"Not Just Any Ordinary Economic Slowdown," Arvind Subramanian Tells Prannoy Roy

Former Chief Economic Adviser to the Government of India, Arvind Subramanian, spoke to Dr Prannoy Roy on the state of economy in an exclusive interview, saying the government's figures of GDP growth - 4.5 per cent - could be a "rosier picture than the underlying reality." Mr Subramanian further said the economic downturn the Indian economy is facing is not an ordinary slowdown, but something that hasn't been seen in the last 20-30 years.

Here are the highlights of Arvind Subramanian's interview:

Prannoy Roy: Three-four months on this one paper and it's causing quite an impact. But I think it's more when I read it, I feel I do follow the Indian economy quite closely but I learnt a lot. Let's start with the most simple, straightforward fact. Most know this but just put it in stark terms, just have a look at this. Is the Indian economy heading for ICU?

Just look at the figures here, the figures suggests that the growth rate is plummeting in India; plummeting means it was 8% a short while ago and now it's 4.5% in the most recent quarter and these are government sources. So Arvind, when it was 7-8%, you wrote that very strong paper with a lot of analysis of why our data is not too good; it's probably 2.5% higher, so 8 would have been 5.5, so 4 is bad enough even if it's correctly 4. Could it be even less than that?

Arvind Subramanian: Well, you see, as you know that the GDP numbers are, you know becoming, you know, not as informative as it used to be, I mean there are difficulties with those numbers.

Prannoy Roy: Is it around the world recognized now that there are some problems with the numbers because it never used to be.

Arvind Subramanian: Yeah, I think now it is globally accepted that, you know, GDP numbers need some, you know, looking at carefully. So the answer to your question is four-and-a-half and four-and-a-half. You see, I can't be precise but as we go through the indicators that we are going to go through now, you know to look at the more detailed macro indicators, you know you get the impression that in fact maybe, even four-and-a-half is a picture, a rosier picture than the underlying reality.

Prannoy Roy: That's shocking because I would be feeling awful about the country if it's going at about four-and-a-half percent, I mean it's back to old school Raj Krishna days and it could still be really 3%. That is just horrifying.

Arvind Subramanian: I can't give a number. As we go through the indicators, we will see that in fact, it is something what we are going through as you said is a great slowdown, it's something that probably we haven't seen for a very long time; 20-30 years you know; the real economy is in not just any ordinary slowdown.

Prannoy Roy: I really feel that's the point that you highlight in this paper and I don't think everybody has understood the magnitude of the problem. I knew we were in bad shape. But till I read your paper, I felt that was a problem, and I look at some of the indicators that make you even question whether 4.5% is depressingly low. If you look at imports, how bad is the Indian economy? Imports are as bad, almost as bad as 30 years ago. As you were saying we have never seen bad indicators for the last three decades. So in the current growth, imports are down to 6% and the capital goods industry, really important, almost proxy for investment, down 10%. When you have gone -6 and -10, you have to go back 30 years to find things similar. Look at that imports okay -16% and little more and capital good industry -9 very comparable and what was the growth rate 30 years ago? 1.1 with that kind of figures. So when we look at the figures today -6 and -10, what is the GDP growth? Is it really 4.5 based on the comparison we would have to question it?

Arvind Subramanian: See I think you know many, many not just there are also export figures, consumer good figures, tax revenue figures. In fact in the paper what we do is that we take all these indicators and then say let's look at you know a previous era of a slowdown which is 2000 and 2002. Yeah, there what you find is that even though the GDP growth around then was four-and-a-half; all these indicators were positive. It's only you have to go back to 1991 when growth was close to 1%.

Prannoy Roy: In a terrible slowdown of 2001-2002, these two indicators are actually marginally positive and others, and you still had 4.5% with positive, now it's negative and you have to go back 30 years to find that, that is a real shocker! And that really does make you question whether with this kind of figures you can have 4.5. But anyway, we will get into as you say there are more figures to point out to, let's have a look at the Indian economy, the great slowdown, more indicators of that, just have a look at these first for example. In fact, if you look at finding consumer good production, growth rate, consumer goods, it's not just capital goods, consumer goods production growth rate is falling. Look at that from 5% just 2 years ago to 1% now. 1% in consumer good production is worrying - isn't it?

