McDonald's Meals Not Cheaper Despite GST Rate Cut. Twitter Not Lovin' It | Read

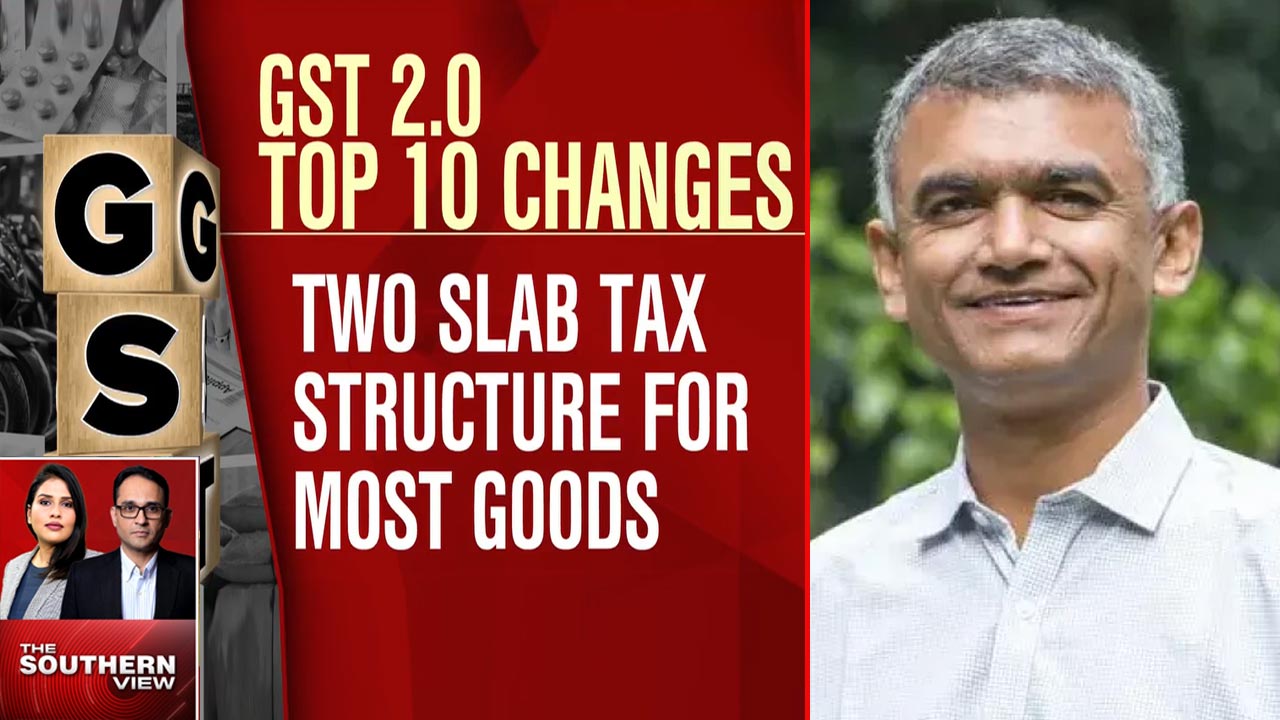

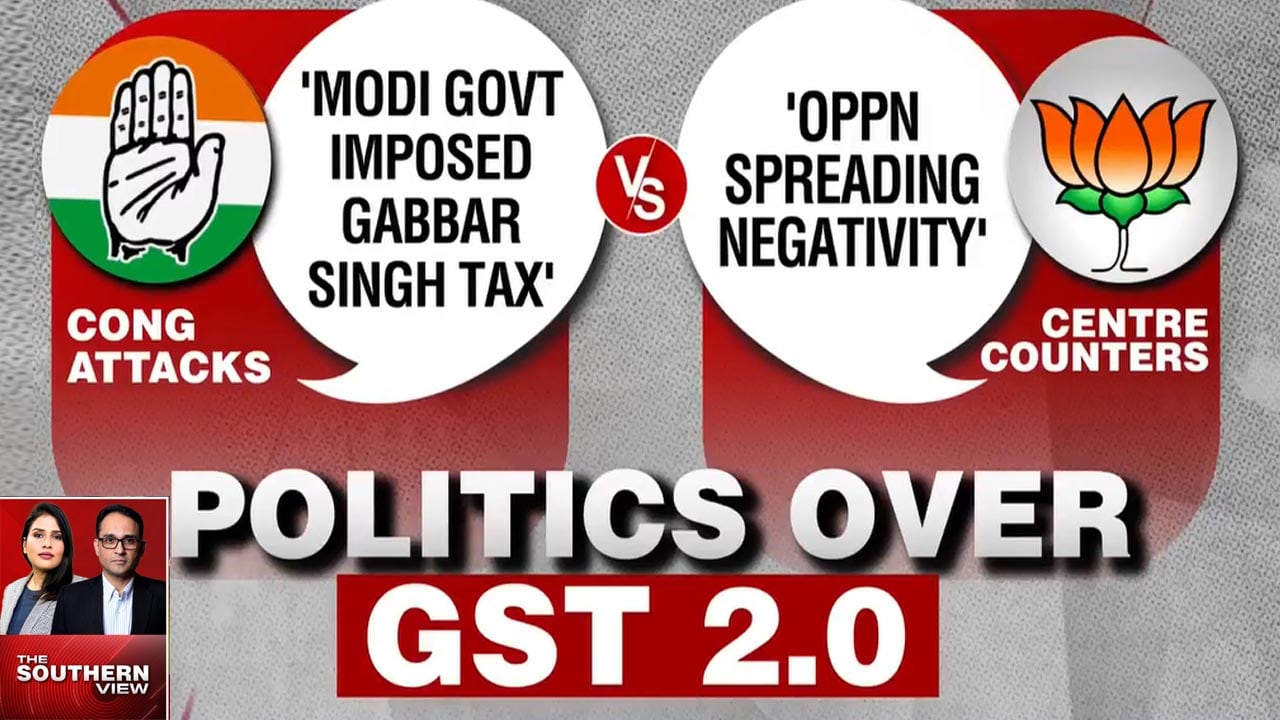

In a move set to make eating out lighter on customers' pockets, the GST (Goods and Services Tax) council slashed the tax rate for restaurants last week. The tax rate for restaurants was revised downwards to a uniform 5% from the earlier 12% for non-air conditioned restaurants and 18% for air-conditioned restaurants. But restaurants won't get the benefit of input tax credit, a facility to set off tax paid on inputs with final tax. The tax cut was part of the biggest change to GST rates since July 1. Apart from restaurants, tax rates for 200 items were also slashed.