home

videos

Shows

ndtv-special-ndtv-24x7-

Prannoy Roy, Investor Ruchir Sharma Discuss Top 10 Trends of 2022

Prannoy Roy, Investor Ruchir Sharma Discuss Top 10 Trends of 2022 | Read

Global investor and author Ruchir Sharma discussed the top ten trends of the year 2022 in a discussion with NDTV's Dr Prannoy Roy. Mr Sharma, in his forecast, said, this year, inflation is likely to increase but there could be some constraining factors.

Here is the full transcript of the discussion:

NDTV: Welcome everyone to what I honestly believe is our most important annual show on what's going to happen in the year ahead. And I don't just mean the amazing amount of feedback and viewers that we get for this show, that's the quantitative measure and it is huge. I also mean the quality of the content, the forecast for the year ahead, like, should you buy or should you sell shares and stocks, should you buy or sell property? Really affects our decisions in our everyday life, this show. How will India do? It affects our country. How will India do versus the rest of the world in 2022? The politics, the macro, global relations, all the data and graphics in the show are researched and produced by the absolutely amazing Ruchir Sharma and his team of course. Ruchir is widely respected, has one of the most brilliant minds globally and they say that about him even when he is not in the room. We are very, very lucky to have Ruchir join us once again this year with all his findings on the top ten trends of 2022. Now watch these fascinating findings, I just found them amazing, about what to expect over the next twelve months, I learnt a lot and I am sure you will too. So, Ruchir thank you very much for joining us and sparing the time, thank you very much.

Ruchir Sharma: Thanks Prannoy, delighted to be back, it's been nearly a decade since we have had this annual tradition and happy that we are carrying it along.

NDTV: Wonderful. Shall we just go straight into the graphics because we have got so much to cover over the next 50 minutes actually. You know the first thing that you always say and I respect you for that because I would never do it, let's look at how right and how wrong I was in the previous year you say. So, let's look at what you had said in the previous year, the top ten trends of 2021, let's review and get your perspective on what was right and what was wrong.

So, those are the top ten, now let's focus on first forecast that you made, the trend that you made in January 2021 of what was going to happen. Let's see what you said about the first point, you said, the global economy would be surging and the stock market would be sluggish and your review shows this, it shows that, if you look at the first of last ten years forecast growth surged but actually so did the stock market. Global growth was at six percent, higher than most people expected but you expected it, so you were different from the rest, and you were right in terms of global growth of six percent, it's huge. The stock market, the US surged actually, actually only two countries really surged, US and India's stock market, which I guess the US is a huge part of the global stock market, the rest of the world more or less eight percent, more or less average and fascinating, Ruchir, worst performing according to you, your data, China's stock market minus 23 percent, second worse and worst is Pakistan minus 25 percent.

Ruchir Sharma: Yes, we looked at about 60 odd stock markets around the world for which data is available and so India was in the top quartile, in fact India's exact rank was around 13th or so of the 60 stock markets around the world in dollar terms and it's just I guess a sheer coincidence that the two worst performing markets and absolute worst were China and Pakistan. So, something I guess, a lot of Indians would like to cheer about.

NDTV: Okay, let's move quicky on to the second of your kind of top trends. Inflation, you said is set to rise and then what is the actual figures, let's have a look at the data that you actually produced to compare with your trend. Global inflation was 4.8 percent while rest of the economists globally thought would be 2.7, so you were spot on there, Ruchir.

Ruchir Sharma: Yes, I think that there was so much stimulus put into action, so much disruption to the supply chains brought about by the pandemic and the lockdowns that inflation was finally set to rise. I mean for 40 years we haven't had an inflation performance of this kind in many countries including the United States. Now in India's case, inflation behaved a bit better, especially at the consumer price level, and so in fact India's inflation rankings improved on a global basis. Like after long time India's inflation rankings were similar to rest of the world or somewhere in the middle, but I think that the key think here is that the inflation surge was a lot more than people expected in 2021.

NDTV: The third trend you said was that global interest rates would increase sharply and of course when interest rates rise, bond prices fall down. Look at those, interest rate, they really shot up. Now how is that compared, this is developing countries in particular, and government bond prices fell by 5.8 percent, that is worst since 1999.

Ruchir Sharma: Yes, it's very rare for government bond prices to fall, because it is a very safe investment and there are very few and far between years when government bond prices fall. Bond prices fall when interest rates rise, they move in the opposite direction and so as interest rates rose sharply around the world, particularly in emerging markets, with long-term interest rates rising even in places such as India, where the two-year paper and ten-year paper, all those interest rates rose from a very low base quite sharply. Bond prices fell, yes; it was a terrible year to be a bond investor in 2021.

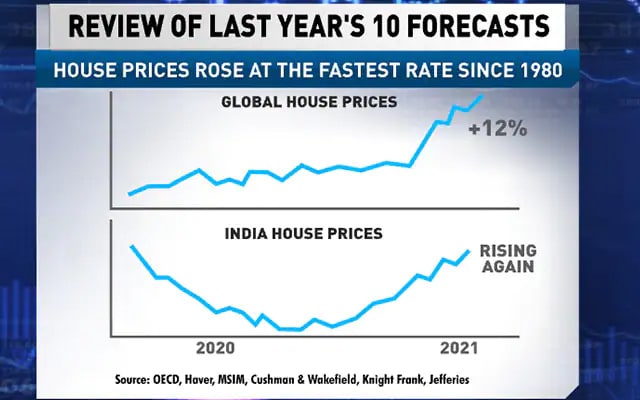

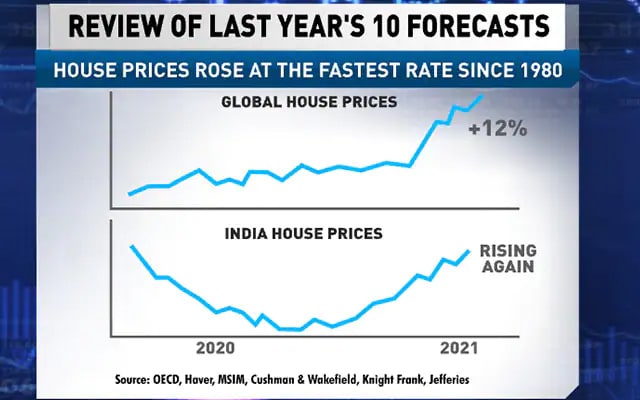

NDTV: Right, your next forecast was you said, buy property. Prices are going to go up, really. And if you look at it, in fact, house prices according to you rose at the fastest rates since 1980s, that is forty years, we are talking about global house prices. India didn't follow that pattern, it went down, but it was the end of 2021 that house prices in India have started rising again, right?

Ruchir Sharma: Yes, it's been a terrible year for the property markets in India as we know over the last decade with property prices barely rising, but finally we are seeing sales are picking up, supply has been constrained, inventories are falling and in the major cities, prices are beginning to rise. So yes, it's been a very good time to buy property around the world, in fact almost too good, it's taking many people to think that property prices are becoming unaffordable and that's a major political issue growing in many countries. In India's case not so as yet because the affordability still remains relatively good for many people, even though I know that everybody wants it to be cheaper, but generally property prices have been quite low, but I think they have started to rise and set to rise further in the year ahead.

NDTV: Now your fifth point, you said the US dollar will decline and then you produced data to check whether you are right or wrong. Let's see what you said, basically, the dollar went down for little bit, but just look relatively and when you talk about decline you always talk about relatively prices. Bitcoin went up 59 percent, while the dollar just 6 percent, amazing difference.

Ruchir Sharma: Yes, that's the point I made on the show last year that there is no real alternative to the US dollar in terms of any other currency. The Chinese currency has not been able to take the space, the Euro is still embattled by a lot of its internal problems, so when there is no alternative to the US dollar and yet people are searching for an alternative, crypto currency such as Bitcoin are likely to emerge as some sort of an alternative and that's what happened last year. It was a great year to be investing in crypto currencies, in fact the number of cryptocurrencies in the world has exploded. There are nearly 8k crypto currencies in the world now compared to just over 4k a year ago. Bitcoin is what we hear a lot about and Ethereum, but the explosion in crypto currencies is telling you that people are really searching for alternatives out there to the US dollar given that most currencies is able to fill that space in.

NDTV: You know one of the most surprising trends that you talked about or forecast that you talked about in January 2021 was about commodity prices, which everybody thought it's the end of commodity prices, they are never going to rise and you said that this year is going to be big, a revival in commodity prices and in fact it's turned out to be best year for commodities for nearly 50 years. I mean that is a huge length of time, and commodity prices rose 40 percent. A, how did you foresee this? And B, why did it happen?