Arvind Subramanian: So I think one way of thinking about it is if you look at all these indicators Prannoy yeah, they are either in negative growth territory or they are barely positive growth territory. Right. And you know what it says is like this is not any slowdown, that's why it's India's great slowdown. See the comparison with 1991-1992 - we have to be careful because you know we don't have macroeconomic crises at all, in fact, one of the achievements of the government has been to stabilize the macro-economy, you know inflation has come down, our reserves are very healthy. We have no external debt problem so we are not going to have a currency crisis. Inflation is relatively low. In 1991, we had this BOP crisis - major, destructive - that's not the comparison; the comparison is with what happened to the real sector of the economy. You know growth, investment, exports and imports which matters for jobs, which matter for lives, it also matter for how much revenue that the government has to spend on social programs. So the interesting thing is that and maybe we can talk about that later. What you know is the way this slowdown is going to manifest itself or is manifesting itself not in terms of you know - 'Oh exchange rate collapsed or inflation rate is going up'.

Prannoy Roy: See, okay these are all index of industrial production and various other forms of symptoms. One of the symptoms you point to, which actually rings very close to everybody's understanding is how much electricity is being generated. If that's up, it's a good sign, if everything is down and that's up, something's wrong. But look at what electricity generation growth is happening in India. It is really really serious. It's a sign of a major crisis, the great slowdown. Electricity, the lowest growth in 30 years. 30 years! Look at that, of course it goes up and down over different cycles but look at the two earlier terrible low points, 2001, 3%, 2008-09-10 again after the great financial crash, 2.5. And now electricity generation has grown by 1.8? That really makes you feel, that's serious.

Arvind Subramanian: You know, this is of course one amongst many indicators and it is an important indicator. You know that the Chinese Prime Minister Li Keqiang, he did an index, he said he also had doubts about Chinese numbers on growth rates so he said, no let's measure it some other way, and in that, you know, electricity is a very crucial component.

Prannoy Roy: Capital goods down, tax revenues down okay. Let's just have a look at tax revenues. Well let's quickly look at exports, what you mentioned and then come to tax revenues because again, historically, exports show whether your country is really booming, whether there is some external factor, the lack of the global trade, it's shrinking. But still, growth rate of 9%, 2 years ago which was not great by the way. 9% exports is not great, down to -1 now. And this is non-oil. Both the imports and exports are non-oil to be comparable. So why is this happening? -1%, again part of the same problem or combination?

Arvind Subramanian: So I think that on the export side, part of it is related to global factors, even if there is of course, the global economy is not doing as well as it used to. But there's also the question of whether, now there are domestic factors at work, you know for example, the Ease of Doing Business, the exchange rate has been slightly strong for some period of time. And you know, the competitiveness of the Indian economy, the competitiveness of our manufacturing, and you know and also our services exports, you know they did very well earlier, now they're doing just modestly well. So all of these I think are, they all kind of, the pattern is the same with all these indicators.

