The Taxation Laws

- All

- News

- Videos

-

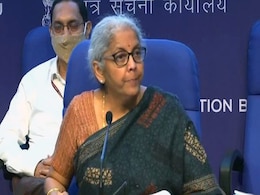

Investors Expect Crypto Tax Could Continue as Nirmala Sitharaman Returns as Finance Minister

- Tuesday June 11, 2024

- Written by Radhika Parashar, Edited by Manas Mitul

The Indian crypto circle has been waiting for FM Sitharaman to revise the tax laws imposed over the crypto sector. Despite the outcry, the finance minister did not announce any taxation relief for the crypto sector while presenting the interim annual budget earlier this year. Her re-appointment to the finance minister’s position has sparked conce...

-

www.gadgets360.com

www.gadgets360.com

-

ChatGPT Writes Essays on Constitutional Law, Taxation, Passes Exams at US Law School

- Wednesday January 25, 2023

- Agence France-Presse

ChatGPT, the chatbot from OpenAI that has taken the internet by storm, has written essays on topics ranging from constitutional law to taxation and torts and passed exams at a US law school. A professor at Minnesota University Law School, gave ChatGPT the same test faced by students, consisting of 95 multiple-choice questions and 12 essay questions...

-

www.gadgets360.com

www.gadgets360.com

-

ChatGPT Passes US Law School Exam, Writes Essays On Taxation, Constitution

- Wednesday January 25, 2023

- World News | Agence France-Presse

A chatbot powered by reams of data from the internet has passed exams at a US law school after writing essays on topics ranging from constitutional law to taxation and torts

-

www.ndtv.com

www.ndtv.com

-

Nothing Outlaws Crypto as Long as You Follow Legal Process, MoS IT Rajeev Chandrasekhar Says

- Friday January 20, 2023

- Reuters

Rajeev Chandrasekhar, Minister of State for Electronics and Information Technology, said Thursday that here was no issue with cryptocurrencies in India if all laws were followed. Speaking at an event in Bengaluru, he said: "There is nothing today that outlaws crypto as long as you follow the legal process."

-

www.gadgets360.com

www.gadgets360.com

-

Labour Laws Upgrade, Simplification Of Taxes Key To India's Trade: Report

- Thursday August 4, 2022

- Business | Press Trust of India

Upgrading labour laws, simplifying taxation and creating a stable tariff environment are imperatives to facilitate a larger trade between India and the world, a new report said.

-

www.ndtv.com/business

www.ndtv.com/business

-

India to Bring Laws on Crypto Taxations, RBI Deputy Raises CBDC-Related Concerns Before IMF

- Monday June 6, 2022

- Radhika Parashar

As India awaits its crypto laws, it is also gearing up for a revamp in the taxation laws around virtual digital assets (VDAs). The development also comes at a time when the RBI deputy governor T Rabi Sankar told IMF officials that stablecoins are not exactly safe to be used as payment options.

-

www.gadgets360.com

www.gadgets360.com

-

OECD Drafts Rules to Standardise Crypto Data Sharing Among Global Tax Authorities

- Wednesday March 23, 2022

- Radhika Parashar

The Organisation for Economic Co-operation and Development (OECD) has proposed a set of laws circling around the taxation of crypto assets. The rules aim to clarify instructions on how global tax agencies exchange crypto-related data among themselves. The rules aim to bring cryptocurrencies under the international tax system.

-

www.gadgets360.com

www.gadgets360.com

-

Australia Plans Crypto Taxation as Government Gears to Reform Payment Laws

- Monday March 21, 2022

- Radhika Parashar

The government of Australia has begun thinking of ways to regulate the crypto sector. Along with bringing digital assets under the tax regime of the nation, Australia is also aiming to ensure investor protection. Foreign crypto exchanges operating in the country may also have to agree to store Australian data inside the country itself.

-

www.gadgets360.com

www.gadgets360.com

-

Centre Releases Draft Rules For Withdrawal of Retrospective Tax Demands

- Sunday August 29, 2021

- Business | Edited by Animesh Singh

The draft rules say the Centre will not proceed with demands related to retrospective tax levy, provided that all companies withdraw cases against it

-

www.ndtv.com/business

www.ndtv.com/business

-

Lok Sabha Passes Bill To End All Retrospective Taxation, Rajya Sabha Next

- Friday August 6, 2021

- India News | Press Trust of India

A bill that aims to end all retrospective taxation imposed on indirect transfer of Indian assets was passed by the Lok Sabha today amidst continuous protests by opposition over the alleged snooping through the Pegasus spyware and other issues.