Ruchir Sharma: Yes, I think that what's happening here is that and something we'll speak about in one of the trends here as well over the next few minutes. There is so much pressure to cut new investment in oil, in mining, a lot has to do with political pressure, the pressure for climate change, green politics, which is all fine, we all want a better environment and climate out there, but the problem is we are cutting supply of commodities and yet the demand for commodities whether it is driving or it's got to do with building solar panels and new green infrastructures, we still demand commodity is going up, supply constraint. It's basic economics that you constrain the supply for all sorts of reasons but you still keep demanding, prices are naturally bound to go up and that is what's happening.

NDTV: Right, then in your next point, I am just going very quickly through last year. I don't know how you can take an exam like this, I would avoid it like the plague but next one, you said developing countries around the world will stage a comeback, but that really didn't quite happen. There was a huge gap between growth of developing countries in 2010, like seven percent compared to two percent rich countries but now it's almost neck and neck, so developing countries almost fell back, right?

Ruchir Sharma: Yes, a lot of this really has to do with the slowdown happening in China, that's what is deflating this number a lot, but in general this number is very disappointing for the developing countries. I was expecting some sort of a reversal to begin in 2021. There are some signs of that happening outside of China with the growth rates accelerating in places for Vietnam, Poland, and other places even in the Middle East, but generally it continues to be a disappointing time for growth in developing countries after incredible promise they held a decade ago. We all know how the entire world was captured by BRICs and those kinds of concepts and those stand so badly discredited now.

NDTV: Right, right. Now your eighth point, you talked about the digital revolution spreading rapidly in 2021 and the data shows how amazingly correctly you were. Look at mobile phone usage of data traffic, it went up by 42 percent in the year, that's huge, right? Unprecedented, Ruchir?

Ruchir Sharma: Yes, in fact the kind of data we have consumed over the past year, I am told that it is equivalent to the entire data that was consumed until the year 2016 in history. So, really, the way the digital revolution is spreading is quite fascinating. There are more than four billion people with a smart phone now around the world, that is more than half of the entire population of the world and remember the processing power of a smart phone is similar to what used to be of the processing power of a super computer when it first came out in the 1970s or something. So, everyone is virtually walking around with a super computer in their pocket and that opens up so many options for doing things digitally.

NDTV: See Ruchir, I use those old computers and we still produce micro models of the economy. You guys are only on phones and you have no excuse. Anyway, let's move onto your second last one, the rise of new challengers to the big tech companies like you know Apple and Google, but if we look at last year, in fact, big tech companies were smashed in China, but kept rising in the US. Just look at the amazing graph that you have produced Ruchir. USA big tech companies have taken a bigger and bigger share of the market but challengers have also done well. They have gone up 15 percent, not as much as the big techs and in China the big tech companies just plummeted. Why, why again?

Ruchir Sharma: Yes, in China's case there's a lot of concern out there about the way capitalism was going, it was unbridled capitalism. I had shown data in fact earlier this year to show that in the year 2020, China produced many more billionaires than even the United States, the Chinese government is concerned about the kind of concentration and power that's happening in its corporate sector. It's concerned about wealth and inequality and of course wants to maintain a very strong state, so therefore we saw the Chinese government really crack down on the tech sector very hard in China which is what hurt the stock prices and the entire market evaluation of the Chinese tech sector. I am told that the Chinese tech sector last year lost nearly two trillion dollars in their entire value. You know which is half of their value was wiped out in one year. So, that shows up in the fact that it was very poor year for the performance of the Chinese market, for Chinese techs names in particular, but what the rise has been that the US tech names, the bigger cap names, they keep galloping ahead, Apple now the first company to get to a to a trillion dollars. I remember now in 2017 when Apple's market went across a trillion dollars it was a sign of, you know, a fair amount of conversation back then but now it's touching three trillion dollars. So that is a surprise to me as how long the winning streak of the US mega cap has lasted.

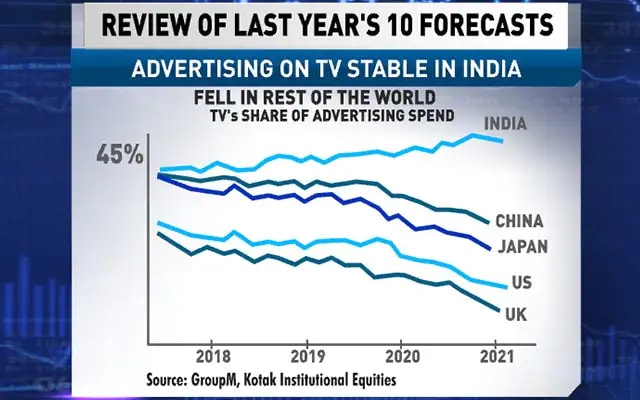

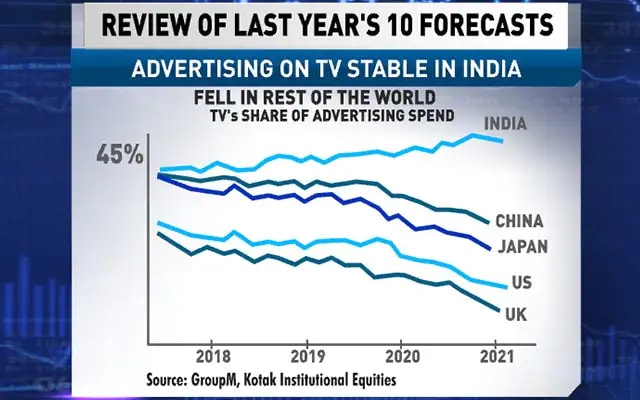

NDTV: Right, but you were spot on about the end of big tech in China. Finally, your tenth trend, last year January looking ahead at 2021 you said the end of television, thank goodness you said in brackets, except India, what are the actual figures? If we look at your data, again this is all Ruchir's data which I am just reading out. Only country where TV did not really fall, that means the share of advertising revenue etc, was in India, everywhere else they fell and this graph actually underestimates a month they fell. So, India stayed on. India is a very sensible country, Ruchir?

Ruchir Sharma: Yes, in terms of I guess TV business, but I think in all the other countries we are seeing is a major decline in the TV's share in the total ad pie. In India it is quite fascinating that there has been an explosion in the digital advertising but it's all coming at the expense of print and the share of television in the media pie remains relatively stable at around 45 percent. So yes, one of things that worked out, I guess.

NDTV: Absolutely spot on there. Okay, now that was just amazing, I would give you A++ even when you are not in the room, yes 90 percent marks for last year, fantastic. Okay, let's look at the top ten trends now, Ruchir, looking ahead at 2022. The first thing you are saying 2022 we will all see a decline in global birth rates and that will accelerate in 2022 and some of the data looks like this, just have a look.

Ruchir Sharma: Yes so, you know Prannoy, one of the fascinating things about this crisis that has been this entire pandemic, that if you look at it most crises in the past typically half of the crises breaks out, the world is turned upside down. A defining feature of this crisis was that many of the trends that were already in place before the pandemic broke out have merely been accelerated by this pandemic. Now some of the strengths completely make sense such as increased digitisation with people working more from home so that makes sense. But this thing I think has been a bit counter-intuitive. We are seeing a decline in birth rates take place around the world in a fairly sharp way. Why is that happening? I think that is something we really need to know a bit more about or need to learn a bit more about, because we are, you will expect that people are spending more time at home, birth rates should increase, instead birth rates are falling sharply. Most they have fallen in recent times has been during the pandemic. You can see the data here for China, even places like the United States that the birth rates are falling here, so the demographic challenge that world has been facing has only been accelerated by this pandemic and that has I think serious implications for economic growth.

You know we keep on talking why can't countries like India grow at 7-8 percent? Why can't countries like United States grow at 3-4 percent, when it's because the demographics have shifted significantly. The number of countries now which have a shrinking working age population has exploded. And this is even true in India, the working age population is not shrinking, but if you look at India what's happened during the pandemic here, we only, we don't have data for the entire country, but we have managed to get some data just for the city of Bombay, and you can see during the pandemic there has been such a sharp decline in the birth rates in a place like Bombay. I think that's a pre representative of what must be happening in the rest of India.

NDTV: Yes, that is really astounding that 153 is the annual average rate for those five years and now it has just dropped dramatically. In fact, it has dropped so much that India's birth rate for the first time is below the global average birth rate. That is incredible, that data.

