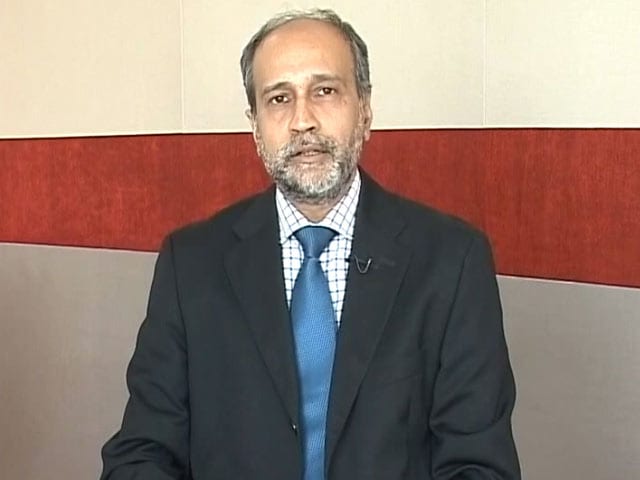

See muted response to Bank of Japan measures: Credit Suisse

Markets may not respond significantly to the Bank of Japan's decision to adopt a 2 per cent formal inflation target, says Michael O'Sullivan, head of global asset allocation and research at Credit Suisse Private Bank. He, however, adds that currency market tensions are rising as central banks adding liquidity is pushing currencies like the yen and dollar lower. Meanwhile, the euro's strength in turn could prove to be negative for the European region, he says.