-

www.ndtv.com

www.ndtv.com

-

Gross Direct Tax Collection Rises By 5% Till November, Says Finance Minister

- Monday December 2, 2019

- Business | Press Trust of India

Ms Sitharaman said several domestic and global firms have expressed interest in investment post announcement of the reduction in corporate tax rate.

-

www.ndtv.com/business

www.ndtv.com/business

-

Parliament Live Updates: Calling Pragya Thakur Terrorist Worse Than Mahatma Gandhi's Murder, Says BJP

- Friday November 29, 2019

- India News | Edited by Ridhima Shukla

The winter session of parliament will today consider some bills for discussion and passing. They include Taxation Laws (Amendment) Bill, 2019. Finance Minister Nirmala Sitharaman is scheduled to move that the bill further to amend the Income Tax Act, 1961, and to amend the Finance Act, 2019, be taken into consideration.

-

www.ndtv.com

www.ndtv.com

-

Finance Minister Nirmala Sitharaman Introduces Bill To Cut Corporate Tax

- Monday November 25, 2019

- Business | Press Trust of India

The Taxation Laws (Amendment) Bill, 2019 will replace the Taxation Laws (Amendment) Ordinance, 2019, promulgated on September 20, 2019.

-

www.ndtv.com/business

www.ndtv.com/business

-

Centre To Introduce Bills On Corporate Tax In Lok Sabha Today

- Monday November 25, 2019

- India News | Indo-Asian News Service

The government will introduce two important Bills in the Lok Sabha on Monday -- the Taxation Laws (Amendment) Bill and the International Financial Services Centres (IFSCs) Authority Bill.

-

www.ndtv.com

www.ndtv.com

-

"GST May Have Flaws, But It's The Kanoon": Finance Minister Nirmala Sitharaman At Pune Event

- Friday October 11, 2019

- India News | Edited by Jimmy Jacob

Finance Minister Nirmala Sitharaman today admitted before a group of taxation experts that the Goods and Services Tax framework may still have some flaws two years since its introduction, but sharply advised them against "damning" a law that has been passed by Parliament with widespread approval.

-

www.ndtv.com

www.ndtv.com

-

Investors Expect Crypto Tax Could Continue as Nirmala Sitharaman Returns as Finance Minister

- Tuesday June 11, 2024

- Written by Radhika Parashar, Edited by Manas Mitul

The Indian crypto circle has been waiting for FM Sitharaman to revise the tax laws imposed over the crypto sector. Despite the outcry, the finance minister did not announce any taxation relief for the crypto sector while presenting the interim annual budget earlier this year. Her re-appointment to the finance minister’s position has sparked conce...

-

www.gadgets360.com

www.gadgets360.com

-

ChatGPT Writes Essays on Constitutional Law, Taxation, Passes Exams at US Law School

- Wednesday January 25, 2023

- Agence France-Presse

ChatGPT, the chatbot from OpenAI that has taken the internet by storm, has written essays on topics ranging from constitutional law to taxation and torts and passed exams at a US law school. A professor at Minnesota University Law School, gave ChatGPT the same test faced by students, consisting of 95 multiple-choice questions and 12 essay questions...

-

www.gadgets360.com

www.gadgets360.com

-

ChatGPT Passes US Law School Exam, Writes Essays On Taxation, Constitution

- Wednesday January 25, 2023

- World News | Agence France-Presse

A chatbot powered by reams of data from the internet has passed exams at a US law school after writing essays on topics ranging from constitutional law to taxation and torts

-

www.ndtv.com

www.ndtv.com

-

Nothing Outlaws Crypto as Long as You Follow Legal Process, MoS IT Rajeev Chandrasekhar Says

- Friday January 20, 2023

- Reuters

Rajeev Chandrasekhar, Minister of State for Electronics and Information Technology, said Thursday that here was no issue with cryptocurrencies in India if all laws were followed. Speaking at an event in Bengaluru, he said: "There is nothing today that outlaws crypto as long as you follow the legal process."

-

www.gadgets360.com

www.gadgets360.com

-

Labour Laws Upgrade, Simplification Of Taxes Key To India's Trade: Report

- Thursday August 4, 2022

- Business | Press Trust of India

Upgrading labour laws, simplifying taxation and creating a stable tariff environment are imperatives to facilitate a larger trade between India and the world, a new report said.