Ruchir Sharma: Exactly, I mean can you imagine that the amount of time we have spent fretting about the demographic time bomb in India. We all grew up hearing about that that in 70s, 80s. And now the picture has changed so dramatically where the slowdown in the birth rates has been so significant that India's population growth rates now is also getting to a level which is likely to fall below the global averages, but interestingly, the birth rate for the first time now has already fallen below the global average.

NDTV: That is an amazing change of perception that everybody must recognize fast.

Ruchir Sharma: Yes, and one very important point to put here, this is for me the single most important reason why India will not be able to grow on a sustained basis at 7, 8, or 9 percent. No country with a birth rate this low and with a population growth in such decline has been able to grow rapidly. I think this is a point which is just not internalized by many people, forget policy makers, even serious economists, when they go on talking to me about why India can grow at eight to nine percent. The problem is that no country with demographics of this kind has ever been able to grow at a rate of 8-9 percent. Just doesn't happen.

NDTV: Very interesting point, because you talked about this earlier that your workforce is also not growing, which you need if you want to grow by 7-8-9-10 percent right?

Ruchir Sharma: Yes. I mean you need your working-age population to be growing by well over two percent to achieve those kind of growth rates. And of course, India can try and correct for those things, for example one thing we can speak about at some other point in time is that the female participation in India's labour surprisingly keeps falling and that's another factor we need, but the big message here is that it is very difficult for India's growth rate now to be anywhere north of 5-6 percent given the changing demographics.

NDTV: Very, very interesting. Your second point, which is really surprising for everybody, you say that China's economic power is currently peaking. It's reaching its peak. Most people think China is about to take off, take over the world, but you are saying that it is peaking if not already at peak. Look at that China's contribution to global growth, how much is falling since 2019. It went up a little bit and down again. That's amazing Ruchir.

Ruchir Sharma: Yes, there are variety of reasons to why that is happening, it goes back to the old point that demographics, and here is the shocking thing, which is that from next year onwards, China's overall population is likely to start shrinking, not just the labour force which has been shrinking, but China's overall population is likely to start shrinking from next year.

NDTV: Not just growth rate, you mean absolute number of people will go down in China?

Ruchir Sharma: Yes, yes, yes. And that is not something which anyone expected, even I'd say, three to four years ago. So, a huge change, so in China's case the entire growth will have to come from productivity as its labour force has been shrinking and now, even its overall population is set to shrink from next year. This is one of the very important reasons why I think that China's growth in likely to decline. And the other thing has to do with debt that China has been relying on so much, debt to grow very rapidly over the last few years and now that its debt levels are so high, its policy makers are very worried. They are keen to take China off that drug, of taking on more and more debt. So, it's already complicating China's economic growth story. So yes, this combination of too much debt, change in demographics, these are all likely to lead to a decline in China's growth rate far beyond what I think the consensus expects currently.

NDTV: That is a very surprising thing Ruchir, again a real eye-opener. Everybody thought India-China trade going up by billions of dollars and you know accelerating, but in fact China's trade with India is dropping by 0.4 percent which is, while it's going up with Mexico, Russia, Brazil, and Taiwan, when actually trade with India is falling.

Ruchir Sharma: Yes, so this was happening even as China's economic might was increasing over the last decade. These are decadal figures, but I think generally the point I am making here is that China is obviously a very large economy, will remain a very important, but the margin, its influence in economic terms is likely to decline and with India also, that trend is likely to be accelerated in the years ahead.

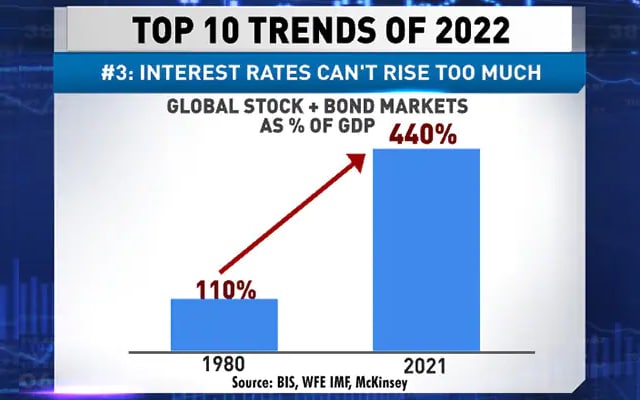

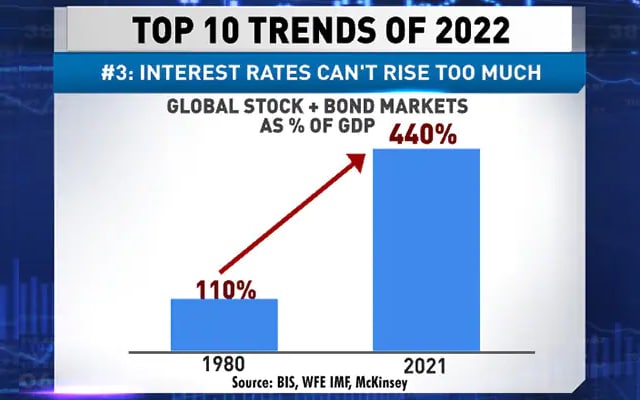

NDTV: So, Ruchir, let's move on to your third top trend of 2022, you're talking about global debt trap deepening. You've talked a lot over the last three, four years about global debt, but the trap now has deepened. Just look at the data. It is shocking. According to your data spiked during the pandemic.

Ruchir Sharma: Yes, it spiked during the pandemic and has taken even more countries deeply into debt. So, you can see here, the trend over the last two or three decades that, you know, when I first got into this business of investing, there was not a single country in this world which had a debt-to-GDP ratio of more than 300 percent.

NDTV: That's 1998, you are talking about 1998 when there was zero countries, but you were not born in 1998, were you Ruchir?

Ruchir Sharma: Well yes, I mean it is back to 1995 in fact when I started investing, but yes at that point of time there were countries in debt to GDP ratio of more than 300 percent. Today there are 25 from China to Japan, United States, a whole bunch of European countries and that is a very big reason why it is so difficult for interest rates to go up, we are so dependent on debt, on servicing that debt.

NDTV: You also pointed out that India's debt is high for, if you compare them with similar economies. Look at that, Vietnam is higher than us, but Egypt, Indonesia, Bangladesh, have got much lower debt as a percentage of GDP. India's debt as to GDP percentage is 175 percent, that's very high and worrying.

Ruchir Sharma: Yes, these are total debt numbers, it includes government debts, all the private sector debt, you know, which is corporate and households. So, we put all the data together out here and I think so at one level the fact that India's debt to GDP ratio is not above 300 percent is fine, but generally, the lesser advanced countries tend to have lower debt to GDP ratios and for a country with per capita income of just under $3000, India's debt to GDP, overall debt to GDP is quite high, largely because of the government debt, the government and the related sectors, their debt levels are relatively high for a country of this per capita income. So that is something which is like obviously concerning. The only good news there is that most of the debt is owned by domestic institutions, very little of this is owned by foreigners, so when that happens at least the currency tends to be more stable.

NDTV: One of the things that comes out of what you say is that interest rates really don't have very much room to rise any further. If you look at global stocks and bond market, how much they have grown, compare them with GDP. In 1980, they were just about the same as the GDP, a little more. Now they are 4 times the GDP. That's just huge.

Ruchir Sharma: Yes. This is the double-barrel effect that higher interest rates can have, which is that if interest rates go up, not only does that really hurt you on the debt side because there's so much debt and it becomes harder and harder to service that, but also the fact that the stock market, the bond markets around the world are so big and so much of that is dependent on a very low-interest rate environment. So, this is something that we have to be very sensitive about, that if interest rates start to go up, both the asset markets and the debt serviceability becomes a lot more difficult.

NDTV: Now the other interesting point is that yes, inflation will rise as you say, but it may not hit double digits as a lot of people are saying that it's going to go through the roof, it's just like unprecedented. Now, why do you say that?

Ruchir Sharma: Firstly, for some structural reasons, I think inflation is on an uptrend now, and for reasons we have already foreshadowed in this show. One is the fact that as you see a decline in population, you see less people entering the labour force, that sets up the platform for higher wages. So, one is population decline. Second is an environment of de-globalisation where countries are becoming much more protectionist, there's obviously less competition there. Then, in general, a trend we'll speak about in this show is where productivity has been relatively weak, with so many inefficient companies operating out there, zombie companies as we call them. And that's another reason why we are likely to see higher input cost with lower productivity. And in general, there's very little appetite for any government to engage in any kind of austerity. As those debt numbers show, that historically, governments would take more debt in times of crisis. Now, they take debt in both good and bad times. So, the government is on a spending spree in general. These are some of the long-term reasons why I think inflation around the world is on an uptrend after being on a downtrend for the last 40 years. Having said that, there are some immediate checks and balances ....

