasin

Prime Minister Narendra Modi on Saturday launched the India Post Payments Bank or IPPB -- the largest payments bank in the country by network size. A payments bank operates on a small scale; it carries out most banking operations but cannot give loans or issue credit cards directly. The new bank will leverage the postal department's vast network ac...

-

www.ndtv.com

www.ndtv.com

-

SBI Says Nearly 40% Of Savings Accounts Exempted From Minimum Balance Rules

- Monday August 6, 2018

- Business | NDTV Profit Team

SBI has classified its branches into four categories: rural, semi-urban, urban and metro. It has set different average monthly balances to customers holding savings bank accounts with it, depending on the location of branch. Customers failing to meet the average monthly balance requirements in a month have to bear certain penalty charges. These cha...

-

www.ndtv.com/business

www.ndtv.com/business

-

Minimum Balance Requirement: The Monthly Average You Need To Maintain In Your Account

- Saturday August 4, 2018

- Business | NDTV Profit Team

Leading public sector banks State Bank of India (SBI) and Punjab National Bank (PNB), and private sector peers HDFC Bank and ICICI Bank have fixed their monthly average balance requirements according to the location of a customer's account in urban, metro, semi-urban and rural areas, among other factors.

-

www.ndtv.com/business

www.ndtv.com/business

-

State Bank Of India (SBI) New Interest Rates, Charges, Minimum Balance Requirements Explained

- Monday July 30, 2018

- Business | NDTV Profit Team

SBI (State Bank of India) offers zero balance savings accounts, which do not require any minimum balance. Besides, it also offers savings accounts facility across its metro, urban, semi-urban and rural branches. Minimum balance requirements and penalties across all these savings accounts vary depending on branch location.

-

www.ndtv.com/business

www.ndtv.com/business

-

SBI Lowers Charges On Non-Maintenance Of Minimum Balance To Rs 15 From Rs 50

- Tuesday March 13, 2018

- Business | Press Trust of India

For semi-urban and rural centres, the charges have been reduced from Rs 40 per month plus GST to Rs 12 and Rs 10 per month plus GST, respectively, the bank said in a release.

-

www.ndtv.com/business

www.ndtv.com/business

-

SBI Clarifies On Rs 1,771 Crore Earnings From Minimum Balance Fines: 10 Points

- Tuesday January 2, 2018

- Business | NDTV Profit Team

The country's largest lender, State Bank of India (SBI), collected Rs 1,771 crore between April-November 2017 as charges from customers for failing to maintain monthly average balance in their accounts. This is more than Rs 1,581.55 crore that it earned as net profit in September quarter. The bank on Tuesday clarified on its charges for non-mainten...

-

www.ndtv.com/business

www.ndtv.com/business