-

www.ndtv.com/business

www.ndtv.com/business

-

India to Bring Laws on Crypto Taxations, RBI Deputy Raises CBDC-Related Concerns Before IMF

- Monday June 6, 2022

- Radhika Parashar

As India awaits its crypto laws, it is also gearing up for a revamp in the taxation laws around virtual digital assets (VDAs). The development also comes at a time when the RBI deputy governor T Rabi Sankar told IMF officials that stablecoins are not exactly safe to be used as payment options.

-

www.gadgets360.com

www.gadgets360.com

-

OECD Drafts Rules to Standardise Crypto Data Sharing Among Global Tax Authorities

- Wednesday March 23, 2022

- Radhika Parashar

The Organisation for Economic Co-operation and Development (OECD) has proposed a set of laws circling around the taxation of crypto assets. The rules aim to clarify instructions on how global tax agencies exchange crypto-related data among themselves. The rules aim to bring cryptocurrencies under the international tax system.

-

www.gadgets360.com

www.gadgets360.com

-

Australia Plans Crypto Taxation as Government Gears to Reform Payment Laws

- Monday March 21, 2022

- Radhika Parashar

The government of Australia has begun thinking of ways to regulate the crypto sector. Along with bringing digital assets under the tax regime of the nation, Australia is also aiming to ensure investor protection. Foreign crypto exchanges operating in the country may also have to agree to store Australian data inside the country itself.

-

www.gadgets360.com

www.gadgets360.com

-

Centre Releases Draft Rules For Withdrawal of Retrospective Tax Demands

- Sunday August 29, 2021

- Business | Edited by Animesh Singh

The draft rules say the Centre will not proceed with demands related to retrospective tax levy, provided that all companies withdraw cases against it

-

www.ndtv.com/business

www.ndtv.com/business

-

Lok Sabha Passes Bill To End All Retrospective Taxation, Rajya Sabha Next

- Friday August 6, 2021

- India News | Press Trust of India

A bill that aims to end all retrospective taxation imposed on indirect transfer of Indian assets was passed by the Lok Sabha today amidst continuous protests by opposition over the alleged snooping through the Pegasus spyware and other issues.

-

www.ndtv.com

www.ndtv.com

-

Gross Direct Tax Collection Rises By 5% Till November, Says Finance Minister

- Monday December 2, 2019

- Business | Press Trust of India

Ms Sitharaman said several domestic and global firms have expressed interest in investment post announcement of the reduction in corporate tax rate.

-

www.ndtv.com/business

www.ndtv.com/business

-

Parliament Live Updates: Calling Pragya Thakur Terrorist Worse Than Mahatma Gandhi's Murder, Says BJP

- Friday November 29, 2019

- India News | Edited by Ridhima Shukla

The winter session of parliament will today consider some bills for discussion and passing. They include Taxation Laws (Amendment) Bill, 2019. Finance Minister Nirmala Sitharaman is scheduled to move that the bill further to amend the Income Tax Act, 1961, and to amend the Finance Act, 2019, be taken into consideration.

-

www.ndtv.com

www.ndtv.com

-

Finance Minister Nirmala Sitharaman Introduces Bill To Cut Corporate Tax

- Monday November 25, 2019

- Business | Press Trust of India

The Taxation Laws (Amendment) Bill, 2019 will replace the Taxation Laws (Amendment) Ordinance, 2019, promulgated on September 20, 2019.

-

www.ndtv.com/business

www.ndtv.com/business

-

Centre To Introduce Bills On Corporate Tax In Lok Sabha Today

- Monday November 25, 2019

- India News | Indo-Asian News Service

The government will introduce two important Bills in the Lok Sabha on Monday -- the Taxation Laws (Amendment) Bill and the International Financial Services Centres (IFSCs) Authority Bill.

-

www.ndtv.com

www.ndtv.com

-

"GST May Have Flaws, But It's The Kanoon": Finance Minister Nirmala Sitharaman At Pune Event

- Friday October 11, 2019

- India News | Edited by Jimmy Jacob

Finance Minister Nirmala Sitharaman today admitted before a group of taxation experts that the Goods and Services Tax framework may still have some flaws two years since its introduction, but sharply advised them against "damning" a law that has been passed by Parliament with widespread approval.

-

www.ndtv.com

www.ndtv.com