NDTV: One of the points you say, you are saying that populism, you know, that's part of winning elections. But we move on to your next interesting point. The first point, kind of goes against that, because you say inflation, prices will not rise too much because government stimulus will be set to decline this year. Now if there is no appetite for austerity and populism, that slightly contradicts, so explain that. And you say price spikes in key sectors like transport, lodging and housing may actually ease. And you say, this is important, that tech advances can still restrain the price rise.

Ruchir Sharma: Yes. So, inflation in my forecast is that this is a two steps' forward one step back kind of a process. I underline the structural reasons why inflation is likely to increase, but, immediately in the year 2022, there could be some constraining factors. So yes, in general, the government's spending is likely to keep going up but the stimulus was so heavy and so intense in 2020, 2021 that in 2022 just some hiatus will take place in terms of fresh stimulus, I feel. This is more of a hiatus rather than an end to anything. So, I don't think it's a contradiction that in general governments are more populist. But in 2022, just mathematically it will be hard for them to keep spending at the same rate as they did over the last couple of years and briefly.....

NDTV: Because they may do too much and get into trouble on the election front as well, correct?

Ruchir Sharma: Exactly. We are already seeing pushback of that in the United States where, a country that's been very keen to stimulate at any excuse, you finding there that some of their Democrat senators are wary of putting in more stimulus because inflation is the top-most concern of the US voter. That natural checks and balances are still there. The focus is shifting now from just going all for growth to also constraining inflation a bit. So therefore, I feel that inflation is on a structural up trend but it's a two step forward one step back process. It's likely that in 2022 that the inflation performance is not as bad because of that one step back with some checks and balances from technology to just exhaustion with stimulus setting in.

NDTV: Ruchir, you talk about a really important phenomenon which you call, and I think it's become widely used now, 'greenflation'. Let's see what you mean by 'greenflation'. You mean, green politics meant to reduce oil supply. But what is happening is, there's a decline in investment in oil supply, there's a decline in investment in minerals. But if we move on, we can see that in fact there's still a lot of demand for minerals.

So, we are not investing in minerals, but we are demanding it and using it. So, it's just going contradictory to what 'green' should be. You say we are going green, but we are using more copper. Demand is up 213 percent by 2050 and aluminum demand up by 322 percent. So, 'greenflation' is a problem. You also point out that it's worrying for India because India actually also demands a lot. So, we are vulnerable to 'greenflation'. India is a large importer of commodities. Just look at that, these are commodity imports, India, China, Turkey. Tell us how worrying is 'greenflation' for you?

Ruchir Sharma: Well, it is a big concern because as we spoke earlier of it that we all want a greener planet. The problem is this, to build that greener planet we need to invest in green infrastructure, whether it is solar panels, electrical vehicles. But to do that, you need copper, you need aluminum, those are some of the inputs that you need to build that green infrastructure, so that's the contradiction here. Building this requires some of these polluting metals, but if you keep cutting supply, the price of these metals keeps going up. Even on oil, a lot of the consumption is still based on fossil fuels, when you're cutting supply prematurely, because it is so difficult in the world anywhere to find new investments in oil fields. So, that's the contradiction that you have out there. And therefore, we are already getting 'greenflation', something which is contributing to inflation and likely to contribute even more in the years ahead if the current policies continue.

NDTV: So, the bottom line is, we are talking about a greener world. So, we are not investing in oil and minerals. But we are demanding more minerals, more oil and so we are just raising the prices of those commodities by not investing but by demanding as much. We are just contradicting ourselves and our behaviour.

Ruchir Sharma: Yes.

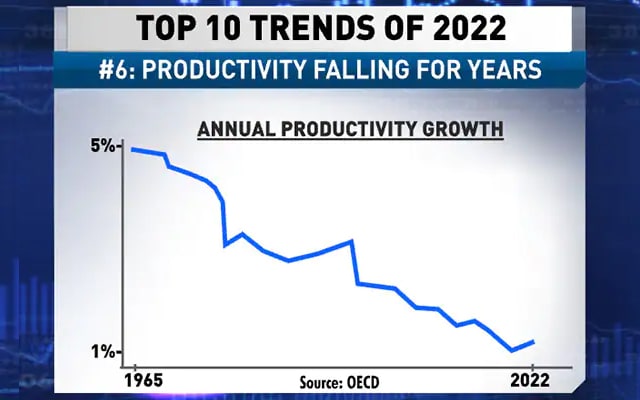

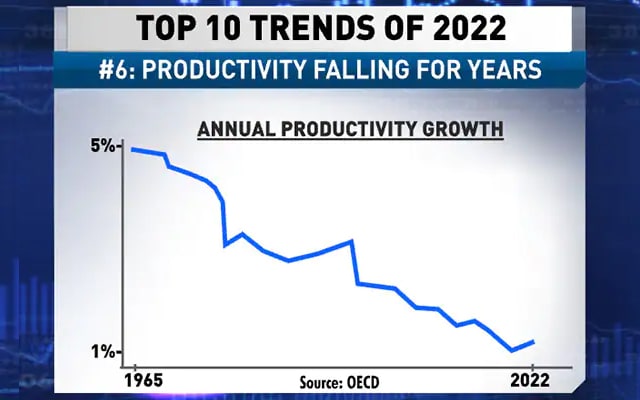

NDTV: Your next point number 6 in your forecast. There is a productivity paradox and that is persisting. And by that you mean that the productivity has been falling for years. The growth in productivity has been falling for years. I am really shocked at that graph. I don't think too many people are aware of this. Everybody would have thought that tech would have increased productivity but this is shocking Ruchir...

Ruchir Sharma: Yes. It's one of those mysteries out there, that why is productivity falling. Even during the pandemic, we saw a marginal increase in productivity in some countries like United States. But in general, we didn't see a big bump. Now there's some structural reasons why this is happening. It's because maybe we have too much debt which is supporting a lot of inefficient companies, not allowing enough new companies to rise out there, we have a lot of government interference and regulation around there which is also undermining productivity. And of course, some people argue that the new innovation we are seeing tends to be much more, if I can say so, fun-loving and frivolous rather than very serious. Whether it's got to do with gaming or other activities that we are not seeing the benefits of new technology flow to productivity. This is one of the paradoxes out there that we are seeing of a tech boom and yet we are seeing productivity decline. I think as the most fascinating data here is what we have next.

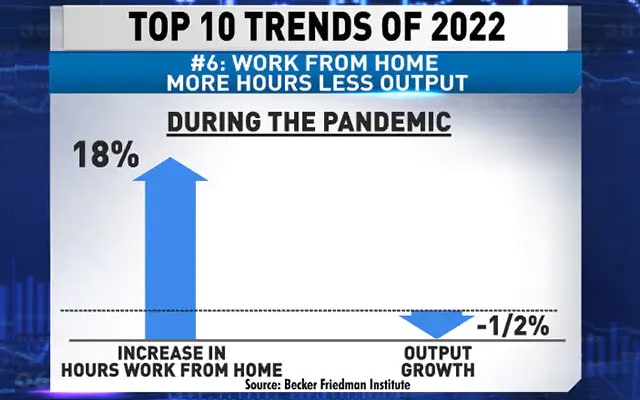

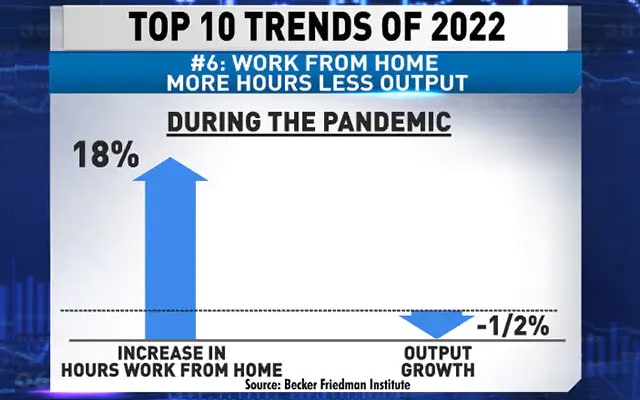

NDTV: That actually surprised me a lot and slightly disappointed me that working from home, your productivity would go up. You don't have to spend time in traffic. In fact, Indians are late for meetings but not for zoom meetings. We are spot on time. But your data shows in work from home, there's more hours spent and less output created. During the pandemic, the increase in hours work from home up 18 percent and output growth down by half a percent. One thing, I hope people don't claim they are working at home when they just have their video off.