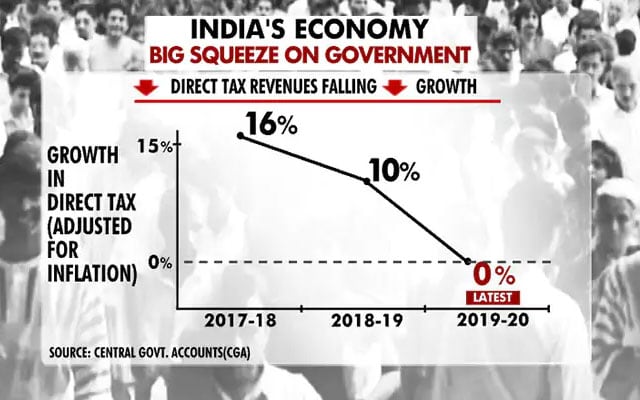

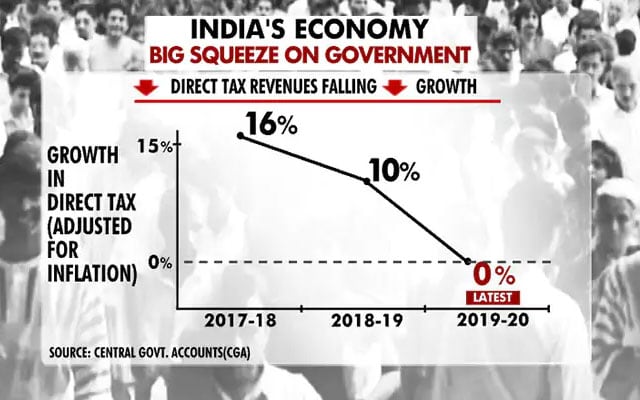

Prannoy Roy: The trend downwards is the big worry. Now all this affects not only jobs as you said, it also affects how much revenues the government gets. If the economy is doing well, it has a huge impact on revenues. Let's have a look at how much direct taxes, there's a big squeeze currently on government and you as the Finance Ministry, and I was there many years before you were born, feel sorry for Finance Minister who look at this direct tax, direct tax. We are not even talking about GST here. Direct tax revenues are falling. They were growing at 16%, these are nominal of course.

Arvind Subramanian: But this is adjusted for inflation.

Prannoy Roy: Oh yes, you had adjusted for inflation. So we would've been maybe 19, so adjust it by about 3-4%, maybe 16, 10 and now 0% growth. That is terrible.

Arvind Subramanian: So essentially, with both direct taxes and the GST, we're collecting for the first 8-9 months for which data were available, were about 3 and a half, 3.6%, which in inflation, adjusted is virtually 0%. So essentially, the government is squeezed for resources.

Prannoy Roy: Right so, those are symptoms which I find I didn't realize how serious it was. Now, remedies, doctor, sorry diagnosis, then we'll go to remedies. So what is the cause of the problem? So diagnosis now, what is the cause, as a doctor you've given 3 or 4 kind of reasons for the slowdown. Let's have a look at some of the reasons that could be causing this great Indian slowdown. Just have a look at this. The reason for the slowdown is basically a breakdown of our financial system. And there have been so many other diagnoses but this one is the key, one that you focused on. And it kind of relates long term and short term problems.

Arvind Subramanian: So you know, obviously, we simplified a little bit that what is, I think the reason we are where we are today is because of a combination of long term factors and short term factors. But they're both connected by the financial system, what we're going to call the, first the twin balance sheet formula...

Prannoy Roy: The famous twin balance sheet, yeah.

Arvind Subramanian: One and then the second wave of the twin balance sheet yeah. But remember the long term factors also include the fact that our exports have you know completely compared to the previous decade, they've slowed down remarkably as we showed you. So that's one lockdown factor. Investment also is down, but investment is critically related to this twin balance sheet, a challenge. We're going to come to that.

Prannoy Roy: Top 8 cities, 2 lakh crores and look at the amount of unsold houses, 8 lakh crores a year. And it's been this kind of, for the last 3 or 4 years, so we are just about building enough to, we are building about 2 lakh crores a year because that 8 lakh crores unsold remains every year. This is huge.

Arvind Subramanian: Yeah, so the way to understand, see, we call this in the paper, a non-bubble bubble. And I'll explain why that is the case. You see this is kind of a little bit counterpart of what happened, you know in the global financial crisis in the United States and in some other countries. So when all this lending goes to the real estate sector, what normally happens is that prices go up, houses get built and there is a very buoyant market. In India, what was different was all this money that was going, remember, lending to real estate was growing at 20% a year, 20% per year, both the banks and the NBFCs. But it was mostly or largely financing the buildup of unsold inventory. So essentially, you're not lending to build, but you're lending to just maintain the inventory. So how does this bubble kind of burst as it were, maybe if you show the next graphic.

