If successful, Anbang's purchase of Starwood would mark the largest purchase of a U.S. company by a Chinese firm.

A business group led by a Beijing insurance firm significantly raised on Monday its multibillion-dollar bid to buy Starwood Hotels & Resorts, one of the largest hotel companies in the United States, providing the latest example of Chinese interest in prime American real estate.

Anbang Insurance Group offered $14 billion in cash for Starwood, roughly $400 million more than a competing proposal from Marriott International, the chain based in Bethesda, Maryland. Starwood owns and operates about 1,200 properties across the world, including brands such as St. Regis, Westin, Sheraton and W Hotels.

If successful, Anbang's purchase of Starwood would mark the largest purchase of a U.S. company by a Chinese firm. And it is among a flurry of deals being pursued by cash-flush Chinese companies that have been facing economic turmoil at home and are now hunting for safer investments overseas.

The United States - and its real estate - have been of particular interest to Chinese firms, a trend that has not gone without notice on the presidential campaign trail. The Chinese government last year lifted a number of restrictions on foreign investments as the country looks beyond manufacturing for growth. Hotels, which often come with prime real estate, big-name brands and a promise of stable returns, have become an especially popular parking-space for China's billions.

The United States - and its real estate - have been of particular interest to Chinese firms, a trend that has not gone without notice on the presidential campaign trail. The Chinese government last year lifted a number of restrictions on foreign investments as the country looks beyond manufacturing for growth. Hotels, which often come with prime real estate, big-name brands and a promise of stable returns, have become an especially popular parking-space for China's billions.

Anbang already owns the JW Marriott Essex House in Manhattan and purchased the Waldorf Astoria New York hotel for nearly $2 billion from Hilton Worldwide two years ago. It has been among the most aggressive Chinese investors, buying up insurance firms and banks in Belgium, South Korea, the Netherlands and the United States in recent months.

"A lot of what the Chinese are looking for is brand names," said Sean Miner, who oversees the China program at the Peterson Institute for International Economics, a Washington-based think tank. "That is something that's been hard for Chinese companies to build on their own, so they're looking to buy them instead."

Anbang leads a purchase group that includes American investment firms. It is typical of a new wave of companies using a strong, fast-growing base in China to expand abroad. Anbang has reaped the benefits of a rapidly growing middle class that needs car insurance to go along with its new cars, health and life insurance to plug holes in China's porous safety net, and home insurance to cover potential problems in the rapidly expanding housing market.

Anbang's chief executive Wu Xiaohui married a granddaughter of China's longtime leader Deng Xiaoping, giving him personal ties that have helped propel the company from what the firm's website describes as a $75 million regional insurer in 2004 to a powerhouse with roughly $25 billion in assets.

This month, Anbang further expanded its reach into the U.S. hospitality industry with a $6.5 billion deal to buy Strategic Hotels & Resorts, a Chicago-based company that owns luxury hotels operating under brands like the Four Seasons, Ritz-Carlton, InterContinental and Loews.

"There's a huge appetite - we're talking very large dollar amounts - for hotels that are built and operating," said Edward Mermelstein, managing partner of Rheem Bell & Mermelstein, a New York-based law firm that specializes in international real estate deals. "We've seen a huge uptick in major purchases by Chinese investors in the last several months, especially by institutional players."

Marriott, which is considering whether to counter the latest offer, has sought to woo Starwood shareholders by highlighting its expertise in running hotels and managing a large loyalty rewards programs. Unlike Anbang's cash offer, it's $13.6 billion stock-and-cash offer would give Starwood shareholders an ownership stake in what would be the world's largest hotel operator. And Marriott warned the Chinese-led deal may have trouble passing muster with regulators.

"Starwood stockholders should give serious consideration to the question of whether the Anbang-led consortium will be able to close the proposed transaction, with a particular focus on the certainty of the consortium's financing and the timing of any required regulatory approvals," Marriott said in a statement Monday.

Last year, Chinese firms bought $5.13 billion in U.S. real estate and hotels, a 68 percent jump from the $3.05 billion they spent a year earlier, according to data from the Rhodium Group, a New York-based advisory firm that tracks Chinese investments in the United States.

In 2012, by comparison, Chinese buyers completed just four real estate deals - versus last year's 39 - totaling $195 million. Most of the investments that year were focused in the energy sector ($3.1 billion) and entertainment ($2.62 billion).

"We're seeing a big shift in Chinese investment from energy toward advanced manufacturing, services and safe havens like real estate," said Thilo Hanemann, an economist at the Rhodium Group.

Hotels, he added, have become especially attractive to investors given the increase in Chinese tourists visiting the U.S. and Europe. The number of Chinese tourists traveling outside of the country is expected to double to 234 million by 2020, accounting for $422 billion in spending, according to a recent report by China Luxury Advisors and the Fung Business Intelligence Centre.