Ruchir Sharma: Yes. This is a data I got from a survey that was carried out in Asia which is of thousands of people which showed that they are working much longer but the output there is slightly lower for the long hours worked. So, productivity in a way has gone down, not up, during the pandemic if we go by this survey.

NDTV: I want to delete this graph and censor it. We all want to work more from home. I think you are being a very negative person. Oh sorry, negative is a good word to use these days. Let's move on to your point number 7, is that there is increasing data localisation. This is what your findings show in fact. The reasons for this, is data nationalism now, developing countries following Chinese authoritarian rule that we will control our data and tech. And there is Western nations' focus on privacy and not letting others snoop on each other, although they do it in different ways. So, people are keeping their data within their country. Is it right? They are not allowing it to cross borders. Is that what you are saying?

Ruchir Sharma: This is a very new development because we spoke a lot about de-globalisation. By that, we have generally referred to increasing protectionism in the trade of goods and services, sometimes even capital and migrant flows. But the assumption everybody had, even a couple of years ago, is that data had no borders. So, it would keep crossing borders and that trend would go on. The importance of data is huge now. I think it's the US Chamber of Commerce that put out a finding that showed data now contributes more to global growth than the trade in goods and services. It's a huge trend out there.

NDTV: That's huge. But Ruchir, one of the points you say following China's authoritarian model. So many countries say we are not going to let our data go across borders because other countries will snoop on us. But actually the authoritarian trend meant the countries want to snoop on their own citizens. And in fact, in that context if you move on to the next graphic, it's a bit worrying. Look at that. The index of data regulation and localization. China, then Saudi Arabia and then India. So, we are third worst in terms of what you call an authoritarian trend in China.

Ruchir Sharma: Yes. This is an independent finding based on the amount of restrictions that governments are putting in place to keep the data at home or other restrictions on data. And India just happens to show up third at the wrong end of this scale on this metric.

NDTV: Very, very interesting. Let's move on to the eighth trend for 2022. And that's what you call Bubblets will deflate. What exactly is a Bubblet? This is how you identify a Bubblets. It's like a good idea gone too far. Classic signs include the prices have doubled of that Bubblet in the last 12 months and a rush of newbie investors. By that you mean people who are not professional investors who really study the market. Just explain this whole idea of Bubblets. You've mentioned cryptocurrencies, tech stocks with no earnings, clean energy stocks which people just buy from their heart and SPACs. If you can explain all these. It's a fascinating trend.

Ruchir Sharma: Yes. So, we have all heard about Bubbles. Obviously, the issue with it is how do you value a Bubble? How do you know something's a Bubble? I have come up with this new concept of Bubblets. So, what's the difference? Bubbles are something I think are very big and cover very big markets. Like you had the huge US stock market Bubble in 1999, 1929. India has had its own stock market Bubbles out there. The signs of the Bubbles and Bubblets are often the same. Which is that you end up getting a lot of speculations over trading, over ownership of a certain number of stocks and valuations obviously get very high. I think the difference is Bubble covers a very big part of the market and Bubblet covers a very specific, smaller part of the market. It's very hard to make the argument that everything in the world is very big Bubble here because stock markets have gone up everywhere. Maybe that's the case. But I feel a bit more on firmer footing by saying that these 4-5 corners of the market are particularly showing signs of a Bubble if not a complete Bubble. So therefore, I call it a Bubblet and in this regard...

NDTV: That's brilliant. I think it's an important, actually a warning. Your next three signs, the third, next one is really, really worrying for most of us. It's data you've produced and it shows Bubblets actually fall 70 percent in 2-3 years. So, they rise a 100 percent in the year before they peak and then they drop 70 percent. That's very worrying when you invest. Next one, you've actually shown how Bubblets have fallen from their peak. If you look at Bitcoins, that's one of the Bubblets, down 57 percent from its peak, green energy down 53, tech with no earnings down 49 percent and SPACs down 39. And finally, as this actually was a chart and data that really, really worried me and would worry a lot of people.

So, Ruchir, what you mentioned about Bubblets is also reinforced and very worrying in your next top trend, top trend number 9, where small investors mania cools. And what do you mean by that? This chart you have produced is astounding. What is happening is types of investors in stocks and share have changed. You know professionals, management, senior management they are selling and who is buying? Small investors, households who really are kind of newbies, you called them earlier. They really don't know that much about the market. So, the texture of the market is changing from professional to people who don't know that much and could be taken for a ride. That is a worry, isn't it?

Ruchir Sharma: Yes. This is data we got from the US where insider selling is at the highest point it has been for the data series that's been produced, so, its insider selling over the last year. On the other hand the amount of flows in mutual funds that went in US in 2021 and typically, investors in mutual funds tend to be small retail investors. Those flows last year were, I think, greater than the flow of the preceding 19 or 20 years. So, it's really a huge amount of interest and flows. Someone's buying and selling always on the stock market. Issue is, who is the most sophisticated buyer or seller? If the insiders are selling and retail investors are buying on the other side, at least intuitively and anecdotally that feels concerning.

NDTV: It does worry you that the quality of people, knowledge of the market. They may have knowledge of a lot of other things but they are entering here. The next graphic, the numbers are astounding of how the markets are changing, the texture of the stock markets. There's a huge rise in small investors. That's a new global phenomenon.

Ruchir Sharma: And true for India as well.

NDTV: Yes. 11 million up to 30 million in basically 2 years. That's a phenomenal increase.

Ruchir Sharma: Yes. And retail investors are now dominating this market. More than half the volume on the stock exchanges now is retail investor volume. You know, small investors speculating a lot. In places like the United States, they tend to do a lot of day trading. Buying very low value options and other kind of instruments to play in the market. So, it is concerning. Now at one level, these numbers are still low that in India, you only have 30 million investors in a population of over a billion. But it's the pace of increase which is a bit concerning. That from a very steady increase that took place for much of the last decade, we have an explosion all of a sudden and the kind of stocks they're buying are often these very low-value kind of stocks and a lot of speculation going on there. It's not just true of India or the US, even places like Europe, Asia, small countries like Philippines. So, this is all the fallout of the incredible amount of liquidity central banks have thrown at the system during the pandemic.

NDTV: I really found this amazing data. It also brings the worry that a lot of small investors may get hurt; you know if there's a drop fall into their Bubblets; they don't know enough. When a big investor gets hurt, we won't mention who, it doesn't really matter. But 30 million small investors, that really is a worry. Your final point is really interesting, Metaverse. That's the catchphrase these days. But you are saying it is really a lot of hype. The physical world is still more important than Metaverse. In fact, the use of the word Metaverse this year by corporates has gone up phenomenally. It has gone up a hundred times what they used to say earlier. It's like the in thing to say, we are in the Metaverse, right, Ruchir?

Ruchir Sharma: Yes. I think this some data that was compiled by Bloomberg, where they looked at the transcripts of the quarterly calls that the managements do and found that it's become fashionable to speak about the Metaverse. A lot of people don't even know what exactly the Metaverse is all about. It's really about how everybody will live in a virtual world where all activities will be done virtually from going to college, or learning or even shopping, gaming. All sorts of things will be done virtually in a 3-Dimensional world. But I think the point being missed here in all this hype is that people still want physical goods. They are still buying homes; they're still buying cars. And there's so much investment that's going in the new economy and very little that's going into the old economy.

NDTV: In fact, you got the data on that. Just have a look at that. How much money is going into the new economy and how much the old economy. In fact, now you point out Ruchir, that the investment in the new economy is rising and just about overtaken the investments in old economy. That's been falling for a long time and now they have just crossed. But you did say the demand for old economy is still rising. Youngsters, millennials and Gen Z are going for home loans, they are demanding cars. Wages are rising for truck drivers and others were threatened by automation. So, there's these contradictory things that are happening, and you have shown throughout your top 10 trends that perception is so different from reality.

Ruchir Sharma: A lot of echo is here, right? Even with the 'greenflation' theme that where is the new investment going and where is demand? So, of course the new economy is becoming more and more important. There's an explosion in digitization as we have shown. But people are still demanding homes, still demanding cars, still demanding commodities. And I think that not enough investment is going in those places and there's too much investment going in the new economy. So that for me is like a common theme I think that runs through these 10 trends.