Prannoy Roy: In commercial credit, right across the board of which housing is one major important part. So collapse in commercial credit and part of it is impact of ILS bubble crisis, we'll come to that. But as part of the collapse in commercial credit, housing loans have also plummeted. Just look at commercial credit, how it's dropped from 22 lakh crores, that's a lot of money, what is it now, 1 lakh crore.

Arvind Subramanian: This is like savage, savage. It's a savage credit crunch, but this is where I want to spend two minutes explaining. Whenever something like this happens, it's like a major financial sector crunch, or you know episode. It happens because of two reasons, there's a trigger and there are some fundamentals which are unsustainable. So the trigger for this was you know ILFS going into default in August 2018. Now why was it a major trigger, it was a seismic event. It was a seismic event for at least two reasons, one, how did this appear out of nowhere? 90,000 crore ILFS company, you know regulators, no one sounded a warning about it, no one knew about it. So 90,000 crores and it turned out to be a huge behemoth. But over and above that, people said look, if this can happen, what else is wrong in the financial system?

Prannoy Roy: Let's have a look at what Arvind Subramanian has written about - looking a little ahead and what are the fundamental, underlying problems that's causing this and could be a worry for the future. Is the crisis going to get worse or not. Or is it just temporary? Companies are actually now paying more in their bank interest than their expected earnings. That's a huge statement and it really is a worrying statement. If every year, you're paying more out on servicing your loans, just the interest than what you're earning in profits, it's a big worry. Look at company finances according to this paper; interest rate on loans currently is 10.5% to companies. And look at what their expected earnings are; likely earning 6.1%. So look at that gap. That means there's a gap, a shortfall annually of 4.4%. Now tell us, how you get these figures.

Arvind Subramanian: So just to explain this a little bit, remember so companies borrow, they make profits and they repay their interest and the loans on that. A kind of proxy see for any one company, you want to proxy it by their profits but for the corporate sector as a whole, generally what we say is that earnings are likely to grow on average with nominal GDP growth. So that's a kind of indicator of how earnings and profits are likely to go. So that is what you get and then you have to repay what you borrowed and for the corporate sector as a whole, it's about 10 and a half percent. In boom periods, like you know in the 2000s and the 1990s, it was completely the opposite. Nominal GDP growth was like 15-20% and interest rates again were like 13-14% so the difference was kind of +5 +6 +7, now it's -4 -5 -6. And this is going to add to the stress on the corporates and therefore, that's why we have to have this in mind when we assess the outlook going forward because what this suggests is that things probably are going to get worse before they get better.

Prannoy Roy: You've had a look at the symptoms, now we're going to the diagnosis and treatment. So we looked at the symptoms, you gave a diagnosis of the problem we saw. Now, what are the remedies and how are you going to treat the economy. Let's have a look one by one at some of things. First, what should you not do? 'Cause given your diagnosis certain things you would treat would exacerbate the problem, so what not to do first in the solution of the crisis. Budget deficit currently does not reflect the true picture because it's got hidden expenditures, so stop those what do you mean by that? Hidden expenditures?

Arvind Subramanian: Yeah so something are in control of the auditor general pointed out are headline deficit have been coming down but you know some major expenditures like for the subsidies for food, Food Corporation of India, some of the infrastructural spending like National Highway Authority, it's not reflected in the budget off balance sheet. Therefore, the true budget deficit the control auditor general is quite a bit higher than that.

Prannoy Roy: We now move on to another area, which everyone says is really distressed - the agricultural sector. You have spent a lot of time on this. Let's look at what Arvind Subramanian says about fixing agriculture.

Arvind Subramanian: Number 1, main thing is direct cash to farmers. Direct. Don't give it through fertilizer companies, power companies so that they get cheap fertilisers and power. Just give them the cash direct. There are statistics showing farmer incomes have gone down despite subsidised fertilizer and power.