"In the case of hotels like the Waldorf-Astoria, they believe they may be able to use domestic connections to bring more tourists to these properties," Hanemann said.

That marks a reversal from the early 2000s, when U.S. companies flocked to invest in China following the country's entry to the World Trade Organization.

Thayer Lodging, an Annapolis-based hospitality investment firm, was one of those companies. In 2004, it partnered with China's largest hospitality company to provide independent management services for hotels.

"Our hope and plan was that as the hotel industry grew in China, we would be able to grow very rapidly," said Frederic V. Malek, Thayer's chairman and a former president of Marriott.

While the management firm has picked up some high-profile contracts, including one to manage a luxury hotel in Shanghai Towers, growth hasn't been as dramatic as Malek had once hoped.

"It's been much slower than we anticipated," he said. "It's been harder and slower slogging."

Competition has grown too, as more American hotel chains increasingly look to China for international growth. Marriott has roughly doubled its hotel count in China since 2012. McLean, Virginia-based Hilton Worldwide this month said it would open opening 206 new hotels in the country, effectively quadrupling its presence.

InterContinental Hotels Group, the parent company of Holiday Inn, has taken its plans a step further, developing a line of hotels specifically for Chinese travelers called Hualuxe. The company currently has three properties in China, with 21 more in the pipeline.

In recent years, companies largely unfamiliar to American investors have bought up a number of iconic U.S. brands, including movie-theater operator AMC Entertainment Holdings (purchased by Dalian Wanda Group for $2.64 billion in 2012) and meat processor Smithfield Foods (scooped up by Shuanghui International for $7.1 billion in 2013).

Already this year, Chinese companies have announced plans to buy 153 foreign companies worth $103 billion, according to Dealogic, a data research firm in New York.

"Where the Chinese lead is that they're willing to pay a premium in order to go forward," Mermelstein said, "There are very few that can compete with the Chinese in terms of dollar amounts."

At least one hotelier, however, says he's not looking for Chinese cash: Donald Trump, whose Trump Hotels oversees 14 luxury properties around the world.

"Investments, I don't need," the Republican presidential front-runner said March 21 at a media event at his upcoming Trump International Hotel in downtown Washington. "[The Chinese] don't have to give me their money."

But, he added: "Tourists, certainly. We want tourists from China."

© 2016 The Washington Post

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Anbang Insurance Group offered $14 billion in cash for Starwood, roughly $400 million more than a competing proposal from Marriott International, the chain based in Bethesda, Maryland. Starwood owns and operates about 1,200 properties across the world, including brands such as St. Regis, Westin, Sheraton and W Hotels.

If successful, Anbang's purchase of Starwood would mark the largest purchase of a U.S. company by a Chinese firm. And it is among a flurry of deals being pursued by cash-flush Chinese companies that have been facing economic turmoil at home and are now hunting for safer investments overseas.

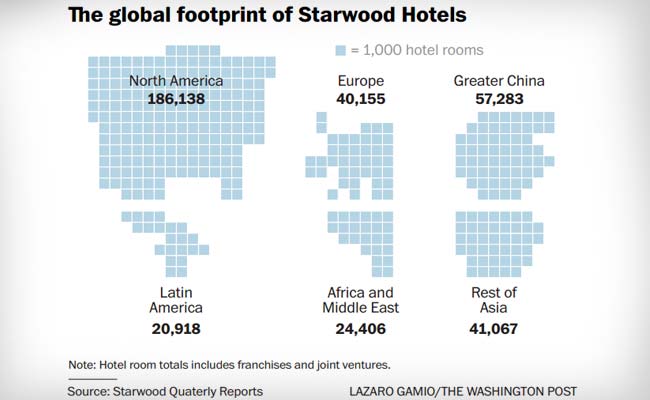

The global footprint of Starwood Hotels. (Photo by: Lazaro Gamio - The Washington Post)

Anbang already owns the JW Marriott Essex House in Manhattan and purchased the Waldorf Astoria New York hotel for nearly $2 billion from Hilton Worldwide two years ago. It has been among the most aggressive Chinese investors, buying up insurance firms and banks in Belgium, South Korea, the Netherlands and the United States in recent months.

"A lot of what the Chinese are looking for is brand names," said Sean Miner, who oversees the China program at the Peterson Institute for International Economics, a Washington-based think tank. "That is something that's been hard for Chinese companies to build on their own, so they're looking to buy them instead."

Anbang leads a purchase group that includes American investment firms. It is typical of a new wave of companies using a strong, fast-growing base in China to expand abroad. Anbang has reaped the benefits of a rapidly growing middle class that needs car insurance to go along with its new cars, health and life insurance to plug holes in China's porous safety net, and home insurance to cover potential problems in the rapidly expanding housing market.