NDTV: As you kind of do a quick summary, let's just look at the top 10, this is all available on ndtv.com and you can you can look at in detail there. Ruchir, overall, summarise what do you see in the top 10 trends of 2022?

Ruchir Sharma: As I said, there are some echoes out here which is the disconnect between what people are demanding and what supply is out there. I think it looks like there are risks building out there with interest rates set to rise even further and that could deflate some of the optimism and some of the Bubblets out there. I do feel that countries like the United States, the speculation is more than in some of the emerging countries. I think we also have to see with the pandemic. As we started at the outset of the show that it's quite fascinating that how the pandemic has mainly accelerated many trends that were already there before Feb, March 2020. I think that's really going to be out there. So much also really depends on how life returns to normal or not. As I keep saying that God made epidemiologists to make economists look smart.

NDTV: Epidemiologists and Bengali economists, neck and neck, and only time will tell. But Ruchir I found this year particularly fascinating because you showed the difference between perception and reality and many worrying signs. And I think all our viewers will really study this carefully and act on this kind of solid data. Thank you once again Ruchir, deeply. I know how hard you worked for this. For once in your life, you did do a little work. Thank you very much.

Ruchir Sharma: Thanks Prannoy. Always a delight to do this and I hope at least for India the good times come back or roll on from the stock market after the phenomenal year of 2021.

NDTV: Good times as we sardars say gunr gunr. Thank you.

Here is the full transcript of the discussion:

NDTV: Welcome everyone to what I honestly believe is our most important annual show on what's going to happen in the year ahead. And I don't just mean the amazing amount of feedback and viewers that we get for this show, that's the quantitative measure and it is huge. I also mean the quality of the content, the forecast for the year ahead, like, should you buy or should you sell shares and stocks, should you buy or sell property? Really affects our decisions in our everyday life, this show. How will India do? It affects our country. How will India do versus the rest of the world in 2022? The politics, the macro, global relations, all the data and graphics in the show are researched and produced by the absolutely amazing Ruchir Sharma and his team of course. Ruchir is widely respected, has one of the most brilliant minds globally and they say that about him even when he is not in the room. We are very, very lucky to have Ruchir join us once again this year with all his findings on the top ten trends of 2022. Now watch these fascinating findings, I just found them amazing, about what to expect over the next twelve months, I learnt a lot and I am sure you will too. So, Ruchir thank you very much for joining us and sparing the time, thank you very much.

Ruchir Sharma: Thanks Prannoy, delighted to be back, it's been nearly a decade since we have had this annual tradition and happy that we are carrying it along.

NDTV: Wonderful. Shall we just go straight into the graphics because we have got so much to cover over the next 50 minutes actually. You know the first thing that you always say and I respect you for that because I would never do it, let's look at how right and how wrong I was in the previous year you say. So, let's look at what you had said in the previous year, the top ten trends of 2021, let's review and get your perspective on what was right and what was wrong.

So, those are the top ten, now let's focus on first forecast that you made, the trend that you made in January 2021 of what was going to happen. Let's see what you said about the first point, you said, the global economy would be surging and the stock market would be sluggish and your review shows this, it shows that, if you look at the first of last ten years forecast growth surged but actually so did the stock market. Global growth was at six percent, higher than most people expected but you expected it, so you were different from the rest, and you were right in terms of global growth of six percent, it's huge. The stock market, the US surged actually, actually only two countries really surged, US and India's stock market, which I guess the US is a huge part of the global stock market, the rest of the world more or less eight percent, more or less average and fascinating, Ruchir, worst performing according to you, your data, China's stock market minus 23 percent, second worse and worst is Pakistan minus 25 percent.

Ruchir Sharma: Yes, we looked at about 60 odd stock markets around the world for which data is available and so India was in the top quartile, in fact India's exact rank was around 13th or so of the 60 stock markets around the world in dollar terms and it's just I guess a sheer coincidence that the two worst performing markets and absolute worst were China and Pakistan. So, something I guess, a lot of Indians would like to cheer about.

NDTV: Okay, let's move quicky on to the second of your kind of top trends. Inflation, you said is set to rise and then what is the actual figures, let's have a look at the data that you actually produced to compare with your trend. Global inflation was 4.8 percent while rest of the economists globally thought would be 2.7, so you were spot on there, Ruchir.

Ruchir Sharma: Yes, I think that there was so much stimulus put into action, so much disruption to the supply chains brought about by the pandemic and the lockdowns that inflation was finally set to rise. I mean for 40 years we haven't had an inflation performance of this kind in many countries including the United States. Now in India's case, inflation behaved a bit better, especially at the consumer price level, and so in fact India's inflation rankings improved on a global basis. Like after long time India's inflation rankings were similar to rest of the world or somewhere in the middle, but I think that the key think here is that the inflation surge was a lot more than people expected in 2021.

NDTV: The third trend you said was that global interest rates would increase sharply and of course when interest rates rise, bond prices fall down. Look at those, interest rate, they really shot up. Now how is that compared, this is developing countries in particular, and government bond prices fell by 5.8 percent, that is worst since 1999.

Ruchir Sharma: Yes, it's very rare for government bond prices to fall, because it is a very safe investment and there are very few and far between years when government bond prices fall. Bond prices fall when interest rates rise, they move in the opposite direction and so as interest rates rose sharply around the world, particularly in emerging markets, with long-term interest rates rising even in places such as India, where the two-year paper and ten-year paper, all those interest rates rose from a very low base quite sharply. Bond prices fell, yes; it was a terrible year to be a bond investor in 2021.

NDTV: Right, your next forecast was you said, buy property. Prices are going to go up, really. And if you look at it, in fact, house prices according to you rose at the fastest rates since 1980s, that is forty years, we are talking about global house prices. India didn't follow that pattern, it went down, but it was the end of 2021 that house prices in India have started rising again, right?

Ruchir Sharma: Yes, it's been a terrible year for the property markets in India as we know over the last decade with property prices barely rising, but finally we are seeing sales are picking up, supply has been constrained, inventories are falling and in the major cities, prices are beginning to rise. So yes, it's been a very good time to buy property around the world, in fact almost too good, it's taking many people to think that property prices are becoming unaffordable and that's a major political issue growing in many countries. In India's case not so as yet because the affordability still remains relatively good for many people, even though I know that everybody wants it to be cheaper, but generally property prices have been quite low, but I think they have started to rise and set to rise further in the year ahead.

NDTV: Now your fifth point, you said the US dollar will decline and then you produced data to check whether you are right or wrong. Let's see what you said, basically, the dollar went down for little bit, but just look relatively and when you talk about decline you always talk about relatively prices. Bitcoin went up 59 percent, while the dollar just 6 percent, amazing difference.

Ruchir Sharma: Yes, that's the point I made on the show last year that there is no real alternative to the US dollar in terms of any other currency. The Chinese currency has not been able to take the space, the Euro is still embattled by a lot of its internal problems, so when there is no alternative to the US dollar and yet people are searching for an alternative, crypto currency such as Bitcoin are likely to emerge as some sort of an alternative and that's what happened last year. It was a great year to be investing in crypto currencies, in fact the number of cryptocurrencies in the world has exploded. There are nearly 8k crypto currencies in the world now compared to just over 4k a year ago. Bitcoin is what we hear a lot about and Ethereum, but the explosion in crypto currencies is telling you that people are really searching for alternatives out there to the US dollar given that most currencies is able to fill that space in.

NDTV: You know one of the most surprising trends that you talked about or forecast that you talked about in January 2021 was about commodity prices, which everybody thought it's the end of commodity prices, they are never going to rise and you said that this year is going to be big, a revival in commodity prices and in fact it's turned out to be best year for commodities for nearly 50 years. I mean that is a huge length of time, and commodity prices rose 40 percent. A, how did you foresee this? And B, why did it happen?

Ruchir Sharma: Yes, I think that what's happening here is that and something we'll speak about in one of the trends here as well over the next few minutes. There is so much pressure to cut new investment in oil, in mining, a lot has to do with political pressure, the pressure for climate change, green politics, which is all fine, we all want a better environment and climate out there, but the problem is we are cutting supply of commodities and yet the demand for commodities whether it is driving or it's got to do with building solar panels and new green infrastructures, we still demand commodity is going up, supply constraint. It's basic economics that you constrain the supply for all sorts of reasons but you still keep demanding, prices are naturally bound to go up and that is what's happening.