Prannoy Roy: Because they are not being passed on, I guess.

Arvind Subramanian: Farm incomes have come down despite production remaining the same. International prices have also come down. Fertiliser and power subsidies create so many adverse effects - overuse, soil quality, environmental quality, health quality, and they go disproportionately to large farmers. So any long run sustainable agriculture in India has to have this. The big point here is that we have to raise agricultural productivity. I think that should be the overarching objective here.

Prannoy Roy: The average viewer. What should they do about this worrying diagnosis?

Arvind Subramanian: I will summarise in 4-5 big points. This is very serious. It has structural components and short-term components. It's the great slowdown. We shouldn't expect that things will automatically get better. I think we should moderate our expectation about what long-run growth will happen in India. Our world economy is not sustaining the kind of exports that happened in 2000s. We have a balance sheet challenge. Third, the standard remedies to get out of this. Reduce interest rates, increase the deficits, those tools are not available. This is not despair or giving up. We are not entitles to 8-9% growth. I don't like the despair. It's in our hands. Over the next few months, there will be good news. The economy is getting better.

Here are the highlights of Arvind Subramanian's interview:

Prannoy Roy: Three-four months on this one paper and it's causing quite an impact. But I think it's more when I read it, I feel I do follow the Indian economy quite closely but I learnt a lot. Let's start with the most simple, straightforward fact. Most know this but just put it in stark terms, just have a look at this. Is the Indian economy heading for ICU?

Just look at the figures here, the figures suggests that the growth rate is plummeting in India; plummeting means it was 8% a short while ago and now it's 4.5% in the most recent quarter and these are government sources. So Arvind, when it was 7-8%, you wrote that very strong paper with a lot of analysis of why our data is not too good; it's probably 2.5% higher, so 8 would have been 5.5, so 4 is bad enough even if it's correctly 4. Could it be even less than that?

Arvind Subramanian: Well, you see, as you know that the GDP numbers are, you know becoming, you know, not as informative as it used to be, I mean there are difficulties with those numbers.

Prannoy Roy: Is it around the world recognized now that there are some problems with the numbers because it never used to be.

Arvind Subramanian: Yeah, I think now it is globally accepted that, you know, GDP numbers need some, you know, looking at carefully. So the answer to your question is four-and-a-half and four-and-a-half. You see, I can't be precise but as we go through the indicators that we are going to go through now, you know to look at the more detailed macro indicators, you know you get the impression that in fact maybe, even four-and-a-half is a picture, a rosier picture than the underlying reality.

Prannoy Roy: That's shocking because I would be feeling awful about the country if it's going at about four-and-a-half percent, I mean it's back to old school Raj Krishna days and it could still be really 3%. That is just horrifying.

Arvind Subramanian: I can't give a number. As we go through the indicators, we will see that in fact, it is something what we are going through as you said is a great slowdown, it's something that probably we haven't seen for a very long time; 20-30 years you know; the real economy is in not just any ordinary slowdown.

Prannoy Roy: I really feel that's the point that you highlight in this paper and I don't think everybody has understood the magnitude of the problem. I knew we were in bad shape. But till I read your paper, I felt that was a problem, and I look at some of the indicators that make you even question whether 4.5% is depressingly low. If you look at imports, how bad is the Indian economy? Imports are as bad, almost as bad as 30 years ago. As you were saying we have never seen bad indicators for the last three decades. So in the current growth, imports are down to 6% and the capital goods industry, really important, almost proxy for investment, down 10%. When you have gone -6 and -10, you have to go back 30 years to find things similar. Look at that imports okay -16% and little more and capital good industry -9 very comparable and what was the growth rate 30 years ago? 1.1 with that kind of figures. So when we look at the figures today -6 and -10, what is the GDP growth? Is it really 4.5 based on the comparison we would have to question it?

