Essar under I-T lens

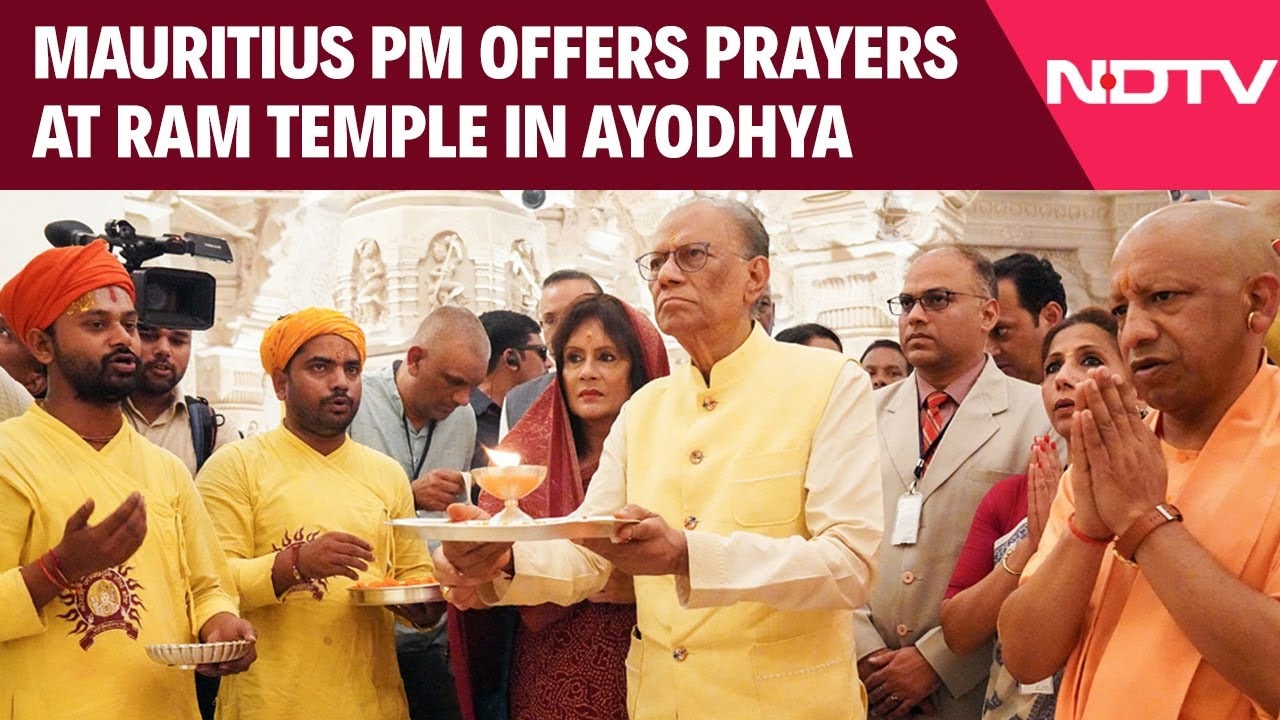

In April, Essar agreed to sell its 33 per cent stake in Vodafone Essar to Vodafone for $5 billion. Essar was ready to pay capital gains tax on 11 per cent of that stake held by an Indian entity. But it argued that no tax was payable on the 22 per cent stake, because that stake was held by companies based in Mauritius. The Income Tax department is examining whether Essar is resorting to round tripping and the stake held in Mauritius is not held by companies but individuals.