NDTV: Right, then in your next point, I am just going very quickly through last year. I don't know how you can take an exam like this, I would avoid it like the plague but next one, you said developing countries around the world will stage a comeback, but that really didn't quite happen. There was a huge gap between growth of developing countries in 2010, like seven percent compared to two percent rich countries but now it's almost neck and neck, so developing countries almost fell back, right?

Ruchir Sharma: Yes, a lot of this really has to do with the slowdown happening in China, that's what is deflating this number a lot, but in general this number is very disappointing for the developing countries. I was expecting some sort of a reversal to begin in 2021. There are some signs of that happening outside of China with the growth rates accelerating in places for Vietnam, Poland, and other places even in the Middle East, but generally it continues to be a disappointing time for growth in developing countries after incredible promise they held a decade ago. We all know how the entire world was captured by BRICs and those kinds of concepts and those stand so badly discredited now.

NDTV: Right, right. Now your eighth point, you talked about the digital revolution spreading rapidly in 2021 and the data shows how amazingly correctly you were. Look at mobile phone usage of data traffic, it went up by 42 percent in the year, that's huge, right? Unprecedented, Ruchir?

Ruchir Sharma: Yes, in fact the kind of data we have consumed over the past year, I am told that it is equivalent to the entire data that was consumed until the year 2016 in history. So, really, the way the digital revolution is spreading is quite fascinating. There are more than four billion people with a smart phone now around the world, that is more than half of the entire population of the world and remember the processing power of a smart phone is similar to what used to be of the processing power of a super computer when it first came out in the 1970s or something. So, everyone is virtually walking around with a super computer in their pocket and that opens up so many options for doing things digitally.

NDTV: See Ruchir, I use those old computers and we still produce micro models of the economy. You guys are only on phones and you have no excuse. Anyway, let's move onto your second last one, the rise of new challengers to the big tech companies like you know Apple and Google, but if we look at last year, in fact, big tech companies were smashed in China, but kept rising in the US. Just look at the amazing graph that you have produced Ruchir. USA big tech companies have taken a bigger and bigger share of the market but challengers have also done well. They have gone up 15 percent, not as much as the big techs and in China the big tech companies just plummeted. Why, why again?

Ruchir Sharma: Yes, in China's case there's a lot of concern out there about the way capitalism was going, it was unbridled capitalism. I had shown data in fact earlier this year to show that in the year 2020, China produced many more billionaires than even the United States, the Chinese government is concerned about the kind of concentration and power that's happening in its corporate sector. It's concerned about wealth and inequality and of course wants to maintain a very strong state, so therefore we saw the Chinese government really crack down on the tech sector very hard in China which is what hurt the stock prices and the entire market evaluation of the Chinese tech sector. I am told that the Chinese tech sector last year lost nearly two trillion dollars in their entire value. You know which is half of their value was wiped out in one year. So, that shows up in the fact that it was very poor year for the performance of the Chinese market, for Chinese techs names in particular, but what the rise has been that the US tech names, the bigger cap names, they keep galloping ahead, Apple now the first company to get to a to a trillion dollars. I remember now in 2017 when Apple's market went across a trillion dollars it was a sign of, you know, a fair amount of conversation back then but now it's touching three trillion dollars. So that is a surprise to me as how long the winning streak of the US mega cap has lasted.

NDTV: Right, but you were spot on about the end of big tech in China. Finally, your tenth trend, last year January looking ahead at 2021 you said the end of television, thank goodness you said in brackets, except India, what are the actual figures? If we look at your data, again this is all Ruchir's data which I am just reading out. Only country where TV did not really fall, that means the share of advertising revenue etc, was in India, everywhere else they fell and this graph actually underestimates a month they fell. So, India stayed on. India is a very sensible country, Ruchir?

Ruchir Sharma: Yes, in terms of I guess TV business, but I think in all the other countries we are seeing is a major decline in the TV's share in the total ad pie. In India it is quite fascinating that there has been an explosion in the digital advertising but it's all coming at the expense of print and the share of television in the media pie remains relatively stable at around 45 percent. So yes, one of things that worked out, I guess.

NDTV: Absolutely spot on there. Okay, now that was just amazing, I would give you A++ even when you are not in the room, yes 90 percent marks for last year, fantastic. Okay, let's look at the top ten trends now, Ruchir, looking ahead at 2022. The first thing you are saying 2022 we will all see a decline in global birth rates and that will accelerate in 2022 and some of the data looks like this, just have a look.

Ruchir Sharma: Yes so, you know Prannoy, one of the fascinating things about this crisis that has been this entire pandemic, that if you look at it most crises in the past typically half of the crises breaks out, the world is turned upside down. A defining feature of this crisis was that many of the trends that were already in place before the pandemic broke out have merely been accelerated by this pandemic. Now some of the strengths completely make sense such as increased digitisation with people working more from home so that makes sense. But this thing I think has been a bit counter-intuitive. We are seeing a decline in birth rates take place around the world in a fairly sharp way. Why is that happening? I think that is something we really need to know a bit more about or need to learn a bit more about, because we are, you will expect that people are spending more time at home, birth rates should increase, instead birth rates are falling sharply. Most they have fallen in recent times has been during the pandemic. You can see the data here for China, even places like the United States that the birth rates are falling here, so the demographic challenge that world has been facing has only been accelerated by this pandemic and that has I think serious implications for economic growth.

You know we keep on talking why can't countries like India grow at 7-8 percent? Why can't countries like United States grow at 3-4 percent, when it's because the demographics have shifted significantly. The number of countries now which have a shrinking working age population has exploded. And this is even true in India, the working age population is not shrinking, but if you look at India what's happened during the pandemic here, we only, we don't have data for the entire country, but we have managed to get some data just for the city of Bombay, and you can see during the pandemic there has been such a sharp decline in the birth rates in a place like Bombay. I think that's a pre representative of what must be happening in the rest of India.

NDTV: Yes, that is really astounding that 153 is the annual average rate for those five years and now it has just dropped dramatically. In fact, it has dropped so much that India's birth rate for the first time is below the global average birth rate. That is incredible, that data.

Ruchir Sharma: Exactly, I mean can you imagine that the amount of time we have spent fretting about the demographic time bomb in India. We all grew up hearing about that that in 70s, 80s. And now the picture has changed so dramatically where the slowdown in the birth rates has been so significant that India's population growth rates now is also getting to a level which is likely to fall below the global averages, but interestingly, the birth rate for the first time now has already fallen below the global average.

NDTV: That is an amazing change of perception that everybody must recognize fast.

Ruchir Sharma: Yes, and one very important point to put here, this is for me the single most important reason why India will not be able to grow on a sustained basis at 7, 8, or 9 percent. No country with a birth rate this low and with a population growth in such decline has been able to grow rapidly. I think this is a point which is just not internalized by many people, forget policy makers, even serious economists, when they go on talking to me about why India can grow at eight to nine percent. The problem is that no country with demographics of this kind has ever been able to grow at a rate of 8-9 percent. Just doesn't happen.

NDTV: Very interesting point, because you talked about this earlier that your workforce is also not growing, which you need if you want to grow by 7-8-9-10 percent right?

Ruchir Sharma: Yes. I mean you need your working-age population to be growing by well over two percent to achieve those kind of growth rates. And of course, India can try and correct for those things, for example one thing we can speak about at some other point in time is that the female participation in India's labour surprisingly keeps falling and that's another factor we need, but the big message here is that it is very difficult for India's growth rate now to be anywhere north of 5-6 percent given the changing demographics.

NDTV: Very, very interesting. Your second point, which is really surprising for everybody, you say that China's economic power is currently peaking. It's reaching its peak. Most people think China is about to take off, take over the world, but you are saying that it is peaking if not already at peak. Look at that China's contribution to global growth, how much is falling since 2019. It went up a little bit and down again. That's amazing Ruchir.

Ruchir Sharma: Yes, there are variety of reasons to why that is happening, it goes back to the old point that demographics, and here is the shocking thing, which is that from next year onwards, China's overall population is likely to start shrinking, not just the labour force which has been shrinking, but China's overall population is likely to start shrinking from next year.

NDTV: Not just growth rate, you mean absolute number of people will go down in China?