Arvind Subramanian: See I think you know many, many not just there are also export figures, consumer good figures, tax revenue figures. In fact in the paper what we do is that we take all these indicators and then say let's look at you know a previous era of a slowdown which is 2000 and 2002. Yeah, there what you find is that even though the GDP growth around then was four-and-a-half; all these indicators were positive. It's only you have to go back to 1991 when growth was close to 1%.

Prannoy Roy: In a terrible slowdown of 2001-2002, these two indicators are actually marginally positive and others, and you still had 4.5% with positive, now it's negative and you have to go back 30 years to find that, that is a real shocker! And that really does make you question whether with this kind of figures you can have 4.5. But anyway, we will get into as you say there are more figures to point out to, let's have a look at the Indian economy, the great slowdown, more indicators of that, just have a look at these first for example. In fact, if you look at finding consumer good production, growth rate, consumer goods, it's not just capital goods, consumer goods production growth rate is falling. Look at that from 5% just 2 years ago to 1% now. 1% in consumer good production is worrying - isn't it?

Arvind Subramanian: So I think one way of thinking about it is if you look at all these indicators Prannoy yeah, they are either in negative growth territory or they are barely positive growth territory. Right. And you know what it says is like this is not any slowdown, that's why it's India's great slowdown. See the comparison with 1991-1992 - we have to be careful because you know we don't have macroeconomic crises at all, in fact, one of the achievements of the government has been to stabilize the macro-economy, you know inflation has come down, our reserves are very healthy. We have no external debt problem so we are not going to have a currency crisis. Inflation is relatively low. In 1991, we had this BOP crisis - major, destructive - that's not the comparison; the comparison is with what happened to the real sector of the economy. You know growth, investment, exports and imports which matters for jobs, which matter for lives, it also matter for how much revenue that the government has to spend on social programs. So the interesting thing is that and maybe we can talk about that later. What you know is the way this slowdown is going to manifest itself or is manifesting itself not in terms of you know - 'Oh exchange rate collapsed or inflation rate is going up'.

Prannoy Roy: See, okay these are all index of industrial production and various other forms of symptoms. One of the symptoms you point to, which actually rings very close to everybody's understanding is how much electricity is being generated. If that's up, it's a good sign, if everything is down and that's up, something's wrong. But look at what electricity generation growth is happening in India. It is really really serious. It's a sign of a major crisis, the great slowdown. Electricity, the lowest growth in 30 years. 30 years! Look at that, of course it goes up and down over different cycles but look at the two earlier terrible low points, 2001, 3%, 2008-09-10 again after the great financial crash, 2.5. And now electricity generation has grown by 1.8? That really makes you feel, that's serious.

Arvind Subramanian: You know, this is of course one amongst many indicators and it is an important indicator. You know that the Chinese Prime Minister Li Keqiang, he did an index, he said he also had doubts about Chinese numbers on growth rates so he said, no let's measure it some other way, and in that, you know, electricity is a very crucial component.

Prannoy Roy: Capital goods down, tax revenues down okay. Let's just have a look at tax revenues. Well let's quickly look at exports, what you mentioned and then come to tax revenues because again, historically, exports show whether your country is really booming, whether there is some external factor, the lack of the global trade, it's shrinking. But still, growth rate of 9%, 2 years ago which was not great by the way. 9% exports is not great, down to -1 now. And this is non-oil. Both the imports and exports are non-oil to be comparable. So why is this happening? -1%, again part of the same problem or combination?

Arvind Subramanian: So I think that on the export side, part of it is related to global factors, even if there is of course, the global economy is not doing as well as it used to. But there's also the question of whether, now there are domestic factors at work, you know for example, the Ease of Doing Business, the exchange rate has been slightly strong for some period of time. And you know, the competitiveness of the Indian economy, the competitiveness of our manufacturing, and you know and also our services exports, you know they did very well earlier, now they're doing just modestly well. So all of these I think are, they all kind of, the pattern is the same with all these indicators.