Anbang's chief executive Wu Xiaohui married a granddaughter of China's longtime leader Deng Xiaoping, giving him personal ties that have helped propel the company from what the firm's website describes as a $75 million regional insurer in 2004 to a powerhouse with roughly $25 billion in assets.

This month, Anbang further expanded its reach into the U.S. hospitality industry with a $6.5 billion deal to buy Strategic Hotels & Resorts, a Chicago-based company that owns luxury hotels operating under brands like the Four Seasons, Ritz-Carlton, InterContinental and Loews.

"There's a huge appetite - we're talking very large dollar amounts - for hotels that are built and operating," said Edward Mermelstein, managing partner of Rheem Bell & Mermelstein, a New York-based law firm that specializes in international real estate deals. "We've seen a huge uptick in major purchases by Chinese investors in the last several months, especially by institutional players."

Marriott, which is considering whether to counter the latest offer, has sought to woo Starwood shareholders by highlighting its expertise in running hotels and managing a large loyalty rewards programs. Unlike Anbang's cash offer, it's $13.6 billion stock-and-cash offer would give Starwood shareholders an ownership stake in what would be the world's largest hotel operator. And Marriott warned the Chinese-led deal may have trouble passing muster with regulators.

"Starwood stockholders should give serious consideration to the question of whether the Anbang-led consortium will be able to close the proposed transaction, with a particular focus on the certainty of the consortium's financing and the timing of any required regulatory approvals," Marriott said in a statement Monday.

Last year, Chinese firms bought $5.13 billion in U.S. real estate and hotels, a 68 percent jump from the $3.05 billion they spent a year earlier, according to data from the Rhodium Group, a New York-based advisory firm that tracks Chinese investments in the United States.

In 2012, by comparison, Chinese buyers completed just four real estate deals - versus last year's 39 - totaling $195 million. Most of the investments that year were focused in the energy sector ($3.1 billion) and entertainment ($2.62 billion).

"We're seeing a big shift in Chinese investment from energy toward advanced manufacturing, services and safe havens like real estate," said Thilo Hanemann, an economist at the Rhodium Group.

Hotels, he added, have become especially attractive to investors given the increase in Chinese tourists visiting the U.S. and Europe. The number of Chinese tourists traveling outside of the country is expected to double to 234 million by 2020, accounting for $422 billion in spending, according to a recent report by China Luxury Advisors and the Fung Business Intelligence Centre.

"In the case of hotels like the Waldorf-Astoria, they believe they may be able to use domestic connections to bring more tourists to these properties," Hanemann said.

That marks a reversal from the early 2000s, when U.S. companies flocked to invest in China following the country's entry to the World Trade Organization.

Thayer Lodging, an Annapolis-based hospitality investment firm, was one of those companies. In 2004, it partnered with China's largest hospitality company to provide independent management services for hotels.

"Our hope and plan was that as the hotel industry grew in China, we would be able to grow very rapidly," said Frederic V. Malek, Thayer's chairman and a former president of Marriott.

While the management firm has picked up some high-profile contracts, including one to manage a luxury hotel in Shanghai Towers, growth hasn't been as dramatic as Malek had once hoped.

"It's been much slower than we anticipated," he said. "It's been harder and slower slogging."

Competition has grown too, as more American hotel chains increasingly look to China for international growth. Marriott has roughly doubled its hotel count in China since 2012. McLean, Virginia-based Hilton Worldwide this month said it would open opening 206 new hotels in the country, effectively quadrupling its presence.

InterContinental Hotels Group, the parent company of Holiday Inn, has taken its plans a step further, developing a line of hotels specifically for Chinese travelers called Hualuxe. The company currently has three properties in China, with 21 more in the pipeline.

In recent years, companies largely unfamiliar to American investors have bought up a number of iconic U.S. brands, including movie-theater operator AMC Entertainment Holdings (purchased by Dalian Wanda Group for $2.64 billion in 2012) and meat processor Smithfield Foods (scooped up by Shuanghui International for $7.1 billion in 2013).

Already this year, Chinese companies have announced plans to buy 153 foreign companies worth $103 billion, according to Dealogic, a data research firm in New York.

"Where the Chinese lead is that they're willing to pay a premium in order to go forward," Mermelstein said, "There are very few that can compete with the Chinese in terms of dollar amounts."

At least one hotelier, however, says he's not looking for Chinese cash: Donald Trump, whose Trump Hotels oversees 14 luxury properties around the world.

"Investments, I don't need," the Republican presidential front-runner said March 21 at a media event at his upcoming Trump International Hotel in downtown Washington. "[The Chinese] don't have to give me their money."

But, he added: "Tourists, certainly. We want tourists from China."

© 2016 The Washington Post

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Track Latest News Live on NDTV.com and get news updates from India and around the world