Ruchir Sharma: Yes, yes, yes. And that is not something which anyone expected, even I'd say, three to four years ago. So, a huge change, so in China's case the entire growth will have to come from productivity as its labour force has been shrinking and now, even its overall population is set to shrink from next year. This is one of the very important reasons why I think that China's growth in likely to decline. And the other thing has to do with debt that China has been relying on so much, debt to grow very rapidly over the last few years and now that its debt levels are so high, its policy makers are very worried. They are keen to take China off that drug, of taking on more and more debt. So, it's already complicating China's economic growth story. So yes, this combination of too much debt, change in demographics, these are all likely to lead to a decline in China's growth rate far beyond what I think the consensus expects currently.

NDTV: That is a very surprising thing Ruchir, again a real eye-opener. Everybody thought India-China trade going up by billions of dollars and you know accelerating, but in fact China's trade with India is dropping by 0.4 percent which is, while it's going up with Mexico, Russia, Brazil, and Taiwan, when actually trade with India is falling.

Ruchir Sharma: Yes, so this was happening even as China's economic might was increasing over the last decade. These are decadal figures, but I think generally the point I am making here is that China is obviously a very large economy, will remain a very important, but the margin, its influence in economic terms is likely to decline and with India also, that trend is likely to be accelerated in the years ahead.

NDTV: So, Ruchir, let's move on to your third top trend of 2022, you're talking about global debt trap deepening. You've talked a lot over the last three, four years about global debt, but the trap now has deepened. Just look at the data. It is shocking. According to your data spiked during the pandemic.

Ruchir Sharma: Yes, it spiked during the pandemic and has taken even more countries deeply into debt. So, you can see here, the trend over the last two or three decades that, you know, when I first got into this business of investing, there was not a single country in this world which had a debt-to-GDP ratio of more than 300 percent.

NDTV: That's 1998, you are talking about 1998 when there was zero countries, but you were not born in 1998, were you Ruchir?

Ruchir Sharma: Well yes, I mean it is back to 1995 in fact when I started investing, but yes at that point of time there were countries in debt to GDP ratio of more than 300 percent. Today there are 25 from China to Japan, United States, a whole bunch of European countries and that is a very big reason why it is so difficult for interest rates to go up, we are so dependent on debt, on servicing that debt.

NDTV: You also pointed out that India's debt is high for, if you compare them with similar economies. Look at that, Vietnam is higher than us, but Egypt, Indonesia, Bangladesh, have got much lower debt as a percentage of GDP. India's debt as to GDP percentage is 175 percent, that's very high and worrying.

Ruchir Sharma: Yes, these are total debt numbers, it includes government debts, all the private sector debt, you know, which is corporate and households. So, we put all the data together out here and I think so at one level the fact that India's debt to GDP ratio is not above 300 percent is fine, but generally, the lesser advanced countries tend to have lower debt to GDP ratios and for a country with per capita income of just under $3000, India's debt to GDP, overall debt to GDP is quite high, largely because of the government debt, the government and the related sectors, their debt levels are relatively high for a country of this per capita income. So that is something which is like obviously concerning. The only good news there is that most of the debt is owned by domestic institutions, very little of this is owned by foreigners, so when that happens at least the currency tends to be more stable.

NDTV: One of the things that comes out of what you say is that interest rates really don't have very much room to rise any further. If you look at global stocks and bond market, how much they have grown, compare them with GDP. In 1980, they were just about the same as the GDP, a little more. Now they are 4 times the GDP. That's just huge.

Ruchir Sharma: Yes. This is the double-barrel effect that higher interest rates can have, which is that if interest rates go up, not only does that really hurt you on the debt side because there's so much debt and it becomes harder and harder to service that, but also the fact that the stock market, the bond markets around the world are so big and so much of that is dependent on a very low-interest rate environment. So, this is something that we have to be very sensitive about, that if interest rates start to go up, both the asset markets and the debt serviceability becomes a lot more difficult.

NDTV: Now the other interesting point is that yes, inflation will rise as you say, but it may not hit double digits as a lot of people are saying that it's going to go through the roof, it's just like unprecedented. Now, why do you say that?

Ruchir Sharma: Firstly, for some structural reasons, I think inflation is on an uptrend now, and for reasons we have already foreshadowed in this show. One is the fact that as you see a decline in population, you see less people entering the labour force, that sets up the platform for higher wages. So, one is population decline. Second is an environment of de-globalisation where countries are becoming much more protectionist, there's obviously less competition there. Then, in general, a trend we'll speak about in this show is where productivity has been relatively weak, with so many inefficient companies operating out there, zombie companies as we call them. And that's another reason why we are likely to see higher input cost with lower productivity. And in general, there's very little appetite for any government to engage in any kind of austerity. As those debt numbers show, that historically, governments would take more debt in times of crisis. Now, they take debt in both good and bad times. So, the government is on a spending spree in general. These are some of the long-term reasons why I think inflation around the world is on an uptrend after being on a downtrend for the last 40 years. Having said that, there are some immediate checks and balances ....

NDTV: One of the points you say, you are saying that populism, you know, that's part of winning elections. But we move on to your next interesting point. The first point, kind of goes against that, because you say inflation, prices will not rise too much because government stimulus will be set to decline this year. Now if there is no appetite for austerity and populism, that slightly contradicts, so explain that. And you say price spikes in key sectors like transport, lodging and housing may actually ease. And you say, this is important, that tech advances can still restrain the price rise.

Ruchir Sharma: Yes. So, inflation in my forecast is that this is a two steps' forward one step back kind of a process. I underline the structural reasons why inflation is likely to increase, but, immediately in the year 2022, there could be some constraining factors. So yes, in general, the government's spending is likely to keep going up but the stimulus was so heavy and so intense in 2020, 2021 that in 2022 just some hiatus will take place in terms of fresh stimulus, I feel. This is more of a hiatus rather than an end to anything. So, I don't think it's a contradiction that in general governments are more populist. But in 2022, just mathematically it will be hard for them to keep spending at the same rate as they did over the last couple of years and briefly.....

NDTV: Because they may do too much and get into trouble on the election front as well, correct?

Ruchir Sharma: Exactly. We are already seeing pushback of that in the United States where, a country that's been very keen to stimulate at any excuse, you finding there that some of their Democrat senators are wary of putting in more stimulus because inflation is the top-most concern of the US voter. That natural checks and balances are still there. The focus is shifting now from just going all for growth to also constraining inflation a bit. So therefore, I feel that inflation is on a structural up trend but it's a two step forward one step back process. It's likely that in 2022 that the inflation performance is not as bad because of that one step back with some checks and balances from technology to just exhaustion with stimulus setting in.

NDTV: Ruchir, you talk about a really important phenomenon which you call, and I think it's become widely used now, 'greenflation'. Let's see what you mean by 'greenflation'. You mean, green politics meant to reduce oil supply. But what is happening is, there's a decline in investment in oil supply, there's a decline in investment in minerals. But if we move on, we can see that in fact there's still a lot of demand for minerals.

So, we are not investing in minerals, but we are demanding it and using it. So, it's just going contradictory to what 'green' should be. You say we are going green, but we are using more copper. Demand is up 213 percent by 2050 and aluminum demand up by 322 percent. So, 'greenflation' is a problem. You also point out that it's worrying for India because India actually also demands a lot. So, we are vulnerable to 'greenflation'. India is a large importer of commodities. Just look at that, these are commodity imports, India, China, Turkey. Tell us how worrying is 'greenflation' for you?

Ruchir Sharma: Well, it is a big concern because as we spoke earlier of it that we all want a greener planet. The problem is this, to build that greener planet we need to invest in green infrastructure, whether it is solar panels, electrical vehicles. But to do that, you need copper, you need aluminum, those are some of the inputs that you need to build that green infrastructure, so that's the contradiction here. Building this requires some of these polluting metals, but if you keep cutting supply, the price of these metals keeps going up. Even on oil, a lot of the consumption is still based on fossil fuels, when you're cutting supply prematurely, because it is so difficult in the world anywhere to find new investments in oil fields. So, that's the contradiction that you have out there. And therefore, we are already getting 'greenflation', something which is contributing to inflation and likely to contribute even more in the years ahead if the current policies continue.

NDTV: So, the bottom line is, we are talking about a greener world. So, we are not investing in oil and minerals. But we are demanding more minerals, more oil and so we are just raising the prices of those commodities by not investing but by demanding as much. We are just contradicting ourselves and our behaviour.

Ruchir Sharma: Yes.

NDTV: Your next point number 6 in your forecast. There is a productivity paradox and that is persisting. And by that you mean that the productivity has been falling for years. The growth in productivity has been falling for years. I am really shocked at that graph. I don't think too many people are aware of this. Everybody would have thought that tech would have increased productivity but this is shocking Ruchir...