Prannoy Roy: The trend downwards is the big worry. Now all this affects not only jobs as you said, it also affects how much revenues the government gets. If the economy is doing well, it has a huge impact on revenues. Let's have a look at how much direct taxes, there's a big squeeze currently on government and you as the Finance Ministry, and I was there many years before you were born, feel sorry for Finance Minister who look at this direct tax, direct tax. We are not even talking about GST here. Direct tax revenues are falling. They were growing at 16%, these are nominal of course.

Arvind Subramanian: But this is adjusted for inflation.

Prannoy Roy: Oh yes, you had adjusted for inflation. So we would've been maybe 19, so adjust it by about 3-4%, maybe 16, 10 and now 0% growth. That is terrible.

Arvind Subramanian: So essentially, with both direct taxes and the GST, we're collecting for the first 8-9 months for which data were available, were about 3 and a half, 3.6%, which in inflation, adjusted is virtually 0%. So essentially, the government is squeezed for resources.

Prannoy Roy: Right so, those are symptoms which I find I didn't realize how serious it was. Now, remedies, doctor, sorry diagnosis, then we'll go to remedies. So what is the cause of the problem? So diagnosis now, what is the cause, as a doctor you've given 3 or 4 kind of reasons for the slowdown. Let's have a look at some of the reasons that could be causing this great Indian slowdown. Just have a look at this. The reason for the slowdown is basically a breakdown of our financial system. And there have been so many other diagnoses but this one is the key, one that you focused on. And it kind of relates long term and short term problems.

Arvind Subramanian: So you know, obviously, we simplified a little bit that what is, I think the reason we are where we are today is because of a combination of long term factors and short term factors. But they're both connected by the financial system, what we're going to call the, first the twin balance sheet formula...

Prannoy Roy: The famous twin balance sheet, yeah.

Arvind Subramanian: One and then the second wave of the twin balance sheet yeah. But remember the long term factors also include the fact that our exports have you know completely compared to the previous decade, they've slowed down remarkably as we showed you. So that's one lockdown factor. Investment also is down, but investment is critically related to this twin balance sheet, a challenge. We're going to come to that.

Prannoy Roy: Top 8 cities, 2 lakh crores and look at the amount of unsold houses, 8 lakh crores a year. And it's been this kind of, for the last 3 or 4 years, so we are just about building enough to, we are building about 2 lakh crores a year because that 8 lakh crores unsold remains every year. This is huge.

Arvind Subramanian: Yeah, so the way to understand, see, we call this in the paper, a non-bubble bubble. And I'll explain why that is the case. You see this is kind of a little bit counterpart of what happened, you know in the global financial crisis in the United States and in some other countries. So when all this lending goes to the real estate sector, what normally happens is that prices go up, houses get built and there is a very buoyant market. In India, what was different was all this money that was going, remember, lending to real estate was growing at 20% a year, 20% per year, both the banks and the NBFCs. But it was mostly or largely financing the buildup of unsold inventory. So essentially, you're not lending to build, but you're lending to just maintain the inventory. So how does this bubble kind of burst as it were, maybe if you show the next graphic.

Prannoy Roy: In commercial credit, right across the board of which housing is one major important part. So collapse in commercial credit and part of it is impact of ILS bubble crisis, we'll come to that. But as part of the collapse in commercial credit, housing loans have also plummeted. Just look at commercial credit, how it's dropped from 22 lakh crores, that's a lot of money, what is it now, 1 lakh crore.

Arvind Subramanian: This is like savage, savage. It's a savage credit crunch, but this is where I want to spend two minutes explaining. Whenever something like this happens, it's like a major financial sector crunch, or you know episode. It happens because of two reasons, there's a trigger and there are some fundamentals which are unsustainable. So the trigger for this was you know ILFS going into default in August 2018. Now why was it a major trigger, it was a seismic event. It was a seismic event for at least two reasons, one, how did this appear out of nowhere? 90,000 crore ILFS company, you know regulators, no one sounded a warning about it, no one knew about it. So 90,000 crores and it turned out to be a huge behemoth. But over and above that, people said look, if this can happen, what else is wrong in the financial system?

Prannoy Roy: Let's have a look at what Arvind Subramanian has written about - looking a little ahead and what are the fundamental, underlying problems that's causing this and could be a worry for the future. Is the crisis going to get worse or not. Or is it just temporary? Companies are actually now paying more in their bank interest than their expected earnings. That's a huge statement and it really is a worrying statement. If every year, you're paying more out on servicing your loans, just the interest than what you're earning in profits, it's a big worry. Look at company finances according to this paper; interest rate on loans currently is 10.5% to companies. And look at what their expected earnings are; likely earning 6.1%. So look at that gap. That means there's a gap, a shortfall annually of 4.4%. Now tell us, how you get these figures.

Arvind Subramanian: So just to explain this a little bit, remember so companies borrow, they make profits and they repay their interest and the loans on that. A kind of proxy see for any one company, you want to proxy it by their profits but for the corporate sector as a whole, generally what we say is that earnings are likely to grow on average with nominal GDP growth. So that's a kind of indicator of how earnings and profits are likely to go. So that is what you get and then you have to repay what you borrowed and for the corporate sector as a whole, it's about 10 and a half percent. In boom periods, like you know in the 2000s and the 1990s, it was completely the opposite. Nominal GDP growth was like 15-20% and interest rates again were like 13-14% so the difference was kind of +5 +6 +7, now it's -4 -5 -6. And this is going to add to the stress on the corporates and therefore, that's why we have to have this in mind when we assess the outlook going forward because what this suggests is that things probably are going to get worse before they get better.

Prannoy Roy: You've had a look at the symptoms, now we're going to the diagnosis and treatment. So we looked at the symptoms, you gave a diagnosis of the problem we saw. Now, what are the remedies and how are you going to treat the economy. Let's have a look one by one at some of things. First, what should you not do? 'Cause given your diagnosis certain things you would treat would exacerbate the problem, so what not to do first in the solution of the crisis. Budget deficit currently does not reflect the true picture because it's got hidden expenditures, so stop those what do you mean by that? Hidden expenditures?

Arvind Subramanian: Yeah so something are in control of the auditor general pointed out are headline deficit have been coming down but you know some major expenditures like for the subsidies for food, Food Corporation of India, some of the infrastructural spending like National Highway Authority, it's not reflected in the budget off balance sheet. Therefore, the true budget deficit the control auditor general is quite a bit higher than that.

Prannoy Roy: We now move on to another area, which everyone says is really distressed - the agricultural sector. You have spent a lot of time on this. Let's look at what Arvind Subramanian says about fixing agriculture.

Arvind Subramanian: Number 1, main thing is direct cash to farmers. Direct. Don't give it through fertilizer companies, power companies so that they get cheap fertilisers and power. Just give them the cash direct. There are statistics showing farmer incomes have gone down despite subsidised fertilizer and power.

Prannoy Roy: Because they are not being passed on, I guess.

Arvind Subramanian: Farm incomes have come down despite production remaining the same. International prices have also come down. Fertiliser and power subsidies create so many adverse effects - overuse, soil quality, environmental quality, health quality, and they go disproportionately to large farmers. So any long run sustainable agriculture in India has to have this. The big point here is that we have to raise agricultural productivity. I think that should be the overarching objective here.

Prannoy Roy: The average viewer. What should they do about this worrying diagnosis?

Arvind Subramanian: I will summarise in 4-5 big points. This is very serious. It has structural components and short-term components. It's the great slowdown. We shouldn't expect that things will automatically get better. I think we should moderate our expectation about what long-run growth will happen in India. Our world economy is not sustaining the kind of exports that happened in 2000s. We have a balance sheet challenge. Third, the standard remedies to get out of this. Reduce interest rates, increase the deficits, those tools are not available. This is not despair or giving up. We are not entitles to 8-9% growth. I don't like the despair. It's in our hands. Over the next few months, there will be good news. The economy is getting better.